Fystack vs Fireblocks – Self-Hosted vs SaaS: What Is the Future of Crypto Asset Custody for Businesses?

Ted Nguyen

Author

BD & Growth @Fystack

For years, Fireblocks defined digital asset custody for institutions.

But the world is changing. In the world of digital asset custody, questions keep coming up:

- What are the best self-hosted alternatives to Fireblocks with full control?

- Which digital asset custody provider with MPC wallets offers the same security and automation but without SaaS vendor lock-in?

- And can self-hosted custody platform really offer enterprise-grade security and reliability?

That’s where self-hosted MPC wallet infrastructure like Fystack changes the game

Built for developers and businesses who want control, transparency, and compliance without vendor dependency, Fystack represents the next evolution of digital asset infrastructure.

Accessible. Auditable. Affordable.

“Fireblocks builds for institutions. Fystack builds for EVERYONE.”

Why Businesses Are Moving from SaaS to Self-Hosted MPC Solution

The crypto industry has learned a hard lesson: convenience has a cost.

When custody is outsourced, control, and sometimes assets, go with it.

In late 2025, we saw "regulated" custodians like Fortress Trust collapse, revealing millions in missing funds. Even major exchanges faced massive operational failures. The lesson?

"Even “regulated” custodians can collapse when their internal controls are opaque and misaligned with on-chain realities."

The event underscores the critical need for businesses to take control of their digital assets.

👉 Read more: The New Standard in 2026 – Self-Hosted MPC Wallet Infrastructure

SaaS vs. Self-hosted MPC Infrastructure

Base, despite its impressive growth, suffered downtime when AWS went offline. And when Base went down, one comment went viral:

“If AWS crashes and your ‘decentralized’ blockchain crashes with it, it’s just fintech with extra steps.”

It’s a reminder that even the biggest names in Web3 are only as “decentralized” as the infrastructure they depend on.

That same lesson applies to digital asset custody and key management.

Because in the end, the question is “Who really holds control?”

There are two clear philosophies emerging in the market:

The SaaS model

Fireblocks made digital asset custody intuitive for institutions. It’s secure, compliant, and polished, the enterprise-grade standard for a reason.

But it’s also centralized by design.

Your private keys, policies, and digital asset operations all live inside their infrastructure. The platform offers a sophisticated policy engine that allows for granular policy controls, and their commitment to disaster recovery provides peace of mind.

You get convenience and a proven track record, but you trade it for sovereignty.

The Self-Hosted Infrastructure model

Fystack flips that equation. It’s built for everyone that wants to own their custody layer entirely. Run it, audit it, scale it without asking permission.

Our self-hosted MPC wallet infrastructure gives you full control over data, keys, and policies while enabling transparent regulatory compliance.

And because we believe in verifiable trust, the code is open.

It’s the difference between trusting a vendor and being able to verify everything yourself.

Table 1. Fystack vs Fireblocks’s Key Features Comparison

Category | Fireblocks (SaaS Custody) | Fystack (Self-Hosted Infrastructure) |

Architecture | Closed SaaS platform | Open-source, self-hosted MPC nodes |

Ownership | Fireblocks controls the infrastructure and update cycle. | You control your data, policies, and deployments fully. |

