2026 Crypto Compliance: Global Stablecoin Laws & Fintech Checklist

Ted Nguyen

Author

BD & Growth @Fystack

Crypto Compliance is definitely the phrase that gives Web3 Fintech founders sleepless at night because the regulation is here. With the GENIUS Act in the US and MiCA in the EU, the rules of the game are being completely rewritten.

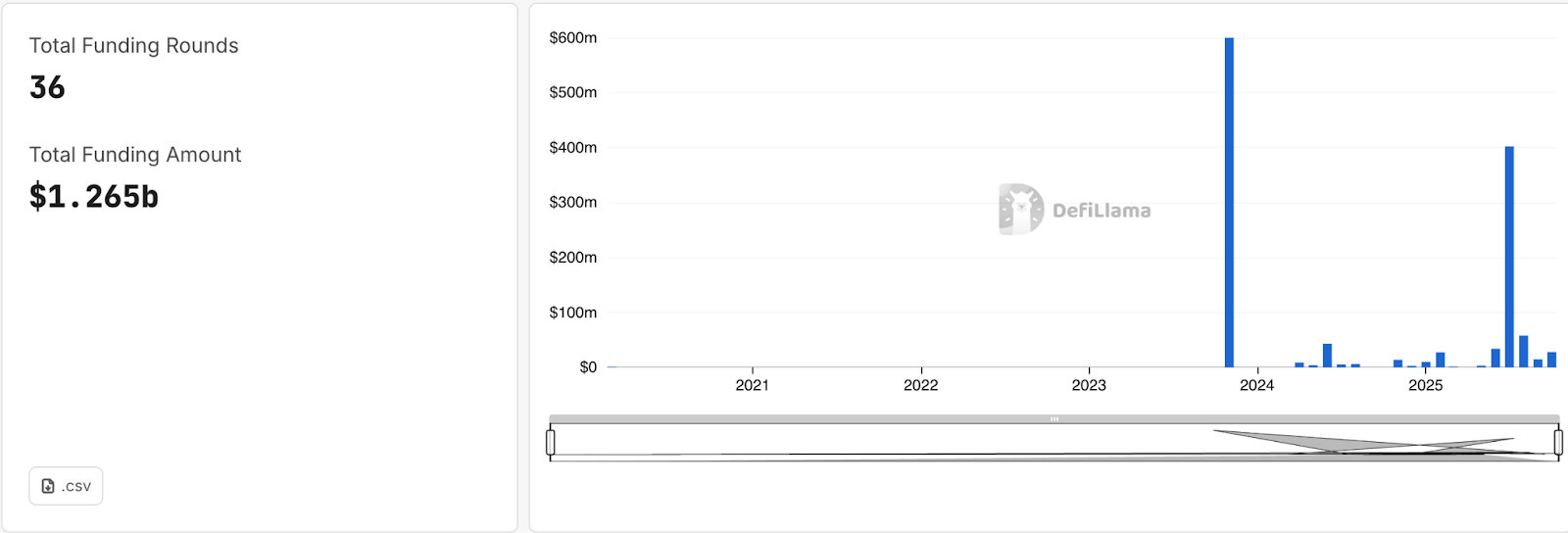

At the same time, stablecoin startups are still booming, raising over a billion dollars for infrastructure.

So, how can a fintech startup innovate and survive without an expensive army of lawyers? What are the deadly traps and how do you avoid them?

This article is your guide and we're going to decode this cryptocurrency compliance together.

If you’ve been searching for answers to questions like:

- What is compliance in crypto and why is it so important now?

- What are the consequences of non-compliance for crypto businesses?

- What are the specific crypto compliance rules in the US, EU, Singapore, and Vietnam?

- What best practices help fintech startups & crypto exchanges maintain compliance effectively?

...then this article is for you! We'll go from the global regulatory map to an urgent 5-step checklist, and finally, explore how Compliance Automation might be the solution.

