Unified Treasury Management: Operating Liquidity Across 15+ Blokchains From One Dashboard

Phoebe Duong

Author

When enterprises expand on-chain, the first thing that breaks is not compliance, security, or engineering. It is liquidity control.

As funds spread across multiple wallets, teams, and more than a dozen blockchains, treasury teams lose the ability to answer basic operational questions in real time:

- How much capital is available right now?

- Which funds are actually usable?

- Where will the next transaction fail due to gas or approvals?

These tools operate outside the execution and signing layer, leaving wallets, gas management, and approvals fragmented at the protocol level. Visibility improves slightly, but execution and governance remain fragmented. Liquidity exists on paper, yet operations slow down because capital is scattered and hard to mobilize.

Fystack was built for this exact moment - when on-chain activity stops being experimental and becomes core financial infrastructure. Unified liquidity in Fystack is not a reporting layer. It is a single operating dashboard that allows enterprises to see, control, and deploy all on-chain capital from one place.

This transition reflects a broader shift in how enterprises approach payment and treasury infrastructure. Stablecoin Adoption in 2026: From Crypto Trading to Global Payments Infrastructure examines why this evolution is becoming unavoidable.

Why Enterprises Struggle to Manage Liquidity Across Multiple Blockchains

Unified liquidity is often misunderstood as a balance aggregation feature. In enterprise environments, it is an operating model implemented through a unified control plane, not a reporting abstraction.

When liquidity spans more than 15 blockchains, the real challenge is not where funds are stored, but how decisions are made and executed across networks. Without a unified control layer, treasury teams are forced to manage wallets, approvals, gas, and transactions separately on each chain, multiplying operational risk and coordination cost.

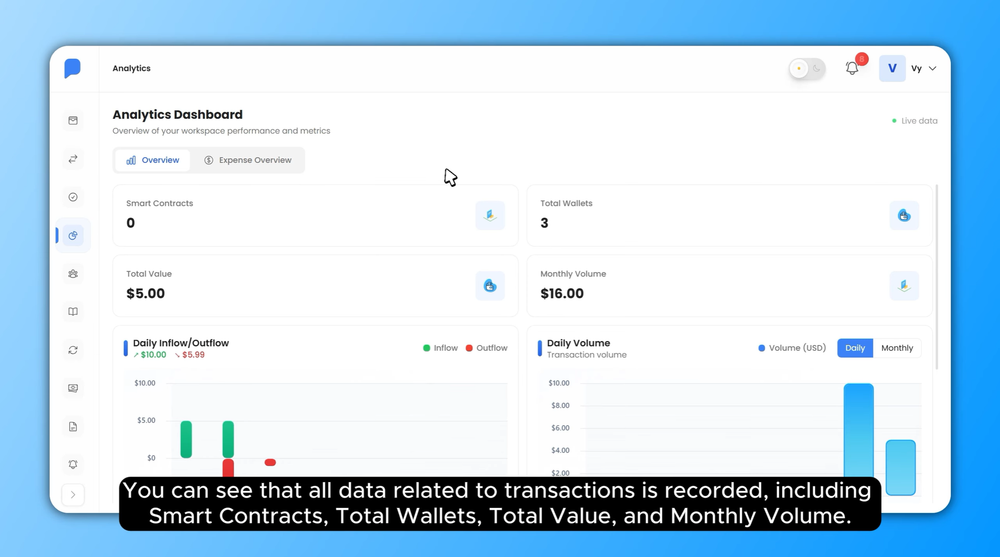

Fystack treats unified liquidity as core infrastructure. All assets, regardless of network, are managed through a single dashboard that standardizes how enterprises view balances, execute transactions, and enforce governance.

At the system level, Fystack provides:

- One operational dashboard across all supported blockchains

- Workspace-based asset orchestration aligned with real organizational structures

- Standardized transaction execution via chain-agnostic APIs, abstracting chain-specific SDKs and transaction formats

- MPC-based custody securing aggregated liquidity

- Real-time, policy-enforced controls over cash flow

This operating model replaces fragmented tooling with a coherent system. Treasury teams no longer react to liquidity issues after failures occur. They operate liquidity proactively, with the same discipline expected from traditional financial infrastructure.

