Solana Recovery After the FTX Collapse (2026 Guide for Web3 Builders)

Phoebe Duong

Author

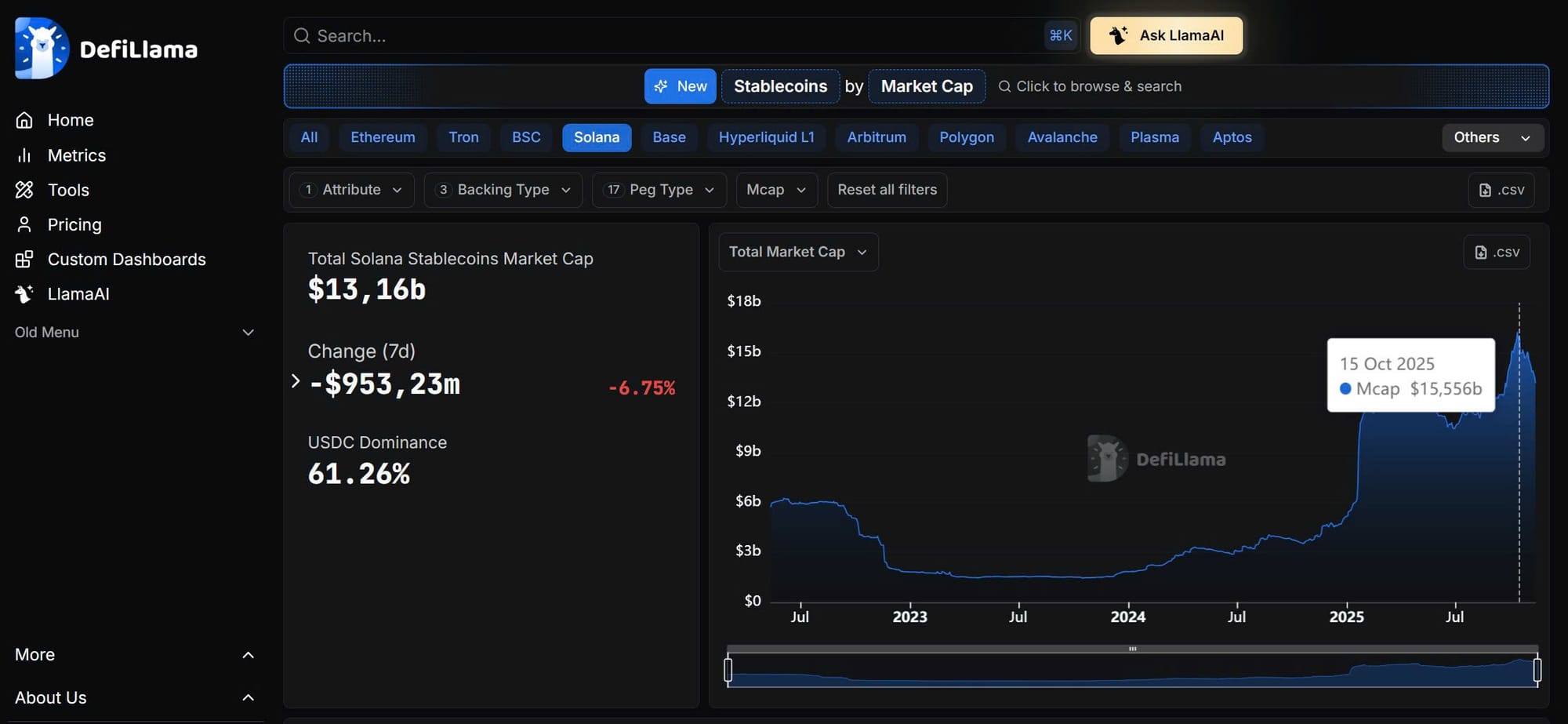

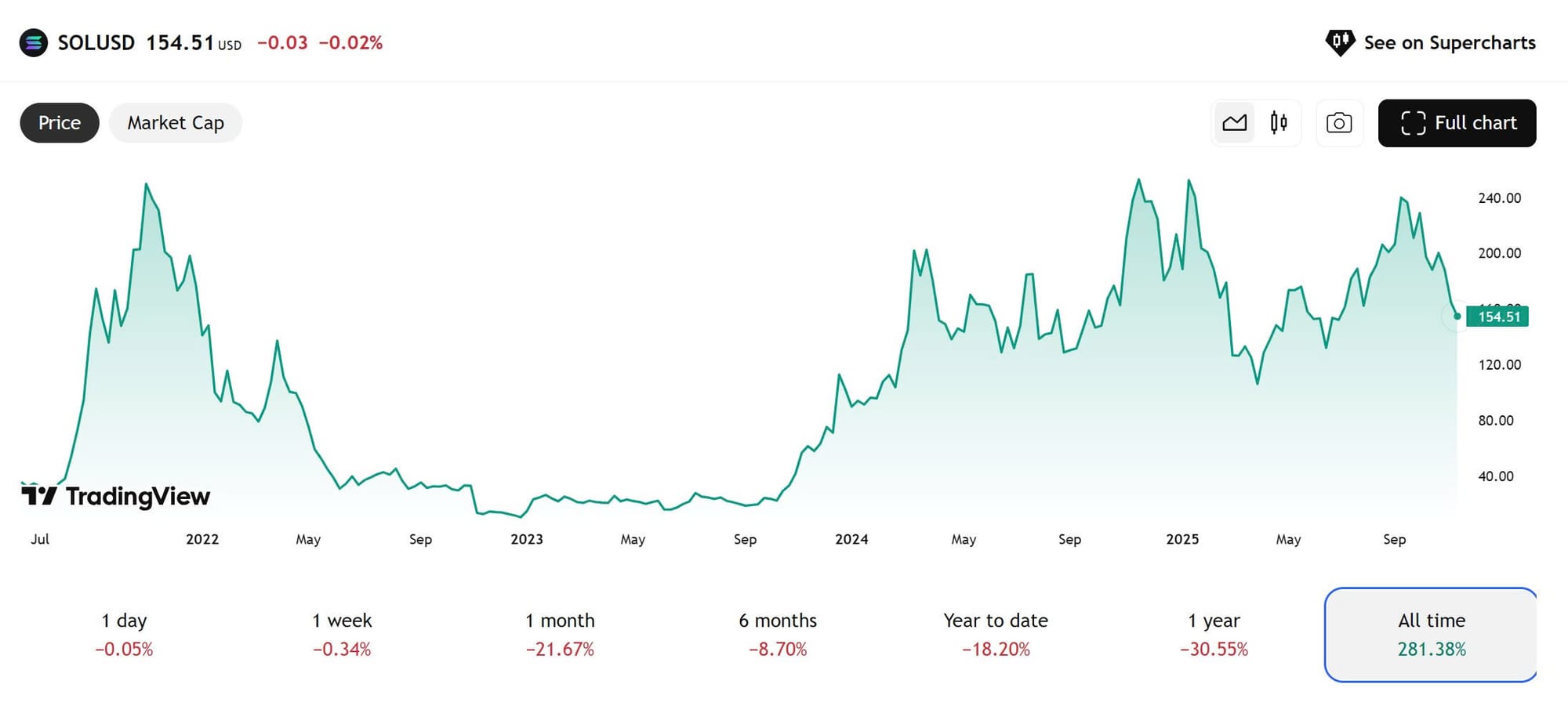

Three years ago, the consensus was that Solana was finished. Following the FTX collapse in 2022, the network faced a crisis of confidence that saw SOL plummet to $8 and developers flee in droves. Fast forward to 2026, and the data tells a radically different story. Solana has successfully transitioned from a speculative "VC chain" into a fundamental layer of the Web3 economy. With a stablecoin market cap exceeding $15.5 billion entering this year, the network has proven its utility beyond the hype cycle, establishing itself as a dominant force in high-frequency DeFi and global payments.

How did a network on the brink of death engineer such a turnaround? This case study explores the three pillars of Solana’s revival: Decoupling from risk, Technological stability, and Narrative reinvention. We will cover:

- The strategic shifts that allowed Solana to regain developer and investor trust.

- The technical leaps that solved the outage issues of the past.

- The 2026-2030 Vision: Where the network goes from here.

For Web3 builders, Solana’s journey offers five essential lessons on survival. In this industry, resilience is the only metric that truly matters.

Solana’s Freefall

At the end of 2022, the crypto market faced one of its biggest shocks when FTX, one of the world’s largest cryptocurrency exchanges, collapsed. FTX was not just an exchange but also operated Alameda Research, a major crypto investment firm that held more than 50 million SOL tokens. Because of this connection, when FTX and Alameda went bankrupt, the price of SOL fell sharply.

Within just a few weeks, SOL dropped to below $8. The DeFi projects on Solana were heavily affected, many were forced to shut down, liquidity disappeared, developers left, and the community began to doubt the blockchain’s future. Many started calling Solana a “VC chain”, implying that the network only survived on venture capital money, and once those funds were gone, Solana would collapse too.