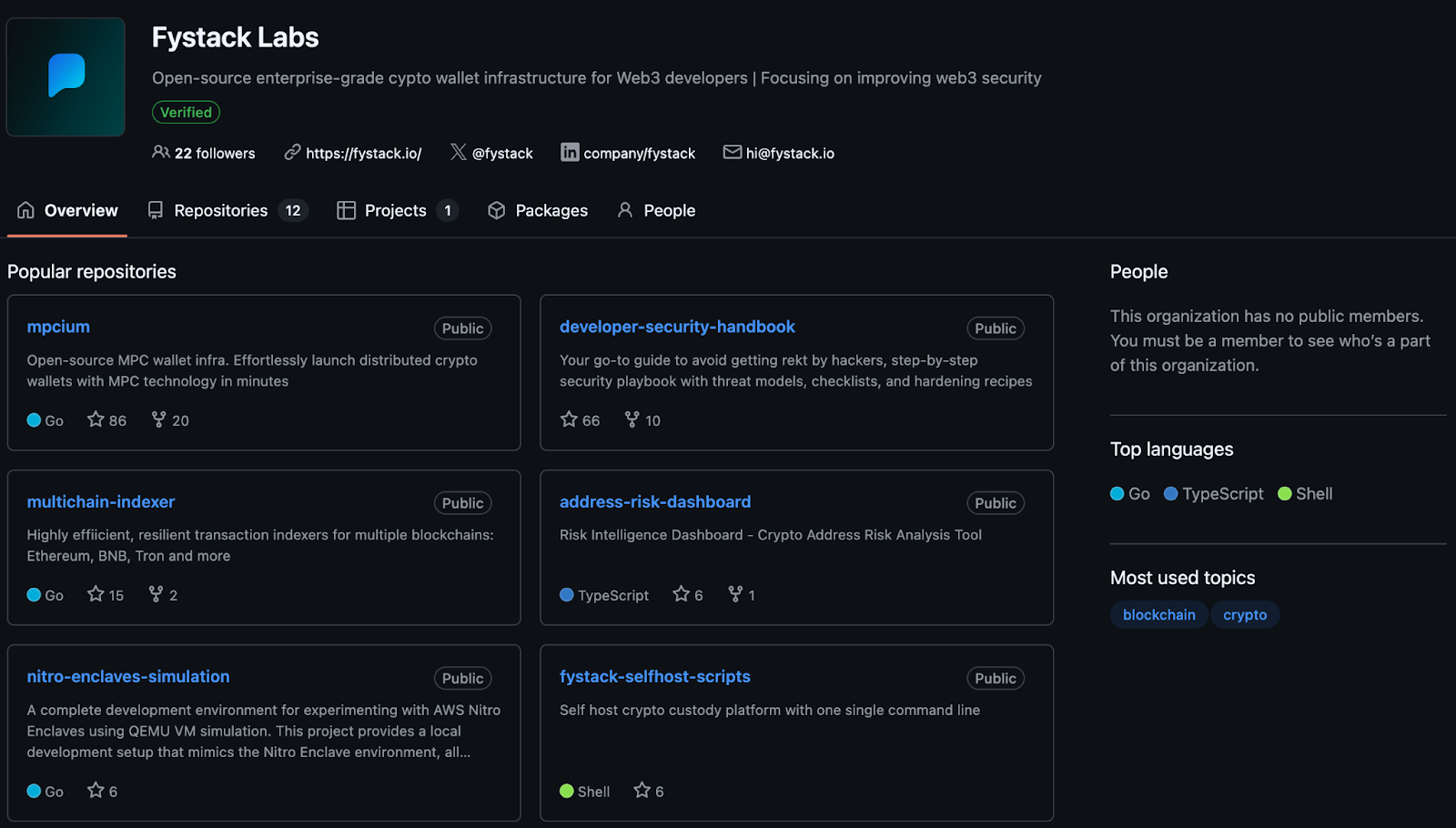

Transparency | Proprietary code and opaque processes. | Auditable via GitHub. Open code, open roadmap, open community. |

Integration | Predefined APIs, limited customization, fixed UI workflows. | SDK-first design, developer-friendly, integrated directly into your stack. |

Compliance | Compliance inherited from Fireblocks’ certifications (SOC 2, ISO). | Compliance defined by your policies, supports data sovereignty, travel rule, and auditability. |

Vendor Lock-in | High, API dependency risks. | None, full exportability and open-source design. |

# of Wallets | Limited, based on your plan | Unlimited, served your needs |

Volume/AUM | $1M Volume, $1M AUM | Unlimited |

Community & Ecosystem | Closed partner network, updates under NDA. | Open community-led roadmap, contributions via GitHub. |

