Why Stablecoin Rails Are Emerging as Key Infrastructure for Cross-Border Payments in 2026

Phoebe Duong

Author

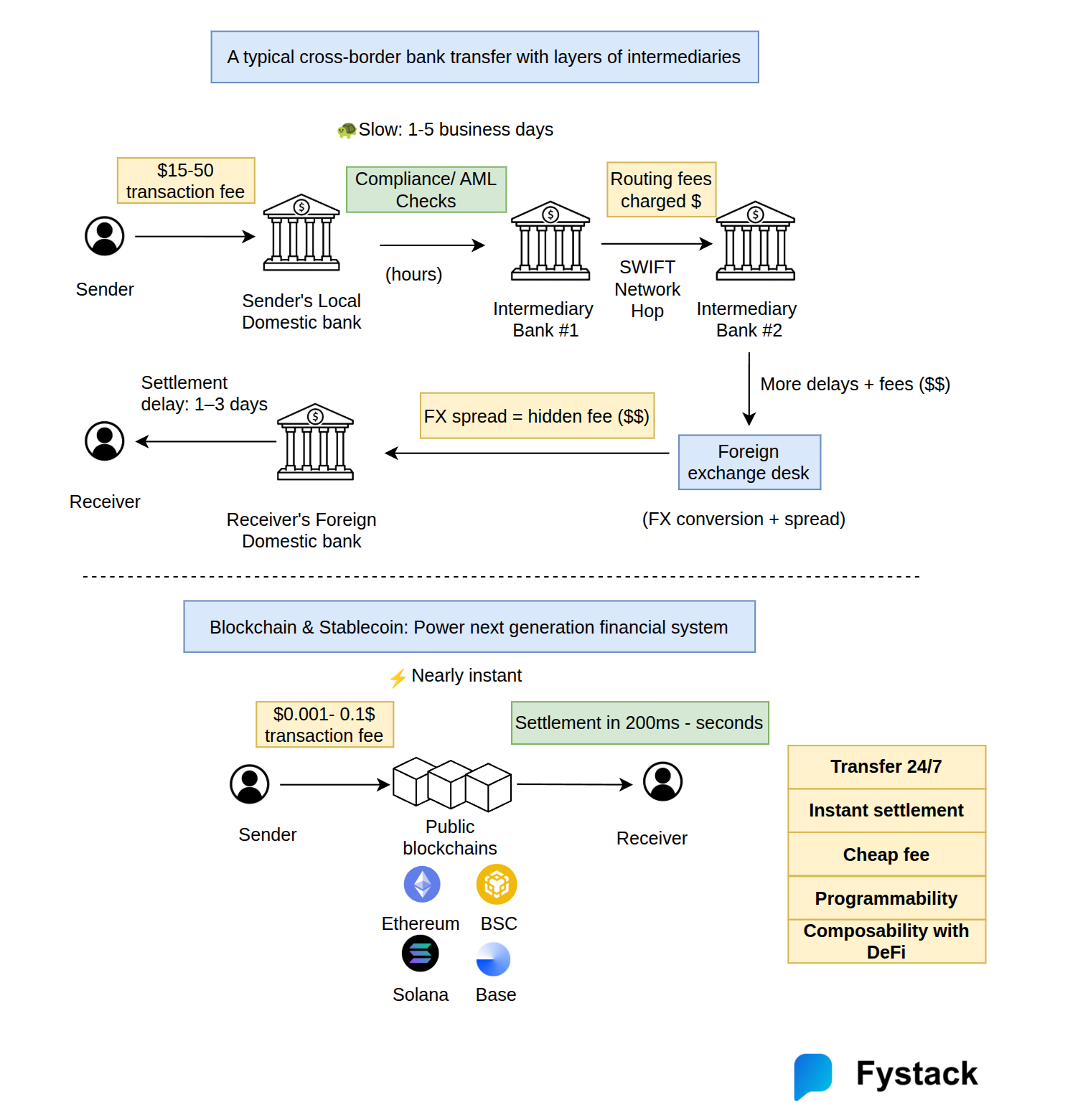

Have you ever wondered why a small business in Singapore paying a supplier in the US must wait 2 to 3 business days, absorb high foreign exchange fees, and sometimes see funds disappear inside the maze of correspondent banking, while an email crosses continents in seconds? This is the core paradox of today’s global financial system and a key reason why cross-border remittance and B2B international payments remain outdated.

