Demystifying Base 2025: How Coinbase’s Layer-2 Won the Ethereum L2 Race (Part 1)

Phoebe Duong

Author

From 2023 to 2025, the Base Blockchain go-to-market journey has become a textbook example of how a Layer-2 (L2) blockchain project can evolve from hype to sustainable growth. In its early phase, Base drew attention simply for being “Coinbase’s Layer-2”, but today, it stands out as one of the few L2 blockchains that have built real, long-term momentum.

Base was born with what most other L2 blockchains can only dream of - direct backing from Coinbase, billions in liquidity, access to over 100 million potential users, and a globally trusted brand name. In short, Base had a “runway” that 99% of projects will never have.

However, if you think Base Blockchain succeeded just because it was backed by Coinbase, think again. Capital, infrastructure, and user access only gave them a head start. To truly scale, Base still had to prove itself through strategy, execution, and product-market fit. At one point, the project nearly flatlined until the team pivoted at the right moment.

If you’ve ever asked yourself:

- What new technology updates did Base roll out in 2025?

- How can builders protect their projects from AWS-style outages?

- And does strong backing always guarantee long-term success?

Then this article is for you.

If you’re mainly interested in how Base approached its go-to-market strategy and user acquisition playbook, jump to part 2.

From Uncertainty to Execution: Base’s Strategic Pivot

Jesse Pollak, founder of Base, once admitted that even the team didn’t fully understand what they were building in the beginning:

That constant test - fail - learn - refine loop helped Base find its true direction. Instead of chasing marketing hype, the team focused on onchain data — studying real transactions, user behavior, and engagement to refine the product step by step.

While Base leveraged Coinbase’s ecosystem to build onchain adoption, Squads did the opposite: they built trust purely from execution, community governance, and developer adoption on Solana. Together, these two stories reveal different sides of the same challenge - how to turn a good technical foundation into lasting market trust: Squads: From Zero to the Multisig Protocol Securing $10B on Solana

What Is Base and Why It Was Created

Base is a Layer 2 blockchain developed by Coinbase, the largest crypto exchange in the United States. Its goal is not simply to launch another blockchain, but to bring Coinbase onchain. In other words, Base aims to make the entire ecosystem of Coinbase users, transactions, and products part of an open blockchain network.

More broadly, this marks the first step in Coinbase’s long-term vision of “bringing the world onchain”, turning blockchain from a niche concept into a real foundation for millions of daily users around the world.

Coinbase chose to build Base on the Optimism Stack, an open-source framework that helps teams deploy Layer 2 networks quickly and reliably. Instead of spending time reinventing technology, Coinbase leveraged Optimism’s existing tools to focus on what truly matters: the user.

Base was created to make the onchain experience as simple as using a Web2 app. Users can log in, trade, or transfer funds without having to understand private keys, seed phrases, or gas fees.

With Base, Coinbase is transforming from a trading company into a Web3 infrastructure platform. It is no longer just a place to buy and sell crypto, but a bridge helping hundreds of millions of users move into the onchain world naturally and safely.

Base Blockchain 2025: Breakthroughs and Unfinished Lessons

As 2025 comes to a close, Base has firmly established itself as Ethereum’s standout Layer-2 network, combining Coinbase’s powerful infrastructure with cutting-edge technical upgrades. But behind the impressive performance lies a familiar tension - between innovation and dependence, between decentralization ideals and real-world fragility.

For both developers and users, Base’s 2025 story is one of bold progress paired with painful reminders about reliability. Here’s a closer look at what changed, what worked, and what cracks began to show.

