Vietnam Digital Asset Law 2026: A Guide to Compliant Crypto Custody & Data Sovereignty

Ted Nguyen

Author

BD & Growth @Fystack

Crypto Custody in Vietnam 2026: Digital Asset Law, Data Localization, and Compliance

Vietnam has long been a global leader in crypto adoption, consistently ranking among the top countries in reports by Chainalysis. Yet, for the past decade, the domestic market has operated in a grey zone.

That era is over. With the approval of the Law on Digital Technology Industry (DTI Law) 2025, Vietnam has established a formal legal framework for digital assets, effective January 1, 2026.

For institutions, this transition brings clarity but also strict new barriers to entry. The days of unregulated offshore custody are ending. The new market will be defined by licensed Crypto Asset Service Providers (CASPs), strict data localization requirements, and enterprise-grade security standards.

This article outlines how these new laws impact crypto custody and why infrastructure strategy is now the key to regulatory compliance.

Vietnam’s Shift From Grey Market to Regulated Crypto Industry

Since 2017, the State Bank of Vietnam has prohibited the use of cryptocurrency as a means of payment, while leaving trading and ownership legally undefined. This created a massive shadow economy where users traded on offshore platforms without protection or AML oversight.

The DTI Law 2025 and Resolution No. 05 fundamentally change this landscape by introducing three critical shifts:

- Legal Recognition: Digital assets are now formally defined as "property" under the Civil Code, granting legal protection to owners.

- The CASP License: The government has established a pilot program to license Crypto Asset Service Providers. Only licensed entities will be permitted to provide exchange and custody services legally.

- Institutional Barriers: New regulations require a minimum charter capital of VND 10,000 billion, at least 65% institutional ownership, at least two qualifying institutions jointly holding 35% or more, and a 49% cap on foreign ownership.

For fintechs and banks, this creates an urgent need to build compliant custody infrastructure immediately.

Vietnam’s Key Digital Asset Regulatory Milestones (2017–2026)

To understand the strictness of the new pilot program, it helps to look at the key timeline of how crypto regulation has evolved in Vietnam over the last decade:

2017: The State Bank of Vietnam (SBV) issued Official Letter No. 5747, explicitly banning cryptocurrency as a means of payment. This effectively blocked banks from touching crypto.

2023: Vietnam was placed on the Financial Action Task Force (FATF) Grey List, a watchlist for countries with strategic deficiencies in AML and counter-terrorism financing frameworks.

Being grey-listed raises cross-border compliance costs, and can restrict access to international financial systems. To exit the list, Vietnam committed to strengthening AML controls for virtual assets and service providers.

2025: The DTI Law 2025 finally recognized digital assets as property. Simultaneously, Resolution No. 05 created the legal sandbox that allows licensed enterprises to provide custody services, ending the era of unregulated framework.