Enterprises care about on-time settlement, cost efficiency, correct recipients, and transparent auditability. This is exactly where stablecoins are gaining ground, shifting from a “crypto convenience” to the backbone of enterprise finance and modern SEA, Africa, LATAM payment solutions.

For a deeper view, we previously analyzed why traditional banks should be concerned about stablecoin adoption.

What Questions Will This Article Address?

• How will stablecoins reshape cross-border payments and corporate treasury management by 2026?

• What are the true drivers of stablecoin growth, if not retail speculation?

• How do global regulatory frameworks enable enterprise adoption of stablecoins for core operations?

Why Cross-Border Payments Still Move Slowly in 2026: The Stablecoin Rail Gap

The modern financial system operates on an unacceptable paradox. Data travels across continents in milliseconds, yet when a small manufacturing business in Thailand pays a raw material supplier in Indonesia, or when a multinational corporation transfers profits from its US branch to its parent in Singapore, the value still settles in 2 to 3 business days (T+2 or T+3). These transfers often incur 3 to 8 percent correspondent banking fees, a significant cost for B2B cross-border payments.

As mentioned earlier, blockchain infrastructure already solved this technical limitation. Solana offers sub-second finality, and Ethereum Layer 2 networks settle transactions within seconds. But stablecoin payment adoption for real-world transactions remains only a tiny fraction of global payment volume.

The Operational Barriers to Enterprise Stablecoin Adoption

The bottleneck is not blockchain speed. The real constraint is the last-mile problem: integrating enterprise accounting systems, ERP workflows, and payment compliance requirements with decentralized payment rails.

Equally important is the absence of the working capital infrastructure that traditional banks provide, including pre-funding mechanisms, FX hedging, liquidity pools, and auditable ledgers that meet enterprise-grade compliance standards.

Why the Winners of 2026 Will Be Stablecoin Infrastructure Providers, Not L1 Narratives

The winners of the next payment cycle will not be projects selling “decentralization” or “trustlessness” as ideology. The winners will be the infrastructure providers that make working capital efficiency invisible - delivering:

• Faster cash flow

• Real-time payment finality

• Operational simplicity

• Enterprise usability without crypto complexity

This signals a shift from stablecoins being an “optional experiment” to an essential component of enterprise financial infrastructure.

How Stablecoins Become the New Cross-Border Payment Standard for Volatile Economies

Stablecoins are not just another speculative crypto asset. They function as what international organizations describe as a form of U.S. dollar influence extension, a tool increasingly relevant for emerging market payments, digital remittances, and regions facing:

• Local currency volatility

• Capital controls

• Limited banking access

• Need for USD-denominated payment stability

This is especially significant in Asia’s emerging markets, where demand for hard-money rails continues to grow.