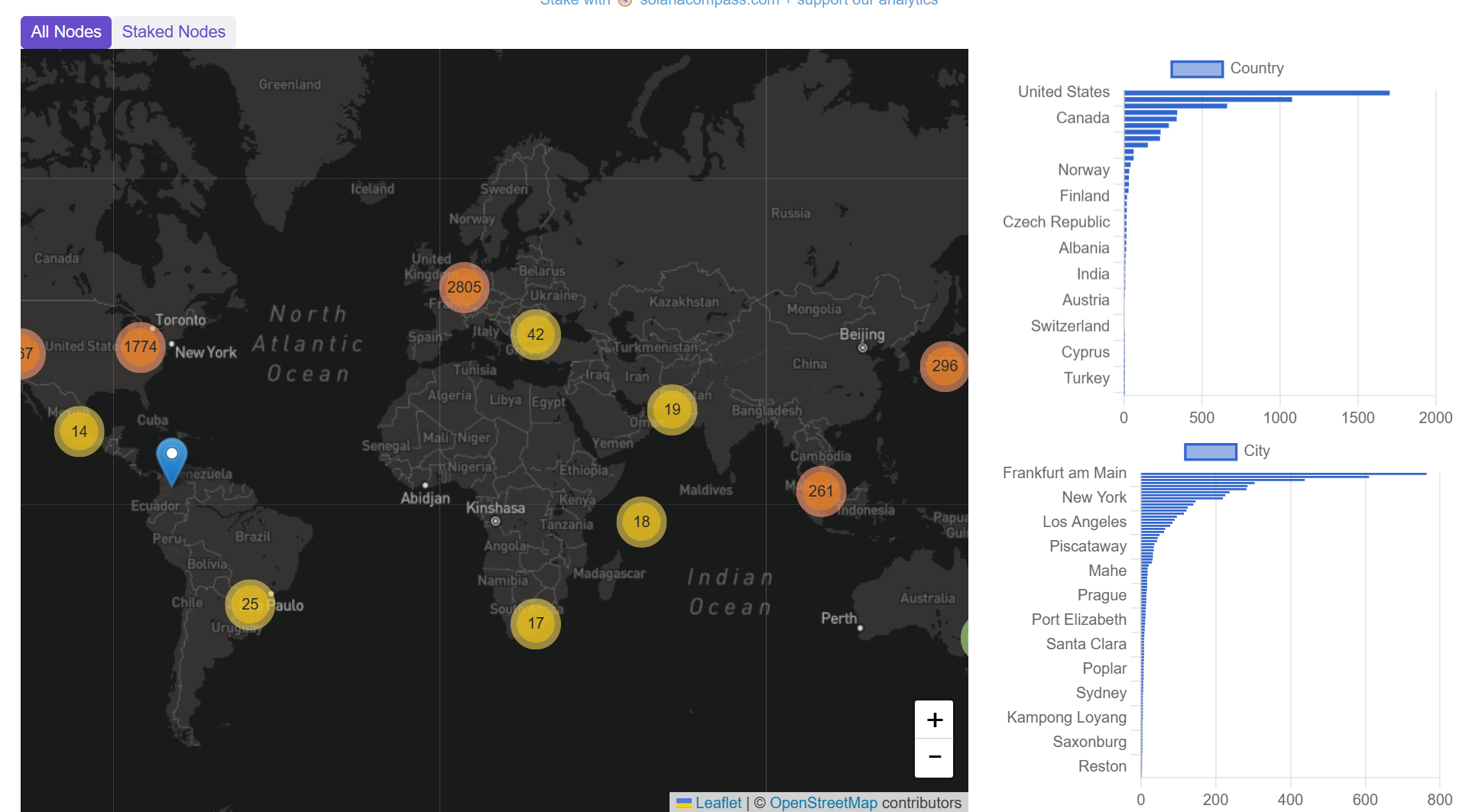

However, the Solana team refused to disappear. They took proactive steps to stabilize the network. First, they released SOL tokens locked in FTX and moved them to trusted custodians such as Kraken and BitGo to prevent forced liquidation. At the same time, they expanded the validator network to more than 5,000 nodes across 40 countries, making the system more decentralized and transparent.

Instead of just talking about recovery, the team focused on action. They improved the infrastructure, supported developers, and slowly rebuilt the community’s trust.

From what looked like a complete collapse, Solana began to reshape itself as an independent blockchain, no longer dependent on FTX or any single institution. This was the first step in its comeback journey and also a valuable lesson for every Web3 project:

Sometimes, to survive, you must be brave enough to walk away from the one who once supported you.

How Did Solana Make Its Comeback?

After the FTX collapse, Solana not only survived the crisis but also staged a strong comeback, driven by three strategic directions:

- Decoupling from FTX

- Upgrading its core technology

- Reinventing its narrative

Each of these pillars played a crucial role in rebuilding trust among investors, developers, and users, while laying the foundation for a sustainable ecosystem.

1. Decoupling from FTX – Cutting ties and rebuilding trust

To understand why Solana needed to distance itself from FTX, it’s important to note that FTX and Alameda Research once held around 11% of the total SOL supply. Much of this amount was staked and locked, meaning it could not be traded immediately. When FTX collapsed, there was a real risk that this massive holding would be dumped on the market, sending SOL prices into another freefall and completely destroying investor confidence.

The Solana Foundation took decisive action. They unstaked 100% of the locked SOL and redistributed it through trusted custodians such as Kraken and BitGo. Payouts to creditors began in May 2025 and were processed within just 1-3 days, minimizing prolonged sell pressure on the market.

These are road bumps that are likely to come for any ecosystem at this stage, especially during this phase of the market cycle. But I think these challenges are ultimately strengthening, and they far outweigh any risks that come from concentrated ownership by a single actor,” said Raj Gokal, COO of Solana, in an interview with Fortune.

At the same time, the validator network - the group of nodes responsible for transaction validation - expanded to over 3,000 nodes across more than 40 countries. This increased decentralization, ensuring that no single entity or group could hold excessive control. The result was greater transparency and trust among developers, investors, and the broader community.

2. Technical Rebirth - Upgrading the Network for Stability

Before the FTX collapse, Solana had a reputation for being unstable, suffering from multiple downtimes and network congestion whenever transaction volume spiked. These issues made both investors and developers question whether the blockchain could handle long-term adoption.

