The 11 Core Components Every Production-Grade Stablecoin Rail Must Have in 2026

Phoebe Duong

Author

By 2026, stablecoins will no longer be “just a token you transfer.” They are evolving into the core of treasury operations, real-time liquidity engines, and the interoperability layer bridging banks, fintechs, and blockchain.

This shift introduces a brutal new requirement: your payment rail must be as resilient as banking infrastructure, not a simple dApp.

turns out institutional stablecoin rails hit different in 2026 💫

— El Chabera 🐻⛓ (@Elchabera) December 6, 2025

ecosystem evolution crushing it:

🔹 $80-120B market size built different

🔹 300% YoY enterprise adoption grinding

🔹 institutional-grade infrastructure loading

🔹 regulatory alignment activated

quality… pic.twitter.com/6YtYfHo7dx

Institutional users do not care which chain you support, how clean your UI looks, or how often you mention “real-time settlement.” What they care about is viability: Can your system withstand an audit? Can it reconcile every cent? Can it comply with evolving regulations while maintaining 24/7 uptime under real financial workloads?

This article breaks down the 11 non-negotiable layers of an enterprise-grade stablecoin rail and explains why standard Web3 wallets fail when facing real money, real audits, and real compliance.

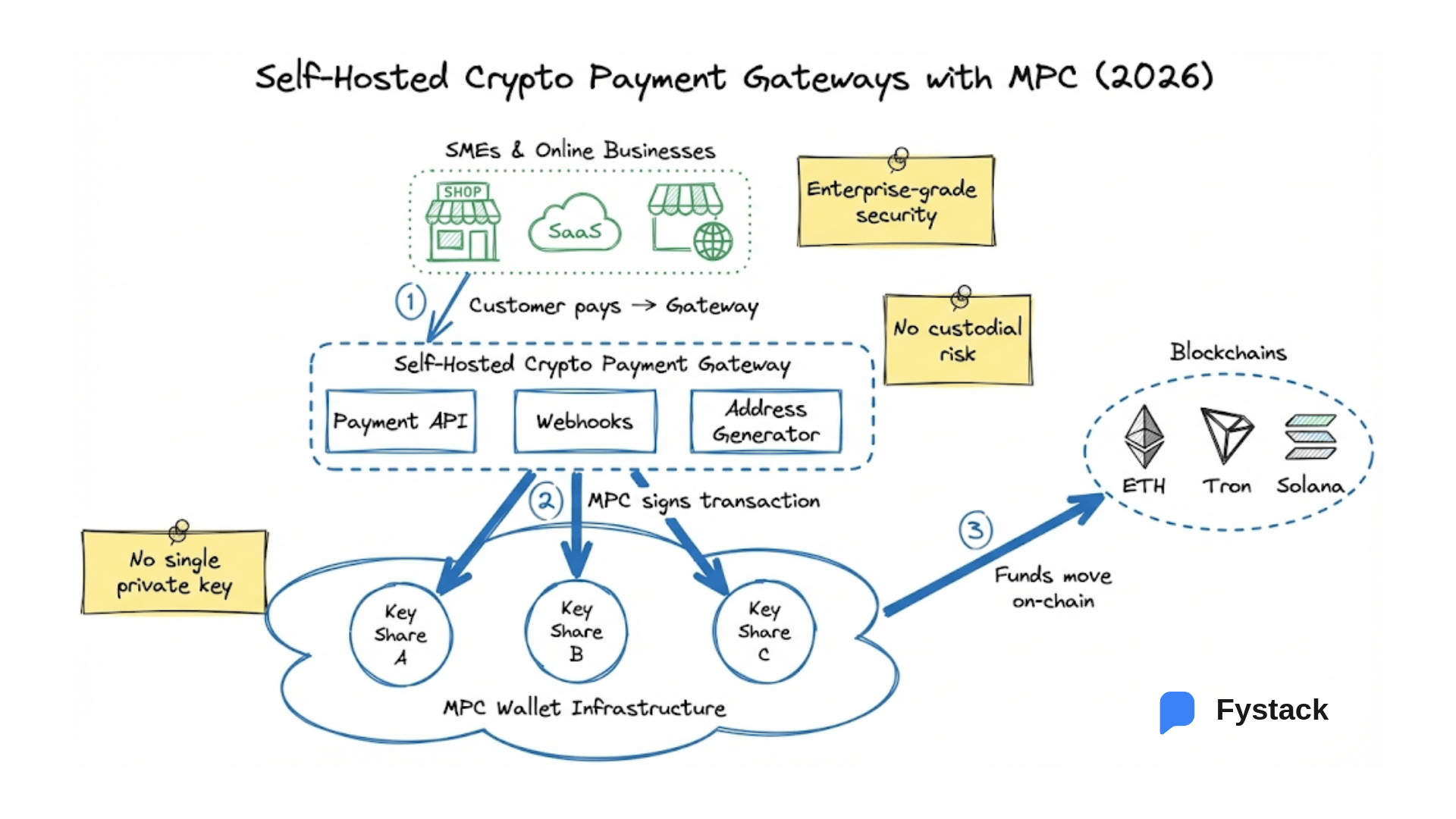

1. Custody & MPC Wallet Infrastructure: The Security Foundation

The first question banks and fintechs ask when evaluating a stablecoin rail is always straightforward: “How do you manage your private keys and wallet operations?”

This is the line separating a standard Web3 payment app from an enterprise-grade stablecoin rail.

Custody is not “storing a private key safely.” It is an operational system where every transaction must pass through layers of policy, permissions, and risk controls. If this layer fails, the entire rail - from settlement to reconciliation - collapses under real audits and real traffic.

To meet institutional expectations, your rail must include:

- Pre-signing risk checks to block unsafe transactions.

- High-throughput wallet generation (thousands per minute).

- Bank-grade cold wallet governance with automated hot–cold orchestration.

- Multi-party computation (MPC) to remove single points of failure.

These requirements are far beyond the capabilities of a typical Web3 wallet - you need MPC/HSM and a policy engine strong enough to support enterprise audits and operations.

This is why Custody is called the “invisible layer.”