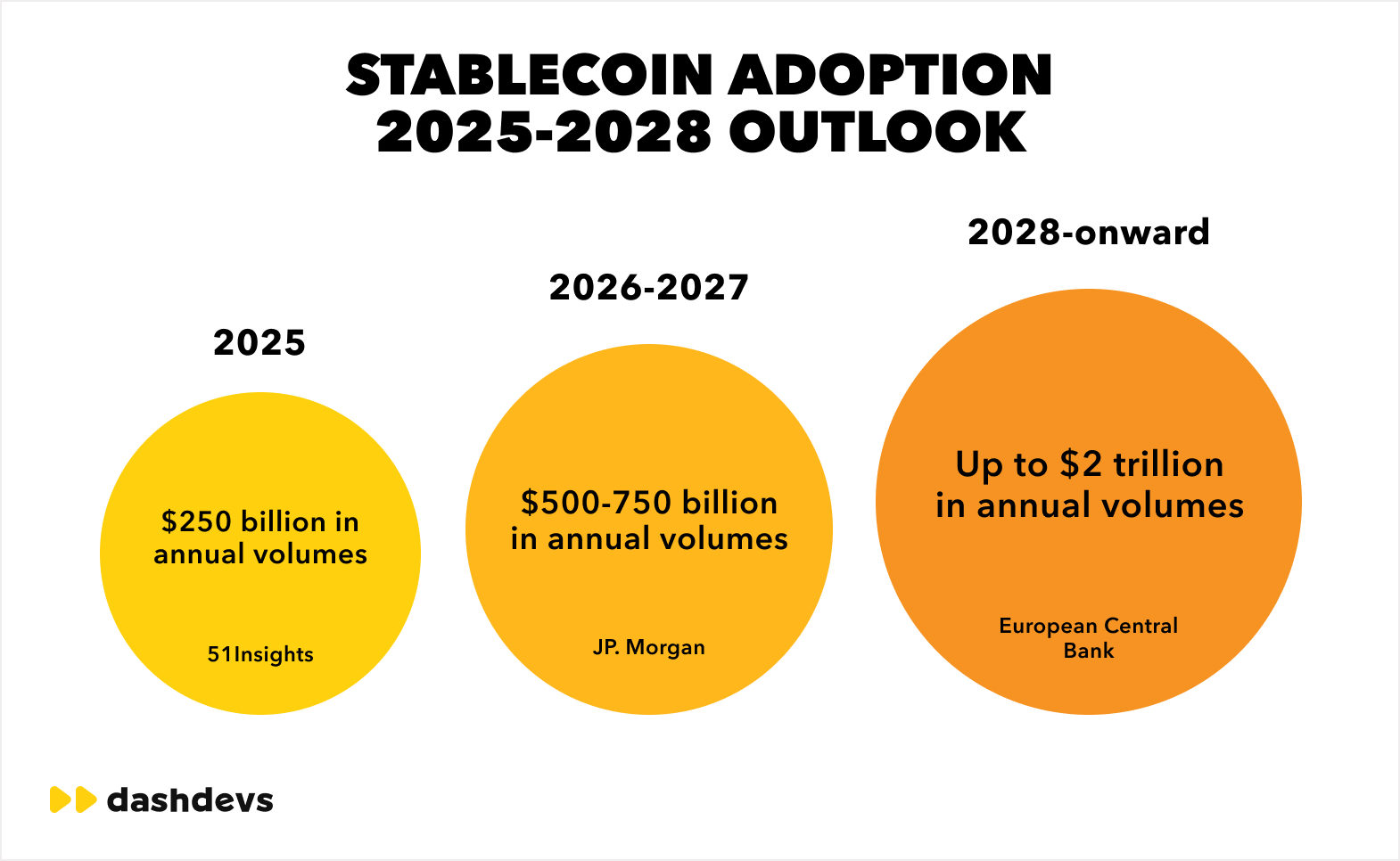

Real-World Transaction Volume: B2B and Payments, Not Just Trading

Although exact figures are difficult to isolate, on-chain stablecoin volumes regularly reach tens of billions to over one hundred billion USD per day. A growing share of this activity is attributed to genuine payment flows, not only speculative trading.

These transactions increasingly include remittances, B2B cross-border payments, and merchant or partner payouts across global corridors. While still a small percentage of total global transfer volume, adoption is rising because the operational benefits are tangible, not speculative.