By 2025, Solana began its technical rebirth, focusing on three key innovations that dramatically improved performance, reliability, and scalability.

Firedancer: Independent Validator Client

Firedancer, developed by Jump Crypto, is a completely independent validator client designed to make Solana nodes process transactions faster and more efficiently. The current hybrid version, “Frankendancer,” now accounts for 9–12% of the total stake (depending on the period) and already processes blocks 20% faster than the original client.

The goal of the full Firedancer release is to reach 1 million TPS (transactions per second) under optimal conditions. This upgrade allows DeFi apps, blockchain games, and consumer services to run smoothly, with lower latency and no network congestion. For non-technical users, this simply means: Solana is now faster, stronger, and capable of handling massive transaction loads without freezing.

Alpenglow SIMD: A New Generation of Consensus

Alpenglow SIMD (SIMD-0326) introduces a new consensus mechanism, which determines how the network agrees on valid transactions. Previously, Solana used Proof-of-History (PoH) combined with TowerBFT, which required around 12.8 seconds to finalize a block.

With Alpenglow’s Votor system, validators now vote directly, allowing block confirmation in just 150 milliseconds—nearly instant finality.

Additionally, only 60–80% of validators are required to reach consensus, reducing the number of nodes that must pause the network from 12 to just 8. This makes Solana more resilient even if some validators go offline, ensuring users can continue to transact seamlessly.

State Compression & TPS Leap - Handling Massive Scale

Solana also improved state compression, a data-optimization technique that compresses NFTs, tokens, and on-chain data, allowing the blockchain to store and process information far more efficiently.

Combined with runtime optimizations, real-world TPS (transactions per second) increased from around 3,000 to over 10,000, and during high-load stress tests, Solana achieved a peak of 100,000 TPS.

The blockspace capacity doubled to 100 million compute units per block, enabling near-zero transaction fees. For everyday users, this means cheaper, faster transactions and no more network congestion.

Thanks to these innovations, Solana now achieves 99.99% uptime, proving that strategic and continuous technical upgrades can turn a struggling blockchain into one of the most robust networks in Web3.

3.Narrative Rebirth - Redefining the Blockchain’s Identity

Before the FTX collapse, Solana carried the stigma of being a “VC chain” - a blockchain backed by large venture capital funds and focused on institutional investors rather than everyday users. When FTX fell, that label became a major barrier: users left, developers hesitated to build, and community trust nearly disappeared.

Solana realized that to achieve a true and sustainable comeback, it needed to change its story - to rebuild how people perceived and connected with the network. This new narrative was built on three pillars:

