Self-Hosted Crypto Payment Gateways in 2026: MPC Infrastructure for Enterprise-Grade Security

Ted Nguyen

Author

BD & Growth @Fystack

The Hidden Risks of Crypto Payments for Growing SMEs

In May 2025, a small business owner in New York watched 17.1 BTC (over $625,000) vanish from his business wallet in seconds.

He used crypto to accept payments from international clients and manage his shop’s cash flow. His mistake? He downloaded a spoofed wallet app from the App Store. "I’m just a small business owner, not a tech expert," he shared with Cybercrime Magazine. "I trusted the App Store was safe."

His story is heartbreaking, but unfortunately, it is not unique. In 2025 alone, 80,000 victims lost a total of $713 million due to personal wallet compromises (Chainalysis).

For a solopreneur, a single hardware wallet or a basic self-hosted gateway might suffice. But the moment your SME grows from 1–2 founders to a team of 5–10 (hiring a CFO, developers, or operations staff), you face a dangerous dilemma:

Scenario 1: If only the founder holds the private key, every single transaction must wait for them to manually sign and the business slows to a crawl.

Scenario 2: To automate this, traditional self-hosted gateways (like standard hot wallet setups) require the private key to reside on the server.

This creates a Single Point of Failure. If a developer makes a config error, an employee goes rogue, or the server is breached, the entire treasury is exposed.

This operational constraint is why forward-thinking SMEs should move beyond standard self-hosted gateways and consider adopting MPC (Multi-Party Computation) Infrastructure to keep control of key data while eliminating the single point of failure.

Hosted vs Self-Hosted Crypto Payment Gateways: Which One Should SMEs Choose?

When an SME decides to accept stablecoins, the decision matrix usually boils down to three hard questions:

- Cost: How much margin are we losing to fees?

- Risk: Who holds the private keys, and can they freeze our funds?

- Scale: As we hire more staff (Finance, Ops, Devs), how do we manage access safely?

Most businesses go through a natural evolution to answer these questions.

For a startup launching its first MVP, hosted gateways such as Coinbase Commerce, BitPay, Binance Pay are the obvious choices, especially when liquidity access and fiat on/off-ramps are still tightly coupled with centralized exchanges and OTC desks.

They are the "Stripe of Crypto": fast setup, fiat conversion, and 24/7 support.

It’s estimated that these major players dominate a significant chunk of the multi-billion dollar crypto payment market.

As one user on X noted:

"Businesses that adopt crypto have an unfair advantage... Instant global payments with lower transaction fees and no chargebacks."

Hosted gateways deliver this promise with zero technical overhead.

Limitations of Hosted Crypto Payment Gateways

However, the cracks in this model appear quickly once transaction volumes increase.

First is the 1% Tax. Coinbase Commerce charges a flat ~1% transaction fee. If your business processes $1M/month, you are effectively handing over $120,000/year just for the privilege of accepting money.

Second is the Custodial Risk. By using a hosted provider, you are facing custodial risk. Mandatory KYC/AML compliance means the provider can freeze your account or offboard you at any moment if their internal policy changes.

The mood on social platforms regarding this model has shifted significantly.

A 2025 thread summed up the sentiment:

"PayPal freezes your funds faster than your ex blocks you... Hosted gateways custody your coins harder than a bank.”

Benefits of Self-Hosted Crypto Payment Gateways

As the limitations of hosted gateways become obvious, many growing SMEs naturally move to self-hosted crypto payment gateways. This approach lets businesses run the entire payment infrastructure on their own servers or VPS, eliminating third-party custody of private keys.

The most compelling difference is cost and control. Instead of paying 1% per transaction, self-hosted solutions charge zero platform fees. You only pay minimal VPS costs (typically $15–30/month) and blockchain network fees.

On $1 million monthly volume, this can save $120,000 per year compared to Coinbase Commerce. More importantly, your funds go directly to wallets you control, removing the risk of sudden account freezes or forced KYC offboarding.

In practice, this shift also forces businesses to think more deeply about how deposits, confirmations, and internal fund movements are actually handled at the infrastructure level.