Users don’t see it, and it’s rarely shown in pitch decks - yet it determines whether your product can enter the institutional world, or stays stuck at the Web3 consumer level.

Many builders only realize this during their first enterprise review - where questions about policies, orchestration, or risk limits can disqualify them within minutes.

If your stablecoin rail aims to survive in an enterprise environment, custody must be rock-solid. There is no shortcut.

Want to implement robust infrastructure from day one? Read Fystack’s guide: Self-Hosted MPC Wallet Infrastructure: Your Keys, Your Coins.

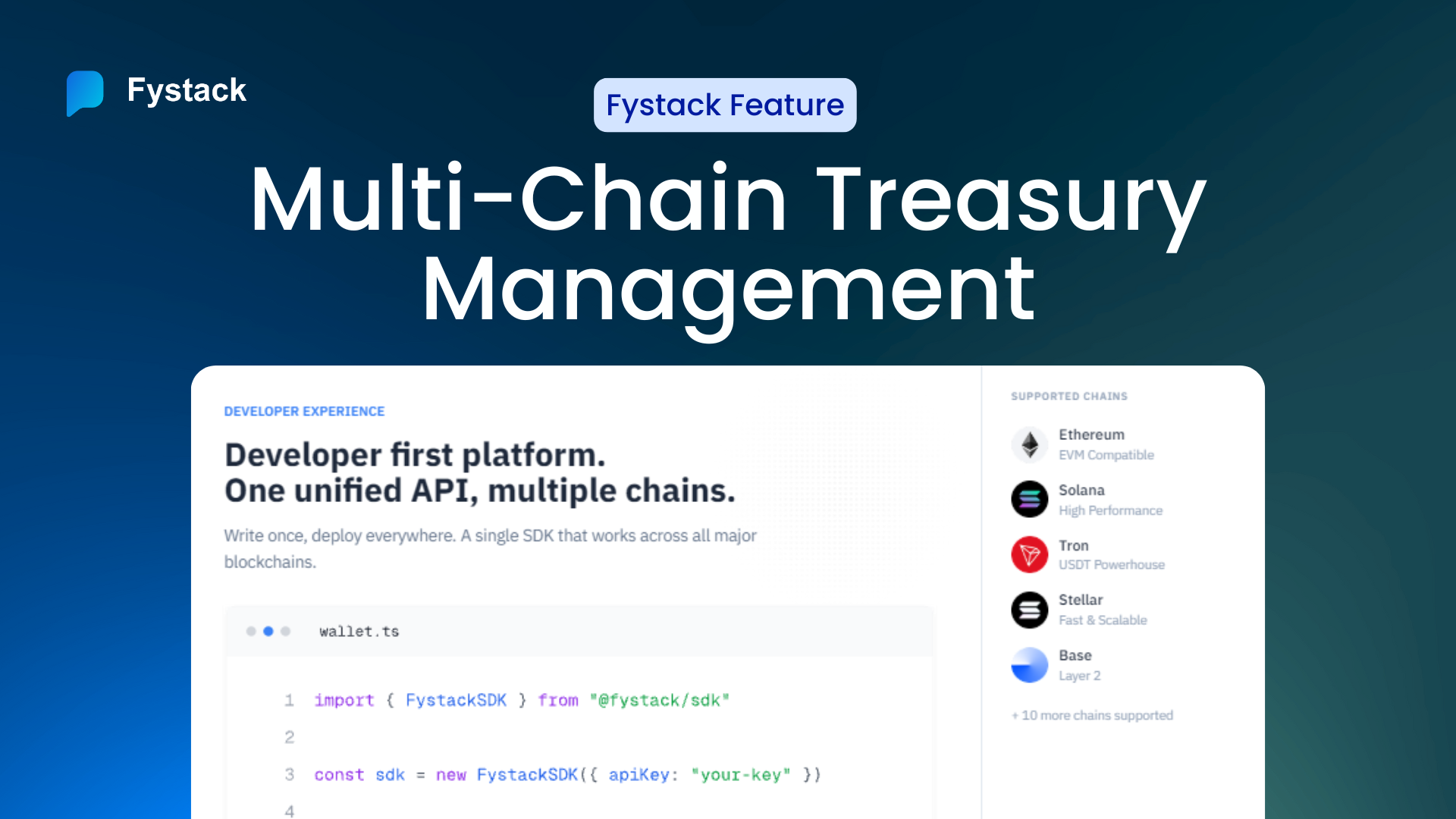

2. Blockchain Payment Engine: Multi-Chain Stability & Failover

Many teams assume multi-chain support simply means deploying the same contract on different networks. For enterprises, it means something entirely different: the rail must stay stable even when the underlying blockchain is unstable.

Every chain behaves differently, and not in small ways but in completely different patterns:

- Solana: extremely fast but prone to sudden congestion

- Tron: very cheap fees but slower finality and unreliable RPC behavior

- Ethereum: predictable security but gas can spike 20 to 50 times within minutes

- Base and other L2s: low fees but sequencer delays can stall confirmations without warning

Once real merchants and real volume enter the picture, these differences cause real failures.

The payment engine’s job is to absorb all of this instability so merchants experience a smooth and predictable flow. If one chain becomes slow, congested, or temporarily unreliable, the engine must automatically switch to fallback RPCs, retry safely, or recover the transaction state without breaking the user experience.

To survive real-world conditions, the engine needs four things:

Smart Retry and Failover Logic

When RPC nodes fail, the mempool stalls, or gas estimates return incorrect values, the engine must:

- retry automatically

- switch to fallback RPC nodes

- rebroadcast when necessary

- maintain a safe transaction state

- avoid double-sending at all costs

A chain can fail, but the payment cannot.

Batching to Prevent Overload

Batching reduces costs, lowers the signing load, and protects MPC or HSM systems from being overwhelmed.

Safe and Real-Time Gas Estimation

Gas cannot be guessed or calculated with fixed formulas. The engine must use real-time chain data to prevent unexpected fee spikes and stuck transactions.

Indexers That Act as the System’s Radar

Indexers must:

- track the latest block

- detect reorgs

- map transactions to invoices and settlements

- trigger accurate, non-duplicated webhooks

If the indexer lags even 30 seconds, merchants assume the platform is down. If it drifts by a single block, reconciliation silently breaks.

