MPC Wallet News 2025: Latest Updates on Leading MPC Service Providers

Phoebe Duong

Author

The crypto wallet market is entering its strongest growth phase yet. According to The Business Research Company, the global market size grew from 14.39 billion USD in 2024 to 19.03 billion USD in 2025, marking a 32.2% increase in just one year.

These numbers did not happen by chance.

Mobile DeFi is exploding, especially in APAC, which now accounts for 68% of new wallet users. At the same time, NFT and GameFi projects are setting higher standards for wallet performance: smoother user experience, gasless transactions, cross-chain support, and near-instant execution. Meanwhile, banks and traditional funds are gradually shifting to self-custody instead of relying on centralized services like Coinbase Custody.

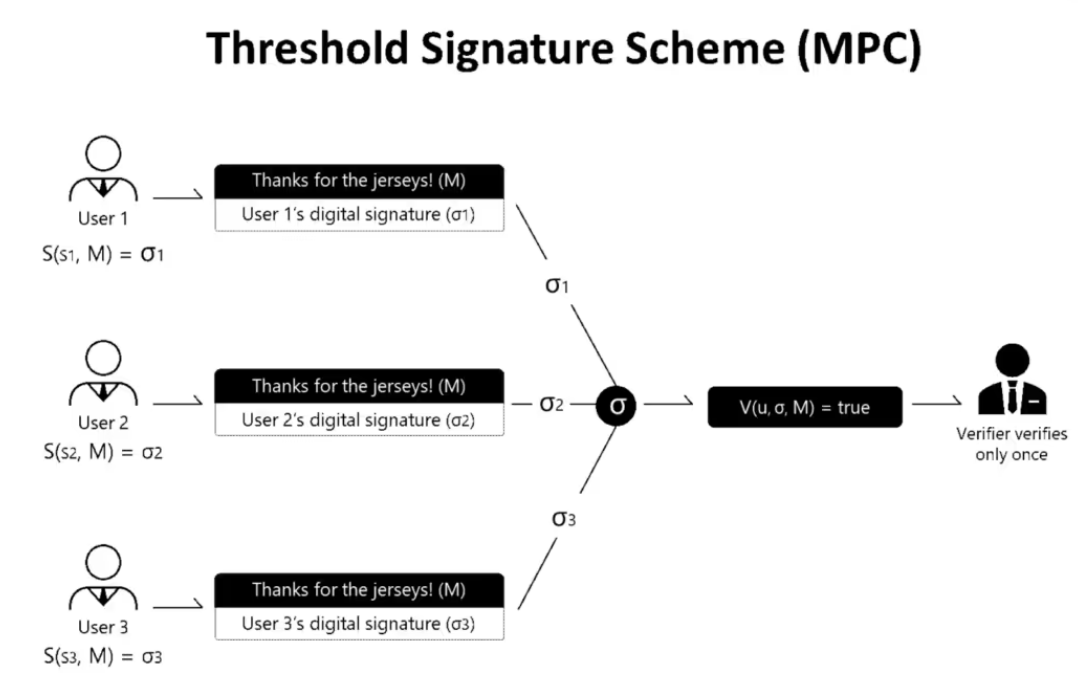

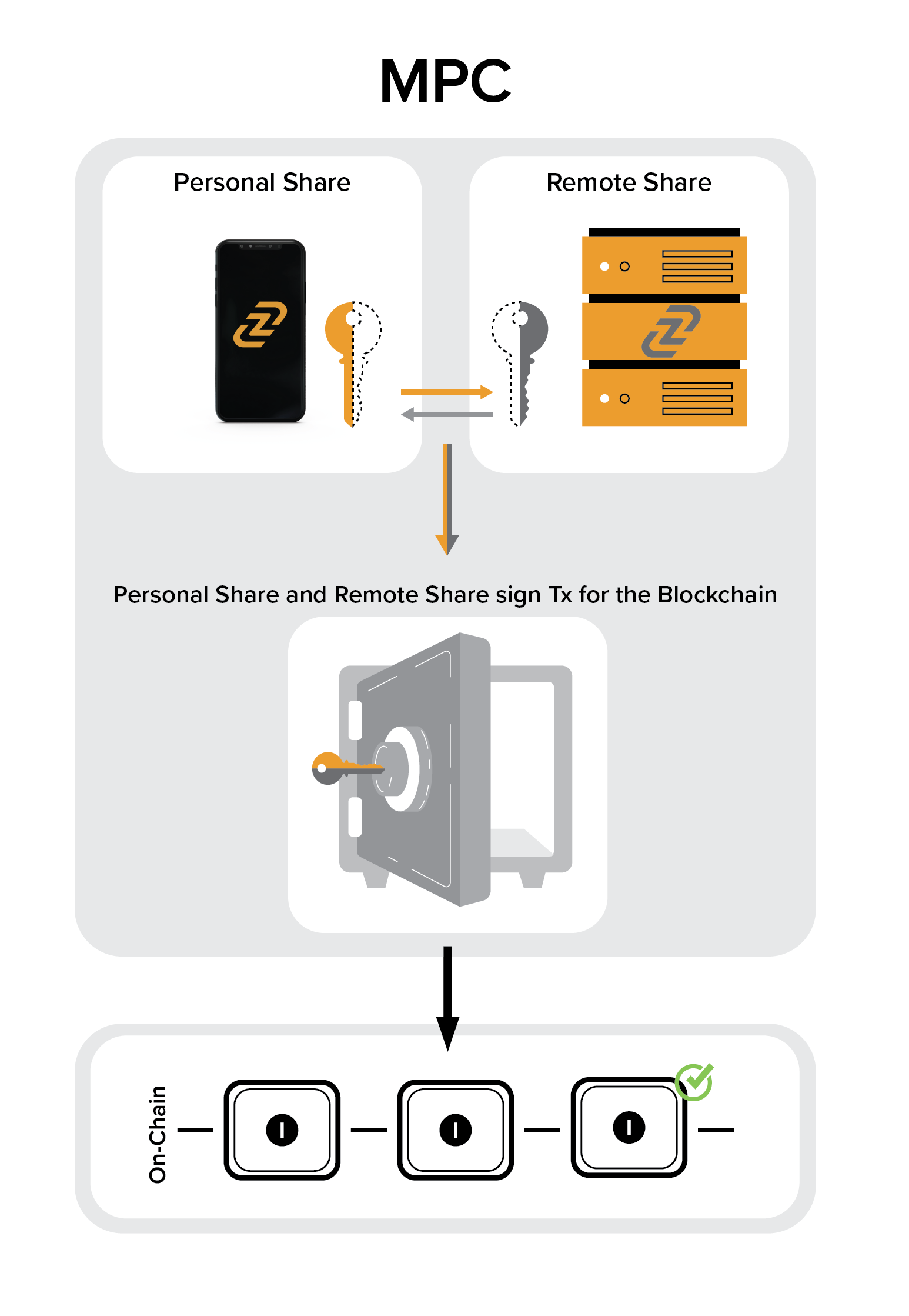

In the middle of this transformation, MPC (Multi-Party Computation) is rising as the bridge between Web2-level usability and Web3-grade security. More than just an encryption method, MPC is redefining how digital wallets work by securing infrastructure and improving user experience at the same time.

If you are still deciding between Embedded Wallets, Hardware Wallets, or MPC/Multisig, check out our guide “Which Wallet Is Right for Your Web3 Startup?”. It helps you understand which wallet type fits your product strategy and compliance needs.

This article explores the questions that will shape the next generation of wallet infrastructure:

- How will the MPC and crypto wallet market evolve from 2025 to 2031?

- Are seedless UX, AI integration, and cross-chain support real trends or just short-term hype?

- What will the adoption curve for MPC and self-custody look like from 2025 to 2026?

- Which MPC providers and wallet platforms should founders watch in 2025?