Flashblocks: Making Onchain Feel Like Web2

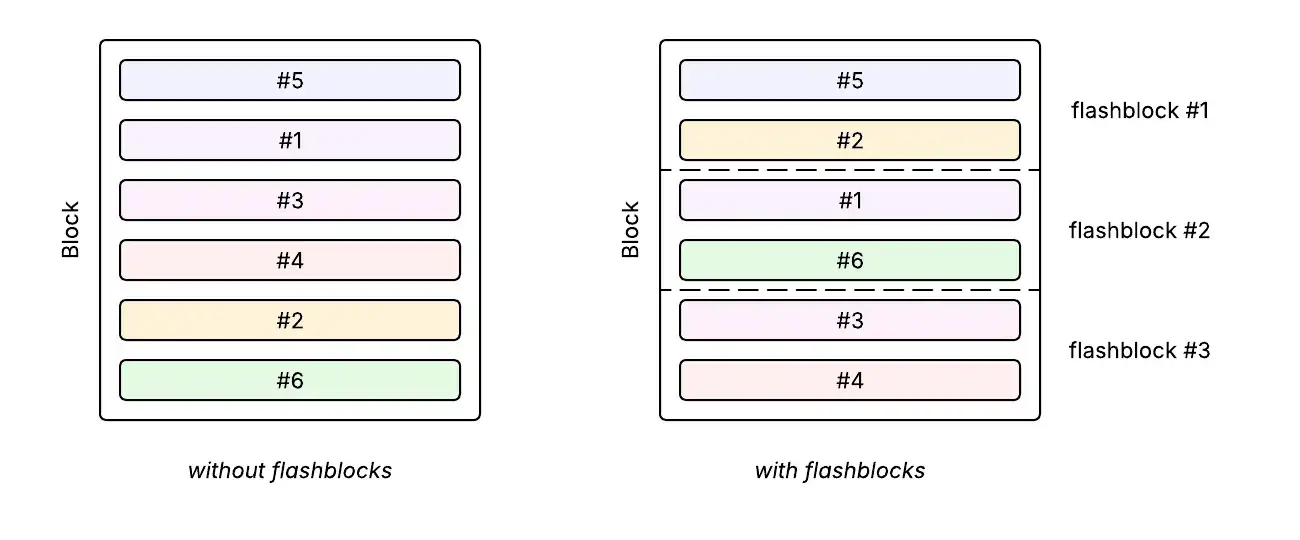

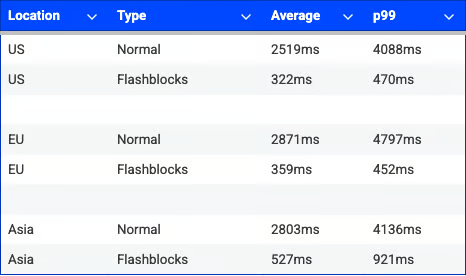

The highlight of Base’s year was Flashblocks, a major upgrade launched in July.

By integrating early transaction confirmations and cutting block times down to just 200 milliseconds (10 times faster than before), Base turned the onchain experience from “tolerable” to nearly instant.

