Stablecoin Adoption in 2026: From Crypto Trading to Global Payments Infrastructure

Ted Nguyen

Author

BD & Growth @Fystack

Over the past year, stablecoins have crossed an important threshold for enterprises and digital-first businesses.

What once functioned primarily as a liquidity tool for crypto trading is now being actively used for payments, cross-border settlements, and treasury flows.

This shift is not driven by a single breakthrough. Instead, it reflects the convergence of regulatory clarity, real economic demand, and infrastructure maturity.

Stablecoin Adoption Is Accelerating as a Global Payment and Settlement Layer

Stablecoin adoption is being shaped by a combination of economic pressure, regulatory progress, and institutional behavior, each reinforcing the other.

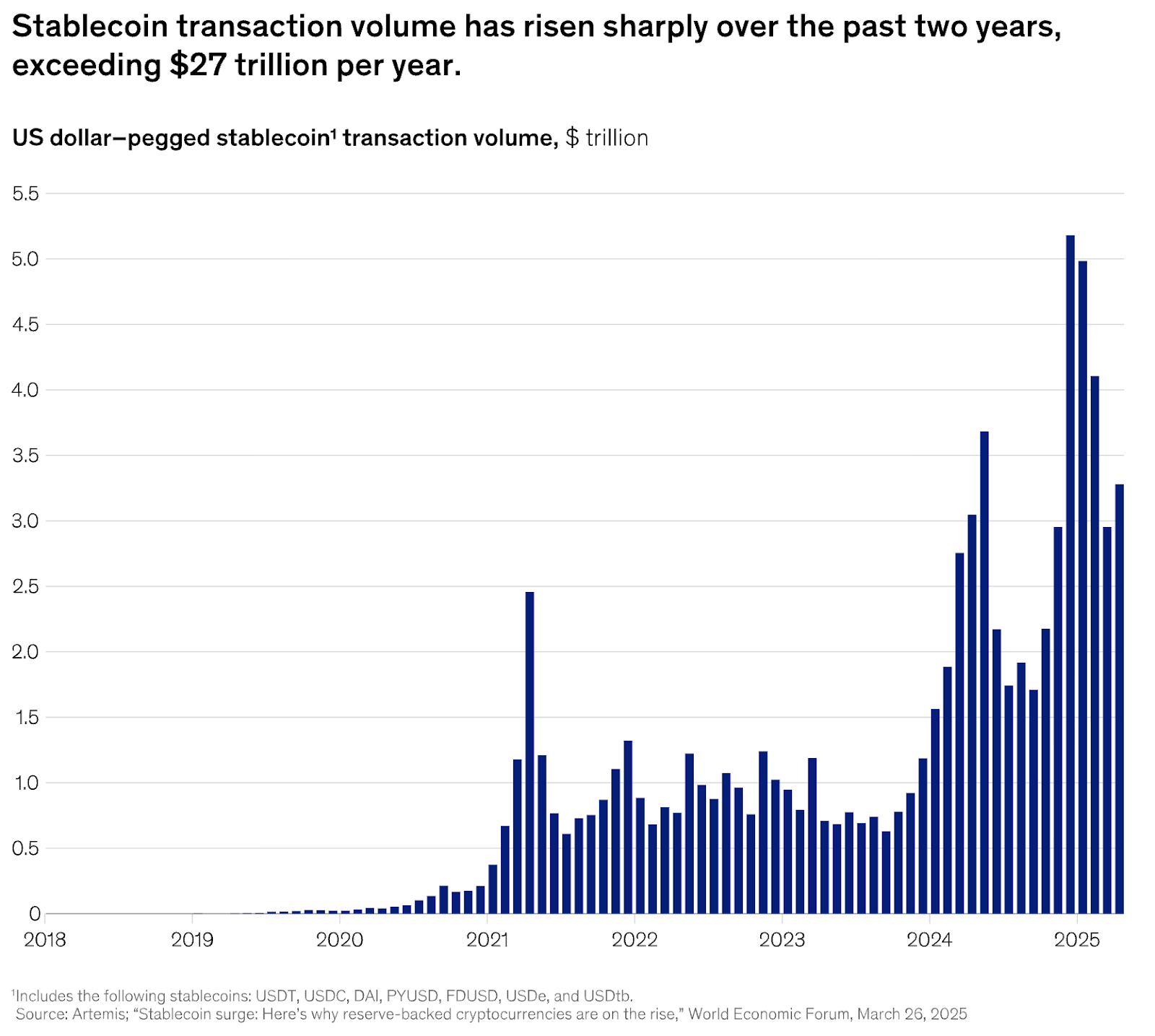

Some may argue that stablecoins pose little to no threat to incumbent payment networks. However, the volume of stablecoin transactions has grown organically by an order of magnitude over the past four years - McKinsey (2025)