Dev-first

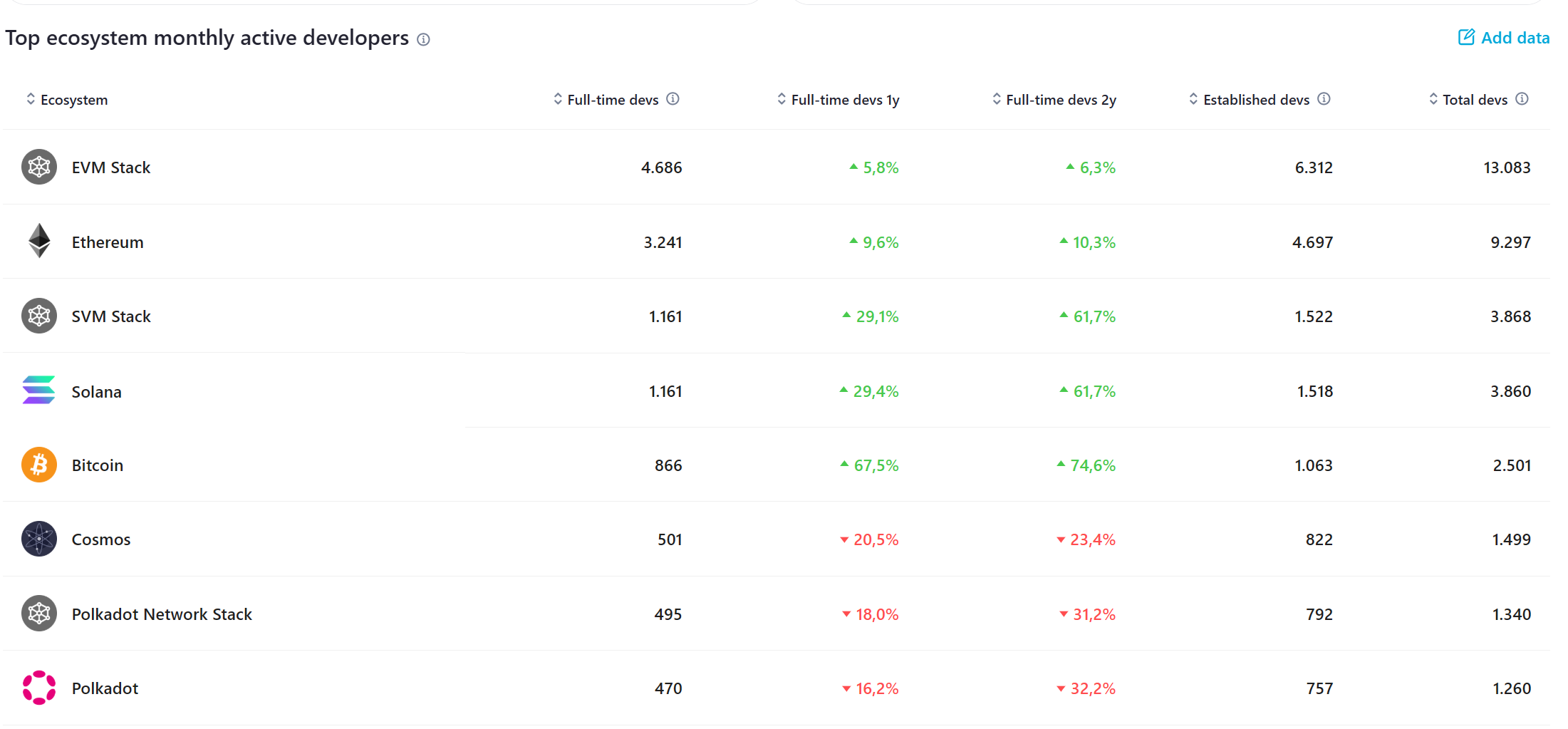

Solana doubled down on its developer ecosystem. By improving developer tools such as Anchor, it became much easier to build dApps without worrying about the complex underlying blockchain mechanics.As a result, the number of active developers on Solana grew 42% year-over-year (YoY) - significantly higher than competing blockchains. This created a vibrant ecosystem full of diverse applications, from DeFi and gaming to consumer-facing Web3 tools.

At a time when most blockchains were cutting grants or pausing initiatives, Solana increased its investment in hackathons, tooling, and education.

The logic was simple: bear markets are when true builders show up.