The Market Is Exploding & MPC is the Eye of the Storm

Let’s start with the numbers that even Wall Street can’t ignore.

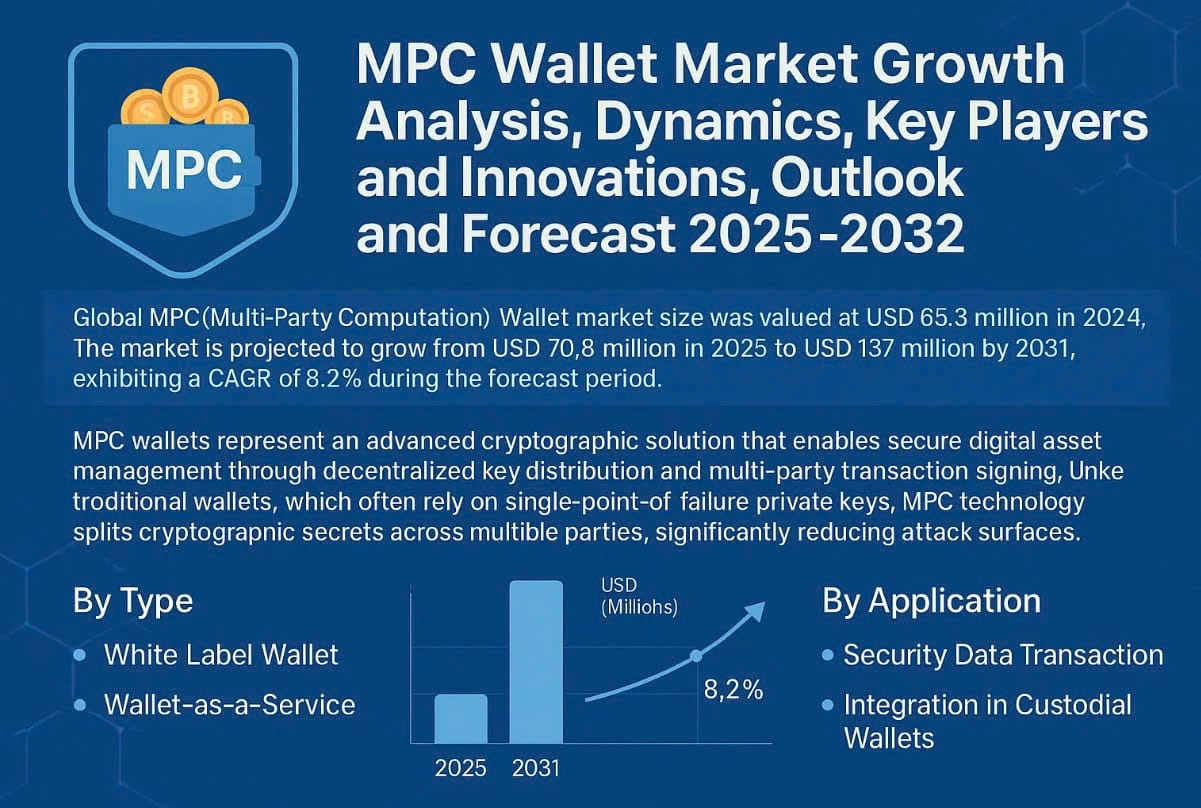

According to Intel Market Research (July 2025), the global MPC wallet market grew from $65.3 million in 2024 to $70.8 million in 2025, and is projected to reach $137 million by 2031, with a CAGR of 8.2%.

Note: This figure represents the market value of the MPC wallet sector, including revenues from hardware, software, and services, not the total value of digital assets held in custody.

At first glance, 8.2% might sound like a steady climb.

In reality, it signals a structural shift.

During the same period, the hardware wallet market - although larger in size - is showing early signs of saturation, growing only 3 to 4 percent year over year (from $474.7 million in 2024, with an overall CAGR of 18.93% through 2033).