Popular Self-Hosted Options in 2026

BTCPay Server

BTCPay Server remains the most established and battle-tested option. Originally built for Bitcoin, it excels at Lightning Network payments and offers excellent censorship resistance. It has a large community, extensive plugins for WooCommerce, Shopify, and other e-commerce platforms, and strong privacy features.

Amidst what's going on lately, I thought it might be a good time to remind everyone that @BtcpayServer supports both PayJoin and CoinJoin.

— Uncle Rockstar Developer (@r0ckstardev) November 12, 2023

So if you're running a BTCPay instance, you can:

1. Withdraw Bitcoin from exchanges with PayJoin, obscuring the amount to outside… pic.twitter.com/ytPCGRoUnh

However, its Bitcoin/Lightning focus makes stablecoin support (USDT/USDC on Tron, Solana, or EVM) less seamless and requires more technical setup and node maintenance.

PayRam

PayRam is a newer, lightweight alternative specifically designed for stablecoins. It prioritizes fast deployment, easy integration with modern stacks, and strong support for low-fee chains like Tron, Solana, and Base.

PayRam positions itself as a simpler, more stablecoin-native option than BTCPay, making it popular among SMEs that mainly deal with USDT and USDC payments.

SHKeeper

SHKeeper takes a similar approach but emphasizes ease of integration with existing CMS and websites. It supports multiple cryptocurrencies including stablecoins, offers zero-commission processing, and is known for its clean merchant dashboard and straightforward API/webhook setup.

Many users choose SHKeeper when they want a balance between simplicity and multi-chain stablecoin functionality.

Feature | BTCPay Server | PayRam | SHKeeper |

Primary Focus | Bitcoin & Lightning Network | Stablecoins (USDT/USDC) | Multi-crypto including stablecoins |

Best For | Bitcoin-heavy merchants. | SMEs focused on stablecoin payments | Merchants wanting easy CMS integration |

Blockchain Support | Limited/Requires extra setup | Multi-chain support | Multi-chain support |

Deployment Time | 30–60+ minutes | ~10–15 minutes | ~15–30 minutes |

Ease of Use | Steep learning curve | Very easy, lightweight | Easy, user-friendly dashboard |

E-commerce Integrations | 10+ ecommerce integrations, including Shopify, WooCommerce | Modern stacks, API-first | CMS/websites, straightforward API |

Platform Fees | 0% | 0% | 0% |

Community & Maturity | Very large & mature | Growing | Established but smaller community |

API & Webhook Support | Yes | Yes | Yes |

Recommended For | Bitcoin-focused businesses | Stablecoin-heavy SMEs & fintechs | Merchants needing simple multi-crypto setup |

