Digital Asset Auto Sweeping on Fystack: Automating Secure Fund Consolidation at Scale

Phoebe Duong

Author

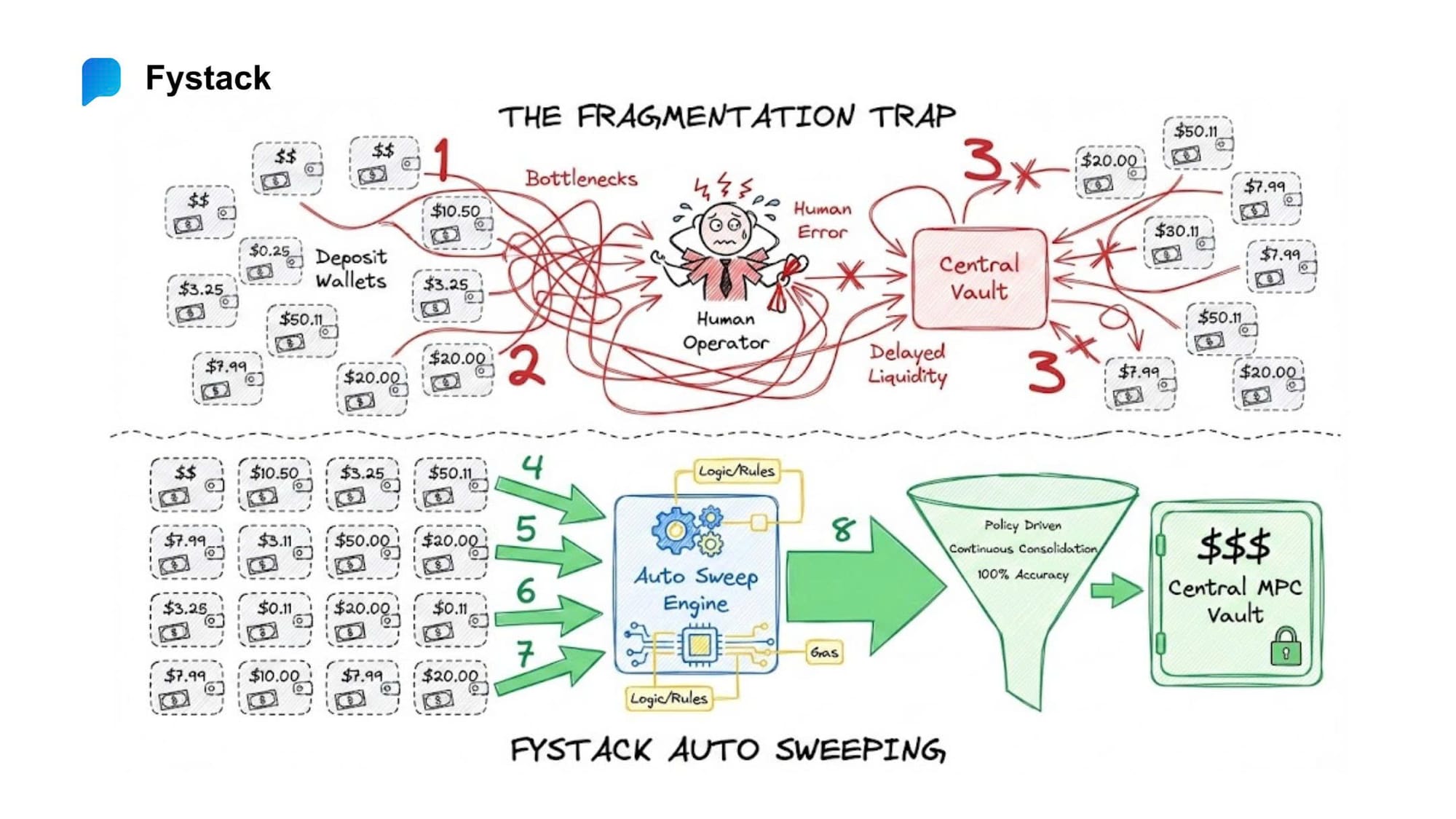

As on-chain systems scale, fund fragmentation becomes an operational risk.