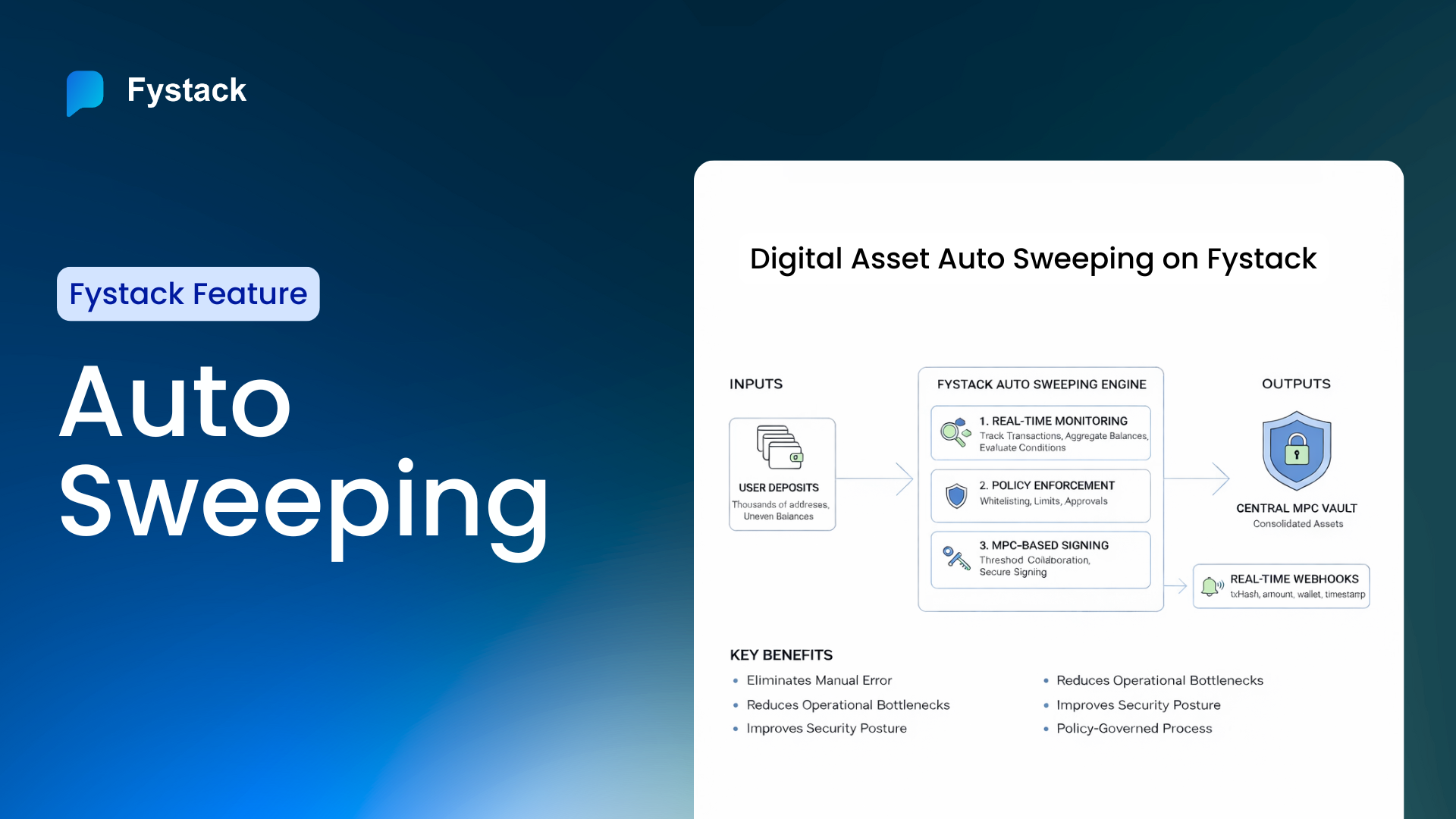

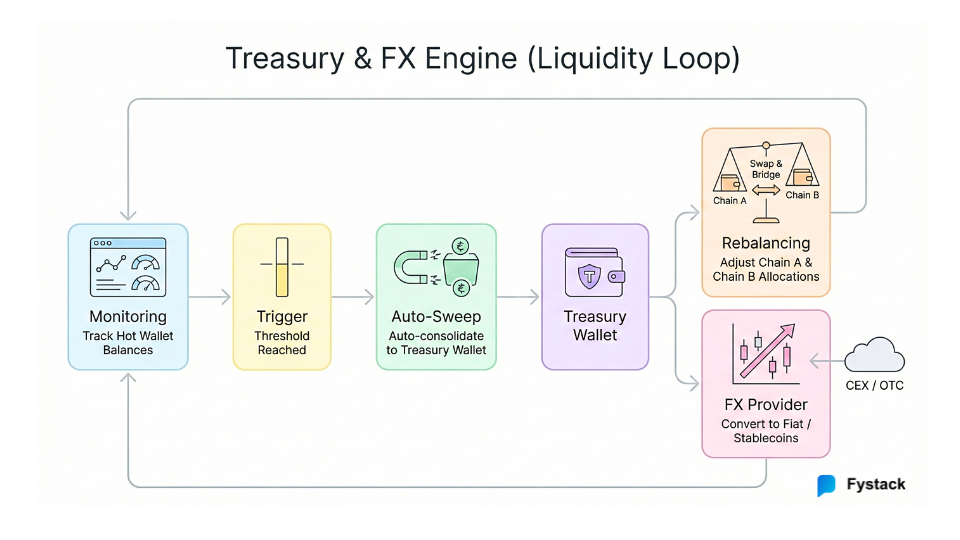

3. Treasury and FX Engine: Liquidity Management & Risk

In the enterprise world, moving stablecoins is the smallest part of the job. What businesses truly require is Real-Time Liquidity Risk Management and predictable economic performance. Your rail must function as a sophisticated financial nerve center: if you cannot guarantee liquidity across all chains 24/7 and manage competitive FX rates, your rail will fail the moment high-volume payments begin and break your merchant’s unit economics.