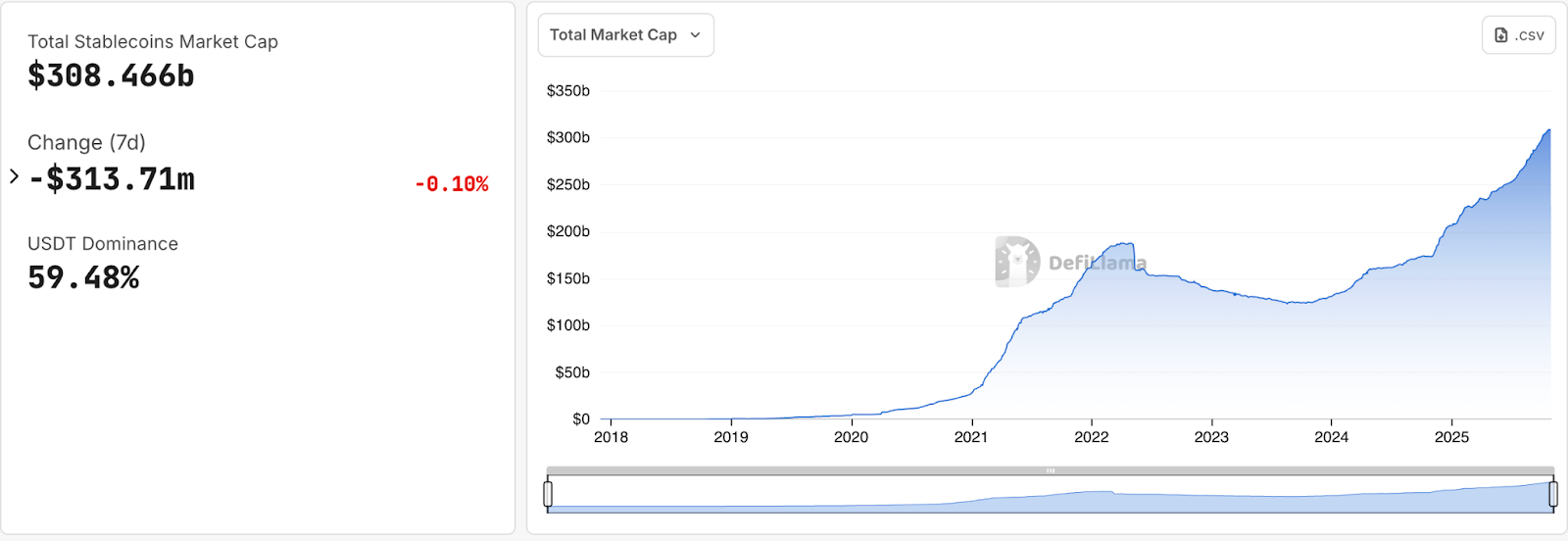

Why You Must Care: A $300B+ Market Is Being Put On Notice

The world of stablecoin payments is exploding. Just check DefiLlama, the total market cap hit a record high this year, sitting at a cool $308B as of right now (Jan 1, 2026).

Stablecoins are totally redefining how we interact with finance. They are shifting from speculative assets to essential rails for B2B settlements and treasury flows.

If you want to learn more about stablecoin payment landscape, especially in SouthEast Asia 2026, I already had one on Fystack.

The advantage is undeniable. It increases financial inclusions for businesses and individuals and enables global cross-border transactions super fast and dirt cheap. It’s a game-changer.

No surprise then that investors are piling in. According to DefiLlama, fintech startups focusing on stablecoins and stablecoin infrastructure have raised over a billion dollars across 36+ rounds recently. This surge in investment is largely driven by regulatory progress, including the signing of the U.S. GENIUS Act by President Donald Trump, according to the World Economic Forum.

Right now, regulatory compliance is becoming mandatory. This new regulatory landscape, with rules like the GENIUS Act, the EU’s MiCA, and Singapore's Payment Services Act (MAS), means crypto companies can no longer operate in a gray area.

And please, don’t even think complying is easy. Get it wrong, and it could cost you a fortune. Take this seriously. Just ask Paxos, they recently got slapped with a $48.5 million settlement in New York for compliance failures, reported by Reuters. This highlights the massive cost of failing to implement Anti-Money Laundering (AML) compliance programs.

One more time, you should be aware about the Anti-Money Laundering (AML) compliance programs.

Key Challenges for Web3 Fintech Startups Regarding Regulatory Compliance

Feeling overwhelmed? If you're running a fintech or stablecoin startup, you probably are. The challenges are real:

- High Cost

Getting compliant isn't cheap. You need to invest a lot in special crypto compliance software and blockchain analytics tools like Chainalysis or Elliptic. You also need ongoing audits and possibly high legal fees just to understand the rules. For startups, the costs of these compliance programs are CRAZY.