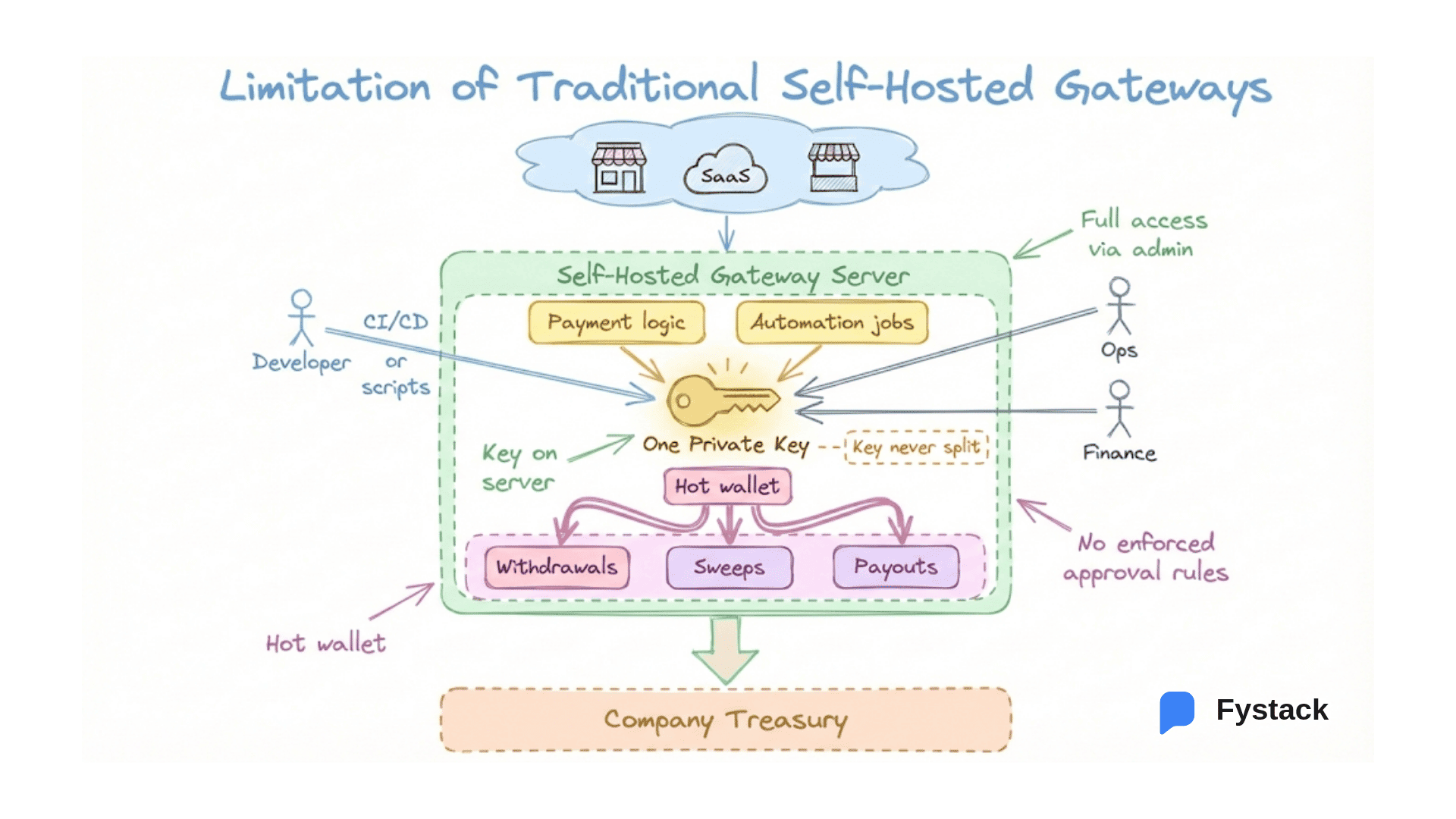

Limitation of Traditional Self-Hosted Gateways

While standard self-hosted gateways solve the issues of fees and custody, they often introduce a different vulnerability rooted in their architecture. To function automatically, such as verifying payments or processing withdrawals without human intervention, these systems generally operate on a hot wallet model.

If a malicious actor gains root access to the machine, or if a software dependency contains a vulnerability, the private key is exposed and funds can be drained instantly.

This architecture also creates a governance blind spot. In a standard hot wallet setup, anyone with administrative access to the server effectively holds full control over the funds.

It becomes technically impossible to enforce internal controls, such as requiring approval for large outflows or setting daily spending limits, because traditional hot-wallet setups lack a native concept of roles, policies, or transaction-level authorization.

For businesses that require strict security protocols and separation of duties, this hot wallet model is fundamentally insufficient.

This architectural limitation is driving the shift toward a more resilient standard known as Multi-Party Computation or MPC.

Key Advantages of MPC Technology in Crypto Payments

Unlike traditional setups where a private key sits entirely on a server, MPC uses threshold cryptography to split the key into multiple independent shares. A transaction can only be authorized when a predefined number of these shares interact (e.g, 2 of 3, 3 of 5)

With MPC, businesses gain access to a suite of controls designed for scale, efficiency, and internal governance.

Automated Treasury Operations

The first major upgrade is the ability to move funds with safety and efficiency through automation. In a standard setup, consolidating funds often requires manual intervention but with MPC, your business solves this constraint with scheduled and threshold-based sweeps, allowing businesses to automatically move incoming customer deposits into secure cold storage without human delay.

Furthermore, advanced systems support multi-chain native automation and gas-optimized batching, which allows treasury teams to process thousands of payouts such as payroll or affiliate rewards in a single transaction, significantly reducing network fees and operational overhead.