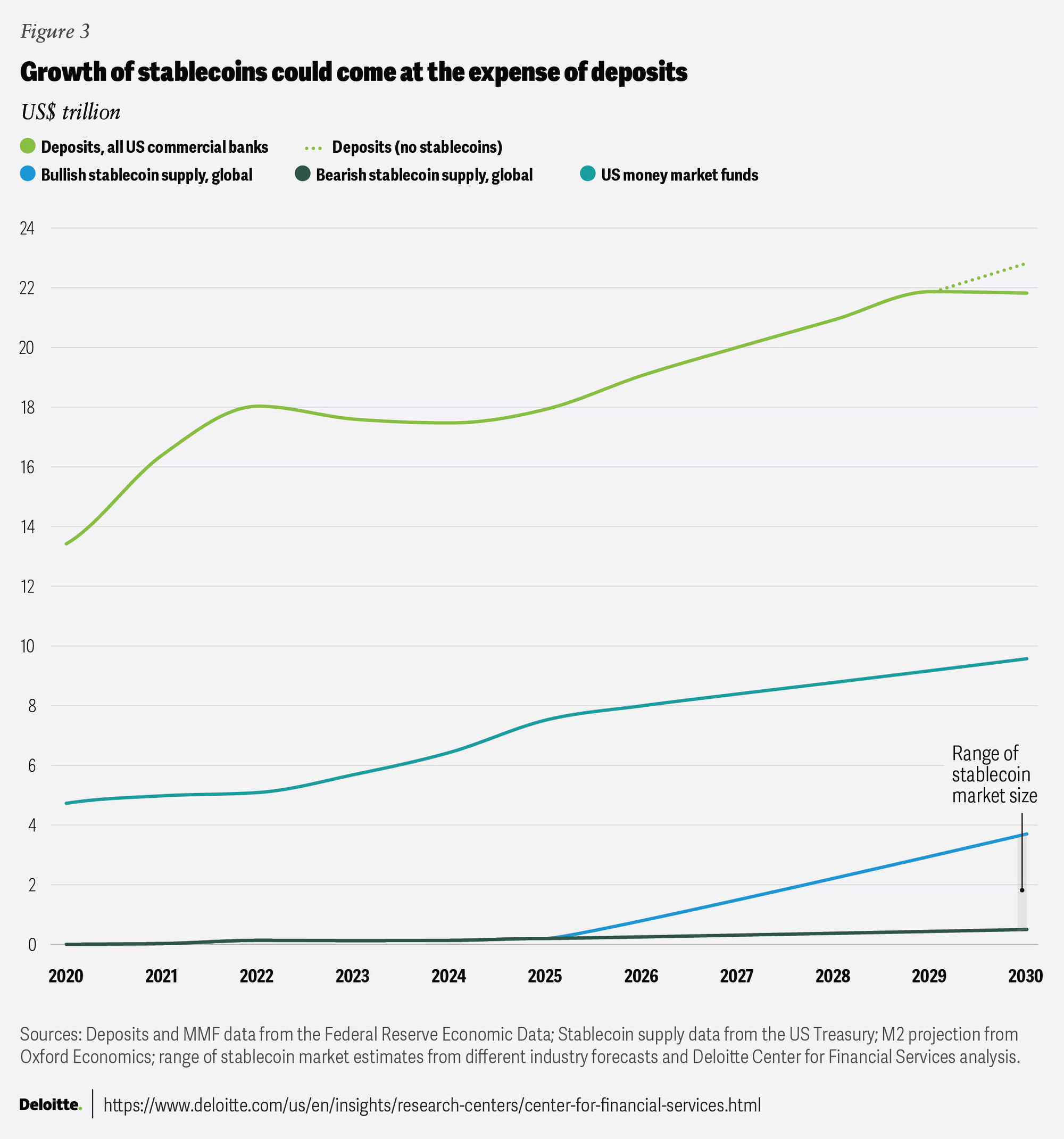

Growth in Stablecoin Market Capitalization

This acceleration is not driven primarily by retail speculation. While speculative flows exist, a rising share of stablecoin activity is fueled by institutional and enterprise adoption.

A 2026 industry prediction summarized it clearly: "By 2026, stablecoins are expected to become foundational for corporate treasury and institutional liquidity management, offering instant settlement, programmable cash flows, and on-demand yield generation." - Zodia Custody 2026 Predictions.