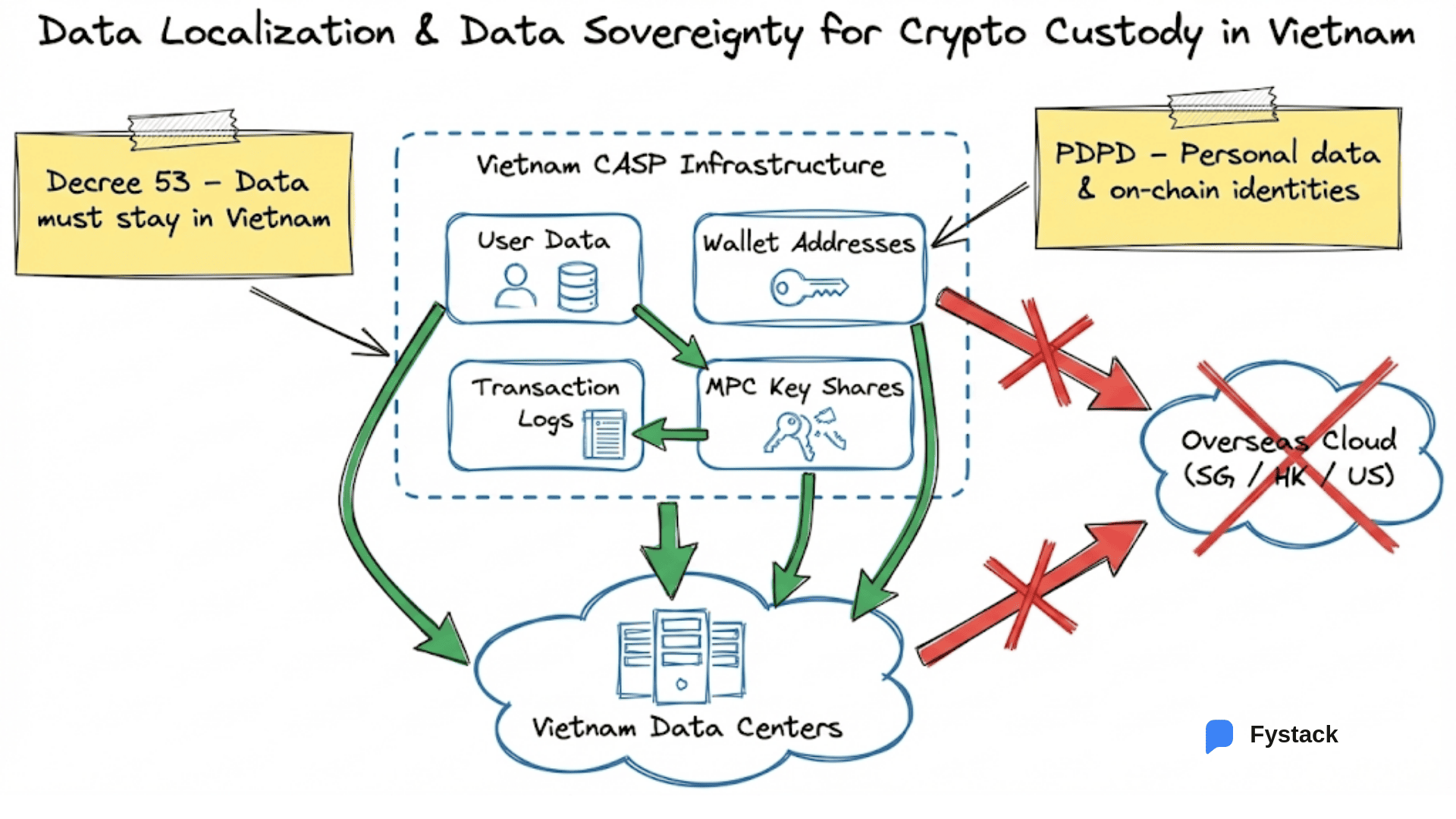

Data Residency and Data Sovereignty Rules for Crypto Custody in Vietnam

Data Residency Requirements for Digital Asset Platforms

Another challenge for institutions apart from capital requirements is data localization under Decree 53/2022/ND-CP, which mandates that regulated service providers must store user data within Vietnam.

The "Locally stored data" extends beyond names and IDs to:

- User-Generated Logs: Account logins, transaction history, and device identification data.

- Financial Data: Wallet addresses and balances linked to specific users.

This requirement creates a conflict with the standard SaaS custody model used globally. In a typical setup, encrypted key material, signing logs, and operational metadata are processed and stored in the vendor’s cloud infrastructure, often hosted on providers such as AWS.

For example, a fintech platform may rely on an offshore custody provider to operate quickly in the early stage. However, when applying for a Vietnamese license and undergoing physical inspection, regulators may find that key custody components are hosted outside Vietnam and cannot be locally verified.

At that point, the institution is required to migrate its custody infrastructure onshore, redesign data flows, and rework operational controls, often causing delays and additional compliance risk.

Personal Data Protection and On‑Chain Identities

It gets stricter with Decree 13 (PDPD), which classifies on-chain wallet addresses linked to identities as "Personal Data." If you rely on a foreign third party to manage your keys and logs, you cannot guarantee the ability to control, pseudonymize, or delete this data as required by Vietnamese law.

Level 4 Information System Security: Vietnam’s National Standard for Crypto Custody

One more key note beside data localization and sovereignty is the security benchmark. Under the DTI Law, licensed crypto custodians must meet Level 4 Information System Security, the second-highest tier under Vietnam’s cybersecurity framework.

This framework applies to systems whose failure would cause especially serious harm to national security, public order, or critical economic interests.

For a crypto custodian, achieving Level 4 compliance requires:

- Zero Downtime: The system must run continuously 24/7 without interruption.

- No Single Point of Failure: The system must use instant, seamless backup mechanisms (Hot-Hot Redundancy), ensuring zero interruption if a primary server fails.

- Physical Inspection: Regulators must be able to verify the physical hardware and software.

If you want a detailed checklist for your startups, please consider our step-by-step workflow for Vietnam regulatory compliant.