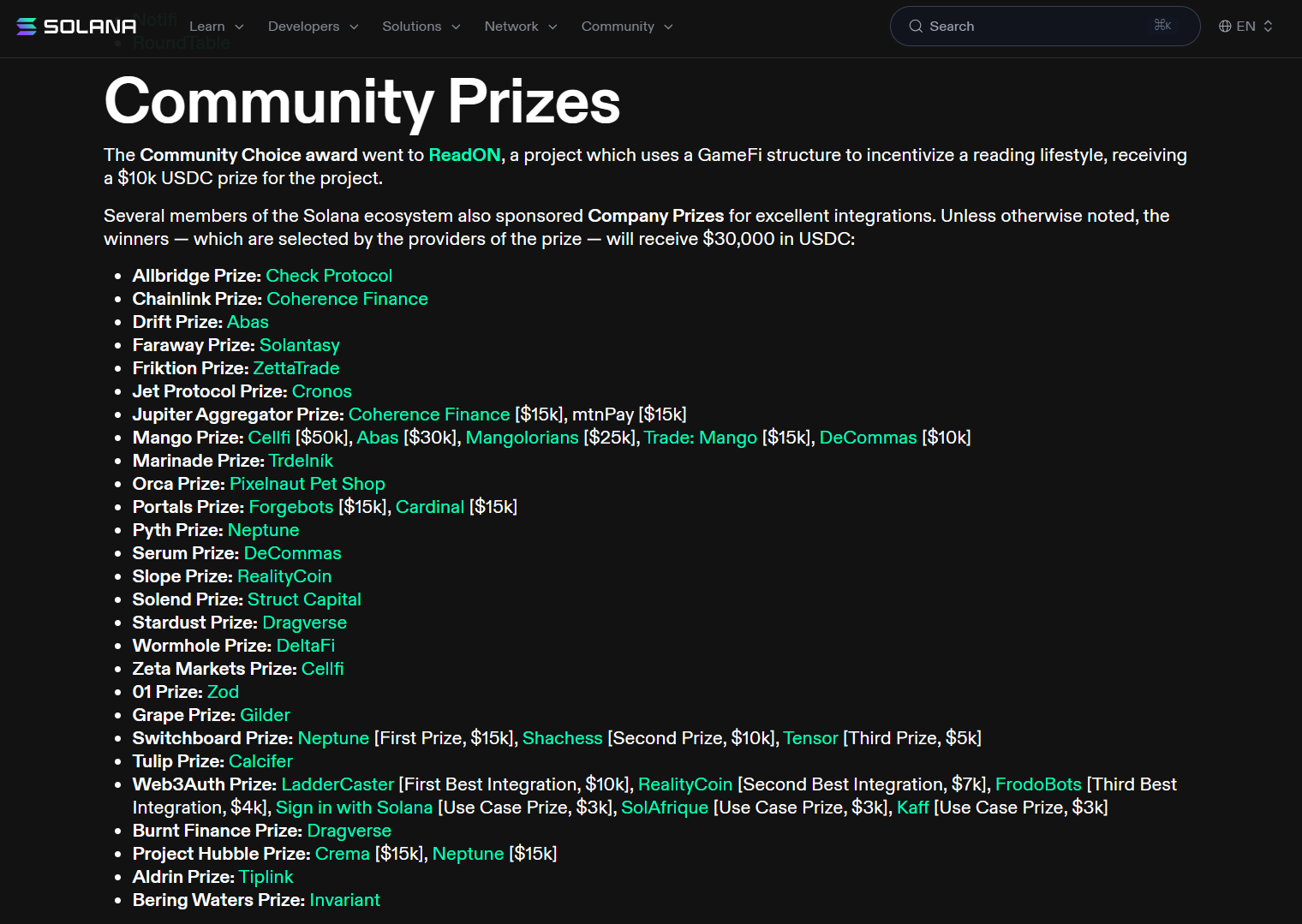

Between 2022 and 2024, the network hosted a string of high-profile hackathons - each one bigger than the last, serving as an engine for innovation and developer onboarding.

🔹 Riptide Hackathon (Feb-Mar 2022)

A global event with up to $5 million in prizes and seed funding. Thousands of developers joined to build DeFi, NFT, and infrastructure projects - many of which later became cornerstones of the ecosystem.

Meet the winners of the Riptide hackathon here

🔹 Summer Camp (2022)

Focused on early-stage crypto products and Web3 startups. In addition to prize money, winners gained accelerator access and mentorship, helping them scale from prototype to product even during the bear.

🔹 Hyperdrive (Late 2023)

A defining moment for Solana’s dev scene - 900+ projects submitted, a 63% increase from Riptide. Despite the market downturn, participation hit record highs, proving that Solana was still a magnet for new talent.

These hackathons weren’t just about weekend coding sprints. Solana built an entire post-event pipeline - offering grants, connections to investors, and technical support for top teams. By late 2023, more than half of hackathon participants stayed active as builders in the ecosystem - a rare feat in Web3.

In 2024, the program was officially handed off to Colosseum, a dedicated Solana-backed accelerator, ensuring long-term continuity for the hackathon movement and deeper ecosystem funding.

Beyond events, Solana made deliberate moves to make building easier, faster, and more rewarding:

- Developer Tooling: Frameworks like Anchor and Solana Mobile Stack simplified dApp development, letting devs focus on products instead of low-level blockchain mechanics.

- Education Programs: The Solana Educate series and regional bootcamps (including three cohorts with Encode Club in 2022) helped thousands of new developers onboard - especially in emerging markets like India and Southeast Asia.

- Grants & Incentives: The Solana Foundation expanded funding for open-source tools, SDKs, and libraries, fueling an 83% YoY growth in active developers by 2024.

- Network Upgrades: Technical improvements - like fee markets, spam mitigation, and transaction prioritization - made building scalable apps smoother, with real-world TPS exceeding 10,000 and peak tests hitting 100,000+.

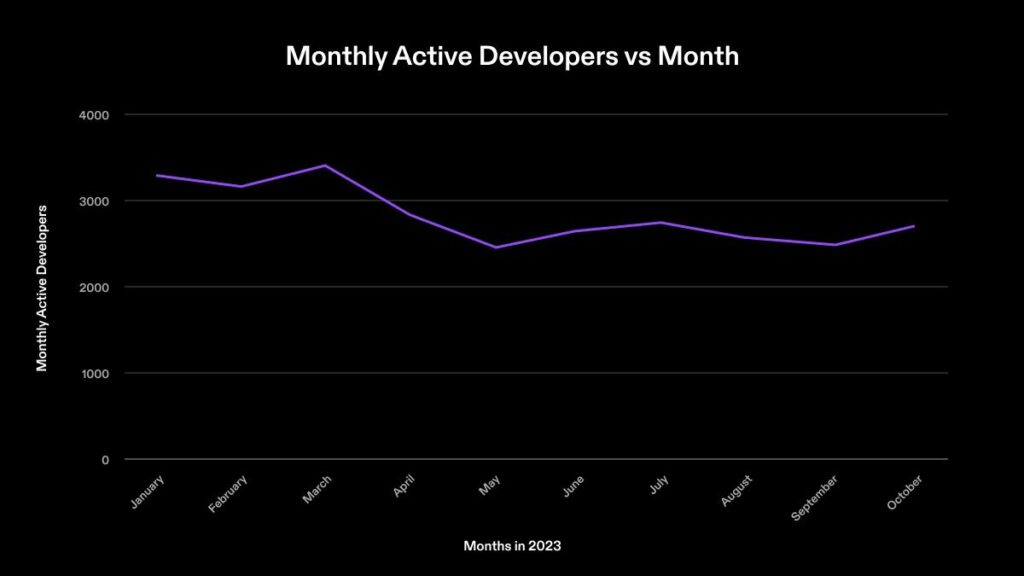

GitHub data revealed that the improved retention rate led to a consistent monthly active developer count ranging from 2,500 to 3,000 within the Solana ecosystem in 2023. The foundation highlighted advancements in tooling for multiple programming languages and additional educational resources as key factors contributing to the positive trend, while acknowledging areas like testing and debugging for potential improvement.

Together, these actions made Solana one of the most developer-friendly ecosystems in crypto with a community that thrived even when prices didn’t.