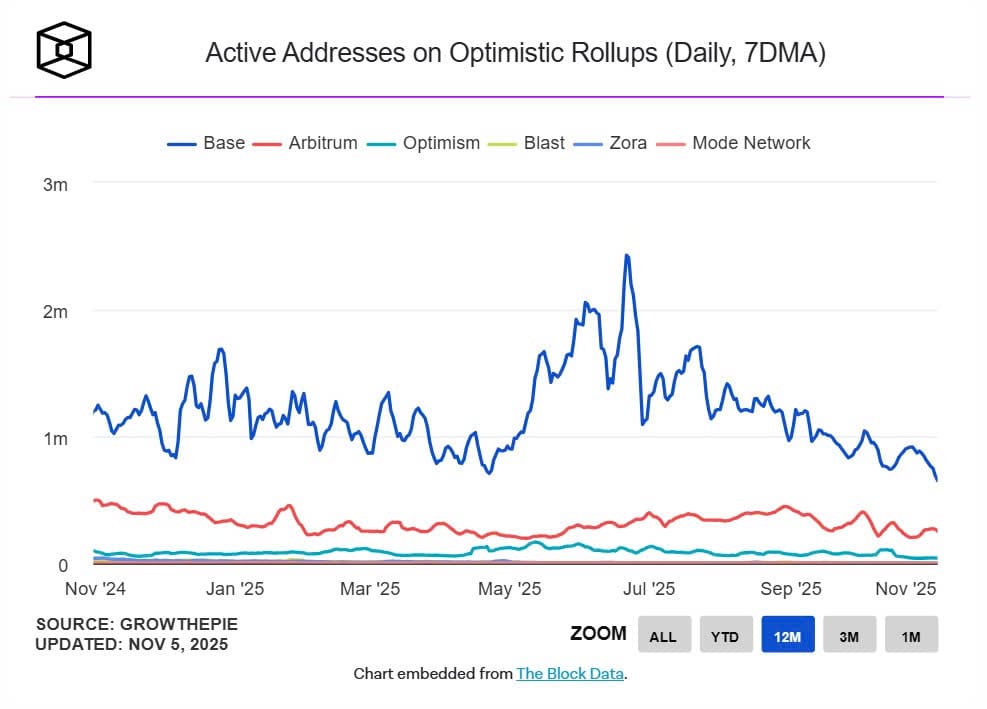

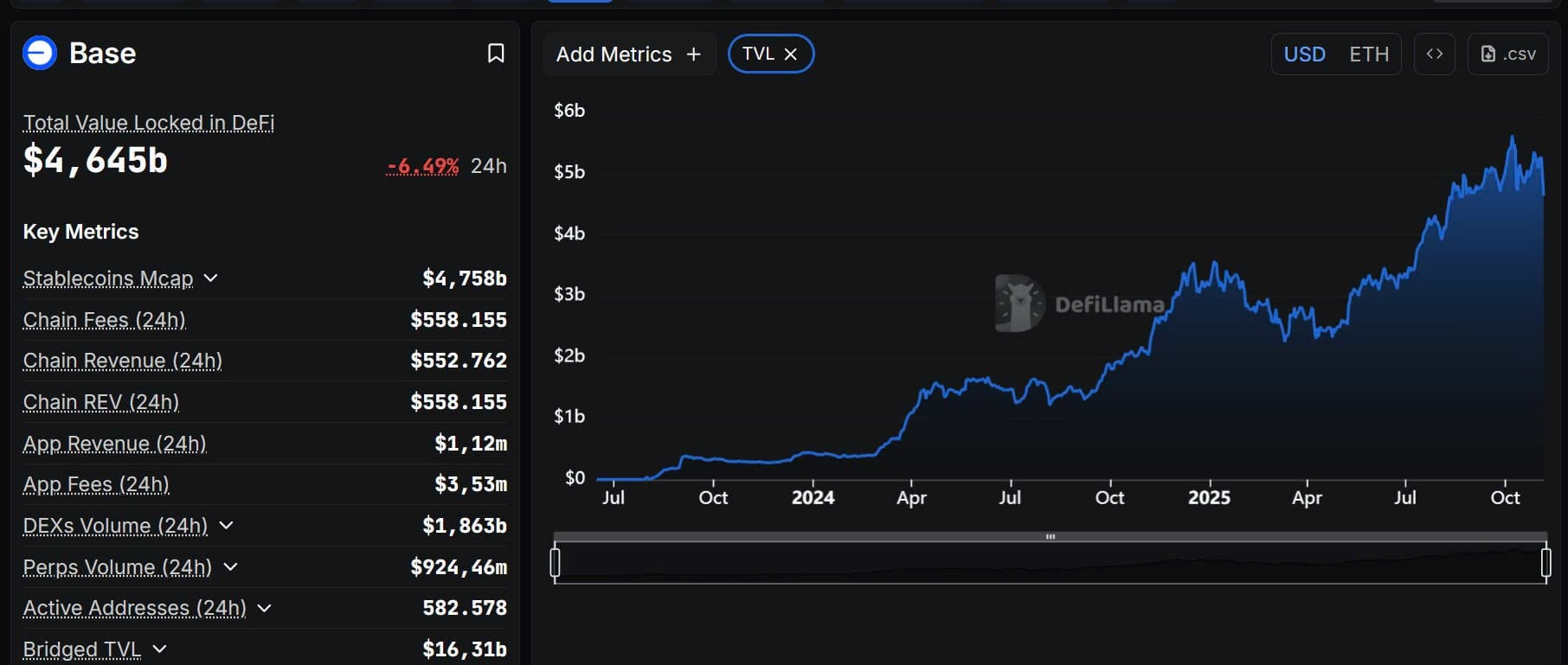

Apps that rely on speed from DeFi platforms to AI agents and social mini-apps - now feel smooth and responsive. The results were striking: Base reached 1.09 million daily active addresses, while its total value locked (TVL) climbed to 11.72 billion USD, capturing nearly a quarter of the entire Layer-2 market.

Flashblocks wasn’t just a backend upgrade; it was a cultural shift, making onchain interaction feel natural instead of experimental.

Stage 1 Decentralization: Progress, But Not Full Freedom

In April, Base achieved Stage 1 status in the Optimism Superchain roadmap - a key milestone that enabled decentralized fault proofs and a 12-member security council. This step reduced censorship risks and cut transaction costs for large-scale apps by up to 30 percent.