Stablecoins vs Legacy Payment Rails: Why Cross-Border Payments Are Broken

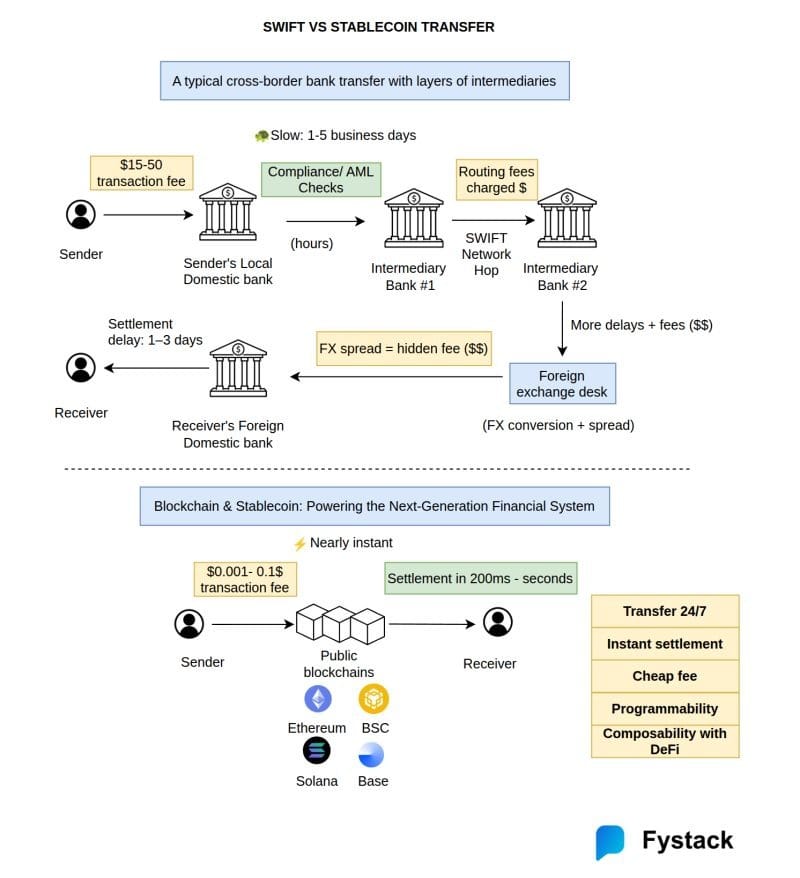

Traditional payment rails remain slow, expensive, and fragmented, especially for cross-border use cases. International transfers take 2-5 days via correspondent banking, hit 6.2-6.3% fees, involve multiple intermediaries, and expose users to opaque FX spreads up to 5%.

"Cross-border payments are generally slower, more expensive and more opaque than domestic ones." - Bank for International Settlements (2020)

These frictions are not incidental. They are the direct result of how cross-border payments are architected.

Cross-Border Payment Systems Are Structurally Inefficient

For most enterprises, cross-border payments fail in predictable ways: they are slow, expensive, and difficult to track.

These issues are not operational accidents - they are the result of how the global payment system is built.

Most international payments still rely on correspondent banking networks, where no single institution has end-to-end control over a transaction. Instead, funds move across a chain of correspondent banks, each maintaining its own ledger, liquidity buffers, compliance checks, and settlement timelines.

This structure creates several systemic inefficiencies:

- Fragmented liquidity: Banks must pre-fund accounts in multiple jurisdictions, tying up capital.

- Delayed settlement: Finality only occurs after reconciliation across intermediaries.

- Limited transparency: Senders often cannot track where funds are or how much will be deducted.

- Operational risk: Each intermediary introduces failure points, cut-off times, and manual processes.

Even when payment messages move faster, the money itself often does not. In practice, this means businesses receive confirmations quickly but still wait days for actual funds to settle.

Cross-Border Payments Became the First Real Use Case for Stablecoins

This is precisely where stablecoins found early traction.

Rather than optimizing correspondent banking, stablecoins introduce a different way to settle value between institutions.

Value moves peer-to-peer on a shared ledger, settles atomically, and remains available 24/7, independent of banking cut-off times or geographic boundaries.

This does not eliminate banks from the process but it changes their role. In many early deployments, banks and payment providers still handle:

- Customer onboarding

- Compliance and reporting

- Fiat on- and off-ramps

Stablecoins simply function as a neutral settlement asset in between.

What changed over the past two years is that stablecoins are no longer confined to niche cross-border corridors. Regulatory clarity, and institutional participation have pushed them closer to the financial mainstream.