Meme-first

Projects like Bonk (2023) sparked a viral meme wave that helped Solana reconnect with retail users. Meme culture made the blockchain feel approachable, fun, and community-driven, breaking away from its old image as a network “for VCs only.” These memes became an organic form of community marketing, spreading awareness faster than any paid campaign and drawing millions of new wallet addresses into the ecosystem.

Retail-first

Solana also focused on accessibility. By integrating user-friendly stablecoin support and simple fiat on-ramps, the network made it easier for retail investors to onboard quickly. This growing retail user base not only added liquidity but also helped the ecosystem become self-sustaining, reducing dependence on venture capital funding.

Thanks to these three directions, Solana didn’t just regain trust - it expanded its influence. The ecosystem became attractive not only to retail users and developers but also to major institutions like Visa (for stablecoin payments) and R3 (for real-world asset tokenization).

In short, the right narrative can turn crisis into opportunity.

Once dismissed as a “VC chain,” Solana has reinvented itself as dev-first, meme-first, and retail-friendly - proving that a strong story and passionate community can revive a blockchain and lay the foundation for long-term growth.

2026 - 2030 Vision: Solana’s Path to Global Scale

After a strong recovery, Solana isn’t just aiming to survive - it wants to become the blockchain anyone can use: fast, affordable, and reliable. Looking at its roadmap from 2026 to 2030, a clear strategy emerges: scaling the tech, attracting both retail users and major institutions, and building a truly vibrant ecosystem.

Solana plans to double its blockspace and fully integrate Firedancer and Alpenglow to reach one million TPS. That might sound ambitious, but for everyday users, it simply means instant transactions, ultra-low fees, and no network congestion even during peak activity. The idea is clear: blockchain shouldn’t just serve investors and developers - it should work seamlessly for millions of regular users.

At the same time, Solana is expanding into AI and real-world assets (RWA) - tokenizing real estate, corporate bonds, and securities, while leveraging AI to forecast risks and optimize trading. This move reflects a shift toward solving real institutional and financial needs, turning blockchain from an experimental playground into a practical tool for global business and investment.

Institutional participation is also growing. CME futures are expected to launch in Q1 2026, staking ETFs are projected to yield between 5-9%, and over $600 million in corporate assets are anticipated to migrate on-chain. This balance between retail and institutional adoption helps Solana maintain both agility and stability, reducing concentration risks.

And as always, the community remains the real growth engine. From meme culture and hackathons to developer grants and one-click meme token tools - these efforts keep builders and users coming back. Technology alone doesn’t make a blockchain last; community engagement does.

In short, Solana’s 2026-2030 vision is to become a network that’s powerful yet accessible, technical yet human - one that learns from the FTX shock, not just to recover, but to grow sustainably on a global scale, where technology, community, and institutions thrive together.

If you want to learn how a project on Solana has grown so powerfully, check out "Squads: From Zero to the Multisig Protocol Securing $10B on Solana (Part 1)"

5 Key Takeaways for Builders

Solana’s story is a vivid example of how to turn failure into opportunity. Its recovery not only stabilized the network but also laid the foundation for sustainable growth. Here are five crucial lessons for builders, explained in detail with actionable takeaways.

1. Be Independent from “Big Players” – Avoid Overconcentration of Tokens

Solana once relied heavily on FTX and Alameda Research, which together controlled over 11% of the total SOL supply, most of it locked in staking. When FTX collapsed, the risk of a massive sell-off could have caused SOL’s price to crash further.

- Limit concentration: Avoid letting any single person, fund, or exchange control too much of your token supply - ideally less than 10% of total supply.

- Vesting and cliffs: Apply a 12-24 month vesting schedule with a 3–6 month cliff for teams, advisors, or investors. This ensures tokens are gradually unlocked over time, reducing sudden market pressure.

- Use multiple custodians: Store large token reserves with several reputable custodians to minimize single-point-of-failure risks.

- Establish a community fund early: Allocate a portion of the token supply to grants, hackathons, or bounties. This fund supports ecosystem growth and gives the project independence from major players.

An independent, transparent network with a community fund creates resilience during crises and builds long-term trust among developers and users alike.

2. Continuous Technical Improvement – Tech Debt Kills Slowly

Solana was once criticized for downtime and low TPS. In 2025, the network implemented Firedancer, Alpenglow, and state compression, boosting TPS from around 3,000 to over 10,000, reaching a peak of 100,000 TPS during stress tests. Blockspace was doubled, transaction fees dropped to nearly zero, and uptime reached 99.99%.

- 12–24 month tech roadmap: Identify necessary upgrades in advance to prevent backlog and tech debt from accumulating.

- Modular client design: Separate system components to reduce single points of failure and improve resilience.

- Testnet and stress testing: Always test before mainnet deployment to ensure the network can handle high load.

- Continuous updates: While MVPs are important, ongoing upgrades are what make the network sustainable in the long run.

Technology isn’t just code - it’s the foundation that allows a project to survive and thrive, especially under market pressure.