Treasury: The System’s Lifeline

The Treasury is the critical layer that prevents systemic failure due to capital shortages, ensuring settlements flow continuously.

- Continuous Liquidity: Funds must be instantly available on every supported chain.

- Auto-Consolidation: Automatic sweeping and consolidation of capital across all operational wallets.

- Cross-Chain Rebalancing: Must automatically fix chain-level imbalances to prevent capital being trapped on the wrong network when volume spikes. No rebalancing kills the rail when volume spikes.

FX Engine: The Adoption Decider

Businesses operate on defined margins and require transparent, competitive FX conversion. If your rail fails to provide competitive rates, enterprise merchants cannot maintain their unit economics and will ignore your product.

- Competitive Pricing: Liquidity must be routed intelligently across CEX, OTC, and AMM venues for the best rate.

- Slippage Protection: Shielding merchants from volatility that breaks their cash flow predictions.

The Treasury and FX Engine are the foundation of your rail’s economic viability. If you get the liquidity and pricing mechanisms wrong, the entire system collapses under real-world volumes. No financial infrastructure can survive without a reliable economic core.

To understand the operational rigor required for indexers, review the hard-earned lessons from a major platform: When CPUs Hit 100%: Hard-Earned Lessons from a Multi-chain Indexer Outage.

4. Compliance, Travel Rule and Risk Engine: Regulatory Adherence

No layer receives more pushback from builders than Compliance, yet none is more crucial for unlocking the enterprise market. Your rail must satisfy evolving regulatory demands. If your system is Non-Compliant, financial institutions are legally prohibited from using it. Compliance is the mandatory prerequisite for your market entry, and Risk is your operational defense.

Compliance and Travel Rule: The Legal Prerequisite

Compliance goes beyond basic KYC; it requires a real-time system executing regulatory policies, backed by mandatory global standards like the Travel Rule. Failure to implement this shuts your rail out of the regulated global payment ecosystem.

- Compliance: A Real-Time Rule Engine. Executing full KYC/KYB flows and continuous sanction screening for all entities. Must automate actions like approving, holding, or rejecting transactions based on policy.

- Travel Rule Integration: You must implement this to enable legal information exchange with regulated financial partners (VASPs) by identifying wallet ownership and sending/receiving Travel Rule messages.

Risk Engine: The Operational Defensive Firewall

The Risk Engine ensures that your system doesn't just report risk, but actively prevents losses by acting on threat signals in real-time. Without this layer, your system lacks the necessary control to handle real financial volume.

- Pattern Detection: Detecting anomalous transactions (sudden withdrawal bursts, mule-like behavior) in real-time.

- Immediate Action: Must automatically Block or Place a Hold on suspicious flows, or Downgrade Limits for high-risk wallets before financial damage occurs.

Compliance and Risk are the definitive factors for enterprise adoption. You must satisfy auditors and regulators first. If you cannot prove full control, an operational defensive firewall, and legal compliance, you will not be allowed to operate in this market.

5. Settlement & Accounting: Reconciliation & Financial Reporting

For a company's Finance Team, Settlement is the formal, auditable process to close the books, not simply sending a transaction. No matter how fast your blockchain is, if your system cannot generate Batch Settlement Records and GAAP/IFRS-Compliant Accounting Reports, their team will be unable to operate your system and maintain regulatory compliance. This is a non-negotiable requirement for enterprise sales.

Settlement and Accounting: From Chain to Ledger

Your rail must manage the full financial lifecycle, translating granular on-chain activity into standardized, auditable financial records. This requires a robust, integrated accounting system.

- Settlement: A Lifecycle, Not a Transfer. A real Settlement Engine must formalize financial obligations, update the internal ledger, and produce auditable records complete with fee and revenue allocation.

- Batch Settlement: The Scaling Requirement. Enterprises settle in batches for predictable reconciliation, lower costs, and clean accounting entries. Your system must integrate batch processing capabilities into finance workflows.

- Accounting Layer: Translating Blockchain to GAAP/IFRS. This layer is mandatory for financial reporting and auditing. No Accounting = No Enterprise Sales.

- Classification: Correctly classifying revenue, costs, liabilities, and assets according to established accounting standards.

- Reporting: Generating required balance sheets and P&L (Profit and Loss) statements for tax and audit purposes.

The Settlement and Accounting layer is the bridge between decentralized ledgers and traditional finance. If you fail to provide a system that generates clean, auditable financial statements, the system is fundamentally unusable for any business facing regulatory scrutiny or public markets.