User deposits arrive across thousands or millions of addresses. Balances accumulate unevenly. Manual consolidation quickly becomes infeasible, not only due to workload, but because it degrades operational efficiency, increases error rates, delays transfers, and weakens consistency in security controls.

This is where Auto Sweeping becomes a core component of crypto treasury management, not a convenience feature.

On Fystack, Auto Sweeping is tightly integrated with MPC custody, policy enforcement, and real-time blockchain monitoring. Asset consolidation is executed automatically as a system-enforced workflow, not as a series of manual transfers - eliminating new security or operational risks as volume grows.

What Is Auto Sweeping?

Auto Sweeping is an automated process that continuously monitors balances across deposit wallets and programmatically transfers funds into a designated central wallet once predefined conditions are met.

Instead of operators manually triggering thousands of transactions, Fystack executes sweeps through policy-driven rules, MPC-based cryptographic signing, and coordinated transaction orchestration.

At a high level, Auto Sweeping allows teams to:

- Monitor balances across large sets of deposit addresses

- Trigger transfers automatically based on policy conditions

- Consolidate assets into secure MPC wallets

- Remove manual handling from routine treasury operations

Why Manual Sweeping Does Not Scale

In small systems, manual consolidation may appear manageable. At scale, it actively undermines crypto treasury operations:

- Creates operational bottlenecks: finance teams cannot process inbound volume fast enough

- Amplifies human error: incorrect addresses, incorrect amounts, or mistimed execution

- Extends security exposure: funds remain unnecessarily long in user-facing wallets

- Breaks liquidity visibility: delayed sweeps distort treasury forecasting and planning

Manual workflows force teams to react. Auto Sweeping replaces this with a deterministic, system-controlled process that executes asset consolidation continuously and predictably.