Why Traditional Custody Models Fail in Vietnam

Vietnam’s regulatory environment creates constraints that many global custody models are not designed for.

In particular, the combination of Level 4 security requirements (continuous availability) and Decree 53 (local inspection and control) limits the set of architectures that can operate compliantly.

Most custody solutions used in global markets assume infrastructure flexibility that does not exist under these rules.

Two issues stand out.

Hardware-Based Custody and Localization Limits

Traditional custody models rely on Hardware Security Modules (HSMs), specialized hardware devices designed to generate, store, and use cryptographic keys in an isolated and tamper-resistant environment,

Or offline cold storage, a type of cryptocurrency wallet that remains disconnected from the internet, to secure private keys.

In Vietnam, this approach faces two practical problems.

First, inspection requirements.

Many modern “cloud HSMs” place physical hardware in overseas data centers.

That means regulators cannot physically inspect or verify hardware located outside Vietnam, thereby creating a direct conflict with Decree 53.

Second, availability requirements.

Cold storage depends on manual, offline access to keys. This design makes fully automated, continuous withdrawals difficult to support. For exchanges expected to operate without interruption, this model struggles to meet Level 4 uptime expectations.

Multi-Signature Wallets and Operational Friction

On-chain multi-signature wallets improve security by requiring multiple approvals for each transaction. However, they introduce trade-offs that are hard to manage at scale.

(Onchain Multisig or Multisig is a method of securing a wallet by requiring approval from multiple private keys stored on separate devices)

Each approval is recorded on-chain, which can reveal internal signing structures and operational patterns. In addition, every signature incurs network fees. For high-frequency or high-volume platforms, this increases cost and reduces execution speed.