However, the biggest bottleneck remains: the sequencer, which still runs under Coinbase’s control. This centralized transaction engine means Base, while more secure and efficient, is still not fully independent.

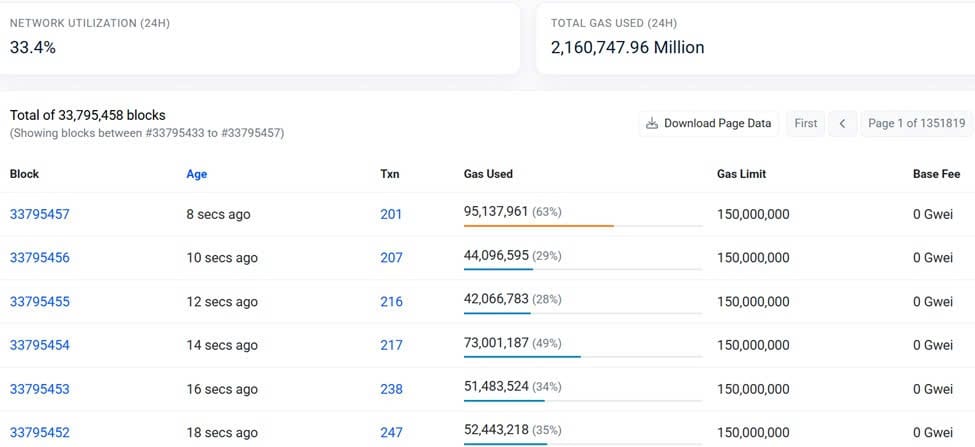

The concern was brought into sharp relief when Base experienced a network outage: block production stopped for around 20 minutes, highlighting the sequencer’s role as a single point of failure. Critics argue that even though Base has advanced its decentralization technically, the fact that one entity controls the sequencer remains a major exposure for the system.

@base is experiencing a chain halt, all other services remain operational. Last block 33792346 pic.twitter.com/vW0dCQzQQP

— Pangea (@in_pangea) August 5, 2025

When AWS Goes Down, And So Does Base

On October 20, 2025, an outage in AWS’s DynamoDB (US-EAST-1 region) triggered widespread disruptions. Base effectively froze for over 30 minutes: wallets went blank, bridges stalled, and swaps failed to execute.