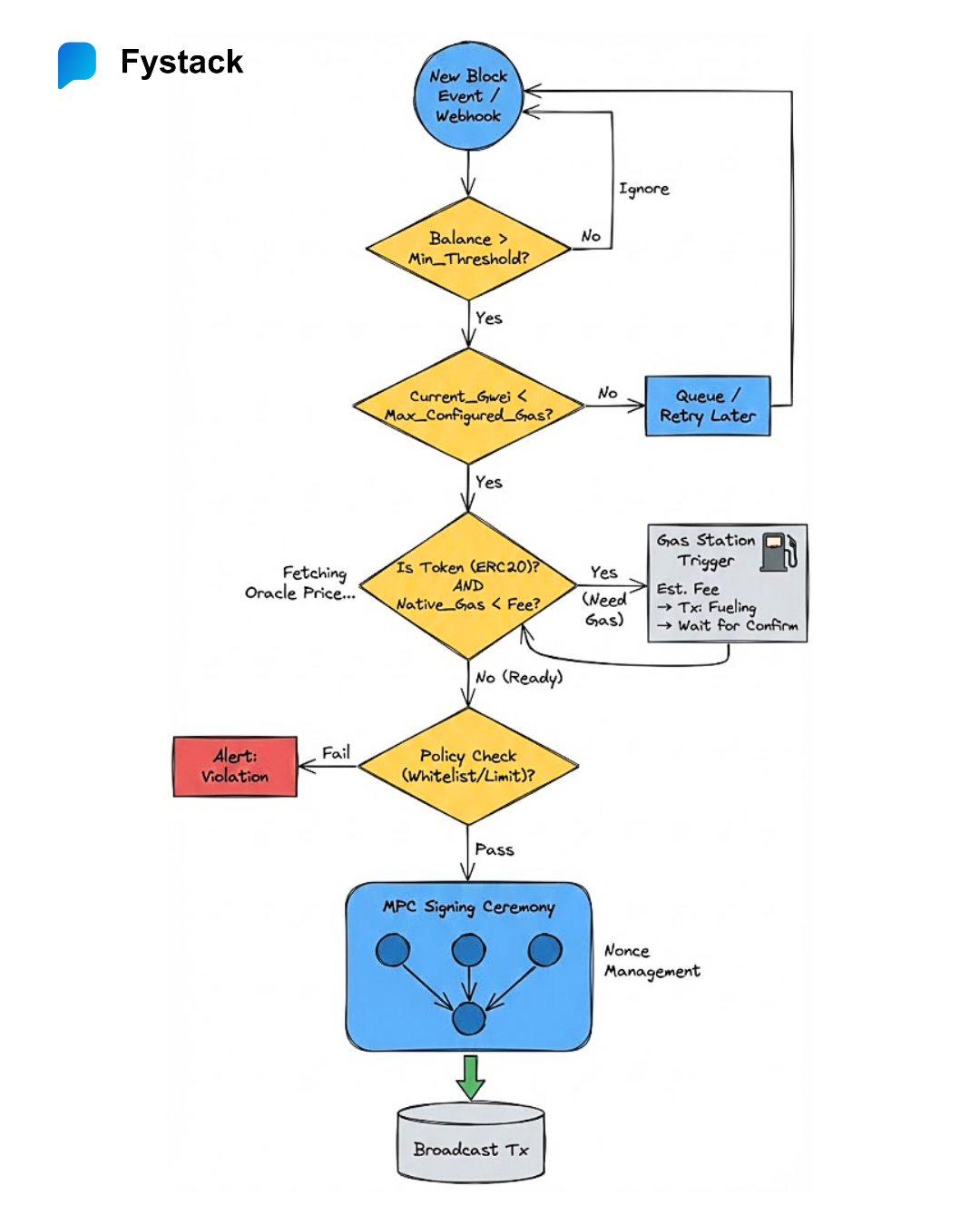

Sweep Task Configuration: How Triggers Work

On Fystack, sweeping behavior is defined through configurable Sweep Tasks. Each task specifies when, how, and under what constraints assets are consolidated.

Balance Threshold Triggers

Sweeps can be configured to execute only when a wallet’s balance exceeds a predefined threshold.

Example:

- Sweep only when balance > $50,000

- Avoid low-value, gas-inefficient transfers

- Optimize transaction cost relative to asset value

This approach is commonly used in high-throughput deposit systems where asset consolidation efficiency matters.

Scheduled Sweeps

In addition to balance-based triggers, teams can define time-based execution windows.

Examples:

- Sweep every hour

- Sweep once per day

- Align consolidation with accounting or settlement cycles

This model improves predictability and simplifies reconciliation.

Gas-Aware Execution

Sweep tasks can also factor in network fee conditions:

- Delay execution during congested periods

- Execute when gas normalizes

- Reduce long-term operational cost without compromising security

Basic Implementation Flow (Dashboard & API)

Auto Sweeping can be configured via the Fystack Dashboard or programmatically through APIs.

Step 1: Create a Sweep Task

Define:

- Asset type (token or native asset)

- Target blockchain

- Source wallet group to monitor

Step 2: Configure Rules

Specify:

- Destination wallet (typically an MPC wallet)

- Trigger conditions (threshold, schedule, gas)

- Policy constraints, if required

Step 3: Real-Time Monitoring via Webhooks

When a sweep is executed, Fystack sends a POST webhook containing:

- txHash

- amount

- status

- source and destination wallets

- execution timestamp

This keeps accounting, reconciliation, and reporting systems synchronized without continuous blockchain polling.