Meanwhile, multisig SaaS solutions are actually losing momentum, dropping from 14 percent to 12 percent growth, due to high operational costs and the persistent risk of single points of failure, according to Sapphire Ventures.

MPC isn’t just growing faster. It is replacing what came before. As institutions and developers converge on a self-custody-first architecture, MPC is emerging as the bridge that connects Web2-grade UX with Web3-grade security.

For a deeper look at how companies are building self-hosted MPC infrastructure and preparing for 2025–2026, check out the article “The New Standard in 2025: Self-Hosted MPC Wallet Infrastructure.”

APAC: The Promised Land for MPC

DeFi ecosystems are thriving in Vietnam, Thailand, and the Philippines. Governments are increasingly supportive - for example, Singapore has already licensed crypto custodians. At the same time, mobile-first users demand wallets that are secure, instant, and user-friendly - experiences that advanced hardware wallets are uniquely positioned to deliver.

This is where MPC (Multi-Party Computation) comes into play. Integrated into hardware wallets, MPC enhances security, reduces centralized custody risks, and still provides a seamless, instant experience for users.

A real-world case brings this into focus. Rakkar Digital (Thailand) recently rolled out MPC-CMP technology for Bitkub, the largest exchange in Southeast Asia. The system now processes around $41.5 million in daily trading volume with zero downtime, as detailed in Bitkub’s official announcement.

Of course, not every country is moving at the same pace. Compliance remains highly localized, with each jurisdiction defining its own rules for crypto custody, data sovereignty, and institutional-grade wallet operations.

If you’re building a Web3 or fintech product, understanding these compliance nuances can make or break your expansion strategy. Learn more in this overview: 2025 Crypto Regulatory Compliance for Web3 and Fintech Startups.

MPC Technology Update 2025: The Latest Innovations from Leading Custody Providers

Below is a deep technical dive into the latest 2025 updates from top MPC providers, and why these developments matter for anyone building the next generation of wallets, payment systems, or DeFi rails.

This section focuses on the newest technology updates. If you just want a simple comparison of costs and features among the top providers, check out the following article: 2025 Top Non-Custodial Solutions for Stablecoin Businesses

Fireblocks

Fireblocks continues to lead the institutional custody race with its MPC-BAM protocol, which balances computation, communication, and latency through a two-party ECDSA model. The protocol refreshes key shares automatically every few minutes, cutting signing latency by about 20%. Combined with zero-knowledge proof support and direct custody integration, Fireblocks is setting a new benchmark for enterprise-grade security.

They are also driving the NIST MPC standardization initiative, pushing for global TSS interoperability and internet-scale signing.