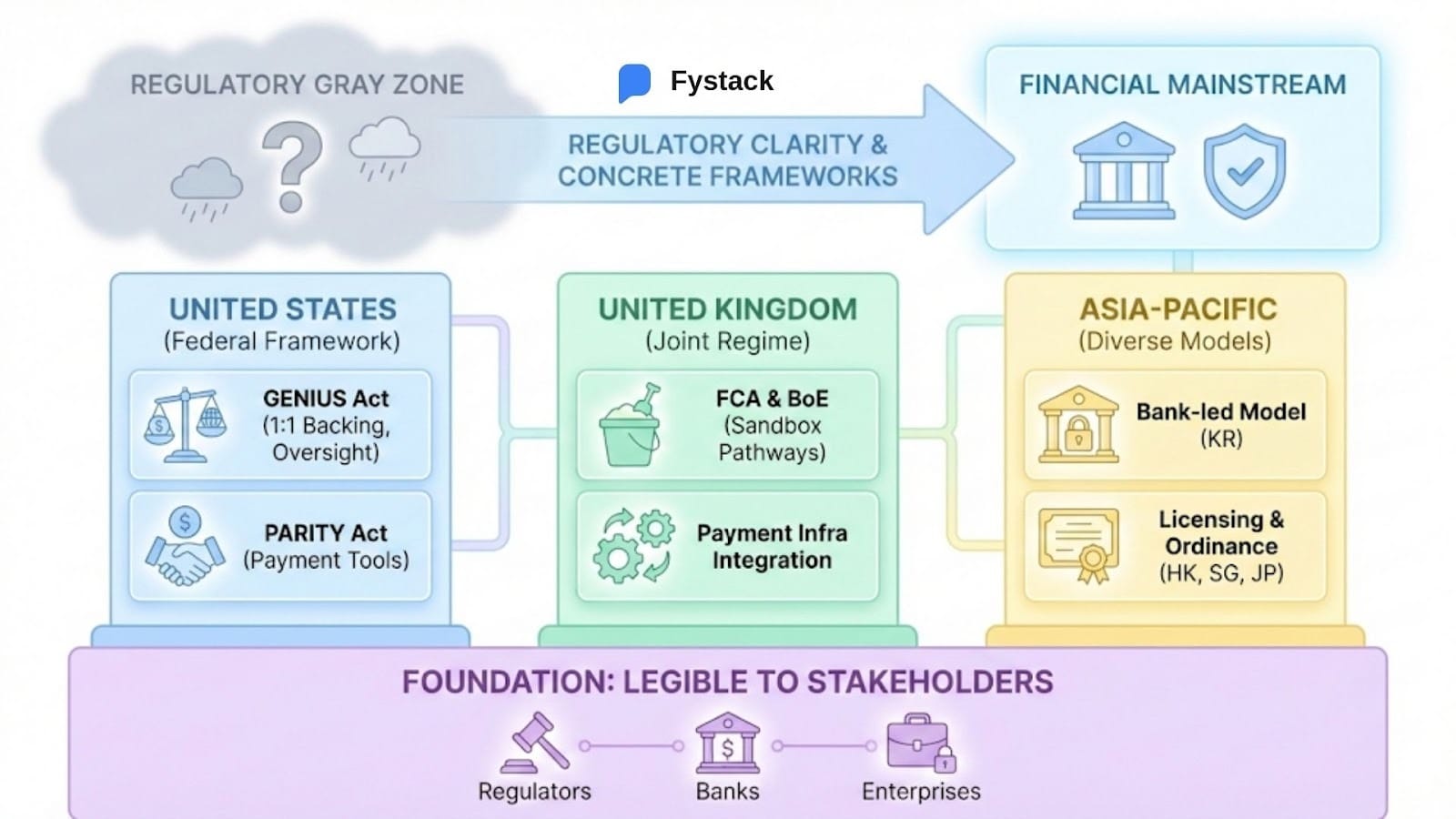

Regulatory Frameworks Enabling Stablecoin Adoption at Scale

For most of the past decade, stablecoins existed in a regulatory gray zone.

That dynamic is now changing. The result is a wave of concrete frameworks that redefine stablecoins as regulated payment instruments rather than speculative crypto assets.

United States

The passage of the GENIUS Act establishes a federal framework specifically for USD-denominated payment stablecoins, with requirements around:

- 1:1 backing in cash or short-term Treasuries

- Monthly reserve disclosures

- Oversight by prudential regulators rather than market regulators

Looking ahead, proposed legislation such as the PARITY Act signals further normalization. By introducing potential tax safe harbors for small-value stablecoin transactions, policymakers are acknowledging stablecoins as payment tools.

United Kingdom

The Financial Conduct Authority and the Bank of England are jointly finalizing a regime that positions sterling stablecoins as part of the country’s payment infrastructure.

Key elements include:

- Sandbox pathways for retail and wholesale payment use cases

- Prudential standards for systemic stablecoins

- Clear operational codes of practice expected to take effect in 2026

Rather than treating stablecoins as crypto innovations, UK regulators are exploring how they can integrate with faster payment systems and existing financial institutions.

Asia-Pacific

Across Asia, the regulatory message is similarly consistent, though execution differs by market.

- South Korea is advancing a bank-led model, requiring stablecoin issuers to operate through regulated consortia with full AML compliance.

- Hong Kong has passed a dedicated stablecoin ordinance, with licensing expected to begin in early 2026 under strict reserve and governance rules.

- Singapore and Japan continue to roll out issuer licensing under existing payment services laws, focusing on consumer protection and reserve transparency.

Taken together, these frameworks make stablecoins legible to regulators, banks, and enterprises.

Institutional Signals Driving Widespread Stablecoin Adoption

Over the past year, stablecoins have quietly moved from pilots to production when large financial institutions started using them in live payment and settlement flows.