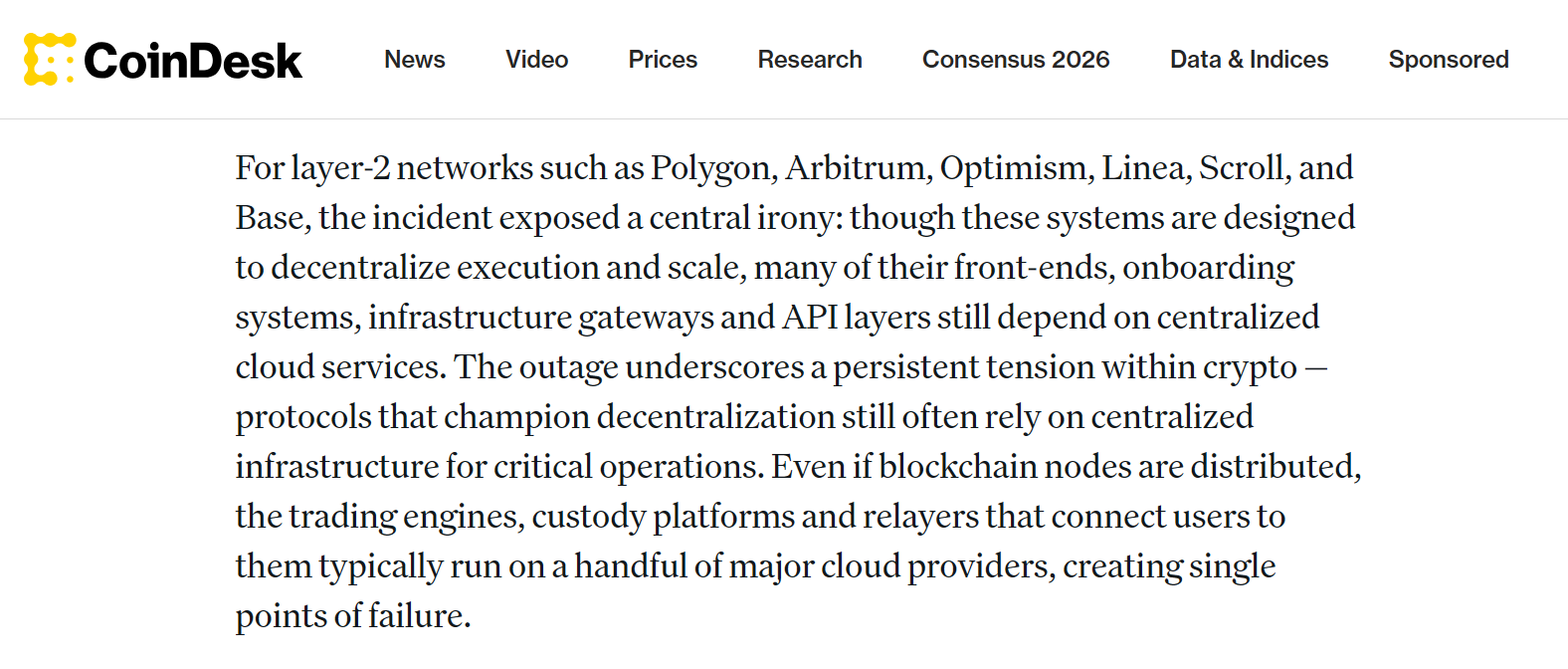

Meanwhile, decentralized blockchains like Ethereum and Bitcoin kept running normally - revealing a key vulnerability. Base was simply too reliant on centralized cloud infrastructure.

This wasn’t the first time. A few months earlier, another AWS issue in Europe had already disrupted major exchanges like Binance and KuCoin. In contrast, Layer-2 networks like Arbitrum and Optimism, which use multi-cloud redundancy, continued processing transactions without interruption.