How Fragmented Liquidity Reduces Capital Efficiency in Multi-Chain Operations

Fragmented liquidity does more than reduce visibility.

It silently destroys capital efficiency.

In multi-chain environments, common failure patterns appear quickly: excess balances accumulate on low-activity networks, while other chains lack sufficient funds or gas to execute transactions. Capital is available in total, but operationally unusable because it sits in the wrong place at the wrong time.

Fystack solves this at the control layer. By consolidating balances, network-specific gas balances, and transaction activity into one control layer, treasury teams can see surplus liquidity immediately and identify shortfalls before execution fails.

As a result:

- Idle balances become visible as soon as they form

- Capital shortfalls are detected early, before operations stall

- Funds move intentionally, toward networks and workflows where they are immediately productive

This is not about moving capital more often.

It is about moving capital with intent.

Enterprises use Fystack because it transforms liquidity from a passive balance sheet item into an actively managed system - visible, deployable, and controlled at all times.

Standardization at this layer is not theoretical. The 11 Core Components Every Production-Grade Stablecoin Rail Must Have in 2026 outlines the infrastructure requirements behind reliable multi-chain execution.

Eliminating Asset Fragmentation With a Unified Treasury Control Layer

Multi-Chain Operations Without Tool Sprawl

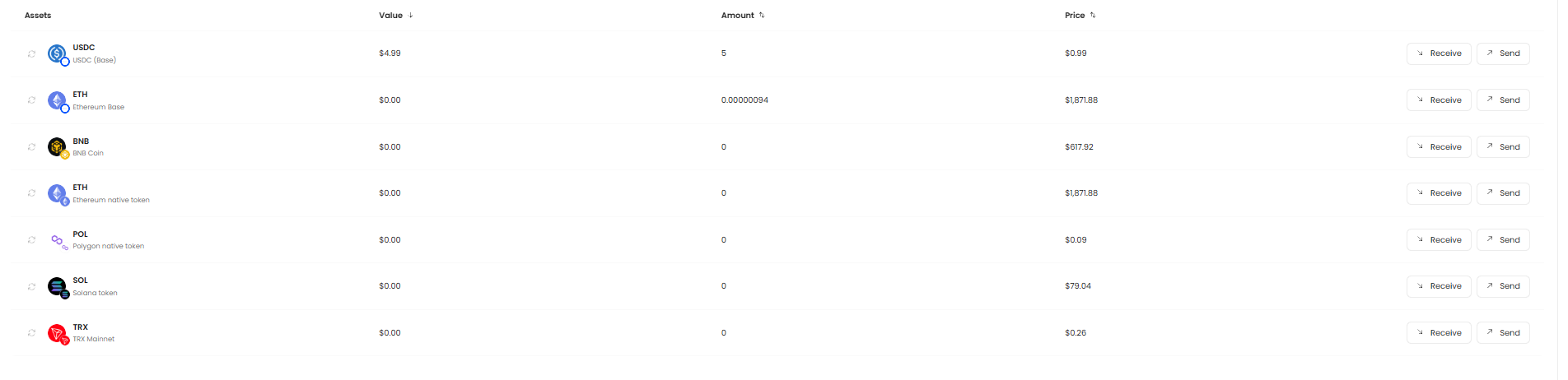

Fystack supports more than 15 blockchain networks through a single interface.

Instead of switching between:

- MetaMask for EVM networks

- Phantom for Solana

- Separate tooling for Tron, Bitcoin, Aptos, and others

Teams orchestrate wallets, balances, and transactions through one operational dashboard backed by a unified execution and signing layer.

This creates:

- A single operational context for all assets

- Fewer reconciliation errors

- A restored, unified view of enterprise liquidity

Fragmentation disappears at the control layer, not through manual coordination.