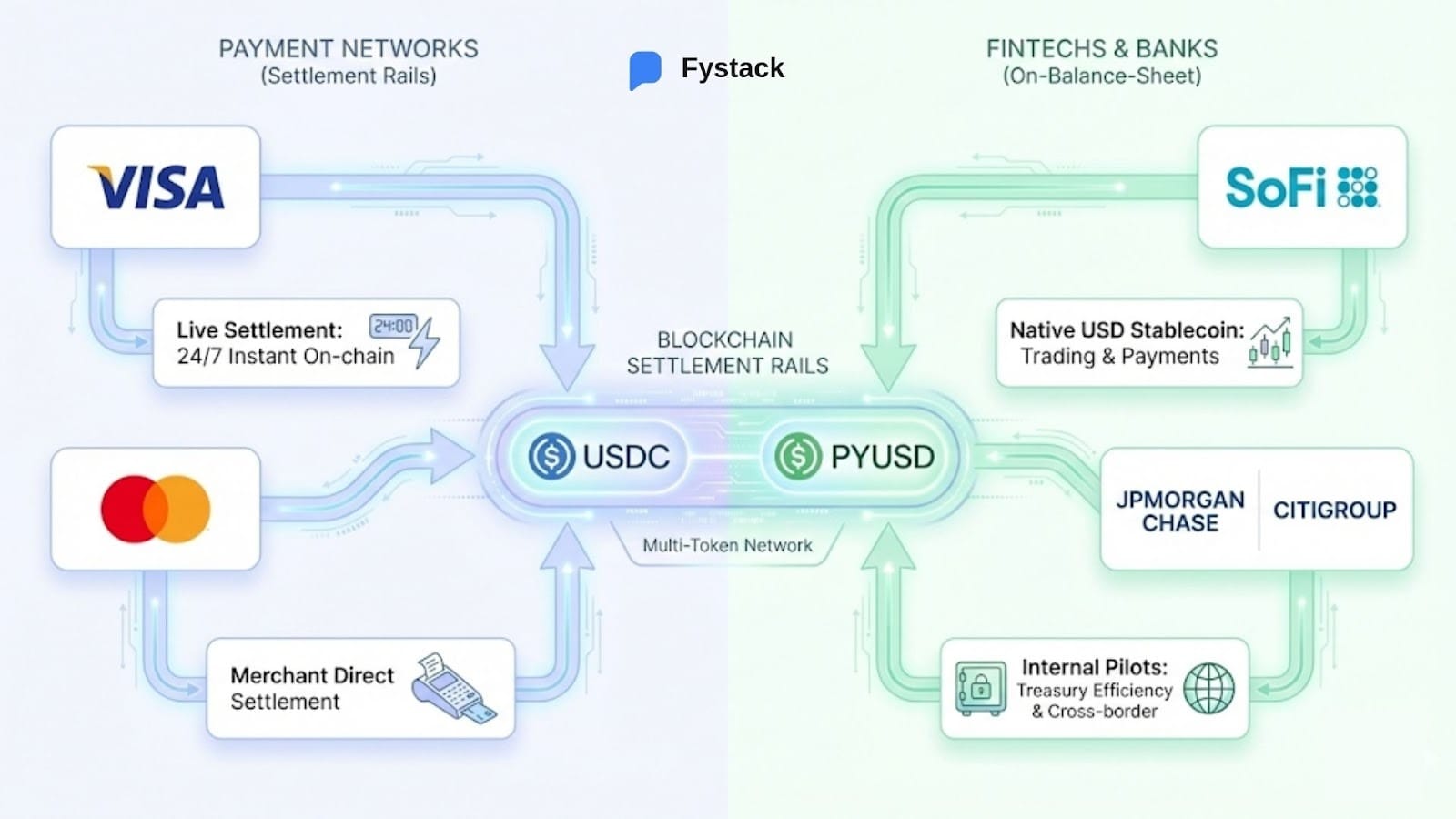

Payment Networks Treat Stablecoins as Settlement Rails

Visa has launched live USDC settlement with U.S. banks, allowing payments to settle instantly on-chain with 24/7 availability.

Mastercard has taken a broader approach. Its multi-token network integrates fiat-backed stablecoins such as PYUSD and USDC, enabling merchants to settle directly while consumers continue to pay as if using traditional cards.

Fintechs and Banks Bring Stablecoins On-Balance-Sheet

SoFi Technologies’s launch of a native USD stablecoin for trading and payments reflects a shift toward first-party issuance, where reserve transparency and settlement speed are treated as product features rather than crypto risks.

Institutions such as JPMorgan Chase and Citigroup have expanded internal and interbank pilots, framing stablecoins as tools for treasury efficiency and cross-border settlement.

Stablecoin Use Cases in 2026: From Trading Tools to Financial Infrastructure

Stablecoins did not begin as a payments innovation. Their earliest adoption was driven by the needs of crypto markets themselves. What has changed over the past few years is who uses stablecoins and for what purpose.

Early Use Cases: Trading, Liquidity, and On-Chain Settlement

For most of the 2017–2021 period, stablecoins served a narrow but critical role inside crypto markets.

They were primarily used for:

- Trading pairs on centralized and decentralized exchanges

- On-chain liquidity in DeFi protocols

- Settlement between exchanges and market makers

In this phase, stability mattered mainly as a functional property. Stablecoins allowed market participants to move value quickly, avoid repeated conversion into fiat, and manage short-term exposure to crypto price volatility.

Adoption was driven largely by market utility within crypto-native environments, with limited integration into traditional payment systems or regulated financial workflows.

Expansion Into Payments and Remittances

Over time, stablecoins started appearing not just where crypto was traded, but where value needed to move across borders, balance sheets, and time zones.