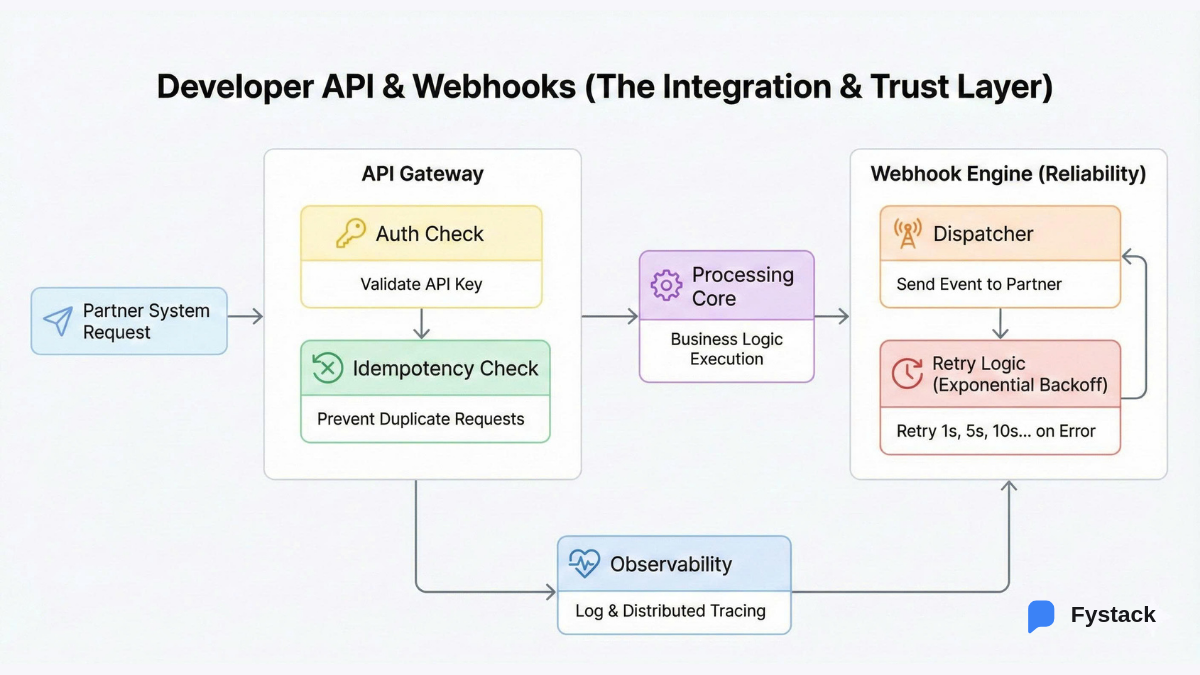

6. Developer API, Webhooks: Integration & Observability

In enterprise software, Your API is Your Product. World-class core technology is useless if partner developers struggle to integrate. You must deliver a Developer Experience (DX) that is seamless, predictable, and reliable. Unreliable integration points, like delayed or duplicated webhooks, instantly kill partner trust and guarantee that Adoption Velocity equals zero.

API and Webhooks: The Market Entry Point

The quality of your API and Webhooks determines whether enterprises adopt your rail or walk away. These must be engineered with the same rigor as your core custody solution.

- API: It Must Feel Like Stripe. The API must be robust, properly versioned, and include a real sandbox environment. Key is guaranteeing idempotency across critical calls to prevent duplicate actions or transactions.

- Webhooks: The Nervous System of Payments. Enterprises rely on webhooks for reconciliation and real-time status updates.

- Reliability: Must include retry with exponential backoff, signed payloads, and a strict guarantee of no duplicate sends.

Observability: Core Infrastructure

When you scale, visibility into system health, performance, and failure modes transitions from being a convenience to a mission-critical infrastructure requirement. Without proper observability, you cannot support merchants or maintain service level agreements (SLAs).

- Monitoring: Requires structured logs, distributed tracing, and real-time alerts for latency, gas costs, and abnormal pending states.

The entire success of your stablecoin rail hinges on the quality of its Developer Experience. You must treat APIs, Webhooks, and Observability as core features, not afterthoughts. This layer is the decisive factor that moves a system from a prototype to an enterprise-integrated platform.

7. Fraud & AML Monitoring: The Defensive Firewall

Nothing kills enterprise trust faster than an unexplained fraudulent or suspicious transaction. For any financial institution, Fraud & AML is the Operational Defensive Firewall. Your system must actively prevent losses by acting on risk signals in real-time. If fraud is only detected after the financial loss has occurred, the system has failed its core purpose, and no enterprise will integrate a system that only reports, but does not act.

Fraud Monitoring: Prevention, Not Just Detection

Your system must detect behavioral anomalies and automated attacks instantly. Enterprise clients require automated, intelligent risk decisions - they cannot manually investigate every transaction.

- Pattern Analysis: Detecting abnormal withdrawal patterns, sudden volume spikes, and suspicious automation (bot-like flows) in real-time.

- Immediate Action: The system must trigger automated responses: it must automatically Block or Place a Hold on transactions, or Downgrade Limits for high-risk wallets based on real-time scoring.

AML/KYT Monitoring: Automated Risk Decision

This layer provides the necessary intelligence to comply with global Anti-Money Laundering (AML) standards and Know-Your-Transaction (KYT) requirements.

- Real-Time Scoring: Risk-score wallets instantly based on long-term behavior and association with known criminal clusters.

- Compliance Enforcement: Enforcing region-specific thresholds and rules to ensure the rail maintains its legal permission to operate.

The integration of Fraud and AML monitoring proves the financial maturity of your rail. This unified firewall is mandatory. Without it, the risk of financial loss and regulatory non-compliance makes enterprise adoption impossible.