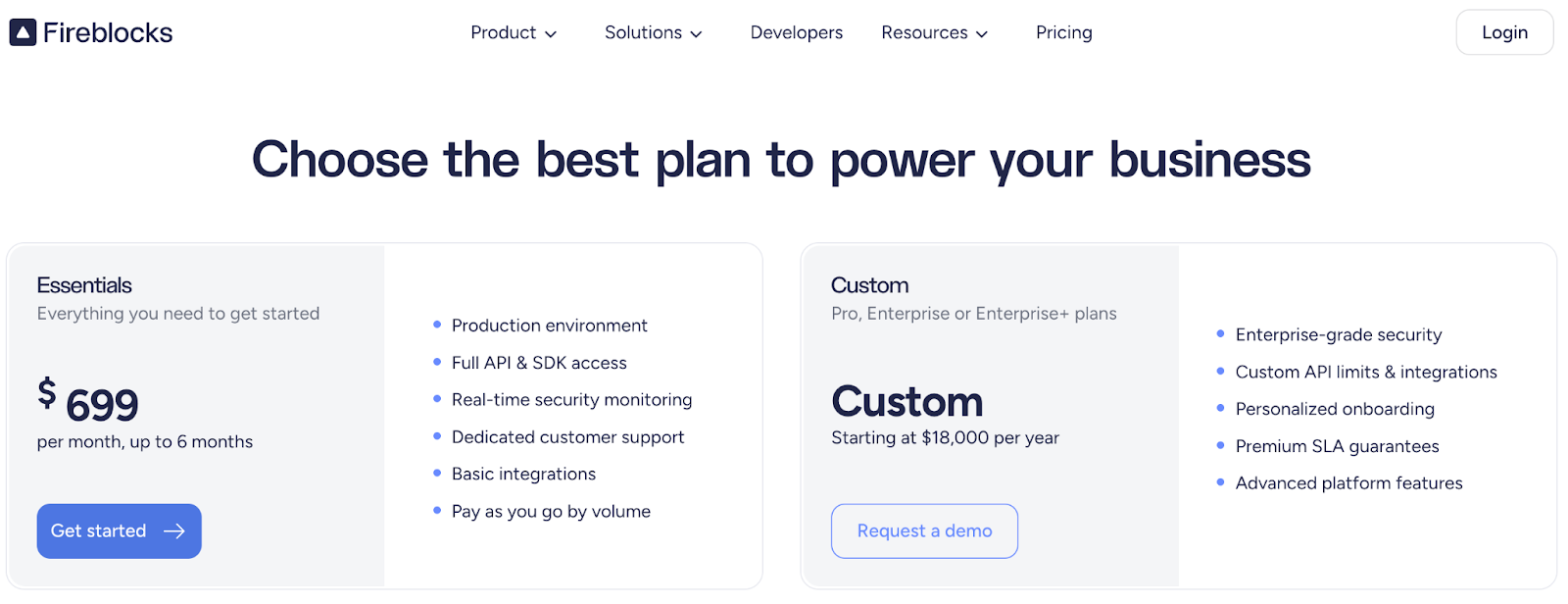

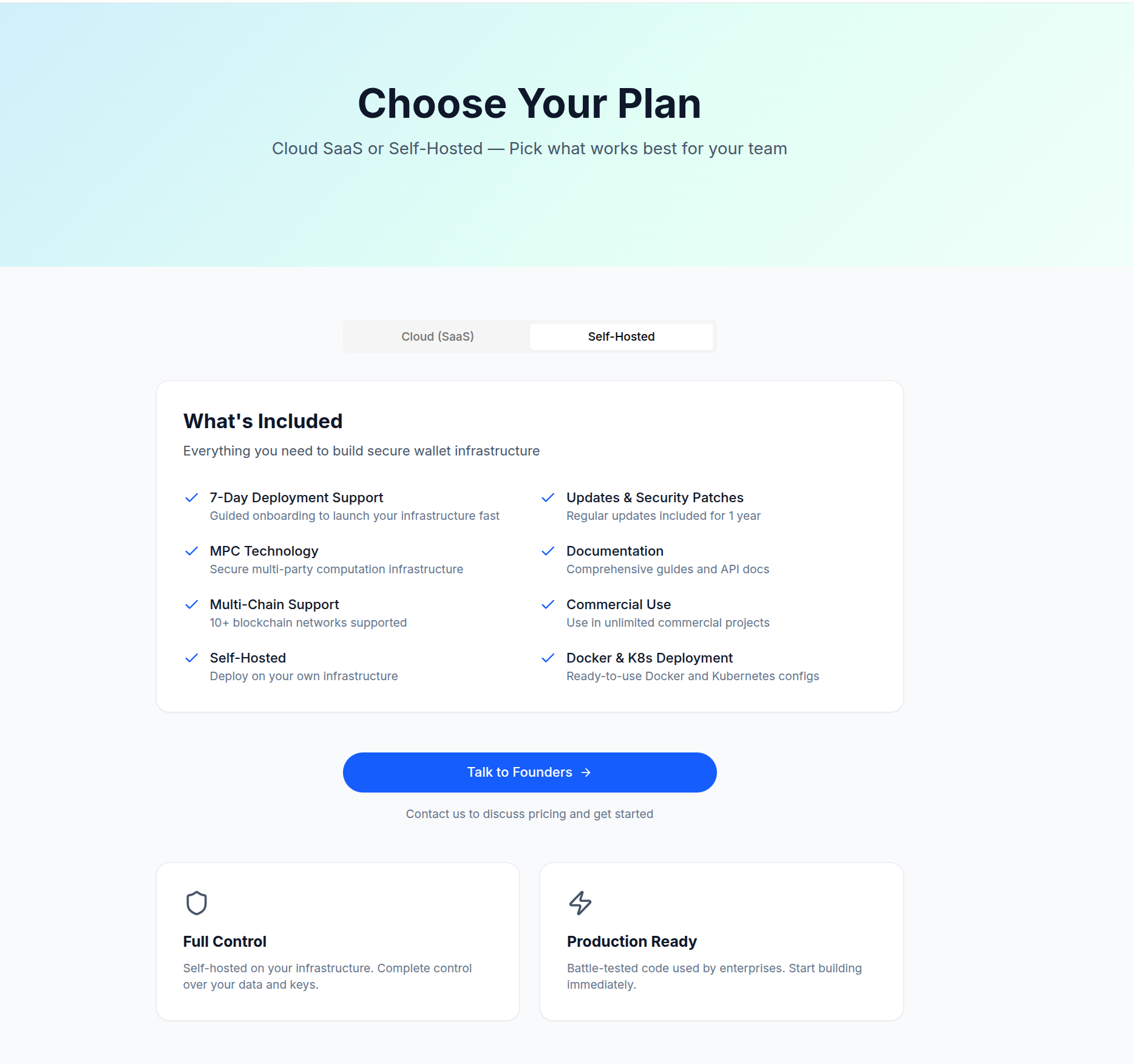

Pricing | Starter plan, $8,388/year. Higher level plan, $18,000+/year | $10,000 one-time license, exclusive offer available. |

Transparency and Auditability

It’s 2026 and if you still trust the black box, you’re outdated.

The old world ran on trust-based custody: opaque SaaS providers, proprietary systems, and glossy dashboards that tell you everything’s fine.

But we’ve entered a new age of verify-based control. That shift was discussed in The New Standard in 2026: Self-Hosted MPC Wallet Infrastructure.

In this new model, you don’t take a vendor’s word for it. You read the code, audit the logic, and verify the policy yourself.

That’s what Fystack enables.

It’s open-source, developer-friendly, and fully self-hosted.

Your engineers can check every cryptographic protocol. They can also check every signing rule and every policy enforcement flow.