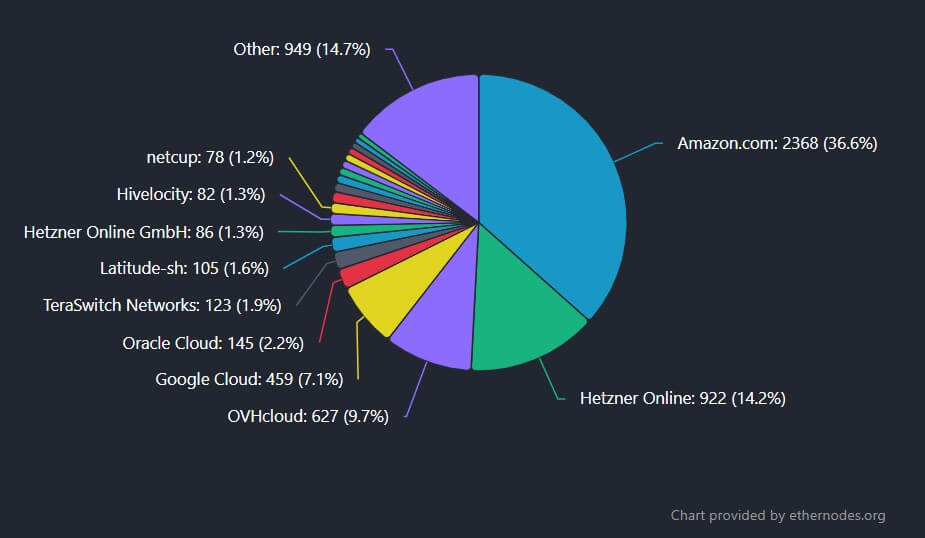

For context, data from Ethernodes shows that AWS hosts roughly 2,368 Ethereum execution layer nodes, accounting for about 37% of the network’s total.

This means that a technical issue at the provider or even one of its data center can slow entire ecosystems built on top of it.

Although no user funds were lost, confidence took a hit. One viral comment summed it up:

“If AWS crashes and your ‘decentralized’ blockchain crashes with it, it’s just fintech with extra steps.”

it all looks good on here, but Base is the highest affected network/L2 on the AWS outage!

— capGoblin (@dharshan_tw) November 1, 2025

idk how literally no one talks about that!? https://t.co/CYdBuyscFW https://t.co/95EkJIBZJc

Following the incident, Base promised to roll out multi-cloud architecture and distributed sequencers in 2026 to reduce dependency on any single provider. But the impact was clear: overall DEX trading volume across the market dropped by around 15 percent in the following week, as users and developers grew cautious about reliability risks.

Builder Takeaways: Innovate, But Build to Last

Base’s 2025 journey shows a simple truth: speed wins users, but resilience keeps them. Builders should design for both.

- Audit your stack. Identify how much of your infrastructure depends on AWS, Infura, or other single-point providers.

For a concise security checklist for Web3 startups, see Security 101 for Web3 Startups.

- Adopt distributed systems early. Explore DePIN-style solutions like Akash (for compute) or Filecoin (for storage) to reduce single-cloud exposure.

- Rethink wallet design. If your app involves asset management or transaction signing, consider using self-hosted MPC wallets (multi-party computation wallets). These let users control their private keys securely without relying on one server — helping you stay operational even if a cloud provider fails.

If you’re interested in how Web3 companies adopt self-custody or multisig wallets, you can also read Why Fintech Companies Should Choose MPC Wallets to Go On-Chain to understand the difference between multisig and MPC in real-world enterprise use.

The takeaway is clear: technology can drive growth, but only resilient systems survive at scale.

The “Inherited” Advantages Base Gained from Coinbase

Before diving into what makes Base’s go-to-market strategy stand out, let’s take a step back. It is undeniable that Base was born with advantages that most other Layer 2 projects can only dream of. These strengths gave it a nearly perfect runway when starting its go-to-market journey.

1. Liquidity and user base

With more than 110 million verified Coinbase Wallet users, Base already had a massive community ready to activate once its mainnet launched. Onboarding was nearly frictionless: users could bridge assets to Base directly within the Coinbase app with a single tap, without installing a new wallet, entering a seed phrase, or worrying about data exposure.

2. Brand trust

In a market full of new blockchains and potential risks, the label “Made by Coinbase” alone was enough to make users feel safe. They did not have to fear scams, verify unfamiliar contracts, or learn wallet security from scratch. Coinbase’s reputation replaced the need for extensive user education, saving Base millions in marketing costs while earning instant user trust.