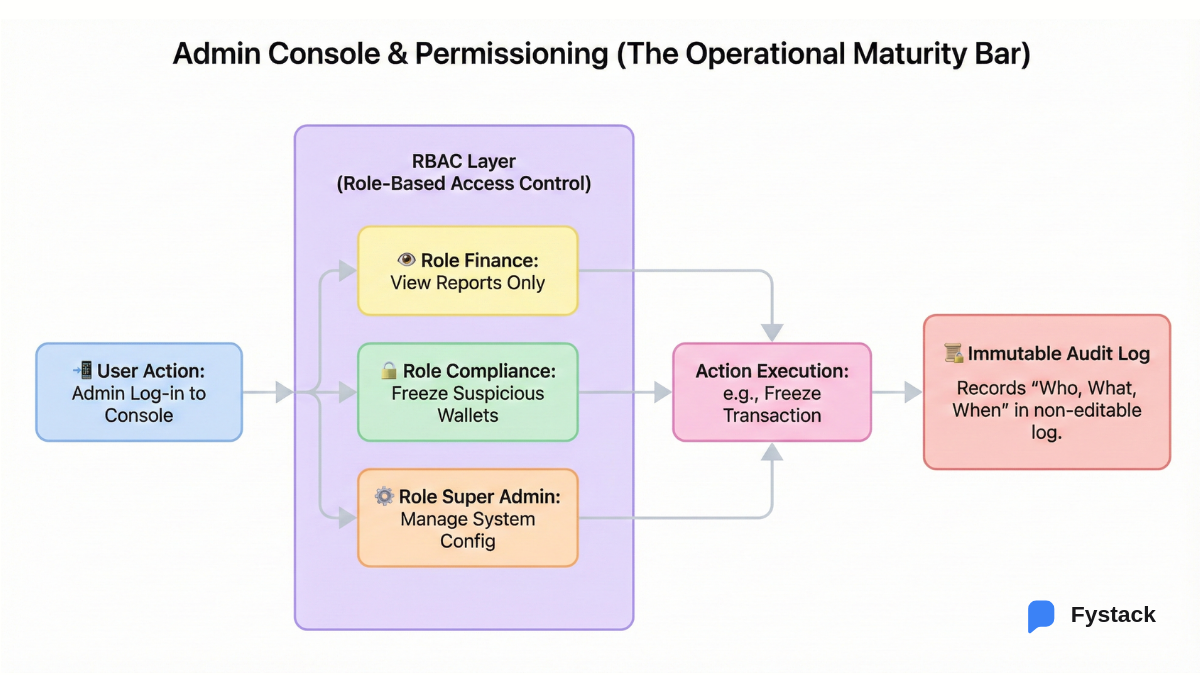

8. Admin Console & RBAC: Operational Controls & Audit Logs

In an Enterprise environment, the Admin Console is the Command Center used daily by Compliance, Finance, Risk, and Audit teams. If you treat this as a secondary dashboard, your system will fail immediately during any external security or compliance review. You must provide the granular permissioning and immutable audit controls necessary to prove operational maturity.

RBAC and Controls: The Security Gateway

Strict Role-Based Access Control (RBAC) and immutable logging are mandatory requirements. Failure to separate duties or log all actions is an instant red flag that voids security standards.

- Admin Console: The Operational Control Center. Provides the necessary visibility and tools for issue resolution and reconciliation (viewing the full payment lifecycle, placing holds, and adjusting balances).

- Permissioning (RBAC): Separation of Duties. The system must enforce separation of capabilities by role (e.g., Compliance can Freeze Payments but Finance cannot Adjust Balances).

- Audit Controls: Mandatory Requirement. Logs must be immutable, detailed, and fully compliant with financial audit standards, recording every administrative action.

The Admin Console is where your product is judged on its operational capabilities. Without verifiable controls, logging, and granular permissioning, you cannot meet the due diligence requirements of any regulated company. No Admin Console + No Permissioning + No Audit = No Enterprise Product.

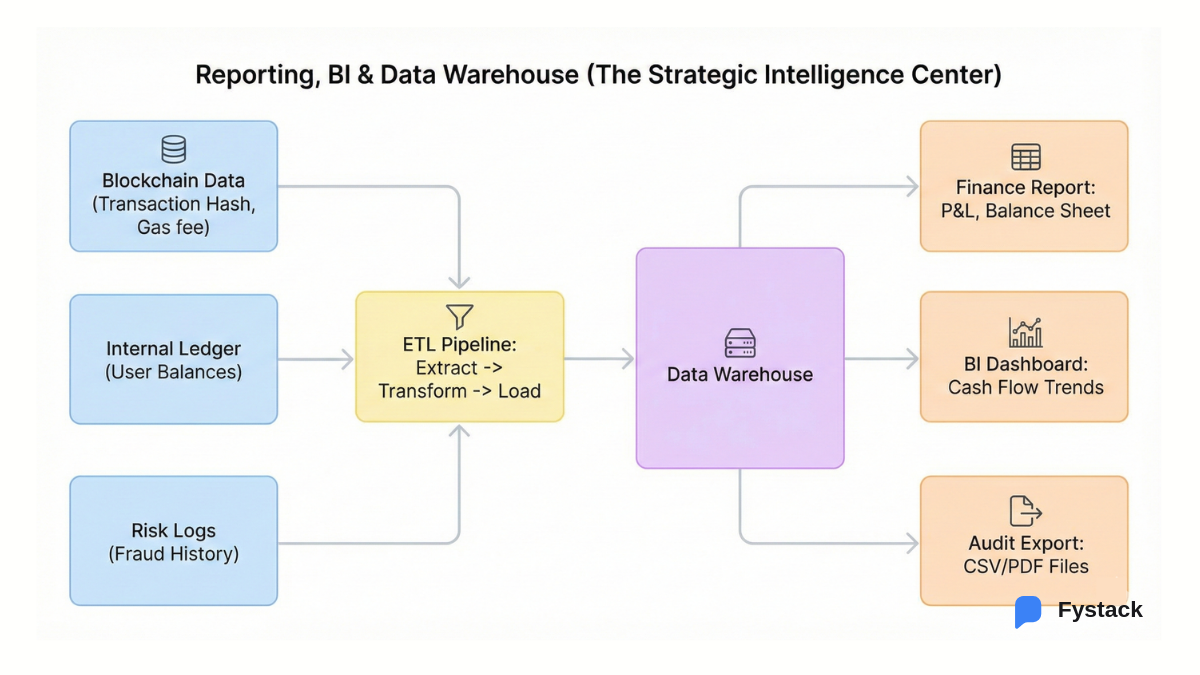

9. Reporting, BI & Data Warehouse: Financial Intelligence

Enterprises run on Compliant Financial Data, not assumptions. Your stablecoin rail may be technologically superior, but if it cannot answer core business questions like profitability, cost analysis, or reconciliation accuracy, the system is fundamentally Unusable for strategic planning and auditing. This layer transforms raw blockchain activity into actionable intelligence.

Reporting and Data Warehouse: The Single Source of Truth

The ability to generate accurate, aligned financial reports and unify all system data is essential for both daily operations and long-term decision-making by executives and auditors.

- Reporting: Real-Time Financial Data System. Reports must be accurate, actionable, and aligned directly with the ledger and settlement data. This enables the finance team to monitor system health and measure value creation instantly.

- BI Layer: Zero Visibility Without It. The Business Intelligence (BI) capability allows internal teams (Finance, Risk, Operations) to analyze volume trends, monitor latency, understand cost distribution, and segment merchant behavior.

- Data Warehouse: The Single Source of Truth. The warehouse must unify all critical data (transactions, ledger entries, risk scores, settlement batches) into one source to enable external audits and financial forecasting.

The Reporting, BI, and Data Warehouse layer is the intelligence center of your entire rail. Without a single source of truth and the ability to turn data into compliant financial reports, your system remains a tool, not a financial platform capable of informing strategic decisions for major enterprises.