You can ensure that your security controls and key management processes are not just compliant on paper but verifiably secure in practice.

This level of transparency is impossible in a closed SaaS environment and is becoming a non-negotiable for modern cybersecurity requirements.

Want to see why this matters?

Read Top Crypto Hacks in 2026: Why We Still Fail to Protect Digital Assets

Developer Experience and Integration

Fireblocks was designed for institutions that want a polished, ready-to-use custody service.

You log in, configure policies, and let their system handle the rest. It’s convenient but also constrained. You operate within their interface, their update cycles, and their API limits.

For many fintechs or exchanges just getting started, that’s enough. But once your product scales, the trade-offs become obvious: every new feature, from engaging with new DeFi protocols to building a unique smart contract wallet, depends on someone else’s roadmap.

By contrast, Fystack’s SDK-first design lets developers embed MPC wallet infrastructure directly into their apps with full transparency.

You can integrate, test, and deploy on your own terms, enabling powerful customizations like programmatic smart contract interactions, advanced workflows, and even integrating modern security measures like biometric authentication.

Want to see how it works?

👉 Explore Fystack Documentation to start building your own self-hosted MPC wallet setup in minutes.

You see the difference?

Fystack optimizes for control, while Fireblocks optimizes for comfort.

And when comfort meets scale, it comes with a hidden cost: vendor lock-in.

Also read: Why Fintech Companies Should Choose MPC Wallets to Go On-Chain

Pricing and Vendor Lock-In: The Hidden Cost of Convenience

Fireblocks model looks simple on paper because it shows predictable pricing, enterprise-grade support, and seamless onboarding. But behind that convenience lies a trade-off that most teams only discover after they’ve scaled.

One user on G2, a Business & Software Review Platform, who already used Fireblocks put it this way:

“The pricing is on the higher side, especially for smaller companies or individuals. It feels like you're paying a premium for the security, which is great, but it can be a bit much if you're not managing large amounts of assets.” - Anonymous on G2

Once your wallets, policies, and API dependencies are tied into a SaaS custody provider, you’re not just a customer anymore. Instead, you’re an extension of their platform.

- Want a new feature? Wait for the next update.

- Need custom compliance rules? File a support ticket.

- Want to migrate? Good luck.

This quiet cost is hidden on paper but can cost millions in lost flexibility and delayed product launches.

That’s why Fystack chose a fundamentally different path.

Its self-hosted architecture means your wallet nodes, data, and cryptographic logic live in your environment.

No forced upgrades, no closed APIs, and no migration nightmare.

👉 And if you’re comparing other tools, check Top Non-Custodial Solutions for Businesses in 2026.

We believe in DYOR — do your own research, even if that means comparing us fairly.