Use cases expanded into:

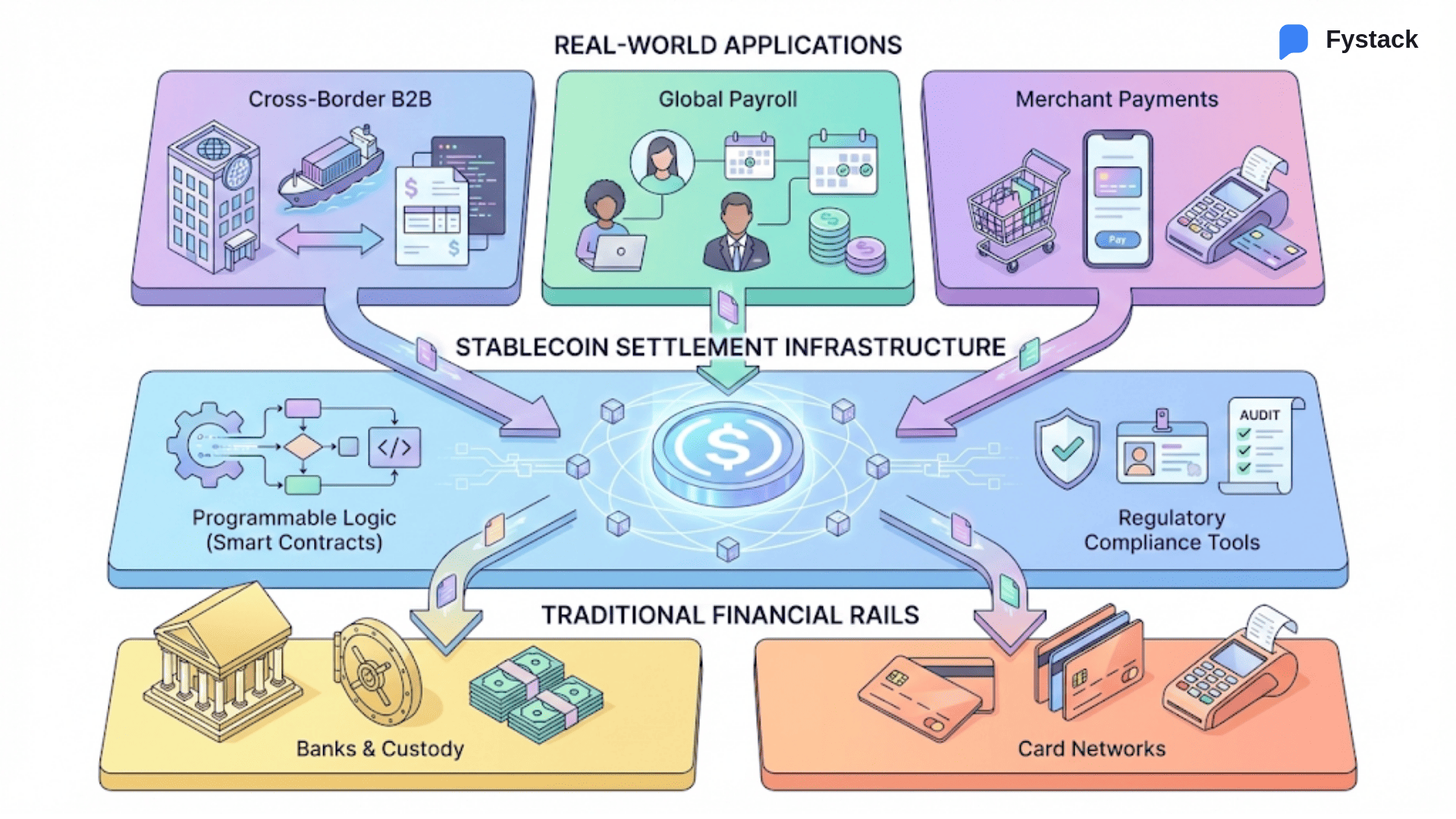

Cross-Border B2B Payments

One of the earliest non-trading applications of stablecoins emerged in cross-border B2B transactions. Exporters, suppliers, and service providers started using stablecoins to settle invoices faster and with fewer intermediaries than traditional correspondent banking allowed.

In these flows, stablecoins function less as speculative assets and more as neutral settlement instruments.

Freelancer and Global Payroll Payments

Stablecoins also gained traction in contractor and payroll payments, especially for globally distributed teams and freelancers in emerging markets. For recipients facing currency volatility or limited access to international banking, stablecoins offer a way to receive USD-denominated value directly, with predictable settlement timing.

Merchant and Commerce-Oriented Payments

A third area of expansion has been merchant and ecommerce payments, particularly in cross-border or digital-first contexts. Some merchants began accepting stablecoins to reduce card processing fees, avoid chargebacks, and accelerate settlement.

While still early in scale, this use case highlights where stablecoins start to intersect with everyday commercial activity, especially in scenarios where traditional payment rails introduce disproportionate cost or delay.

Taken together, these use cases reveal where stablecoins deliver the most value today: in environments where speed, global reach, and settlement certainty matter more than legacy payment conventions.

Stablecoins as Payment Infrastructure

As stablecoins are integrated into enterprise payment stacks, their role shifts from payment instruments to payment infrastructure.

In this sense, stablecoins resemble infrastructure more than products. End users may never directly interact with them, but their presence reshapes how payments function behind the scenes.

Several structural properties distinguish stablecoins from legacy payment rails.

Always-on settlement

Stablecoin transactions settle continuously, without banking hours, cut-off times, or batch processing. Finality occurs at the moment of transfer, rather than after reconciliation across intermediaries.

Programmable settlement

Stablecoins allow payment logic to be embedded directly into the transfer of value. Conditional releases, escrow mechanisms, revenue splits, and milestone-based payments can execute automatically, reducing operational friction and manual oversight.