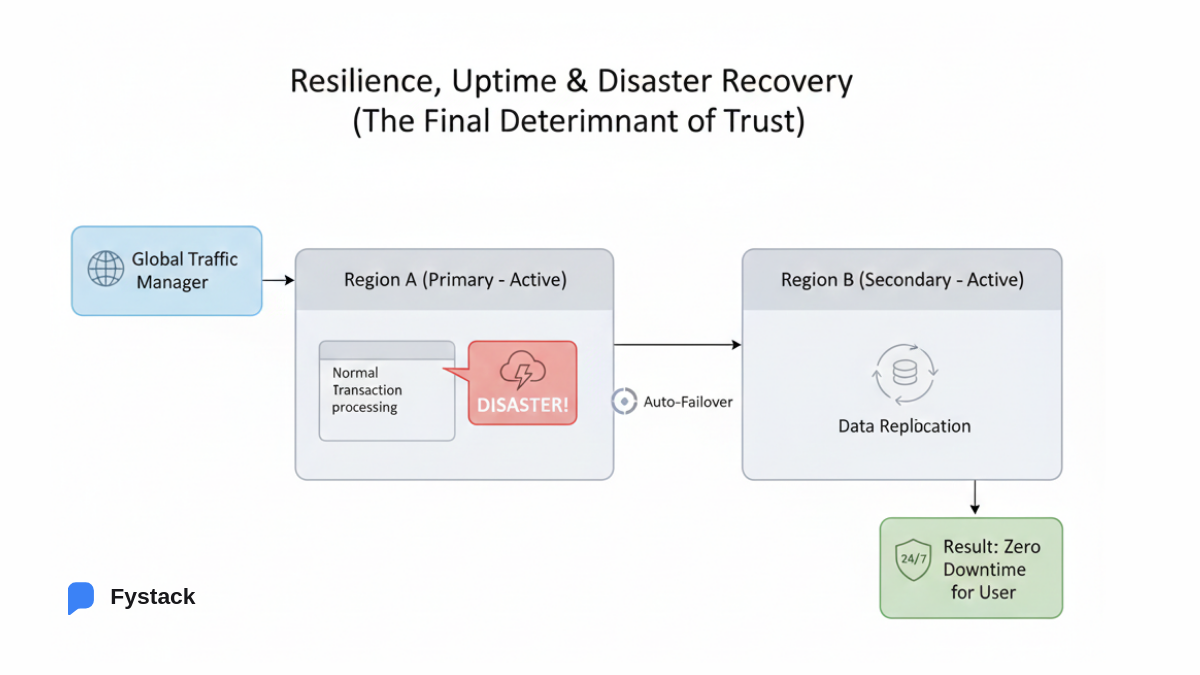

10. Resilience & Disaster Recovery (DR): Ensuring High Availability

Institutional clients do not tolerate downtime. For them, your stablecoin rail is not a dApp; it is mission-critical financial infrastructure. The tenth component, Resilience, is the non-functional requirement that determines whether your system can withstand major failures (chain outages, cloud failures, data center loss) and still maintain continuous operation and data integrity. This is the final determinant of whether you are taken seriously by enterprises.

Uptime and High Availability (HA)

A production-grade rail must be engineered for full redundancy across all layers. True High Availability goes beyond simple load balancing; it requires a strategy to survive catastrophic failures.

- Multi-Region/Multi-Cloud Deployment: Required to survive the loss of an entire data center or cloud region (e.g., AWS US-East failure).

- Active-Active Redundancy: Critical services (Payment Engine, Custody Policy, Indexers) must run simultaneously across multiple regions to ensure zero recovery time objective (RTO=0).

- Near-Zero RTO/RPO: Enterprises require recovery time objectives (RTO) and recovery point objectives (RPO) measured in seconds, not hours, for financial data integrity.

Disaster Recovery (DR) and Testing

Disaster Recovery (DR) is not a written plan; it is a continuously tested capability. Auditors will demand proof that your system can survive a simulated disaster.

- Immutable Ledger & State Integrity: In a failover scenario, the system must guarantee that the financial ledger remains intact and transaction state is preserved without duplication or loss.

- Regular Fire Drills: Must perform mandatory, scheduled DR testing (e.g., quarterly chaos engineering or failover simulation) where the primary environment is intentionally shut down.

- Secure Backup and Restoration: Encrypted, geographically separate backups with tested restoration procedures that meet regulatory requirements.

The level of investment and rigor you apply to Resilience and Disaster Recovery defines the line between a Web3 protocol and a true financial utility. Institutional trust is built on uptime and the absolute certainty that data will not be lost, regardless of external failure. If your rail cannot guarantee 24/7 uptime and auditable recovery, the previous nine components are meaningless.