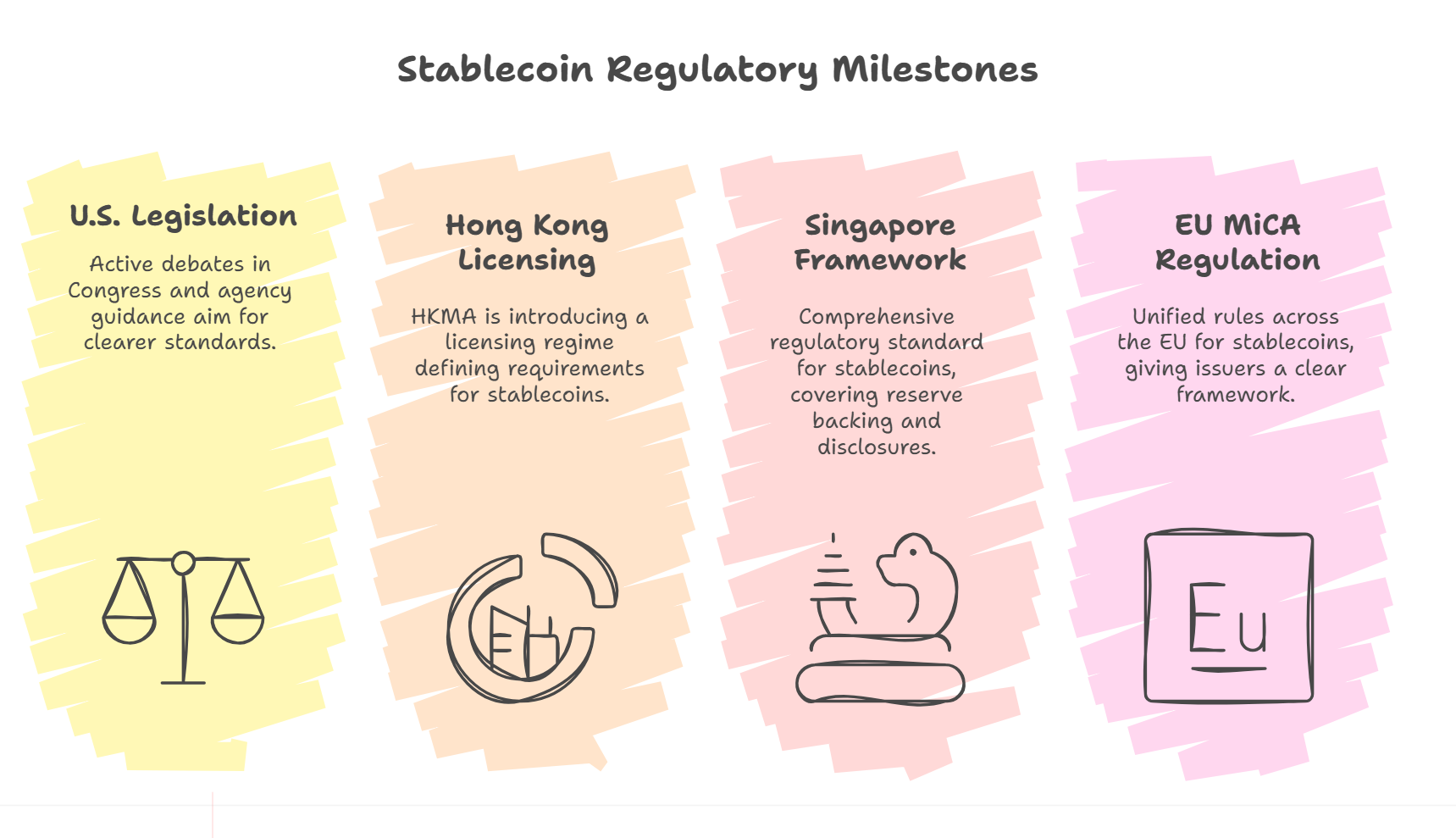

Regulatory Support: Clear Frameworks Reduce Compliance Barriers

The regulatory landscape is evolving quickly, enabling enterprise stablecoin adoption and giving institutions greater confidence to integrate stablecoin payment infrastructure.

Key Regulatory Milestones Enabling Enterprise Participation

- U.S. Stablecoin Legislation: Although a complete federal framework has not been finalized, multiple proposals are actively debated in Congress. Agencies such as the Federal Reserve, OCC, and SEC continue issuing guidance. These discussions aim for clearer standards that banks and financial institutions need before adopting stablecoins at scale.

- Hong Kong’s Stablecoin Licensing Regime: The HKMA is introducing a licensing regime defining requirements for reserves, custody, governance, and issuer accountability.

- MAS Singapore’s Stablecoin Framework (SCS): A comprehensive regulatory standard for SGD- or G10-pegged stablecoins, covering reserve backing, capital requirements, and disclosures. This positions Singapore as a leading hub for payment-stablecoin issuance in Asia.

- EU MiCA Regulation: MiCA introduces unified rules across the EU for reserves, governance, custody, and reporting, giving stablecoin issuers a clear operational framework.

These frameworks significantly reduce compliance friction for banks, asset managers, and corporate treasuries.

This reality forces Web3 product teams to integrate compliance considerations from day one, especially for enterprise blockchain solutions. For teams preparing for this shift, I strongly recommend reviewing a global stablecoin compliance checklist for fintech in 2025.