Interoperability and composability

A single stablecoin can move across wallets, platforms, and jurisdictions without changing its underlying form. Payments become composable building blocks that integrate with accounting systems, treasury tools, and increasingly, tokenized financial assets.

Crucially, stablecoins are not replacing banks, card networks, or payment applications.

Instead, they are emerging as a settlement layer between them.

Banks still handle compliance, custody, and fiat conversion.

Payment apps still manage user experience and consumer protection.

Stablecoins operate in the middle, moving value efficiently across systems that were never designed to interoperate.

This hybrid model explains why adoption is accelerating without requiring a complete overhaul of existing financial infrastructure.

The opportunity for stablecoins in the next decade is monumental.

— Fred Krueger (@dotkrueger) August 24, 2025

Instead of using checks and wires, businesses will settle an increasing number of payments with stablecoins. The main advantage will be speed and finality of settlement. No wondering if the check cleared. Complete…

The significance of this shift lies not in replacing familiar payment methods, but in changing what happens underneath them.

Risks, Failures, and What to Be Careful About Stablecoins

As stablecoins move closer to mainstream financial infrastructure, the risks surrounding them become more consequential.

Understanding these risks requires separating different stablecoin models and failure modes, rather than treating all incidents as equivalent.

Not All Stablecoins Fail for the Same Reasons

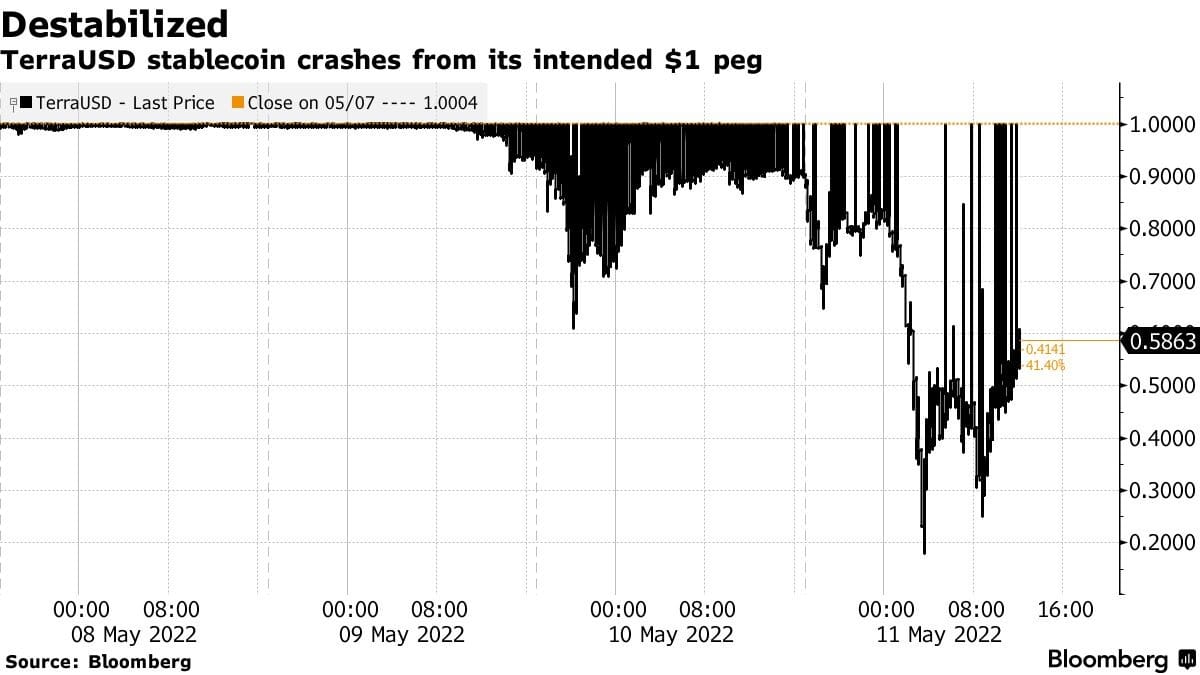

The most visible stablecoin failures of the past decade came from algorithmic or under-collateralized designs, not from fully fiat-backed models.

The collapse of TerraUSD in 2022 is often cited as evidence that stablecoins are unstable by nature.In reality, TerraUSD relied on reflexive market incentives and arbitrage mechanisms rather than verifiable reserves. When confidence broke, the design unraveled rapidly.

By contrast, fiat-backed stablecoins face a different risk profile. Their stability depends less on market reflexivity and more on:

- Reserve quality

- Governance

- Redemption credibility

Conflating these models obscures where the real risks lie.

Key Risk Categories for Stablecoins Going Forward

As stablecoins scale, several risk vectors remain relevant.