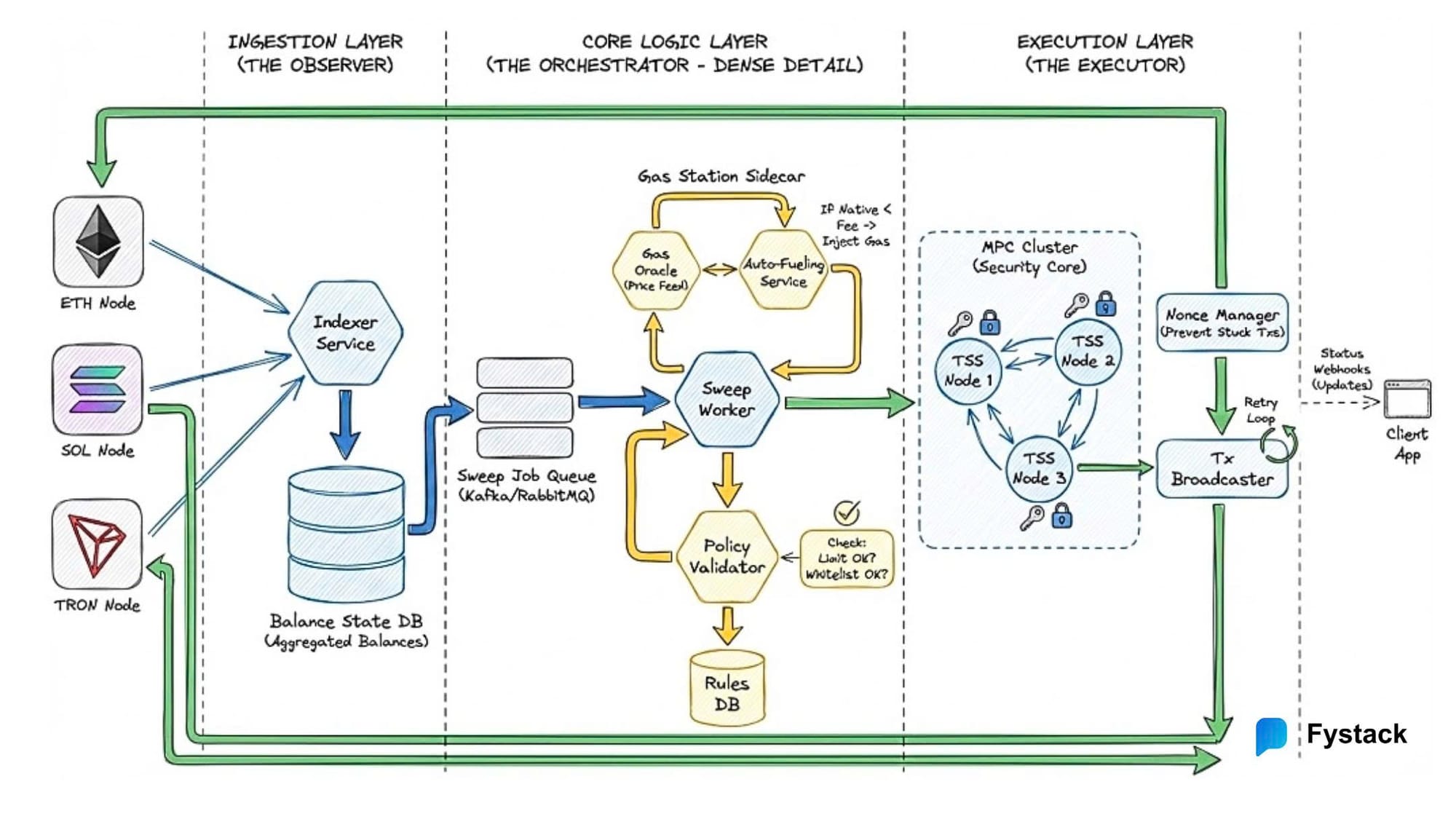

The Technical Architecture Behind Auto Sweeping

Auto Sweeping on Fystack is not a simple transfer loop. It is a coordinated custody workflow combining monitoring, policy enforcement, MPC signing, and transaction execution.

1. Blockchain Monitoring and Balance Aggregation

Fystack operates dedicated indexing and monitoring services that track inbound transactions in real time.

This layer:

- Detects confirmed inbound transfers

- Aggregates balances across deposit wallets

- Continuously evaluates sweep conditions

It acts as the trigger engine for automated execution.