- Legal Hurdles

There’s no one-size-fits-all. You've got different, complex regulatory standards in the US (GENIUS Act), the EU (MiCA), Singapore (PSA), Vietnam (Sandbox), and everywhere else. Understanding and correctly implementing these diverse requirements across borders is a huge legal challenge.

One mistake in interpreting KYC/AML or Travel Rule obligations can lead to big trouble in this complex cryptocurrency ecosystem.

- Talent Scarcity

Finding people who actually understand both crypto and financial compliance? Good luck. There's a major shortage of skilled tech and legal experts who can build and manage these complex crypto compliance systems, making it hard to build a capable in-house AML team.

Read more: Why Fintech Companies Should Choose MPC Wallets to Go On-Chain

But don't panic!

If you want your business to survive and thrive in 2026, you can handle this without breaking the bank, getting lost in legal jargon, or needing a team of legal/compliance experts, or paying a premium for third-party crypto compliance solutions.

The Global Regulatory Map: What You Need to Know (Briefly!)

Regulations are becoming stricter everywhere. While details vary, the core themes are consistent: licensing, reserves, transparency, and robust KYC/AML.

Here we want to break it down for you.

United States (GENIUS Act)

First, looking at the United States, and its GENIUS Act.

This new federal law demands issuers get licensed and hold 1:1 reserves (only cash/short-term Treasuries). Crucially, all players handling these stablecoins are now subject to strict Bank Secrecy Act (BSA) rules, reporting to agencies like the Financial Crimes Enforcement Network (FinCEN). So it requires Web3 fintech startups full crypto AML compliance, monitoring, and reporting like traditional banks. Failure risks license loss and heavy penalties.

EU (MiCA)

Second, let's look at the European Union (MiCA).

Stablecoin issuers need authorization. Key rules include mandatory KYC (Know Your Customer) for transactions over €1,000, monthly transparency reports, and compliance with the Transfer of Funds Regulation (Travel Rule) for data sharing. This often involves complex VASP screening.

(The Travel Rule is an important AML regulatory requirement that applies to the transfer of crypto assets, including stablecoins)

The focus is clearly on market integrity and financial stability. Technical standards are still being finalized, with full implementation expected soon.

Singapore (Payment Services Act)

Third, we come to SEA, and the big name here to consider is Singapore (Payment Services Act).

Singapore continues to build its reputation as a regulated hub. The Payment Services Act (PSA) already requires licenses for converting stablecoins to/from fiat.

As it continues to develop the regulation. Now, the Monetary Authority of Singapore (MAS) is proactively building future infrastructure with Project BLOOM. BLOOM wants to help with domestic and cross-border settlement. It uses tokenized bank liabilities and well-regulated stablecoins. This promotes standard risk management.

Compliance is non-negotiable.

Vietnam (Resolution 05 Sandbox)

Lastly, the list ends with Vietnam (Resolution 05/2025 Sandbox).

Vietnam is taking a cautious, step-by-step approach via a 5-year pilot program (Resolution 05/2025). Here are key points for Web3 Fintech/Stablecoin startups:

A key rule is that all crypto transactions (including stablecoin conversions or exchanges) must eventually pass through a very small number (max 5) of highly capitalized, licensed Vietnamese exchanges.

It means that using stablecoins for direct P2P or B2B payments outside these licensed exchanges falls into a significant legal gray area under this pilot program.

In short, for Web3 fintechs operating in Vietnam, compliant stablecoin use currently means working within very narrow, centralized pathways defined by the sandbox. General payments are still restricted. The regulatory focus is clearly on a slow, controlled pilot.

The takeaway? No matter where you operate, robust compliance systems are becoming mandatory.

Your 2026 Fintech Compliance Checklist: 5 Urgent Actions

Feeling overwhelmed? Focus on these five critical actions now to prepare:

1. Standardize Your KYC/AML Processes:

Don't wait. Implement strong customer identification (KYC - Know Your Customer) and anti-money laundering (AML) procedures. These must meet international standards and form the basis of Customer Due Diligence.

Regularly update watchlists and ensure you have mechanisms for real-time transaction monitoring and reporting suspicious activity, as required by MiCA and the GENIUS Act.