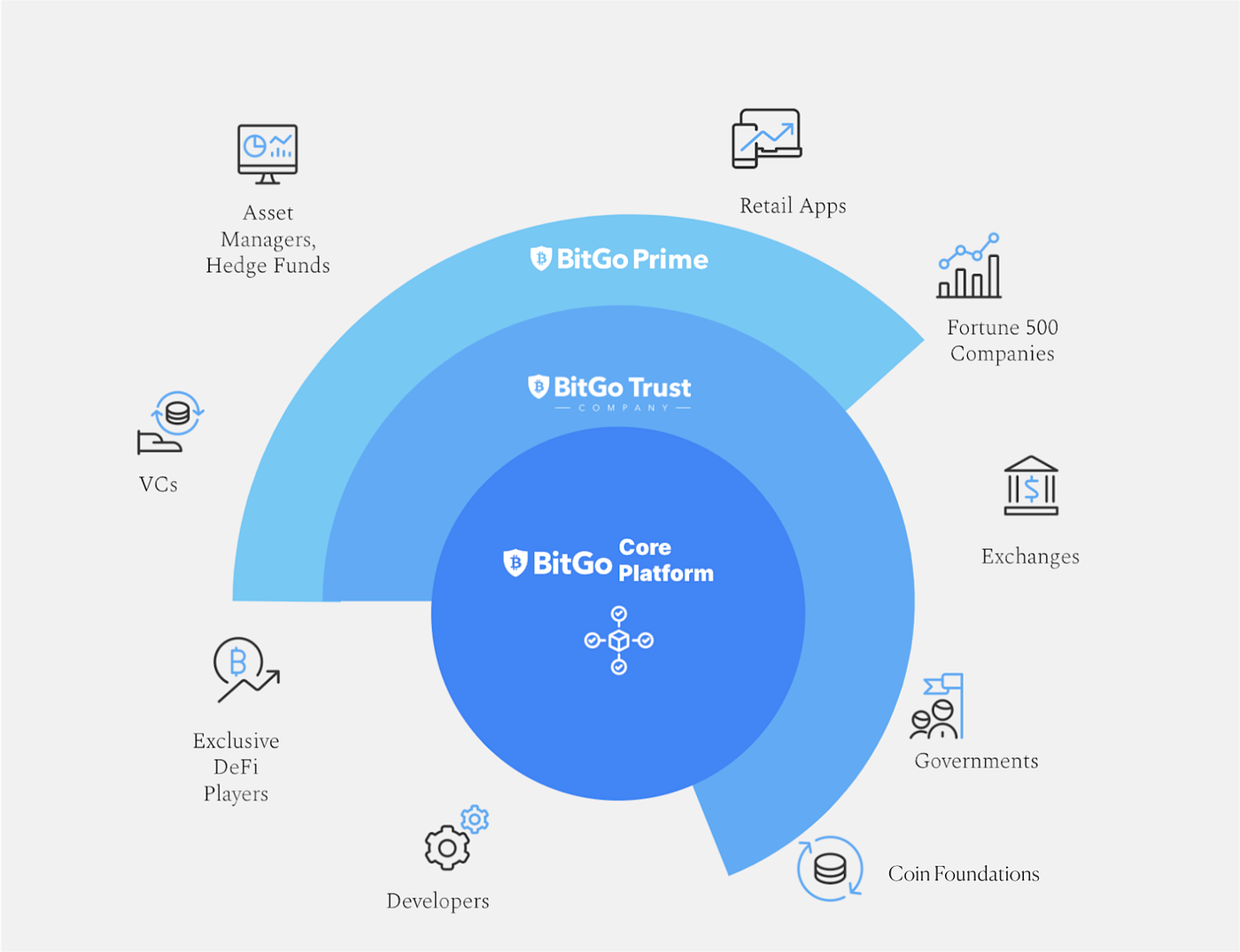

BitGo

BitGo is doubling down on its open-source approach. The company recently boosted rewards in its TSS Bug Bounty Program by 50%, encouraging more security researchers to test and improve its hybrid MPC–multisig technology.

The latest update adds multi-region key separation for stronger security and cuts atomic swap costs by up to 15%, making transactions faster and more efficient.

For developers and institutions, BitGo’s support for 20+ new Solana-based assets marks a major step toward broader, truly multi-chain asset management.

ZenGo

ZenGo is raising the standard for consumer wallet security. Its new Multiple Seedless Wallets feature lets users create several MPC wallets with rotating key shares and a built-in Web3 firewall that blocks phishing attempts before they happen.

The company also rolled out ERC-4337 + MPC Gasless Recovery, a breakthrough that has reportedly solved more than 90% of lost wallet recovery cases.

In short, ZenGo is turning advanced MPC technology into something effortless - building what could become the first truly user-friendly MPC wallet stack.

Safeheron

Safeheron’s new MPC Node Suite 2.0 introduces open-source C++ libraries for flexible 2-of-3 and 3-of-3 MPC-TSS configurations, now enhanced with Intel SGX trusted execution for extra protection.

The result is a faster, more secure, and fully auditable keyless wallet infrastructure that enterprises can trust.

Through new partnerships with StableStock and BYDFi MoonX, Safeheron is showing how MPC can go beyond crypto - powering tokenized real-world assets (RWA) and defending systems against state-level security threats.

