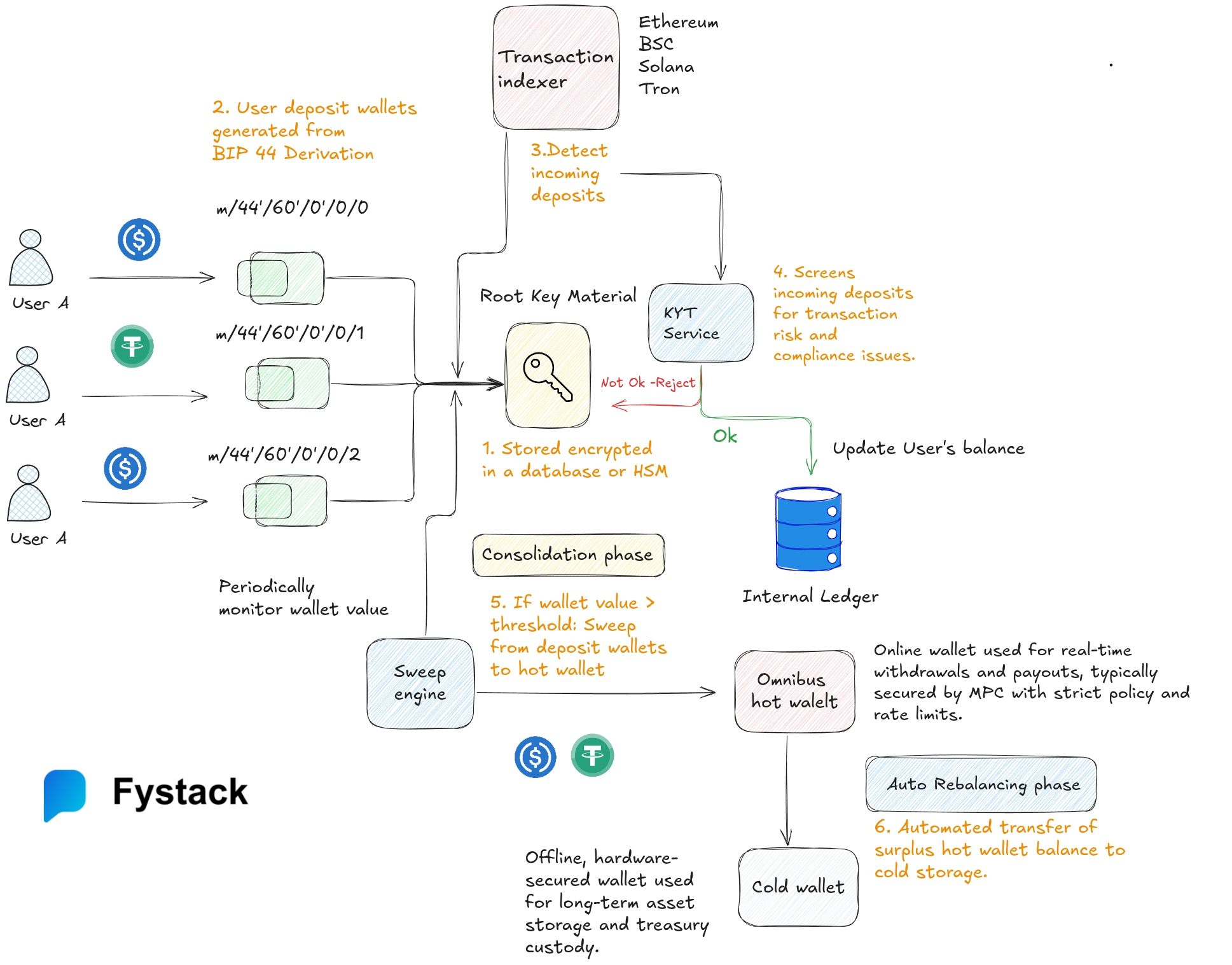

How MPC Wallets, KYT Screening, and Automated Consolidation Power Secure Crypto Payments

Thi Nguyen

Author

Founder

TL;DR: How to Build a Compliant Stablecoin Payment Flow

A compliant stablecoin payment flow consists of on-chain deposits, KYT screening, off-chain accounting, MPC-secured hot wallets, and automated treasury management.

By combining transaction monitoring, KYT providers, MPC wallets, and automated consolidation, payment platforms can process stablecoin payments securely, compliantly, and at scale.

As crypto payments move from experimentation to real-world adoption, payment platforms face a difficult challenge:

how to move funds fast, securely, and compliantly at scale.

Merchants expect instant settlement. Regulators expect full traceability. Security teams expect zero key exposure. And finance teams expect treasury efficiency.

This is where a modern custodial payment architecture becomes critical.