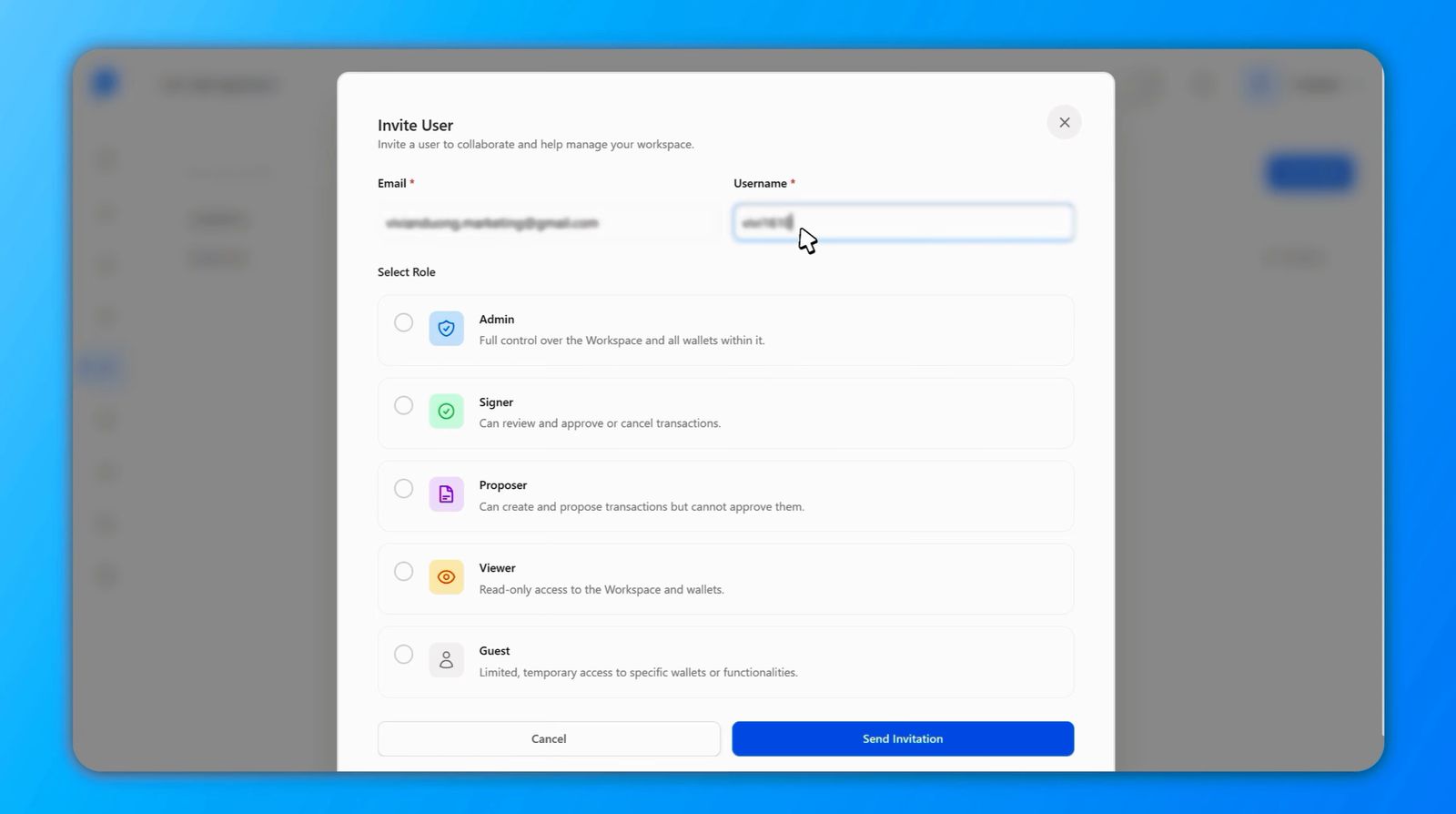

Granular Governance and Team Access

As teams grow, managing who has access to funds becomes critical. MPC infrastructure handles this bottleneck with a robust User Management system. This includes Role-Based Access Control (RBAC) with granular permissions, ensuring that team members only access what they need.

Crucially, this is reinforced by Approval Groups, which enforce multi-signature workflows. A business can configure the system so that sensitive operations or large transactions require approval from multiple stakeholders, effectively preventing internal fraud and unauthorized transfers.