Qredo

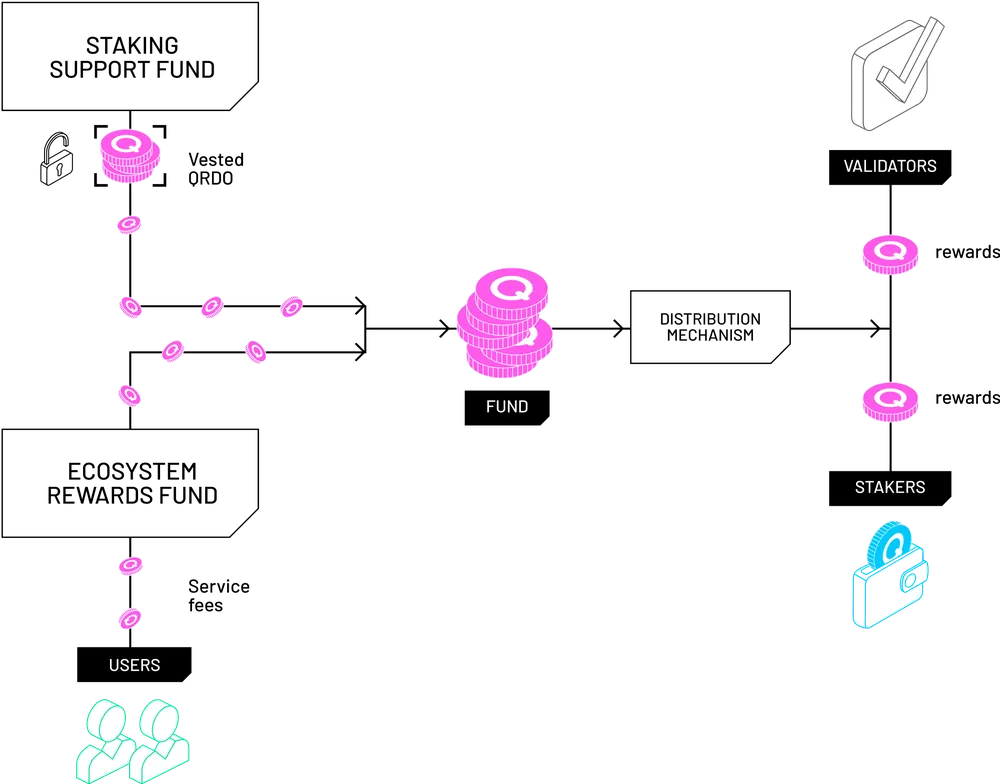

Qredo is taking MPC to the next level by combining it with Layer-2 technology. Its new QRDO Tokenology L2 runs on a Cosmos-based ZK-rollup, enabling decentralized MPC (dMPC) atomic swaps across nearly all major blockchains.

This design allows for keyless smart contract deployment and MEV-resistant treasury operations, helping DeFi teams cut on-chain costs by up to 30%.

With this, Qredo is showing that MPC isn’t just about securing assets anymore, it can also power scalable governance, automation, and interoperability across ecosystems.