3. Infrastructure and financial support

Coinbase Ventures directly invested in and supported Base, providing developer tools, technical resources, and even gas fee and monitoring infrastructure. By building on Optimism Stack, Base did not need to start from zero and could focus entirely on improving user experience. Unlike smaller projects chasing funding or managing high burn rates, Base could dedicate all its energy to product execution.

4. Distribution power

Coinbase already had built-in distribution channels reaching millions of users through email, push notifications, and in-app messages. When Base mainnet launched, a single in-app announcement was enough to make millions of users aware, bridge assets, and start exploring. Other chains would have to spend millions of dollars on advertising to achieve the same level of awareness.

5. Regulatory advantage

Coinbase is a publicly listed company in the United States, meaning all its activities operate under clear legal frameworks. Thanks to that, Base became one of the most regulation-compliant and institution-friendly Layer 2 blockchains on the market. It can more easily partner with large enterprises, list tokens, and avoid many of the legal risks that smaller or anonymous chains face.

When Everything Aligned: Base Took Off

With all those advantages in place, Base grew rapidly after launching its mainnet in August 2023. Within just one month, its Total Value Locked (TVL) exceeded 400 million USD, making it one of the fastest-growing Layer 2 blockchains in history.

In the first week (September 8, 2023), Base’s TVL passed 150 million USD, quickly surpassing StarkNet, according to data from L2Beat. By the end of September, Base reached 534 million USD in TVL, capturing 5.17% of the Layer 2 market share, with 1.88 million daily transactions - outperforming Avalanche, Optimism, and Tron.

Behind those impressive numbers were Coinbase’s 110 million users and the simple “one-click bridge” experience that made onboarding to Base effortless, even for complete beginners.

But Base Also Nearly Failed

The post-launch momentum did not last long. After just a few weeks, Base began to face the same challenge that most new chains encounter: users came fast, but left even faster. Many users simply bridged their funds, made a few swaps to test the network, and then withdrew back to centralized exchanges. As liquidity flowed out, TVL started to fall sharply.