2. Verify Your (or Your Partner's) Reserves:

If you issue or rely on a stablecoin, demand proof of reserves. Ensure they meet 1:1 backing requirements with safe assets and offer audit transparency. To understand exactly what banking-grade infrastructure looks like, check out our guide on the 11 essential layers 👉 The 11 Core Components Every Production-Grade Stablecoin Rail Must Have in 2026

3. Upgrade Your Security & Monitoring Infrastructure:

- Regulators demand proof of secure operations.

- Conduct regular security audits. Ensure your tech stack allows for robust monitoring and traceability of transactions across borders (essential for the Travel Rule).

- Pay special attention to key management, data encryption, and access controls for all digital assets.

Read more: Security 101 for Web3 Startups

Building this monitoring into a verifiable infrastructure layer makes the process much simpler. Fystack provides secure MPC wallet infrastructure solutions for this.

Why’s Fystack your best choice? Read our article on Top5 non-custodial MPC wallet providers, and you know the reason why.

4. Review and Secure Necessary Licenses

Operating without the right licenses is asking for trouble. Identify all required registrations in your target markets before launching or expanding stablecoin services.

5. Build a Culture of Compliance

Compliance isn't just one person's job. Train your entire team (tech, ops, finance) on the new regulations and internal procedures. Establish clear risk management protocols and conduct regular internal audits to stay prepared for external reviews.

There are only 5 actions needed but if you execute this checklist thoroughly using purely manual processes, it can feel like an impossible task.

It's resource-intensive, slow, and prone to human error.

That’s why Compliance Automation, built directly into your core wallet infrastructure, is a “must-have.”

Web3 Fintech Startups Need Automated Crypto Compliance Solution

At Fystack, we believe you should focus on building your product and serving customers, not drowning in compliance paperwork. Our self-hosted, open-source MPC wallet infrastructure is designed with compliance automation at its core, effectively creating a form of Automated Blockchain Monitoring.