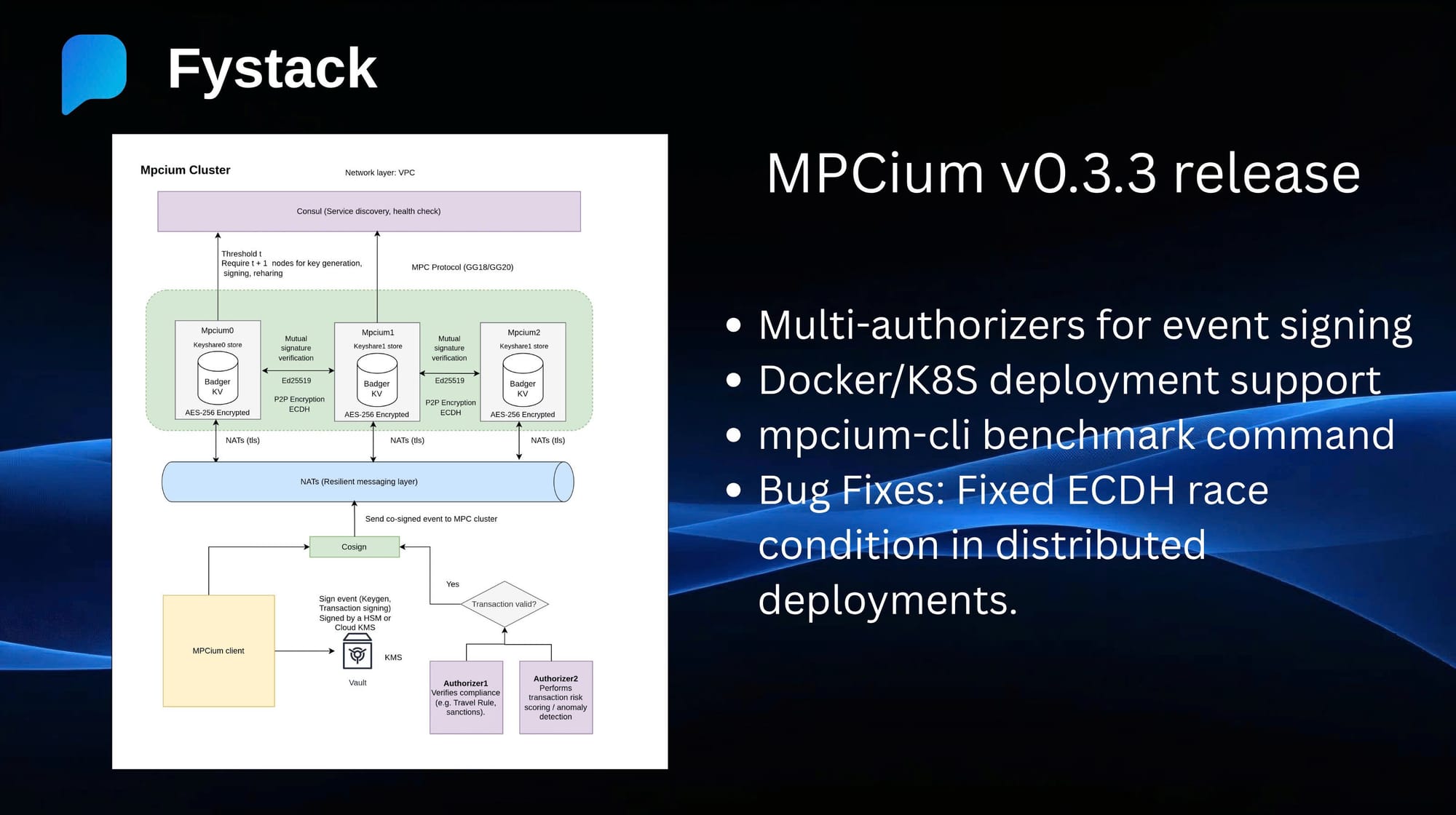

Fystack

Most MPC providers keep their systems closed and hard to access. Fystack takes the opposite approach by opening everything up for developers and businesses.

Its latest release, Mpcium v0.3.3, is an open-source MPC platform built in Go and TypeScript. It can run on your own servers or across multiple clouds, giving full control over security and deployment.

The core idea is simple: no private key ever exists in one place.

Every transaction is signed through multiple parallel nodes that verify policies together, which means stronger protection and faster execution. In real-world deployments across Southeast Asia, companies have cut operational time by up to 60% compared to traditional custody systems.

Mpcium also connects with compliance tools like Webacy’s DD.xyz Risk Checks to detect potential sanctions or address poisoning before any transaction goes through.

What makes Fystack truly different is how it brings enterprise-grade security to everyday builders. With its Policy-as-Code (PaC) engine, teams can define spending limits, approval rules, and asset controls directly in YAML or TypeScript - tools they already use for infrastructure and DevOps.