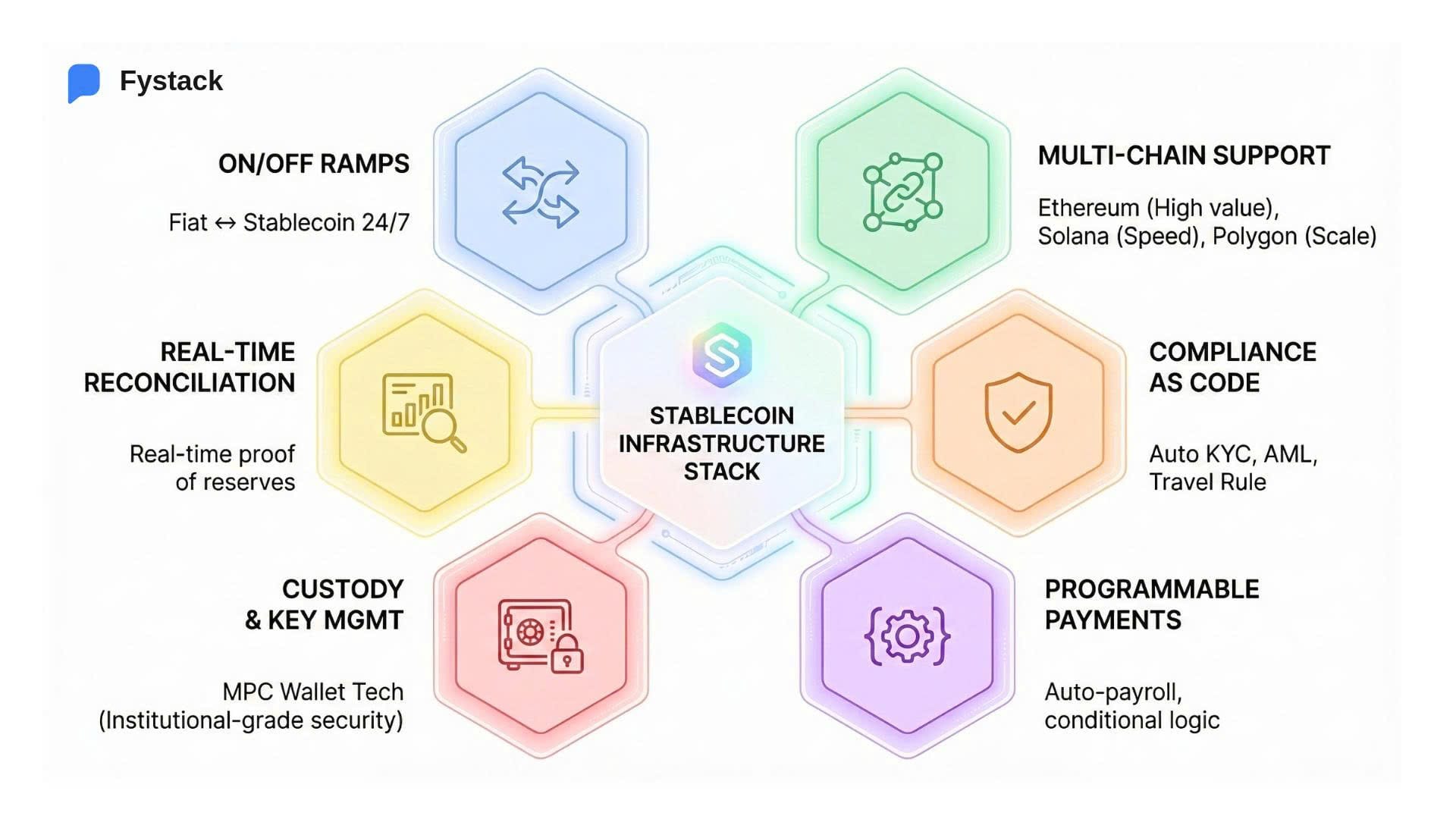

The Essential Capabilities of a 2026-Ready Stablecoin Payment Infrastructure

For any vertical SaaS model to work, the underlying stablecoin infrastructure must provide several core capabilities.

1. 24/7 On and Off Ramps

Businesses need instant, always-on conversion between stablecoins and fiat currencies such as USD, EUR, and GBP. This enables smooth cash flow and eliminates manual intervention.

2. Multi-Chain Support

Customers should be able to choose the blockchain that fits their operational needs. Examples:

- Ethereum for high-value B2B settlement

- Solana for high-frequency or micropayments

- Polygon for emerging market scale

Interoperability across chains is essential for reducing fragmentation.

3. Compliance as Code

Enterprises require built-in KYC, AML, travel rule compliance, and regulatory reporting. These must run automatically in the background so teams avoid separate audit burdens.