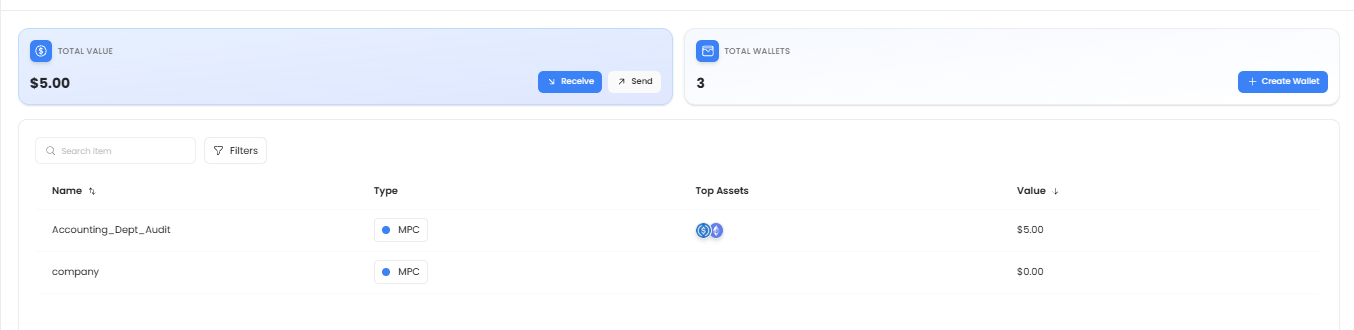

Workspace-Based Asset Segmentation

Enterprises never manage a single pool of capital.

They manage multiple mandates with distinct risk, compliance, and operational requirements.

Fystack introduces Workspaces that reflect real-world organizational structure:

- Capital segmentation by department, product, or geography

Assets are logically separated without requiring separate wallet infrastructure. - Isolation preserved across multiple blockchains

Governance boundaries remain intact even when assets span heterogeneous networks. - Policy differentiation by operational context

Approval flows, spending limits, and controls adapt to each mandate.

Liquidity is unified without collapsing internal governance.

Standardizing Transactions and Gas to Reduce Multi-Chain OPEX

As enterprises expand to multiple blockchains, engineering and treasury overhead grows faster than transaction volume.

Each network introduces its own transaction model and fee mechanics - from EIP-1559 on Ethereum to parallel execution and dynamic fees on non-EVM chains. In practice, this forces teams to maintain chain-specific SDKs, wallet logic, and operational playbooks. Engineering resources are diverted from core product development to maintaining infrastructure that must constantly adapt to protocol upgrades and network changes.

This fragmentation turns gas and transaction handling into an OPEX problem.

Fystack removes this overhead by acting as a standardized execution layer across all supported blockchains. Instead of building and maintaining chain-specific logic, teams interact with a single API and dashboard using consistent concepts such as wallets, transactions, networks, and approvals. Fystack handles the translation and execution details behind the scenes.

The impact is immediate:

- Lower engineering maintenance cost across multi-chain environments

- Faster deployment of new networks without additional wallet logic

- More predictable execution behavior across heterogeneous blockchains

Preventing Failed Transactions With Real-Time Gas and Fee Visibility

In multi-chain operations, liquidity that cannot move is functionally unavailable. Transaction failures are often caused not by insufficient capital, but by missing gas on the right network at the right moment.