3. Right Narrative – A Good Story Matters More Than Perfect Code

Before FTX, Solana was labeled a “VC chain”, a blockchain relying heavily on venture capital funding. After the shock, Solana pivoted to dev-first, meme-first, and retail-first, fostering meme culture, hackathons, and grants to attract developers and individual users. Memes made the blockchain approachable, fun, and easy to engage with, sustaining excitement over the long term.

- Build the community before the product is perfect: Run hackathons, grants, and meme contests to engage developers and users early.

- Use narrative and memes strategically: Memes can increase viral adoption, keep developers engaged, and draw in retail users simultaneously.

- Align narrative with actual product use: A story isn’t just entertaining - it should support onboarding, retention, and real utility.

A well-crafted narrative helps a project grow its user base, retain developers, and attract institutions, often more effectively than relying solely on perfect code.

4. Retail Users Are the Engine of Growth

Today, Solana has over 2.2 million daily active wallets, with 60% of transactions on-ramped via USDC. Meme culture, DeFi applications, and user-friendly tools help individual users participate and sustain the network.

Detailed lessons and practical applications:

- Simple, intuitive UX: Reduce barriers for new users; actions should take under 3 seconds.

- Accessible on-ramps: Integrate stablecoins, PayPal, or Venmo to make funding wallets easy for newcomers.

- Fast deployment tools: Offer 1-click token deployment, meme creation, or mini-dApps for direct, hands-on experiences.

Retail users are more than statistics - they are the primary force that sustains and grows the ecosystem, reducing dependence on whales or large funds.

5. Antifragile – The Ecosystem Gets Stronger Through Challenges

Solana experienced major downtime in 2022, but the team turned it into an opportunity. They organized Chaos Days, offered high-value bug bounties, published public post-mortems, and continuously upgraded the network. The result: a stronger, more resilient blockchain with 99.99% uptime, ready to handle millions of TPS.

Detailed lessons and practical applications for builders:

- Introduce frequent stress tests: Shut down nodes, flood transactions, and simulate attacks to test the system.

- Learn from failures: Every incident should have a public post-mortem and improvements implemented within 30 days.

- Offer generous bug bounties: Encourage the community to identify vulnerabilities and strengthen the network.

An antifragile ecosystem doesn’t just survive stress — it becomes stronger after every shock.

FAQ

1. Why did Solana crash in late 2022?

Solana’s price collapsed due to the FTX and Alameda Research crisis. Together, these entities held over 11% of total SOL, much of it locked in staking. When FTX went bankrupt, market fears triggered a massive sell-off, affecting DeFi projects, liquidity, and developer confidence.

2. How did Solana recover from the FTX shock?

Solana’s recovery focused on three pillars:

- Decoupling from FTX: Unlocking SOL, redistributing through trusted custodians like Kraken and BitGo, and expanding validators to over 3,200 nodes in 45 countries.

- Technical upgrades: Implementing Firedancer, Alpenglow, and state compression, boosting TPS from 3,000 to over 10,000, and achieving 99.99% uptime.

- Narrative shift: Moving to dev-first, meme-first, and retail-first strategies to rebuild trust and community engagement.

3. What is Firedancer and why is it important?

Firedancer is a validator client developed by Jump Crypto, designed to process transactions faster and more efficiently. It improves TPS, reduces network congestion, and lays the foundation for handling millions of transactions per second (TPS), essential for large-scale dApps and DeFi projects.

4. How does Solana attract developers and users today?

- Dev-first tools: Frameworks like Anchor make it easier to build dApps.

- Meme culture & hackathons: Community-driven initiatives increase engagement and onboarding.

- Retail-first onboarding: Simple UX, one-click token deploy, and stablecoin on-ramps make it accessible for everyday users.

5. How does Solana plan to scale from 2026 to 2030?

Solana aims to become a global, user-friendly, high-performance blockchain:

- Doubling blockspace and fully integrating Firedancer & Alpenglow to reach 1 million TPS.

- Expanding into AI and real-world assets (RWA), tokenizing real estate, corporate bonds, and securities.

- Encouraging institutional participation, including CME futures and staking ETFs, while balancing retail adoption.

- Maintaining community engagement via hackathons, grants, and meme culture to ensure sustainable growth.

6. Is Solana safe for long-term DeFi and dApp projects?

Yes. Solana’s post-FTX recovery, technical upgrades, decentralized validator network, and strong community focus have made it more resilient and scalable. Builders can rely on a network designed for high TPS, low fees, and stable uptime, with a vibrant ecosystem of developers and retail users.

Conclusion

The takeaway for builders is clear: there are no shortcuts to sustainable growth. You must build financial independence, make technology the foundation, and craft a story your community wants to hear. Every failure is a learning opportunity, and every improvement is a step toward making your project antifragile.

For Solana, market shocks are no longer threats - they are fuel for new strength. For your project, the question is: how will you turn challenges into opportunities? How will you ensure it not only survives but thrives in the future?

Our community

If you’re building your own Web3 SDK, wallet infrastructure, or just trying to make onboarding less painful, join Fystack's Telegram group. It’s where developers and founders swap lessons, share benchmarks, and discuss real strategies to grow Web3 products that actually scale.