4. Programmable Payments

Stablecoin rails must allow:

- Automated disbursements

- Recurring or scheduled payments

- Multi-party settlement flows

- Conditional logic for treasury automation

This is the foundation for financial workflow automation.

5. Custody and Key Management

Enterprises need MPC-based wallets or institutional-grade custody that removes the friction of self-management. This is why many companies are evaluating self-hosted MPC wallet infrastructure, which aligns with the principle of "your keys, your coins" while maintaining enterprise security requirements.

6. Real-Time Reconciliation

Blockchain-native auditability enables:

- Continuous proof of reserves

- Instant reconciliation

- CFO dashboards with real-time insights

- End-to-end operational transparency

This is essential for regulated industries.

The Hidden Complexity Behind Stablecoin Payments: Where Startup Teams Get Stuck

This is where the narrative shifts toward Part 2. Many founders understand the macro thesis and the vertical strategy, but they underestimate the operational complexity of running a real payment rail. It is similar to wanting to build an airline but focusing only on designing beautiful planes while forgetting about airports, air traffic control, maintenance, and safety systems.

Overestimating Blockchain Simplicity

Many founders believe that "just put it on Ethereum" will solve the problem. In reality:

- Gas fee optimization

- RPC reliability

- Multi-chain reorg protection

- Bridge security often consumes 40 to 60 percent of engineering effort. A payment rail is a living system that requires continuous operational work.

Underestimating Custody and Compliance

Building enterprise payment infrastructure means delivering:

- Institutional-grade MPC or certified custody

- Independent attestation

- Data retention and regulatory reporting pipelines

This alone can take 6 to 12 months. Any gaps introduce legal, operational, and reputational risk.

Missing the Liquidity Requirement

On-chain payments are useless without liquidity. Founders must decide whether to:

- Provide their own liquidity, or

- Secure exclusive agreements with custodians, OTC desks, or DEX aggregators

Liquidity is the lifeblood of stablecoin payments.

Forgetting Operational Resilience

Banks and enterprises expect:

- 99.99 percent uptime

- Instant dispute resolution

- Clear SLAs and incident workflows

Many blockchain infrastructure providers do not commit to this level.

The natural question becomes: How can you build this infrastructure without turning your company into a bank or a full custodial institution?

The answer is a hybrid architecture that uses:

- Specialized custody platforms

- Liquidity providers and aggregators

- MPC-backed key management infrastructure

- Composable compliance modules

Part 2 will outline this architecture in detail, specifically for fintech teams building Web3-enabled payment products.

FAQ: Stablecoins and the Future of Payments

What are stablecoins and why do they matter for enterprise payments?

Stablecoins are cryptocurrencies pegged to assets like USD. They matter because they offer T+0 settlement, low-cost transfers, and no FX volatility, which improves enterprise cash flow.

How do stablecoins fix cross-border payment delays?

Traditional rails take 2-3 business days. Stablecoin transfers settle within seconds or minutes, enabling faster, more predictable global operations.

How do regulations affect enterprise stablecoin adoption?

Frameworks like EU MiCA, MAS Singapore, and HKMA guidelines provide legal clarity and risk reduction, making stablecoins safer for banks and enterprises to integrate.

What’s the difference between crypto wallets and vertical fintech for stablecoins?

A crypto wallet is general-purpose. Vertical fintech is specialized SaaS that uses stablecoins under the hood to solve business workflows (payroll, supplier payments, treasury) without exposing crypto complexity.

Why is USD stablecoin demand high in emerging markets?

Because of local currency instability, inflation, and limited banking access. USD stablecoins provide value preservation and efficient cross-border transactions, making them a reliable financial tool.

Conclusion

By 2026, stablecoins will quietly power the global payment stack behind the scenes. The winners will not be the teams selling "crypto." The winners will be the teams building vertical SaaS products that deliver:

- Faster cash flow

- Lower FX friction

- Instant settlement

- Automated financial operations

- Real-time treasury visibility

Stablecoins will be the invisible infrastructure making these benefits possible, but the end-user will barely notice. That is exactly the point.

If you care about security, compliance, and reliability in Web3 operations:

👉 Try Fystack today: https://app.fystack.io

👉 Join our Telegram community for web3 security updates, engineering insights & product updates: https://t.me/+9AtC0z8sS79iZjFl