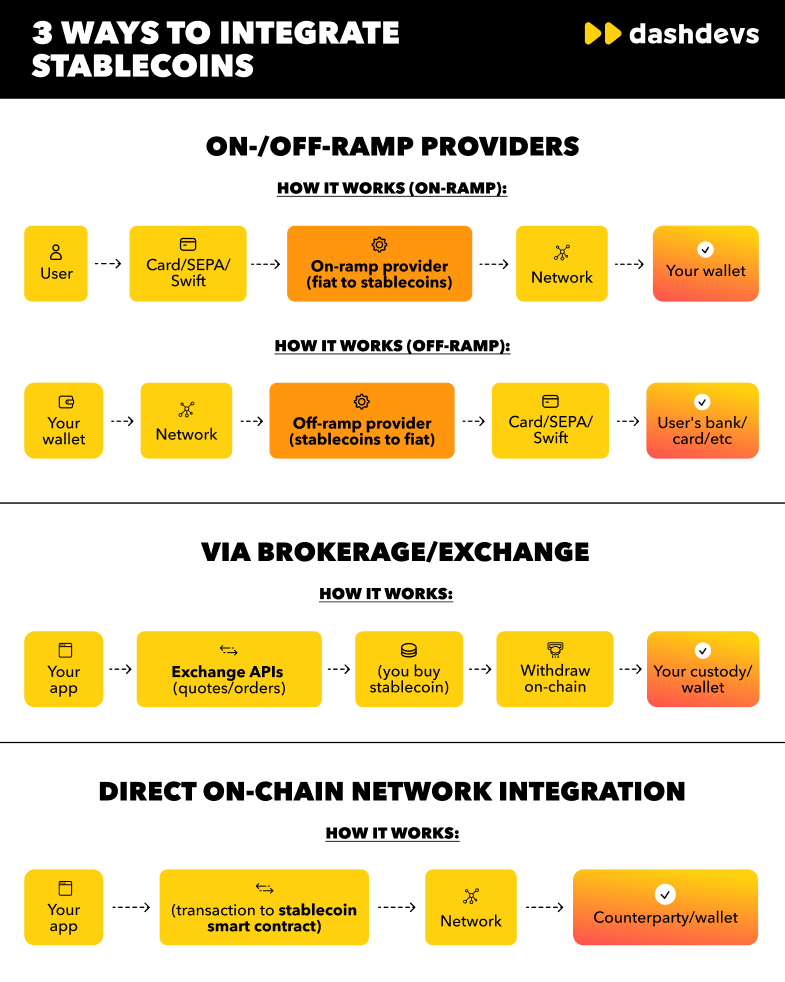

11. On/Off-Ramp: Fiat-to-Crypto Bridging

For a stablecoin rail to achieve full “payment rail” capability, it must seamlessly bridge decentralized liquidity with traditional finance. While the Treasury manages internal crypto liquidity, the On/Off-Ramp Layer manages the friction points where real-world fiat cash flow meets your system. Ignoring this layer limits your rail to internal crypto transfers, severely hindering merchant adoption who rely on local bank settlements.

On-Ramp: The Fiat Entry Point

The On-Ramp allows users to convert traditional payment methods directly into stablecoins on your rail. This requires flexible integration with global and regional service providers.

- User Payment Methods: Must support mainstream and regional methods like Credit Card, Bank Transfer, and Mobile Money (M-Pesa, VN Mobile Money).

- Provider Integrations: Requires robust connections to global providers (Stripe, MoonPay, Transak, Ramp) and specific regional fintechs (e.g., Vietnam: 9Pay, PayOS) to maximize market reach and conversion rates.

Off-Ramp: The Merchant Cash-Out Lifecycle

The Off-Ramp is essential for merchants, as their revenue must eventually convert to local currency for payroll and operations. This is where your system fulfills its promise of cash flow utility.

- Cash-Out Channels: Must support diverse channels: stablecoin to local bank accounts, mobile wallets, or efficient conversion to stablecoins on various L2s.

- FX Desk Integration: Requires integration with a sophisticated FX desk to ensure competitive conversion rates from stablecoin to fiat currency, especially for high-volume corporate clients.

The On/Off-Ramp layer is the practical interface that transforms your technical stack into a viable financial product for the mass market. By ensuring low-friction conversion from fiat to stablecoin and back, you guarantee that your rail supports the entire cash flow lifecycle, making it truly competitive with traditional payment networks.

This reality explains why giants like Stripe, Visa, and Circle only launched their stablecoin rails after years of building specialized infrastructure. The complexity at this layer is overwhelming, which is why successful teams choose to leverage dedicated infrastructure partners instead of diverting scarce engineering resources to rebuild these mandatory financial components from scratch.

The Infrastructure Dilemma: "Tank" vs. "Sports Car"

When architecting a stablecoin payment rail, Founders face a critical fork in the road regarding Custody Infrastructure. This is not merely a technical decision; it is a strategic calculation of Time-to-Market and Unit Economics.

The market is currently divided into two distinct philosophies:

1. The Institutional Incumbents (Fireblocks, Cobo, Utila, Safeheron)

Think of these providers as "Tanks." They are heavily armored, battle-tested, and built for war.

- The Upside: They offer fortress-level security, validated by major banks and hedge funds. They sell pure peace of mind.

- The Critical Downside:

- Integration Lag: Due to complex multi-layer security architectures and closed SaaS models, integration timelines typically stretch from weeks to months.

- Developer Friction: Documentation can be fragmented, APIs often have strict rate limits, and support usually involves slow, ticket-based cycles.

- Vendor Lock-in: You operate entirely within their "black box." If their system goes down for maintenance, you go down. If they raise prices, you pay.

2. The Velocity-First Challenger

Fystack approaches the problem with the mindset of Stripe or AWS: Turning complex infrastructure into agile "Plug-and-Play" modules.

- Velocity as a Weapon: Rejecting the industry standard of long onboarding, Fystack utilizes standard REST APIs and ready-to-use SDKs. The goal is to take a business from signup to Go-live in days, not months.

- Infrastructure Autonomy: Unlike the closed SaaS models of competitors, Fystack emphasizes control, allowing businesses to maintain tighter command over their data and policy engines, reducing third-party dependency risks.

- Resource Efficiency: For a Fintech or Web3 startup, spending a quarter and significant capital just to "connect the pipes" is wasteful. Fystack liberates engineering teams from low-level node configuration and key management, allowing them to focus 100% on building the core product.

If you are a global bank requiring legacy financial institutional validation, the incumbents (like Fireblocks) are the safe bet. However, if you are a modern Fintech or Builder prioritizing speed, agility, and operational control, Fystack represents the superior strategic fit. Do not let your infrastructure become the bottleneck that chokes your growth.

To understand the future of institutional custody and the critical self-hosted vs. SaaS decision, review: Fystack vs. Fireblocks: Self-Hosted vs. SaaS Custody.

FAQ: Common Questions About Stablecoin Payment Rails 2026

1. What is an “Invisible Stablecoin Rail”?

2. Why is Data Sovereignty critical for enterprises using stablecoin rails?

3. Should enterprises Build or Buy their stablecoin payment infrastructure?

4. How do stablecoins improve a company’s Unit Economics?

5. What is the future of stablecoins in traditional finance (TradFi)?

Conclusion

Building a stablecoin rail is not about adding a payment method; it is about laying the financial infrastructure for the future.

Custody, treasury, compliance, and reconciliation-these invisible layers determine whether your product is a Web3 experiment or a scalable financial platform. The winners in 2026 will be those who make this infrastructure invisible, compliant, and enterprise-ready.

If you care about security, compliance, and reliability in Web3 operations:

👉 Try Fystack today: https://app.fystack.io

👉 Join our Telegram community for web3 security updates, engineering insights & product updates: https://t.me/+9AtC0z8sS79iZjFl