2. MPC-Based Keyless Transaction Signing

Once conditions are met, transactions are signed through MPC.

Unlike traditional wallets:

- No full private key exists

- Key material is split into cryptographic shares

- Signing requires threshold collaboration

Automation does not weaken custody guarantees.

3. Policy Enforcement Before Execution

Before signing, each sweep is evaluated by a policy engine.

This enforces:

- Destination address whitelisting

- Spending limits

- Asset and network restrictions

- Optional approval logic

Unlike traditional sweeping tools that only “move funds,” Fystack ensures every consolidation action remains policy-compliant.

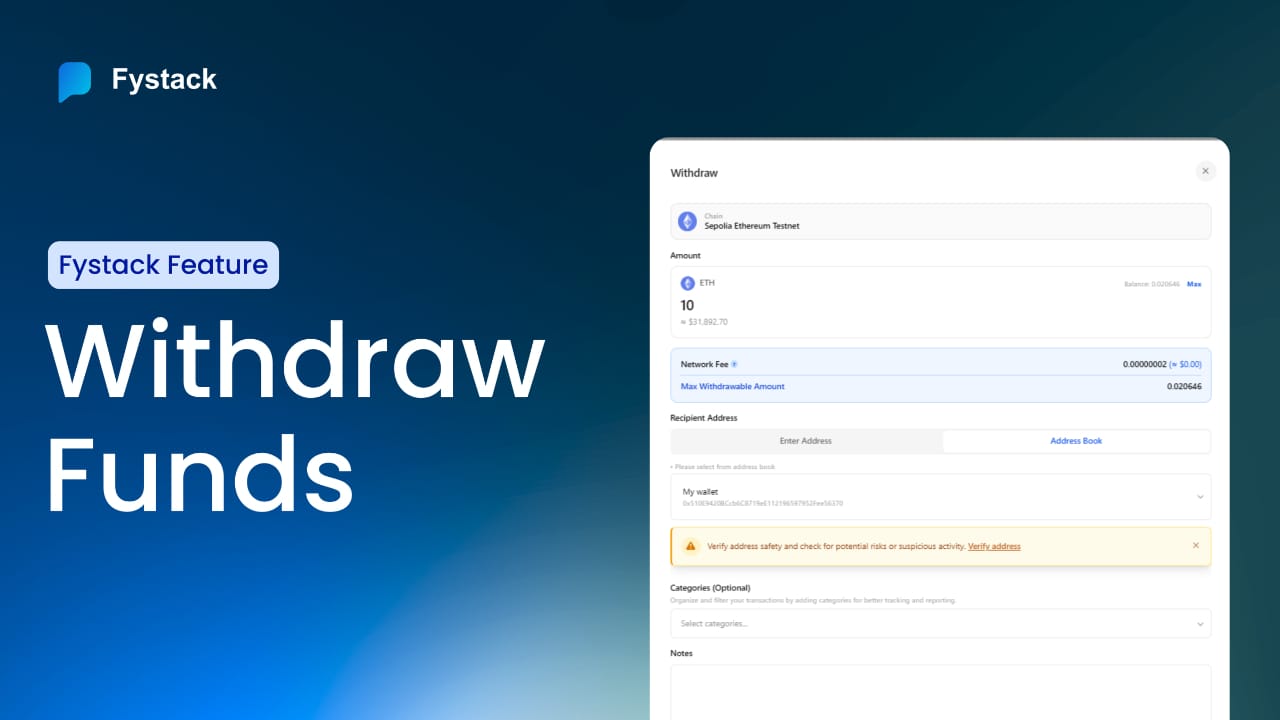

This same policy framework also governs outbound fund movement. On Fystack, withdrawal workflows are designed as controlled, system-enforced processes - ensuring that funds leave custody with the same level of policy discipline as they enter centralized MPC wallets.

4. Gas and Nonce Management at Scale

Sweeping at scale introduces transaction coordination challenges.