Community and Ecosystem

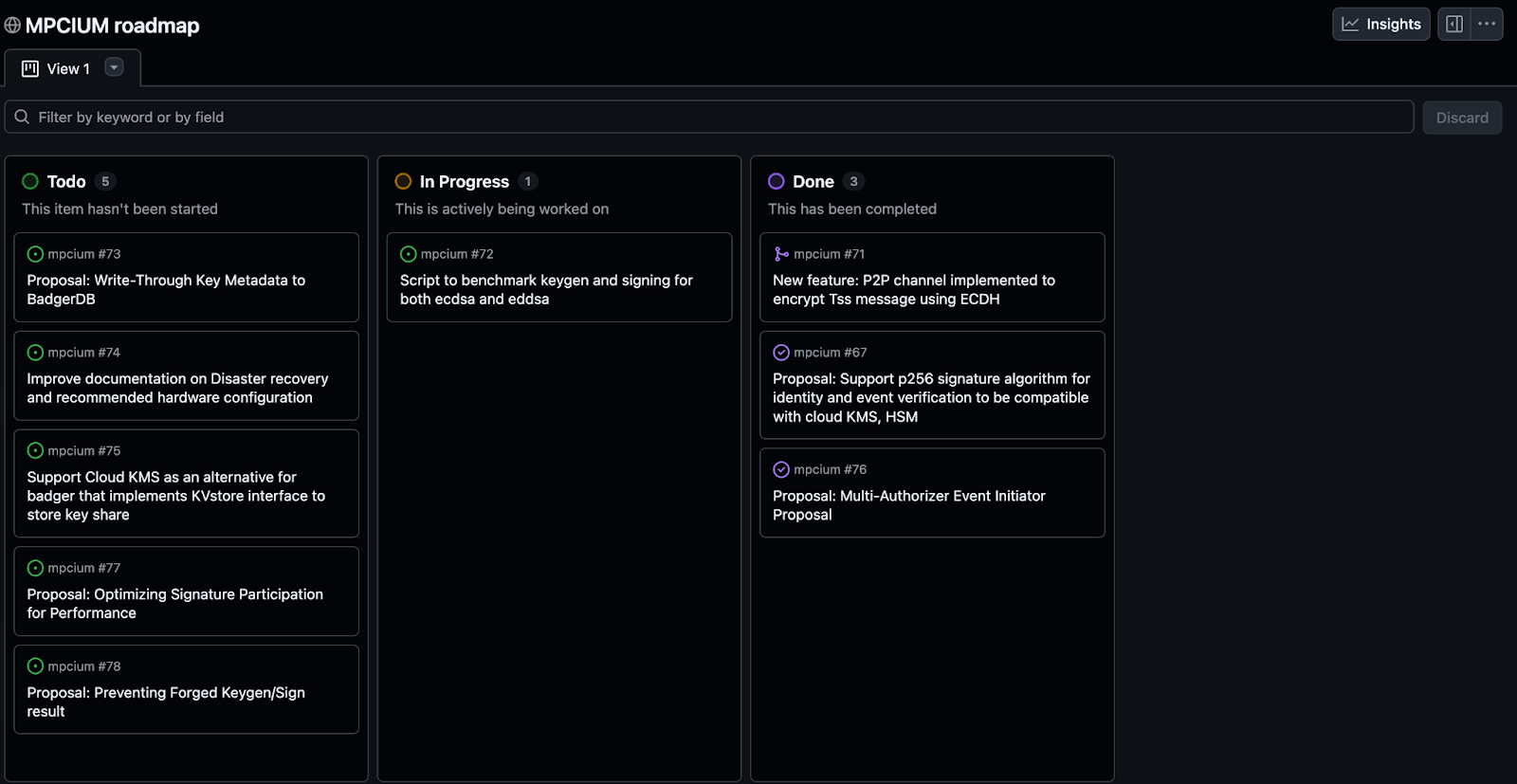

In this new era, wallet infrastructure is developed in public, refined by developer feedback, and strengthened by community audits.

At Fystack, we believe great infrastructure grows with its community. That’s why we developed a community-driven roadmap.

Instead of quarterly releases locked behind NDAs, our feature discussions and changelogs live openly. Builders shape what comes next.

Every commit, every issue, every roadmap vote is a step toward a transparent ecosystem for digital asset custody.

This collaborative approach ensures the platform evolves to meet real-world needs, from enhancing token support to integrating with emerging DeFi protocols.

Because the truth is: the best infrastructure is never built alone.

The Honest Trade-Off

To be honest, I don’t want to sugarcoat Fystack too much because we’re not perfect.

We’re still building.

We listen to our users, iterate fast, and make our product better 1% every day.

Recently, we released MPCium v0.3.3, enhancing decentralization with Multi-Authorizer Support. This is a big step for secure, verifiable key management.

(This update lets multiple authorizers co-sign key generation, signing, or resharing operations. It removes single points of failure and meets modern compliance and Travel Rule requirements.)

But more importantly, Fireblocks still earned their place.

Fireblocks has enabled 2,400+ enterprises, processed $10 trillion in transactions, and secured over 550 million wallets (Fireblocks, 2025).

It operates globally, with offices across the U.S., U.K., Israel, Singapore, and more powered by 500+ people behind the scenes.