In this post, we walk through an end-to-end stablecoin custodial payments flow, highlighting how:

- KYT screening (via providers like Chainalysis, Elliptic, or Webacy) protects against illicit activity

- MPC-secured hot wallets enable safe, real-time payouts

- Fystack’s automated consolidation engine orchestrates deposits, sweeps, and treasury management with minimal manual intervention

1. From User Payment to Deposit Wallets

The flow begins when a customer sends a stablecoin payment (USDC, USDT, etc.) from their wallet.

Instead of reusing a single address, the platform generates unique deposit wallets per user or transaction, typically derived using BIP-44 hierarchical key derivation.

This approach provides:

- Clean accounting and reconciliation

- Strong isolation between users

- Easier compliance investigations

Each deposit address is deterministically generated, while the root key material is never exposed.

Root keys are:

- Encrypted

- Stored securely in a database or HSM

- Used only for controlled signing operations

This design dramatically reduces operational risk while preserving scalability.

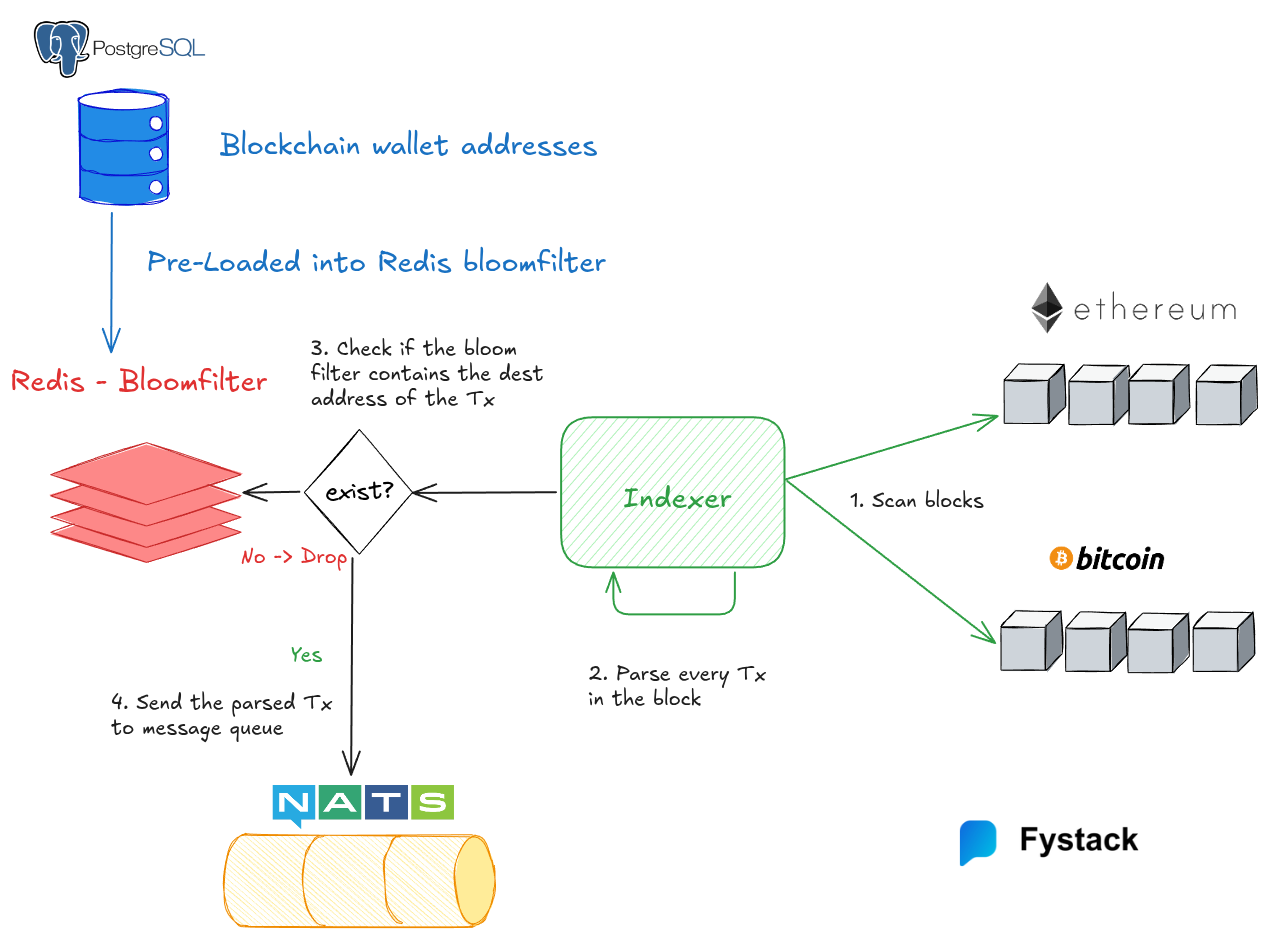

2. Continuous Blockchain Monitoring Across Multiple Networks

Once funds are sent, the transaction is recorded on-chain whether on Ethereum, BNB Chain, Solana, or Tron.