Fystack handles this through:

- Dynamic gas estimation

- Controlled nonce sequencing

- Retry and failure handling

- Optional batching on supported chains

This prevents partial execution or stuck transactions.

5. Token Sweeping and Auto-Fueling

Token sweeps require native gas balances.

Fystack automates this by:

- Detecting insufficient gas

- Funding wallets with minimal native assets

- Executing token sweeps immediately

This prevents stranded balances and maintains operational continuity.

Why Auto Sweeping Matters for On-Chain Operations

As treasury and payments move on-chain, funds fragment across wallets, chains, and small balances.

Without automation:

- Assets sit idle in deposit wallets

- Gas management becomes manual

- Consolidation happens too late

- Operations rely on human vigilance

On-chain systems punish delay and inconsistency.

Auto Sweeping converts asset consolidation into a policy-governed system rule, preserving visibility, security, and operational efficiency as volume scales.

In payment and stablecoin-focused platforms, Auto Sweeping typically operates alongside KYT screening and policy-controlled execution to form a complete on-chain payments stack. When consolidation, compliance checks, and custody controls work together, teams can scale transaction volume without introducing blind spots in risk or treasury visibility.

Conclusion

Auto Sweeping on Fystack transforms asset consolidation from a manual treasury task into a system-enforced custody primitive. Funds are monitored continuously, consolidated automatically under policy control, and secured in MPC wallets as scale increases.

For teams managing on-chain treasury operations, this enables growth without sacrificing security, visibility, or control.

Have questions about your custody setup?Share what you are building via the form and explore how Fystack’s MPC wallets, KYT integrations, and consolidation engine fit your architecture.

Not ready yet?Join our Telegram for product updates and architecture discussions: https://t.me/+9AtC0z8sS79iZjFl

FAQ

What is Auto Sweeping on Fystack?

Auto Sweeping is an automated fund consolidation mechanism that continuously monitors deposit wallets and transfers funds to a designated MPC Wallet once predefined conditions are met. It replaces manual balance checks and ad hoc transfers with system-enforced rules.

Why is Auto Sweeping important for on-chain treasury operations?

On-chain funds often fragment across thousands of deposit wallets. Without automation, teams discover balances too late, miss consolidation windows, or rely on manual intervention. Auto Sweeping ensures funds are consolidated consistently and safely as transaction volume grows.

What triggers an Auto Sweep?

Sweeps can be triggered by balance thresholds, scheduled intervals, or gas conditions. Teams can configure rules such as sweeping only when a wallet exceeds a specific amount or when network fees fall within an acceptable range.

How does Auto Sweeping work with MPC Wallet security?

When a sweep is triggered, the transaction is signed using MPC. Private keys never exist in full form, and all signing operations follow predefined approval thresholds and custody policies before execution.

Can Auto Sweeping move funds from user wallets to a central treasury?

Yes. A common setup is to use Hyper Wallets for user deposits and an MPC Wallet as the central treasury vault. Auto Sweeping consolidates funds from user-facing wallets into the MPC Wallet automatically for centralized control.

How are gas fees handled during Auto Sweeping?

If a deposit wallet does not have enough native tokens to pay gas, Fystack can automatically provision gas before executing the sweep. This prevents failed transactions and manual gas management.

How do finance and accounting systems track sweep transactions?

Every sweep emits structured events through APIs and webhooks, including transaction hash, amount, status, and timestamps. This allows accounting, reconciliation, and internal reporting systems to stay in sync without manual blockchain queries.

Is Auto Sweeping suitable for high-volume platforms?

Yes. Auto Sweeping is designed for exchanges, payment platforms, and Web3 fintechs that process large volumes of deposits daily. It scales without increasing operational workload or custody risk.

Does Auto Sweeping reduce operational risk?

By removing manual balance monitoring and fund transfers, Auto Sweeping reduces human error, delayed responses, and inconsistent processes. Fund movement becomes predictable, auditable, and policy-driven.

FystackFystack

FystackFystack

FystackFystack

FystackFystack