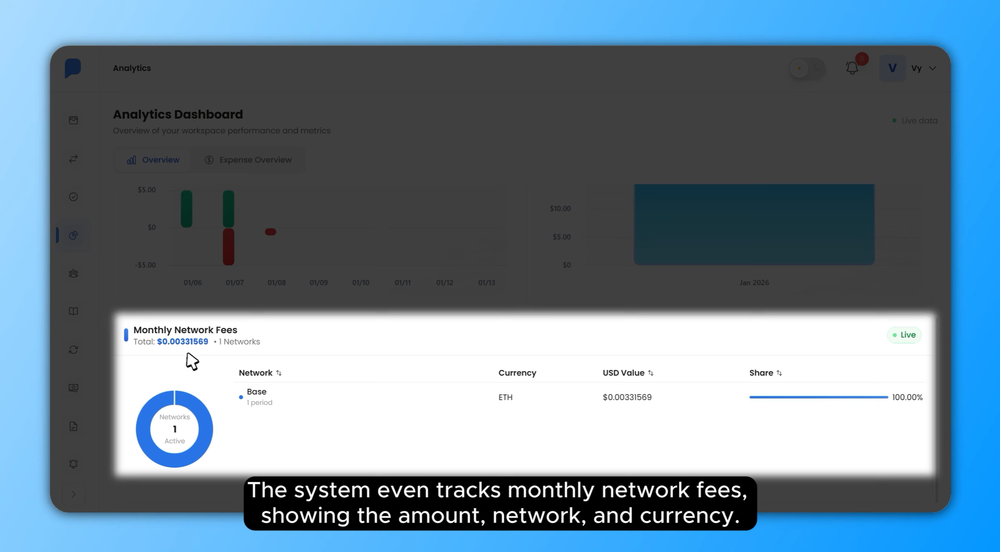

Fystack provides real-time visibility into gas balances and fee readiness exposed via dashboard and event-driven webhooks. Treasury and operations teams can identify execution risks before transactions are submitted, rather than reacting after failures occur.

By centralizing gas monitoring and execution readiness:

- Transactions are less likely to fail or stall

- Capital remains operationally available, not stranded

- Teams can build automated gas provisioning workflows on a reliable foundation

Standardizing transactions and gas management through Fystack allows enterprises to scale on-chain operations without scaling operational complexity. Execution becomes predictable, cost-efficient, and aligned with enterprise-grade expectations.

How Enterprises Secure Aggregated On-Chain Liquidity Using MPC Custody

Aggregating liquidity increases risk unless security scales with it.

Fystack secures unified liquidity using Multi-Party Computation.

For enterprises, custody architecture is both a security and an operational decision. What Is an MPC Wallet? A Practical Overview for Startups and Institutions in 2026 provides a clear comparison of MPC and other non-custodial models.

Keyless Architecture via MPCIUM

Fystack operates a distributed MPC cluster known as MPCIUM.

- No full private key ever exists

- Key material is split into cryptographic shares

- Shares are distributed across independent nodes

- Transaction signing requires threshold consensus

This removes single points of failure while preserving non-custodial guarantees.

Supporting Multiple Cryptographic Standards

Through Threshold Signature Schemes, Fystack supports:

- ECDSA-based networks such as EVM chains and Bitcoin

- EdDSA-based networks such as Solana and Aptos

Unified liquidity does not require unified cryptography. MPC abstracts the complexity.

Policy-Enforced Cash Flow Governance

Institutional-Grade Transaction Controls

At enterprise scale, liquidity without governance becomes a liability.

Fystack enables programmable transaction policies, including:

- Transactions above defined thresholds requiring multi-party approval

- Certain assets or networks requiring CFO-level authorization

- Withdrawals restricted to approved addresses

These rules are enforced at the system level, not through manual review.