A transaction indexer continuously monitors supported networks and detects incoming deposits in near real time.

This monitoring layer is responsible for:

- Detecting inbound transactions

- Tracking confirmation depth

- Normalizing multi-chain data into a single internal format

Only after sufficient confirmations does the system move forward. This protects merchants from chain reorganizations and double-spend risks.

Check out our open-source indexer: https://github.com/fystack/multichain-indexer

3. KYT Screening: Compliance Before Credit

Before any balance is credited internally, the transaction passes through a KYT (Know Your Transaction) screening layer.

This is where providers like:

- Chainalysis

- Webacy

- Elliptic

play a critical role.

Each deposit is screened for:

- Sanctions exposure

- Links to illicit wallets

- High-risk counterparties

- Suspicious transaction patterns

If a transaction fails KYT checks, it is flagged or rejected before touching merchant balances.

If it passes, the flow continues seamlessly.

This step is essential for payment platforms operating in regulated environments and aligns closely with best practices outlined in Fystack’s compliance-focused custody workflows.

4. Internal Ledger Credit: Decoupling On-Chain and Off-Chain

Once a transaction is confirmed and cleared by KYT, the platform updates the internal ledger.

This is a critical design principle:

User balances are accounting entries, not direct reflections of on-chain wallets.

By decoupling on-chain custody from off-chain balances, the platform gains:

- Faster merchant settlement

- Clear audit trails

- Safer fund management

At this point, the merchant sees their balance updated—without funds yet moving into operational wallets.

5. Automated Consolidation: Where Fystack Shines

Deposit wallets are not meant to hold funds indefinitely.

This is where Fystack’s automated consolidation engine becomes central to the architecture.

The system continuously monitors:

- Wallet balances

- Gas costs

- Network conditions

- Configured treasury thresholds

When conditions are met, the engine automatically sweeps funds from multiple deposit wallets into a single omnibus hot wallet.

This process is:

- Fully automated

- Policy-driven

- Optimized for gas efficiency

No manual ops. No risky hot-key scripts. No delayed settlements.

This is the operational backbone that allows crypto payment platforms to scale from dozens to millions of transactions.

Check out our documetation for utilizing Fystack's automation feature for wallet consolidation. https://docs.fystack.io/product/automation

6. MPC Hot Wallets: Secure by Design, Fast by Nature

The omnibus hot wallet is where real-time operations happen:

- Merchant payouts

- Refunds

- On-demand withdrawals

But unlike legacy hot wallets, Fystack’s architecture relies on Multi-Party Computation (MPC).

With MPC:

- Private keys are never reconstructed

- Signing authority is distributed across multiple parties

- Compromise of a single system does not lead to asset loss

Strict policies govern:

- Transaction limits

- Approval rules

- Velocity controls

This aligns with the principles outlined in “MPC Wallets: The Critical Infrastructure for Enterprise-Grade Web3 Security” and forms the security foundation of modern payment platforms.

Checkout our open-source mpc implementation on Github: https://github.com/fystack/mpcium

7. Auto-Rebalancing to Cold Storage

Holding too much value in a hot wallet increases risk.

That’s why Fystack introduces an auto-rebalancing phase:

- Hot wallet balances are continuously monitored

- Excess funds are automatically transferred to cold storage

- Cold wallets remain offline and hardware-secured

This ensures:

- Minimal attack surface

- Strong treasury discipline

- Compliance with internal risk frameworks

The result is a system that balances liquidity and security without human bottlenecks.

Why This Architecture Matters

This end-to-end flow demonstrates how crypto payment platforms can achieve:

- Security through MPC and cold storage

- Compliance through KYT screening

- Scalability through automated consolidation

- Operational efficiency through orchestration instead of manual ops

It’s not just about custody, it’s about building trust infrastructure for digital payments.

Final Thoughts

As stablecoin payments continue to replace legacy rails, platforms need infrastructure that is:

- Secure by default

- Compliant by design

- Automated at scale

By combining KYT providers, MPC-secured hot wallets, and Fystack’s consolidation engine, payment platforms can confidently operate in both high-growth and highly regulated environments.

This is the future of enterprise-grade crypto payments and it’s already here.

Build Secure, Compliant Crypto Payment Infrastructure

Stablecoin payments demand more than wallets.

They require automation, policy enforcement, and security that scales with volume and regulation.

Share with us what you are building and we’ll show how Fystack’s MPC wallets, KYT integrations, and consolidation engine fit your architecture.

Not ready yet?

Join our Telegram to follow architecture updates and product discussions. https://t.me/+9AtC0z8sS79iZjFl