Fystack turns MPC from a cryptographic black box into a transparent, developer-friendly layer that helps businesses build faster, safer, and with confidence.

Programmable AWS-style Policy Engine for Blockchain Wallets:

— Thi Nguyen (@thicody) October 27, 2025

At Fystack, developer experience and transparency through open source are our top priorities.

We’re bringing the familiar AWS-style policy syntax to blockchain and Web3 wallets, making wallet infrastructure not only… https://t.co/S9W2W1hBgA

Explore the open-source engine: Mpcium on GitHub

MPC Wallet Trends 2025

If you’re choosing an MPC wallet provider in 2025, start by understanding the technology shifts shaping the market. Each solution - whether from Fystack, Safeheron, Fireblocks, or ZenGo - caters to a different need: sovereignty, UX, compliance, or scalability.

Here are the five key trends defining how teams build and adopt MPC wallets today, so you can align your choice with what your organization truly needs.

1. Self-Hosted & Data Sovereignty: Fystack, Safeheron

Organizations are moving toward self-hosted MPC wallets to ensure full data control and meet MiCA-level compliance across APAC and Europe.

2. Open-Source MPC Infrastructure: Fystack (Mpcium), BitGo (TSS), Safeheron (Node Suite)

Open-source MPC engines are becoming the new trust standard, enabling teams to audit, customize, and scale wallet infrastructure securely.

3. Seedless & Keyless UX: ZenGo, Fystack

Wallets are shifting to seedless and keyless experiences, reducing onboarding friction and eliminating the single point of failure for end-users.

4. Cross-Chain Interoperability: Qredo (L2), Fireblocks (MPC-BAM)

MPC protocols now power seamless atomic swaps and unified custody across 95% of major blockchains, bridging DeFi, GameFi, and enterprise ecosystems.

5. Policy Engine & Compliance Automation: Fystack (PaC), Safeheron (TEE)

Wallet policies are evolving into programmable layers, allowing real-time transaction rules, KYT checks, and automated multi-approval governance.

Key Takeaways: MPC Wallets 2025

- The crypto wallet market is expanding faster than ever. Growth is fueled by mobile DeFi adoption, the rise of NFT/GameFi, and a growing shift toward self-custody among institutions.

- MPC is becoming the bridge between Web2 usability and Web3 security. It combines the ease of use and familiarity of Web2 with the privacy, compliance, and scalability expected from Web3.

- Self-hosted MPC wallets like Fystack and Safeheron give businesses full control over their data while staying compliant with regional regulations across APAC and Europe.

- Open-source MPC engines are setting a new trust standard, offering transparency, auditability, and faster integration for developers.

- Seedless and keyless wallet experiences (such as ZenGo and Fystack) are lowering onboarding barriers, removing single points of failure, and making wallets more intuitive for everyday users.

- Cross-chain interoperability is now essential. MPC protocols like Fireblocks and Qredo enable secure atomic swaps across nearly all major blockchains.

- Programmable governance and compliance automation are becoming core features. Tools like Fystack’s Policy-as-Code and Safeheron’s TEE integrations let teams automate approvals and enforce policies in real time.

- Founders and product teams should choose wallet solutions based on business priorities - sovereignty, user experience, compliance, or scalability - rather than following market hype.

Conclusion

The message is clear: the crypto wallet market is no longer a trade-off between convenience and security. By 2025, MPC has become the foundation that delivers both.

As users and institutions look for faster, safer, and more compliant ways to manage digital assets, MPC now sits at the heart of this transformation - bringing privacy, flexibility, and scalability together in one unified system.

From open-source engines like Mpcium to large-scale enterprise solutions, one thing is certain: wallets are no longer just tools for holding crypto; they are becoming programmable systems of trust.

Our community

If you want to stay updated on future MPC wallet infrastructure releases or join engineering discussions: https://t.me/+IsRhPyWuOFxmNmM9