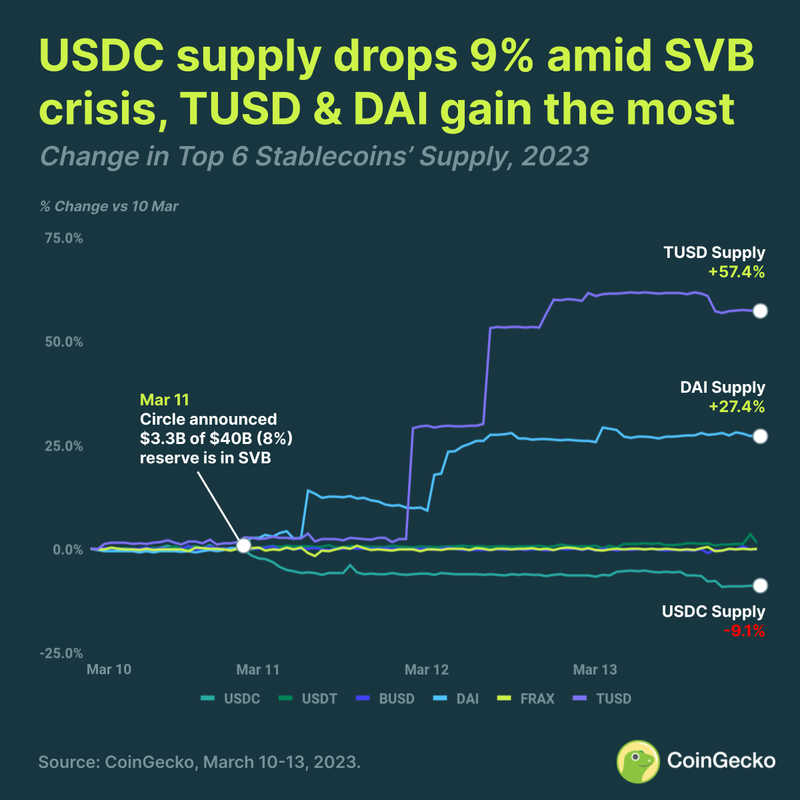

Reserve and custody risk

Even fully backed stablecoins rely on custodians, banks, and asset managers. Concentration of reserves, exposure to specific institutions, or unclear segregation can introduce vulnerabilities during stress events.

The brief de-pegging of USDC in March 2023 highlighted how off-chain banking failures (The SVB Collapse) can propagate into on-chain assets, even when reserves ultimately remain intact (Coingecko, 2023)

Issuer governance and transparency

Stablecoins are only as credible as the entities issuing and managing them. Disclosure frequency, audit standards, and redemption policies shape market confidence, particularly during periods of volatility.

Regulatory fragmentationWhile regulatory clarity is improving, stablecoins still operate across jurisdictions with uneven rules. Inconsistent treatment across markets can complicate cross-border usage and institutional adoption.

Why Past Failures Still Matter

Historical failures continue to shape how regulators, institutions, and users approach stablecoins today.

They inform:

- Tighter reserve requirements

- Stronger disclosure standards

- Clearer distinctions between payment stablecoins and experimental designs

Rather than slowing adoption, these lessons are influencing how stablecoins are integrated more cautiously into financial infrastructure.

The result is a market that is gradually converging toward fewer models, stricter rules, and higher expectations around trust and resilience.