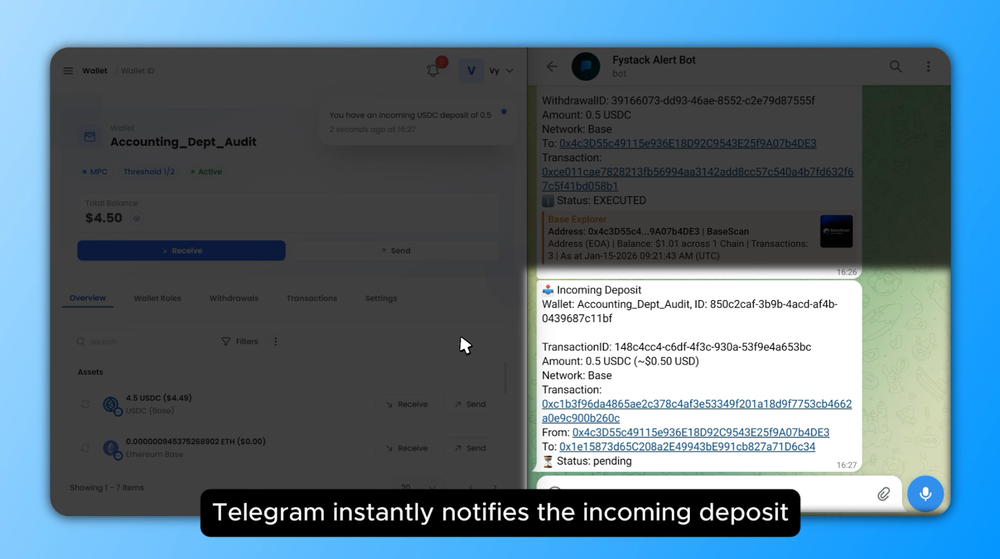

Real-Time Event Streams and Treasury Awareness

Unified liquidity requires real-time awareness.

Fystack provides event-driven webhooks for:

- Incoming funds

- Outgoing transactions

- Balance changes across any supported network

Each event delivers a structured JSON payload within milliseconds, enabling real-time treasury monitoring and reconciliation.

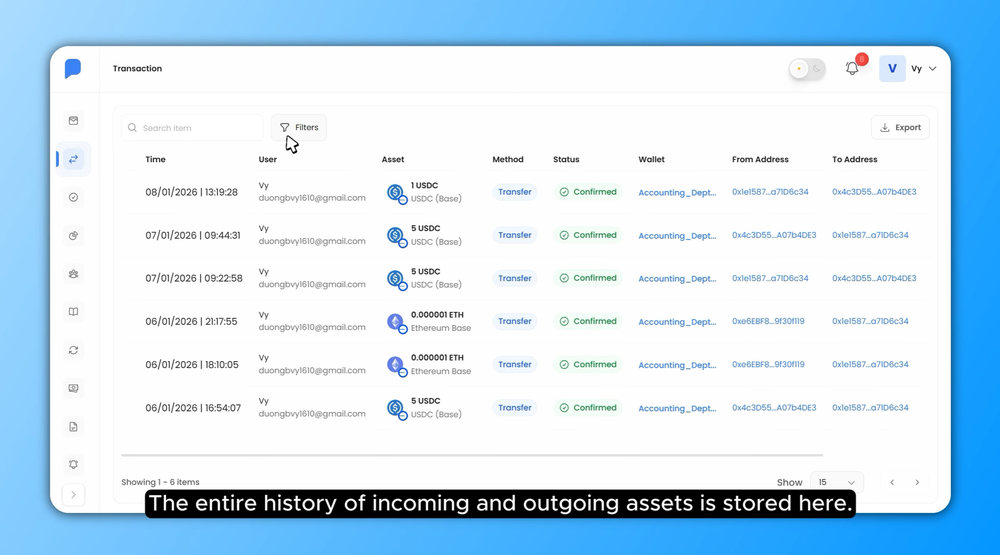

Accountability at Scale: Always Audit-Ready

For enterprises operating on-chain, audit readiness is not a periodic exercise.

It is a continuous operational requirement.

Fystack enables audit-ready treasury operations through:

- Complete, immutable transaction records generated from MPC signing events and on-chain confirmations

- Wallet- and workspace-level traceability aligned with internal ownership and approvals

- Policy-enforced execution via MPC, ensuring actions follow predefined governance rules

- Real-time visibility into balances, flows, and execution status from a single system

Audit-ready at any second - not only at quarter end.

This shifts audit preparation from a reactive, manual process into a built-in operational state, reducing compliance risk while preserving execution speed.

2026: How MPC Wallets and Stablecoins Unlock Just-in-Time Liquidity for Enterprises examines how treasury teams reduce idle capital while preserving execution certainty.

From Fragmentation to Control: Operating Multi-Chain Liquidity With Fystack

Multi-chain liquidity does not break because enterprises lack capital.