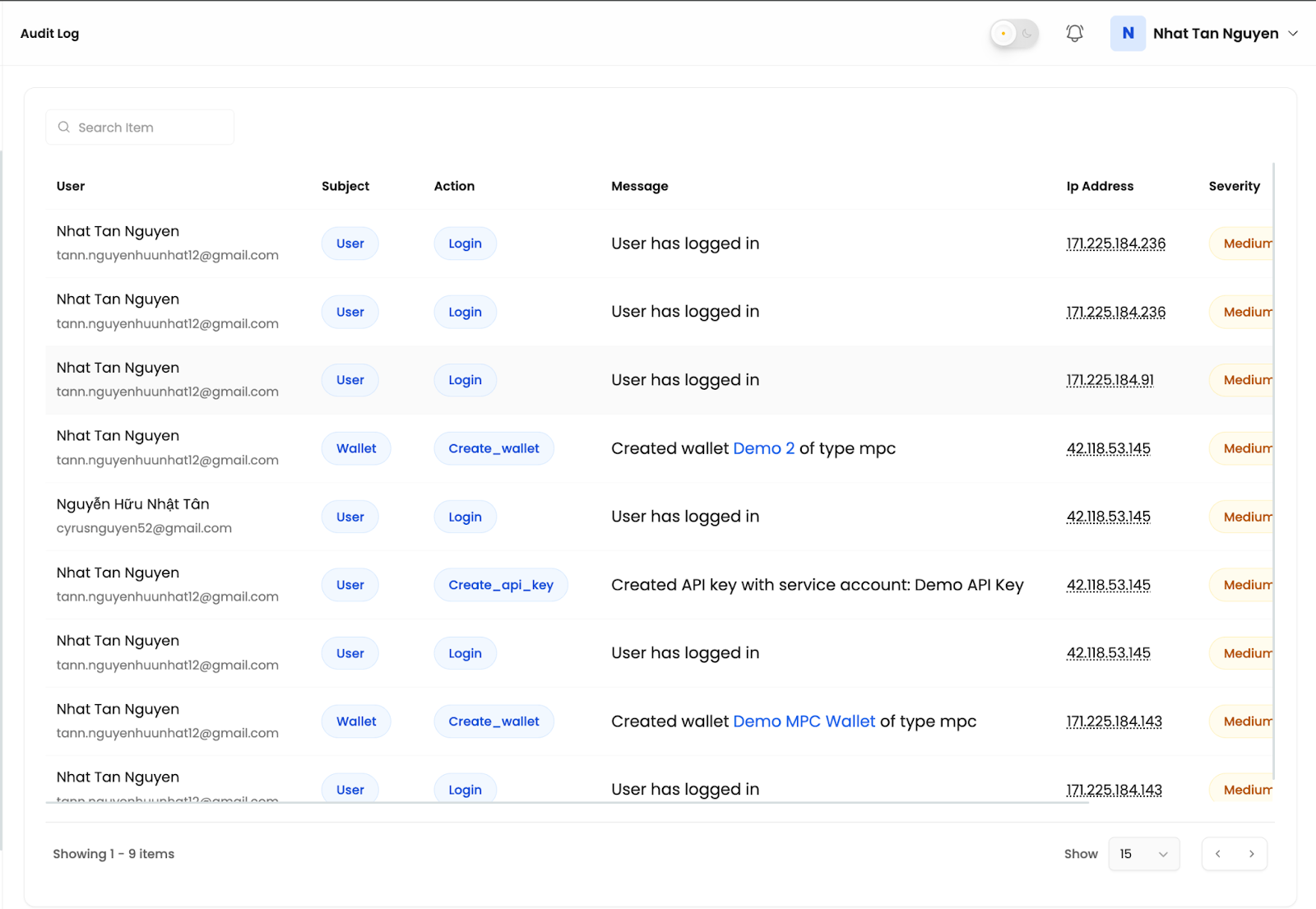

Audit-Ready Reporting

Forget manual data pulling!

Fystack provides built-in, immutable activity history logs for all wallet operations and access attempts. Automatically create reports that you can download. These reports combine on-chain and off-chain activity. This makes auditing easier and helps you meet rules like MiCA.