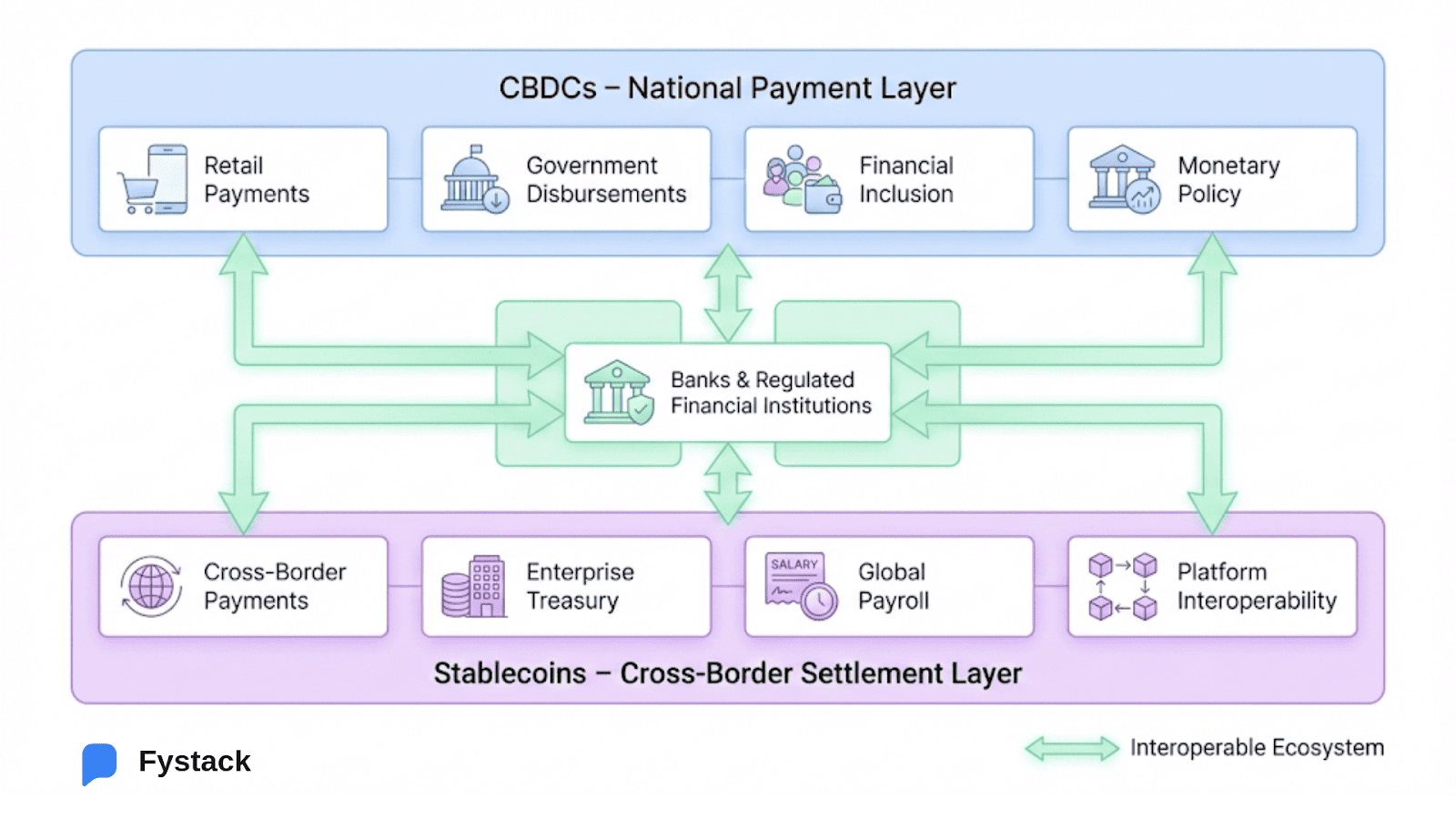

Stablecoins vs CBDCs: Key Differences in Digital Money

As stablecoins move closer to regulated payment infrastructure, comparisons with Central Bank Digital Currencies (CBDCs) are becoming inevitable.

Both aim to modernize how money moves. But they are built on fundamentally different assumptions about who issues money, how it circulates, and what problems it is meant to solve.

Different Goals Behind Stablecoins and CBDCs

Stablecoins emerged from market demand.

They were designed to solve practical problems: settlement speed, cross-border friction, and access to dollar-denominated liquidity in a global, digital economy.

CBDCs, by contrast, are policy-driven.

They are issued by central banks as a direct liability of the state, with objectives that extend beyond payments into monetary policy transmission, financial stability, and regulatory oversight.

Why CBDCs Are Not Yet a Global Payment Solution

Despite ongoing pilots, CBDCs are not yet a viable global payment solution due to key constraints.

First, most projects are domestically oriented: retail CBDCs (for everyday public use) target local systems, while wholesale versions (for interbank transactions) depend on slow-to-negotiate bilateral agreements (deals between just two countries or banks).

Second, cross-border CBDC settlement requires deep coordination between central banks such as FX, legal framework, compliance rules,... These frictions are bypassed by stablecoins.

Third, private-sector stablecoins innovate fast, while CBDCs as public infrastructure prioritize stability over speed.

As a result, CBDCs have not yet displaced stablecoins in areas like cross-border B2B payments, treasury operations, or global digital commerce.

What Comes Next for Stablecoins

As stablecoins move deeper into payment flows, the debate is about what kind of financial system they ultimately reinforce.

Among industry participants, views diverge sharply.

Some see regulation as the end of an era.Trader CryptoSkull (150K+ followers) argues that as stablecoins become regulated payment instruments, the high-ROI, loosely governed phase of crypto will fade. In this view, tighter rules reduce risk—but also compress returns and eliminate much of what made crypto attractive to early participants.

Others believe regulation reshapes rather than suppresses adoption.

Co-founder at MultiversX Labs, Lucian Mincu (137K+ followers) puts it:

“There is a clear 4–5 year opportunity window during which stablecoins could dominate the market and capture significant adoption before EU CBDCs reach production.”

A more expansive view frames stablecoins as a structural challenge to traditional banking itself.Crypto Investor Ryan Sean Adams (237K+ followers) argues that dollar-denominated stablecoins could accelerate capital flight from weaker currencies, forcing governments to respond with controls—ironically reinforcing demand for crypto-native financial rails.

What unites these perspectives is an implicit agreement on one point:stablecoins are no longer marginal.

Whether they lead to consolidation, fragmentation, or disruption will depend less on technology and more on policy choices, institutional behavior, and public trust.

The next phase will be shaped by how stablecoins are governed, localized, and integrated into real financial systems.

Frequently Asked Questions (FAQs)

Are stablecoins mainly used for payments or crypto trading?

Stablecoins are still widely used in crypto trading and liquidity, but payment-related use cases, especially cross-border B2B, remittances, and treasury settlement, are growing the fastest. Adoption is expanding beyond exchanges into real economic flows.

Are stablecoins safe?

Not all stablecoins are the same. Failures like TerraUSD stemmed from algorithmic designs without real reserves. Fiat-backed stablecoins face different risks, primarily around reserve quality, governance, and redemption credibility.

Why are institutions starting to use stablecoins now?

Clearer regulation, better custody and compliance standards, and proven reliability have reduced barriers. Stablecoins now fit more cleanly into payment, treasury, and accounting workflows used by banks and enterprises. This makes stablecoins easier to integrate into enterprise treasury, accounting, and risk management workflows.

Will stablecoins replace banks or card networks?

Unlikely in the near term. Stablecoins currently complement existing systems by improving settlement speed and cost efficiency, while banks and card networks continue to handle onboarding, compliance, consumer protection, and dispute resolution.

What is the biggest risk to stablecoin adoption going forward?

Trust. Adoption depends on transparent reserves, strong issuer governance, and consistent regulation across jurisdictions. As stablecoins become infrastructure, execution matters more than innovation.