Proactive Compliance and Policy Enforcement

MPC infrastructure embeds control directly into the transaction layer through Transaction Policies. Businesses can define strict rules such as spending limits, velocity controls, and address whitelisting. These policies act as an automated firewall, blocking any transaction that violates company rules before it is ever signed.

Additionally, every action within the system, from a policy change to a login attempt, is recorded in immutable Audit Trails. These logs provide a complete history for compliance reporting, ensuring the business is always audit-ready.

Real-Time Visibility and Monitoring

Finally, managing digital assets at scale demands absolute visibility. Modern infrastructure like MPC provides clear operational insights through wallet performance metrics and transaction analytics for treasury operations.

Security teams can set up alerts for suspicious activity or low balances, with real-time notifications delivered directly to communication channels like Telegram and Slack. This ensures that the operations team is immediately aware of any anomaly.

SaaS MPC vs Self-Hosted MPC: Why Control Matters for SMEs

Just as businesses must choose between hosted and self-hosted payment gateways, the same dichotomy exists at the MPC provider.

Currently, the market is dominated by SaaS providers for MPC solutions. While these platforms offer convenience, critical key shares often reside on the vendor's cloud infrastructure, creating potential conflicts with strict data residency and sovereignty laws in several countries like Vietnam, Russia, China.

We have explored the deep trade-offs between these architectural models in our detailed breakdown of SaaS vs. Self-Hosted MPC infrastructure.

This is the specific gap that Fystack is designed to fill. Fystack offers a fully self-hosted MPC infrastructure, allowing enterprises to deploy the core technology on their own servers to retain 100% control over data and keys.

Beyond, this infrastructure powers a complete payment gateway engine, enabling businesses to accept and send crypto payments seamlessly across EVM, Tron, and Solana networks.

Category | SaaS Solution | Self-Hosted Solution |

Ownership | A 3rd-party provider controls the infrastructure and update cycle. | You control your data, policies, and deployments fully. |

Transparency | Proprietary code and opaque processes. | Auditable. |

Integration | Predefined APIs, limited customization, fixed UI workflows. | SDK-first design, developer-friendly, integrated directly into your stack. |

Compliance | Compliance inherited from provider’s certifications (SOC 2, ISO). | Compliance defined by your policies, supports data sovereignty and residency regulations. |

Vendor Lock-in | High, API dependency risks. | None, full exportability and open-source design. |

# of Wallets | Limited, based on your plan | Unlimited, served your needs |

Volume/AUM | Limited, based on your plan | Unlimited |

Conclusion: Choosing the Right Crypto Payment Infrastructure in 2026

In a world where stablecoin volume has reached $33 trillion, accepting crypto is a massive opportunity for SMEs to lower costs and reach global customers.

The choice of infrastructure matters.

If you’re still concerned about your choice, let our team support you and find the optimal solution for your business by sharing your barriers with us here.

In the meantime, you could join our telegram group to share your startup journey with 350+ builders.

Frequently Asked Questions (FAQs)

1. Does Fystack function as a payment gateway?

Fystack is an MPC-powered custody infrastructure that provides full payment capabilities via API, including generating unique deposit addresses, webhooks, and automated payouts. While it replaces the backend logic of a gateway, it is designed for teams building custom payment flows rather than offering plug-and-play merchant plugins like BTCPay or PayRam.

2. Which blockchain networks are supported at Fystack?

We natively support all major EVM chains (Ethereum, Base, BSC, Polygon) as well as Tron and Solana. If Fystack doesn't yet support your desired chain, simply contact us, and we can integrate it within 48 hours.

3. Why do SMEs need MPC instead of a standard hot wallet?

MPC eliminates the "Single Point of Failure" by splitting the private key into multiple shares that never exist in one place. This ensures that even if your server is breached, your funds remain secure, and allows for safe multi-person approval workflows.

4. Can I automate treasury flows like sweeps and payroll?

Absolutely. Fystack’s Policy Engine allows you to configure auto-sweeps to cold storage or execute gas-optimized batch payouts via API. All automated flows are guarded by strict spending limits and address whitelisting to prevent errors.

5. How do I get started or deploy the software?

You can deploy the open-source MPC core (Mpcium) directly on your own infrastructure using Docker or Kubernetes. For integration, check out our SDK and full API references available on our Documentation page.