It breaks because control is fragmented across wallets, networks, and teams.

As on-chain activity moves into production, adding more dashboards or scripts only delays the problem. Visibility improves, but execution, governance, and accountability remain disconnected. Liquidity exists, yet it cannot be deployed with confidence or speed.

Fystack solves this by introducing a system-level operating layer that sits above wallets and below applications. Balances, gas readiness, transaction execution, approvals, and audit trails are managed through one dashboard, enforced by shared policies, and secured by MPC-based custody. Liquidity is no longer observed after the fact - it is controlled at the system level.

This is the difference between tracking multi-chain assets and operating multi-chain liquidity. For enterprises running on-chain infrastructure at scale, that difference determines whether capital remains idle or becomes a strategic advantage.

If you care about security, compliance, and reliability in Web3 operations:

👉 Try Fystack today: https://app.fystack.io

👉 Join our Telegram community for web3 security updates, engineering insights & product updates: https://t.me/+9AtC0z8sS79iZjFl

FAQ

What does “Unified Liquidity” mean in Fystack?

Unified Liquidity in Fystack refers to a system-level operating model that allows enterprises to view, control, and deploy on-chain capital across more than 15 blockchains from a single control plane. It is not a reporting feature, but core infrastructure that unifies balances, gas readiness, transaction execution, and governance.

Why do enterprises struggle with liquidity when operating across multiple blockchains?

As enterprises expand on-chain, funds fragment across wallets, networks, and teams. Each blockchain introduces its own transaction model, gas mechanics, and approval logic. Without a unified execution and signing layer, treasury teams lose real-time visibility and cannot deploy capital efficiently or safely.

How is Unified Liquidity different from balance aggregation tools?

Balance aggregation tools focus on visibility after the fact. Fystack’s Unified Liquidity operates at the execution layer, standardizing how transactions are created, signed, approved, and broadcast across heterogeneous networks. This allows enterprises to manage liquidity proactively instead of reacting to failures.

How does Fystack support liquidity across 15+ heterogeneous blockchains?

Fystack abstracts chain-specific complexity through a unified API and execution layer. Enterprises interact with consistent concepts such as wallets, transactions, and networks, while Fystack handles differences in transaction formats, fee models, and signing logic across EVM and non-EVM chains.

How does Fystack improve capital efficiency in multi-chain operations?

By consolidating balances, network-specific gas levels, and transaction activity into a single system, Fystack allows treasury teams to identify surplus liquidity and capital shortfalls before execution fails. Capital can then be rebalanced intentionally, instead of remaining idle or operationally trapped.

How are gas fees and transaction failures handled?

Fystack provides real-time visibility into gas balances and fee readiness across all supported networks. Execution risks caused by missing gas can be detected in advance, and teams can build automated gas provisioning workflows using APIs and webhooks to prevent failed or delayed transactions.

How is aggregated liquidity secured in Fystack?

Fystack secures unified liquidity using Multi-Party Computation (MPC). Transactions are signed through the MPCIUM distributed MPC cluster, where private keys never exist in full form. Key shares are distributed across independent nodes, and threshold consensus is required for execution, removing single points of failure.

Which cryptographic standards does Fystack support?

Through Threshold Signature Schemes, Fystack supports both ECDSA-based networks such as Ethereum and Bitcoin, and EdDSA-based networks such as Solana and Aptos. Unified liquidity does not require unified cryptography; MPC abstracts this complexity.

How does Fystack enforce governance over enterprise cash flow?

Fystack enables policy-enforced governance at the system level. Enterprises can define approval thresholds, spending limits, address allowlists, and role-based authorization rules. These policies are enforced automatically during transaction execution, rather than through manual review.

What does “audit-ready at any second” mean?

Fystack records all wallet activity, approvals, and MPC signing events at the system level. Transaction data is consolidated across blockchains and can be exported via API or CSV at any time. Audit preparation becomes a continuous operational state, not a manual process performed only at quarter end.