That deserves recognition.

Fystack can’t compete on scale, reputation, or institutional adoption (yet), but we’re making an impact where it matters.

We were recognized by the Vietnam Government Portal for pioneering secure Web3 infrastructure. We’re proud to help Gaian, a growing neobank in Asia, automate custody operations, reducing manual work by 60% and improving security.

We’re also contributing to Vietnam’s growing digital finance landscape as a pioneer in Secured Crypto Wallet Infrastructure for Enterprises, as part of the region’s next wave of RWA and stablecoin innovation.

How Custody Solutions Are Evolving in 2026

The custody game is changing.

The last decade belonged to institutions. The next decade belongs to builders.

Fystack doesn’t aim to replace Fireblocks at being Fireblocks.

We’re here to redefine what custody means for the next generation of Web3 Fintech companies who want to own their infrastructure, verify their security, and serve their markets transparently.

👉 Join the Fystack Community and be part of the builders shaping that future, together.

Frequently Asked Questions - FAQs

1. What is MPC wallet infrastructure?

MPC (Multi-Party Computation) is a cryptographic technology that splits a private key into multiple independent shares stored across different devices or locations.

At no point is the private key ever fully reconstructed, this helps eliminate single points of failure and greatly improves security.

2. What makes Fystack different from Fireblocks?

Fireblocks prioritizes enterprise convenience and managed environments, while Fystack prioritizes control, transparency, and composability.

You own the infrastructure, decide where your keys live, and integrate MPC directly into your own stack without vendor lock-in or opaque pricing.

3. Why is self-hosted custody important for compliance?

Regulatory frameworks like MiCA (EU) and SEC custody rules (US) increasingly require demonstrable control, auditability, and data residency. If your entire security stack is operated by a third-party SaaS, you can’t fully prove compliance. With Fystack’s self-hosted model, your organization maintains full visibility into data storage, transaction policies, and access control. It allows you to satisfy local data sovereignty, AML/KYC, and operational audit requirements more easily.

See also: 2026 Crypto Compliance: Global Stablecoin Laws & Fintech Checklist

4. Is Fystack open source?

Fystack is partially open source today, with a roadmap toward full transparency.We’re prioritizing security hardening and independent audits before exposing every internal module publicly.

MPC custody infrastructure involves critical components that must be thoroughly reviewed to eliminate potential attack vectors.

Our plan is progressive:

- SDKs and developer tools → already public

- Node logic and signing layer → under audit

- Full cluster orchestration → planned open release

You can explore the codebase now: Fystack GitHub Repository

5. Is Fystack compliant for use in regulated markets?

Yes. Fystack provides self-hosted infrastructure, which means you maintain operational and legal control. Unlike SaaS custodians, we don’t hold customer keys or assets.

You can host Fystack on your own servers, choose data regions, and integrate with your jurisdiction’s compliance framework.

6. How does Fystack handle customer support and uptime?

Fystack offers tiered technical support from Telegram-based developer assistance to 24/7 enterprise-grade coverage with direct engineering lead access.

Self-hosted clients manage their own uptime, while our team ensures proactive troubleshooting and best-practice guidance.

👉 Explore Fystack’s Technical Support Plans

7. What are the best alternatives to Fireblocks for MPC wallets?

Fireblocks still dominates the institutional custody landscape. However, a new wave of non-custodial wallet infrastructures is emerging. Each offers its own unique strengths, but none are open-source and self-hosted like Fystack.

If you’re exploring options, we encourage you to do your own research and comparison.

👉 Read: Top Non-Custodial Wallet Solutions for Businesses in 2026

8. What are common challenges users face when switching from Fireblocks to another MPC wallet?

Migrating from SaaS to self-hosted setups often involves changes in workflow, infrastructure setup, and compliance validation.

Fystack offers developer tools, migration guides, and SDKs to make this transition smoother.

👉Talk to our founder about your challenge, and we’re here to help you.