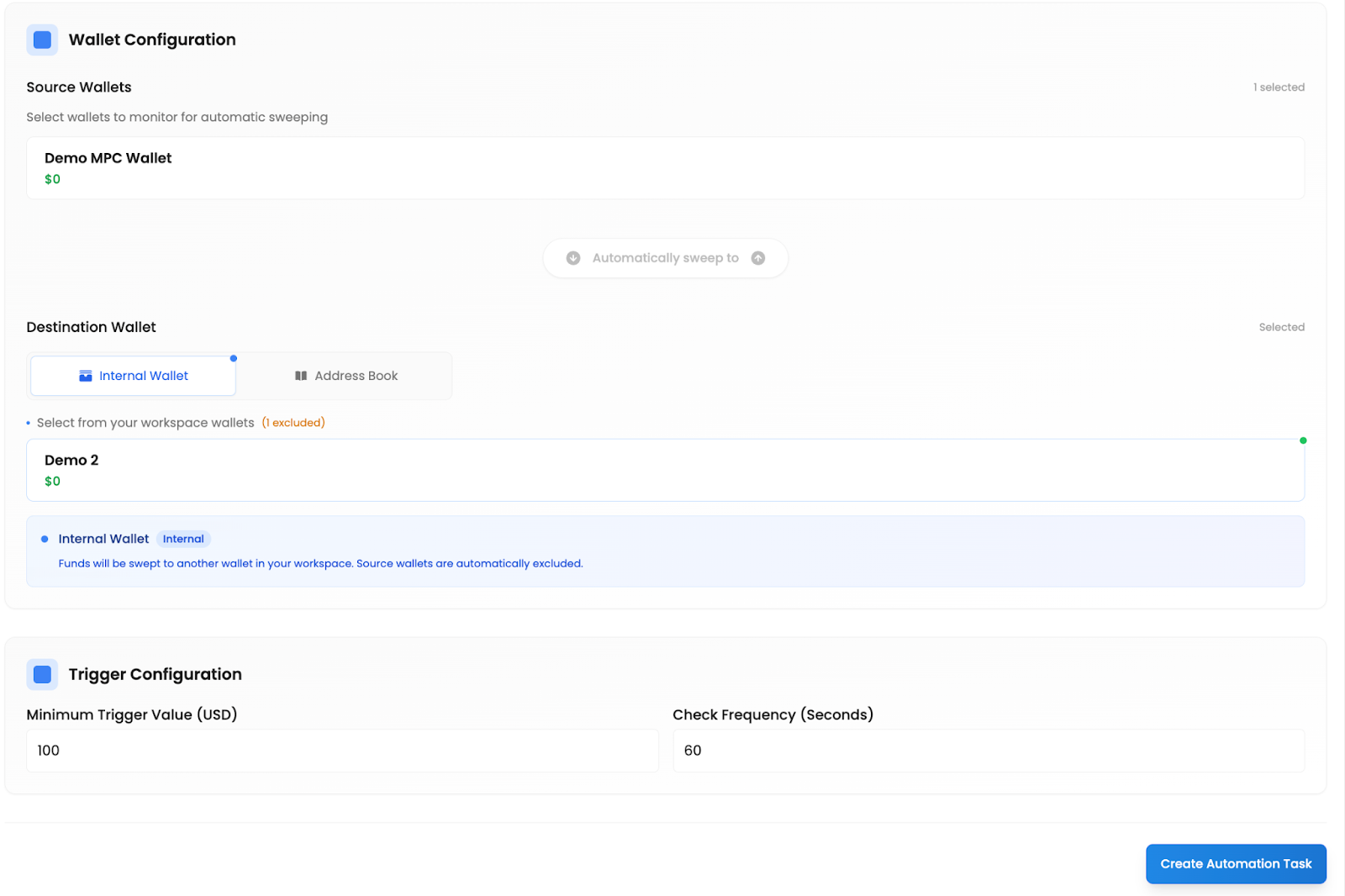

Automated Policy Enforcement

Define your compliance rules once, and let the infrastructure enforce them 24/7. Set up automatic approval rules for low-value transactions (e.g., <$100) while requiring multi-stage manual approvals for larger sums.

This built-in wallet & transaction screening can automatically flag or block transactions based on risk scores, or exceeding thresholds (like MiCA's €1,000 KYC trigger), minimizing manual work while maximizing security.

Self-Hosting for 100% Control & Local Compliance

Besides Wallet-as-a-Service (WaaS), Fystack also offers self-hosted solutions.

This is KEY, especially for businesses in Vietnam/SEA. By deploying Fystack's MPC nodes on your own servers within the country, and that means you’re now:

Meet Data Sovereignty Laws

Ensure sensitive user data stays within Vietnam's borders, complying with local data storage requirements (often 10+ years).

Simplify Local Audits

Provide regulators direct, verifiable access to logs and systems hosted locally, avoiding the complexities of dealing with international SaaS-based wallet infrastructure providers like Fireblocks, BitGo whose data might reside overseas.

Maintain Full Control

You own the keys, the data, and the compliance logic, avoiding the risk of relying entirely on a third-party vendor.

If you are currently evaluating providers like Fireblocks, you need to understand the difference between SaaS and Self-Hosted models.

The Bottom Line

Compliance is complex, but it doesn't have to undermine your business.

You do not want to become the next Paxos. By leveraging compliance automation built into a secure, self-hosted MPC wallet infrastructure, you can meet the demands of 2025 regulations efficiently and verifiably.

More importantly, you have full control over your digital asset.

With Fystack handling the compliance, you're free to focus on what you do best: innovating and growing your fintech business.

Read this article if you’re still unsure why your Fintech startups should choose a self-hosted MPC wallet to move on-chain.

And you might wonder next, why not embedded, or multi-sig wallet solutions?

Ready to automate your compliance and take control?

Sign up for Fystack now for exclusive access.

Join our Telegram Community to discuss compliance challenges and solutions with our team and other builders.

Frequently Asked Questions (FAQs)

What are the key crypto regulations in 2026?

The landscape is defined by the US GENIUS Act (requiring 1:1 reserves and BSA reporting), the EU’s MiCA (mandating KYC for >€1,000 transfers and Travel Rule compliance), and regional frameworks like Singapore's PSA and Vietnam's Sandbox

How does Vietnam's Resolution 05 Sandbox affect local fintechs?

It restricts legal crypto transactions to a few licensed exchanges. Direct P2P or B2B stablecoin payments outside these centralized pathways fall into a legal gray area, requiring startups to strictly follow the pilot program's narrow pathways.

How does Self-hosted MPC help with Data Sovereignty?

Self-hosting Fystack nodes allows you to keep sensitive user data and logs physically within your country (e.g., Vietnam). This meets strict local data localization laws that international SaaS providers (like Fireblocks) often cannot satisfy.