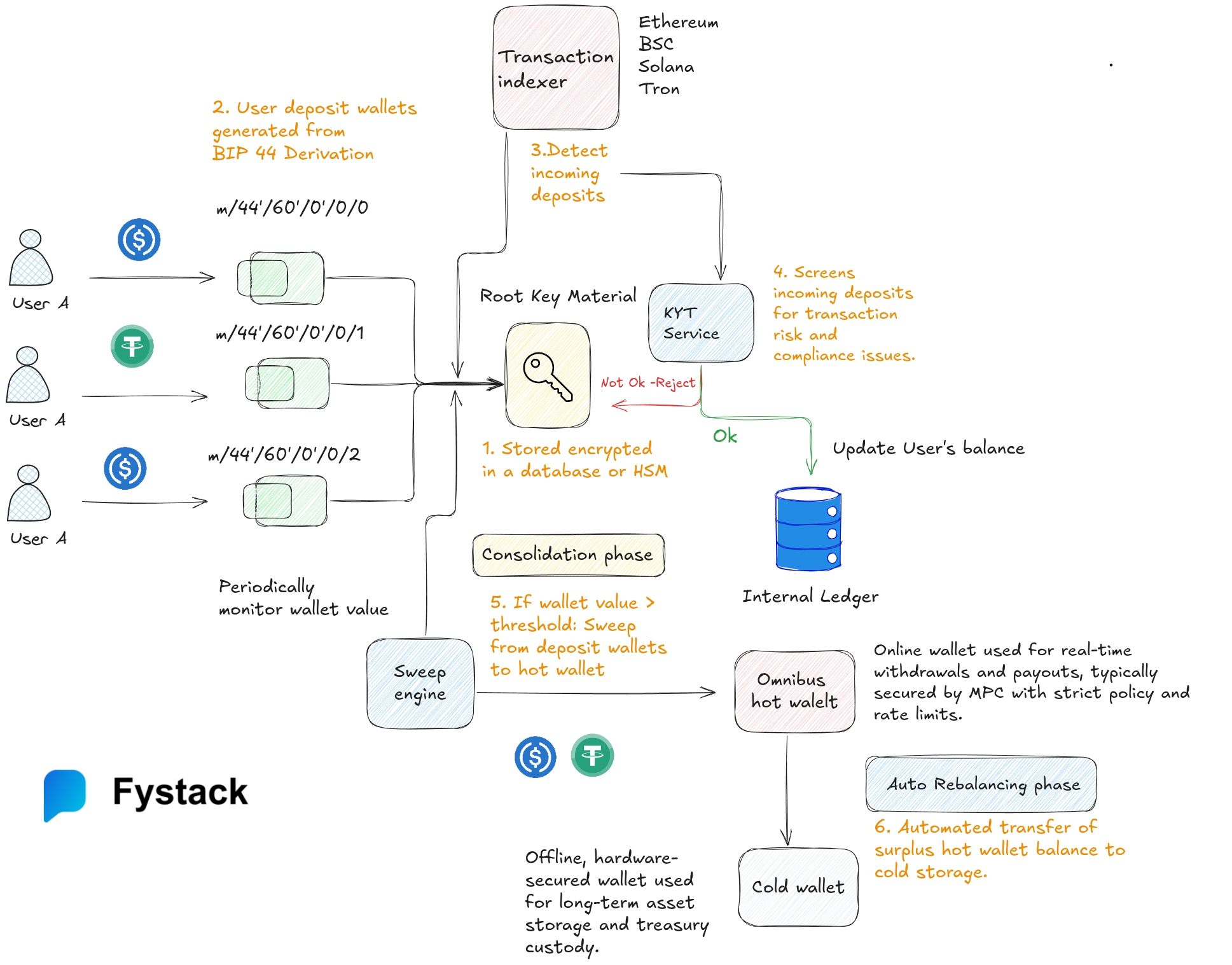

A Practical Digital Asset Custody Solution in Vietnam

Vietnam’s regulatory requirements around availability, inspection, and data locality rule out many custody models that work elsewhere. Keys cannot sit offshore. Signing cannot depend on manual cold storage. Infrastructure must run continuously and remain fully inspectable within the country.

MPC helps address these constraints by distributing signing authority across multiple nodes, removing reliance on a single device or key holder. It supports high availability and eliminates the traditional single point of failure.

If you want yo explore more on MPC, we already wrote a deep dive blog post on How Does MPC work, Use Cases, Advantages, and Disadvantages Compared to Other Custody Models.

However, most MPC wallet infrastructure in the market today still fails Vietnamese requirements. In many SaaS setups, key shares or signing coordination run on the provider’s cloud, often across regions such as Singapore, Hong Kong, or the US. Even if encrypted, key processing outside Vietnam can violate data residency rules and limit regulatory inspection.

The practical solution is a self-hosted MPC model.

In a Vietnam-ready setup, the MPC engine is deployed on infrastructure fully controlled by the local institution. All key shares, signing logs, and transaction metadata stay onshore, whether in private data centers or certified domestic cloud facilities. External services can integrate via APIs, but custody and signing remain local.

If you’re actively looking for an infrastructure provider, please consider Fystack.

We offer self-hosted MPC deployments that run inside private networks, give institutions full control over keys and uptime, and support rapid deployment without vendor-held custody.

The result is a custody baseline that aligns with Vietnam’s operational and regulatory expectations, without forcing teams to build everything from scratch.

Conclusion

Choosing a digital asset custody provider in Vietnam is no longer a matter of cost or speed. With strict data localization, sovereignty, and uptime requirements, custody architecture has become a core compliance decision.

For exchanges, banks, and digital asset platforms, this is not a risk to address after launch. Infrastructure must align with local regulation from day one.

If you are evaluating self-hosted custody options that fit Vietnam’s regulatory environment, Fystack offers infrastructure designed for onshore deployment, operational control, and regulatory alignment.

Reach out, and the team can walk you through what works in your jurisdiction.

Frequently Asked Questions (FAQs)

Is crypto custody legal in Vietnam now?

Yes, but only for licensed entities. Under the DTI Law 2025 and Resolution 05, digital assets are recognized as property, and custody services may operate under a government-approved pilot regime.

What are the key requirements to become a licensed crypto custodian in Vietnam?

Applicants must meet a minimum charter capital of VND 10,000 billion, ensure that at least 65% of capital is held by institutional investors and that at least two qualifying institutions jointly hold 35% or more, comply with a 49% cap on foreign ownership, and operate IT systems certified at Level 4 Information System Security while implementing robust AML, Travel Rule, and reporting controls.

How do Vietnam’s data localization rules affect digital asset custody?

Decree 53 requires user data, transaction logs, and key-related information to be stored on infrastructure physically located in Vietnam and available for inspection.

Why is MPC wallet infrastructure important for compliant crypto custody in Vietnam?

MPC supports high availability and removes single points of failure while allowing all key material to remain onshore, helping custodians meet uptime, data residency and sovereignty requirements.

Can foreign custody providers still serve Vietnamese users under the new rules?

Foreign providers can participate in the Vietnam market only through local partnerships or self-hosted models that allow Vietnamese entities to fully control keys, data, and infrastructure.