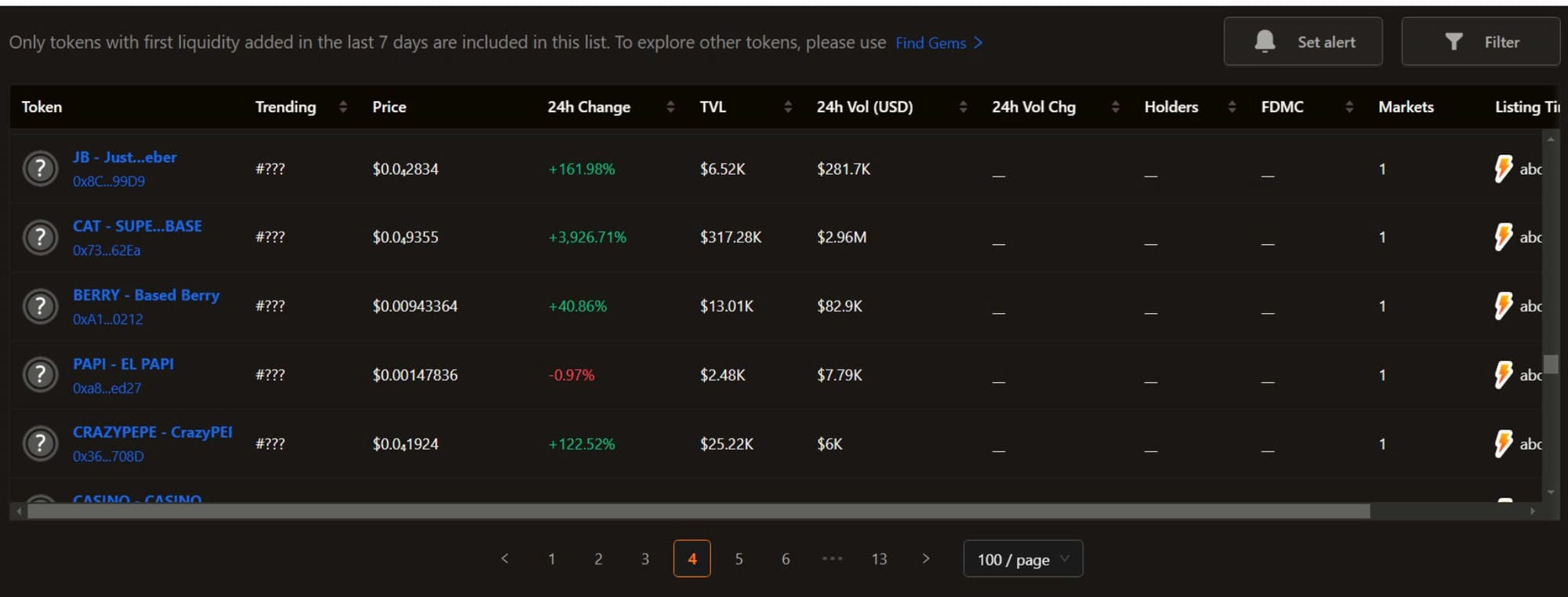

At the time, the DApp ecosystem on Base lacked real depth. A wave of memecoin projects launched and quickly turned into scams or rug pulls, causing community trust to plummet. Front-running bots flooded the network, gas fees spiked during high volume, and the overall UX led to comparisons like “Base feels like Solana 2.0, but slower.”

According to a Cointelegraph report (2024, based on 2023 data), among 905 memecoins launched on Base, 90.5% had unlocked liquidity - making them highly vulnerable to rug pulls. About 1 in 6 were identified as scams, and 91% contained security vulnerabilities (honeypot risks). At launch, Base’s ecosystem lacked depth in DeFi and gaming projects, being largely dominated by the short-lived memecoin hype that followed the mainnet release.

Within two weeks, Base’s TVL dropped from its September peak of 640 million USD to 445 million USD in October 2023, a decline of more than 30%. During the final three months of the year, Base’s TVL hovered between 300-400 million USD, heavily affected by scam DApps and a loss of user confidence.

That moment became a turning point. Base realized that having Coinbase behind them did not make them immune to failure. From that point on, the team began restructuring its go-to-market strategy, focusing entirely on onchain data and real user behavior instead of hype or token yield.

Under growing criticism, Jesse Pollak, the leader of the Base project, publicly apologized and admitted:

The first 6 months were humbling... Coinbase gave us a rocket ship. But we still had to learn how to fly it... We will earn your trust by shipping, not by brand (source: fortune)

Base had every advantage needed to win, and it truly did - at first. But a single misstep in strategy nearly turned that rapid rise into a free fall.

In the next section, we will look at how Base survived and, more importantly, how it became a case study in rebuilding growth through real user data - a lesson every Web3 builder can learn from.

Base 2025: How a Coinbase Layer-2 Reached $1 Billion TVL in 7 Months (Part 2)

Key Takeaways

- Base 2025 showed that even with Coinbase’s massive resources, success in Layer-2 is never guaranteed. The early phase was messy, with unstable growth and user churn.

- Distribution alone was not enough. Despite Coinbase’s user base and liquidity, Base struggled to convert speculative activity into real ecosystem adoption.

- Technical improvements such as Flashblocks and UX optimization marked the turning point that helped Base rebuild trust and reduce friction for new users.

- Centralized dependencies exposed hidden risks. Outages related to AWS and sequencer control reminded builders that decentralization is not just a philosophy but a reliability strategy.

- True sustainability came from iteration, not hype. Base’s pivot toward long-term reliability and user experience offers a clear lesson for new blockchain projects in 2025.

- The case of Base proves that resources can accelerate launch, but adaptability and credibility decide who actually wins the Layer-2 race.

Our community

If you’re building your own Web3 SDK, wallet infrastructure, or just trying to make onboarding less painful, join Fystack's Telegram group. It’s where developers and founders swap lessons, share benchmarks, and discuss real strategies to grow Web3 products that actually scale.