Why banks should fear stablecoins?

Thi Nguyen

Author

Founder

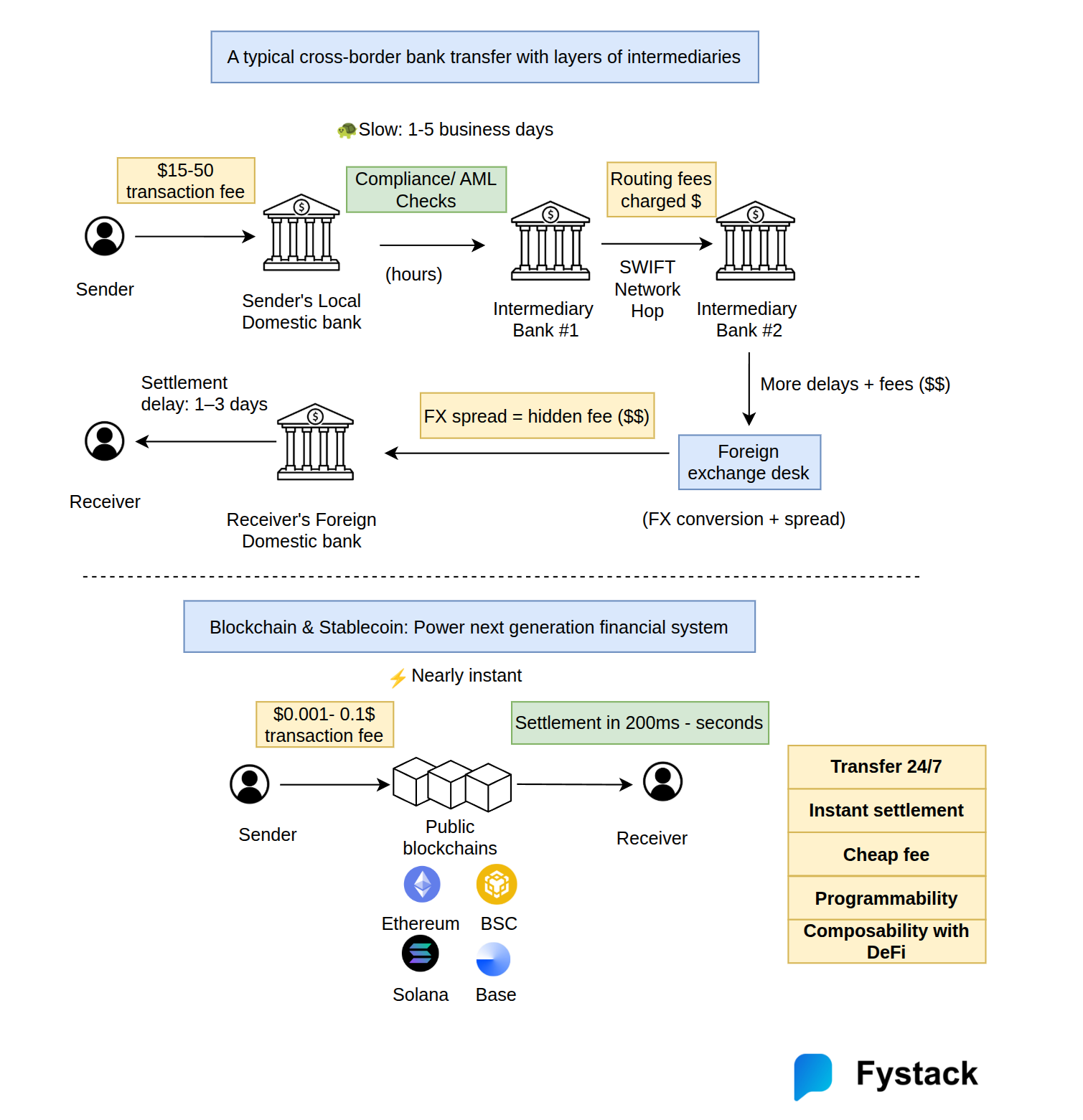

Nowadays in 2025, many cross-border bank transfers still run on the SWIFT system, which was built in the 1970s. That’s why the system has so many bottlenecks. Transfers can take days to settle, with significant fees ranging from $15–$50 per transaction.

The financial system needs an upgrade. This is what blockchain and stablecoins are solving, a decentralized financial system with no intermediaries.

Banks:

- Transfers take days to settle and are delayed on weekends and holidays.

- Closed systems limit innovation, as every integration for money movement requires a large amount of paperwork.

Blockchain and stablecoins:

- Transfer 24/7: Blockchain doesn't stop on holidays or weekends.

- Instant settlement: 200 ms to seconds with fast blockchains like Base, Solana, and BSC.

- Cheap fees: Average transaction cost is around $0.001 to $0.1 depending on the blockchain.

- Programmability: You can implement customized logic for stablecoins, as stablecoins are just smart contracts under the hood.

- Compatibility with DeFi: Unlock innovation by integrating with yield and lending platforms like Aave and Morpho.

Blockchain and stablecoin are borderless technologies that will unlock the next generation of innovative financial applications in the future.

Fystack provides enterprise-grade stablecoin wallet infrastructure designed for fintechs and Web3 companies. Move onchain with confidence and speed up your go-to-market. Learn more at https://fystack.io

Stay connected with the latest in blockchain, stablecoins, and Web3 engineering, join our Telegram community: https://t.me/+IsRhPyWuOFxmNmM9