The RWA Liquidity Crisis: Where Tokenized Assets Struggle to Find Buyers

Ted Nguyen

Author

BD & Growth @Fystack

As of November 2025, the total value of real-world assets (RWAs) on-chain using blockchain technology has reached $35 billion, issued by more than 248 entities (RWA.xyz, 2025).

From tokenized treasuries like BlackRock’s $2.9B BUIDL fund to Franklin Templeton’s $776M BENJI, and Ondo Finance’s 100+ tokenized U.S. stocks, financial giants worldwide are racing to bring off-chain assets on-chain (Forbes, 2025)

In Singapore, OCBC became the first bank to offer tokenized government bonds to accredited investors. They lowered the minimum from S$250,000 to just S$1,000. Meanwhile, Dragon Capital in Vietnam proposed a pilot to tokenize ETFs in collaboration with Vietnam Blockchain Association (VBA).

It feels like asset tokenization’s breakout era. The promises are massive.

Fractional ownership, 24/7 trading, instant settlement, borderless access, and on-chain transparency, all powered by smart contracts.

Overall, I want to quote Waliczek, Blockchain and Digital Assets at World Economic Forum, the saying goes:

“The financial markets are undergoing a quiet revolution powered by asset tokenization…. And it [asset tokenization] could make investing more accessible, faster, cheaper and more transparent.”

The $35B Paradox: Tokenized Value, Zero Liquidity

But despite billions in on-chain assets, a hard truth remains:

“Most RWAs are stuck. They exist on-chain but they barely move.”

So, what went wrong?

- Is RWA tokenization just a hype cycle?

- Why do investors struggle to buy and sell RWAs freely, even as banks and asset managers embrace them?

In reality, tokenization solved ownership but not liquidity.

Investors can own a fractional ownership stake in real estate, a bond, or a private credit fund, but they often can’t sell it.

Billions in tokenized RWAs now sit idle across multiple blockchain networks.

Many RWAs are locked in closed systems, with secondary markets either illiquid or nonexistent.

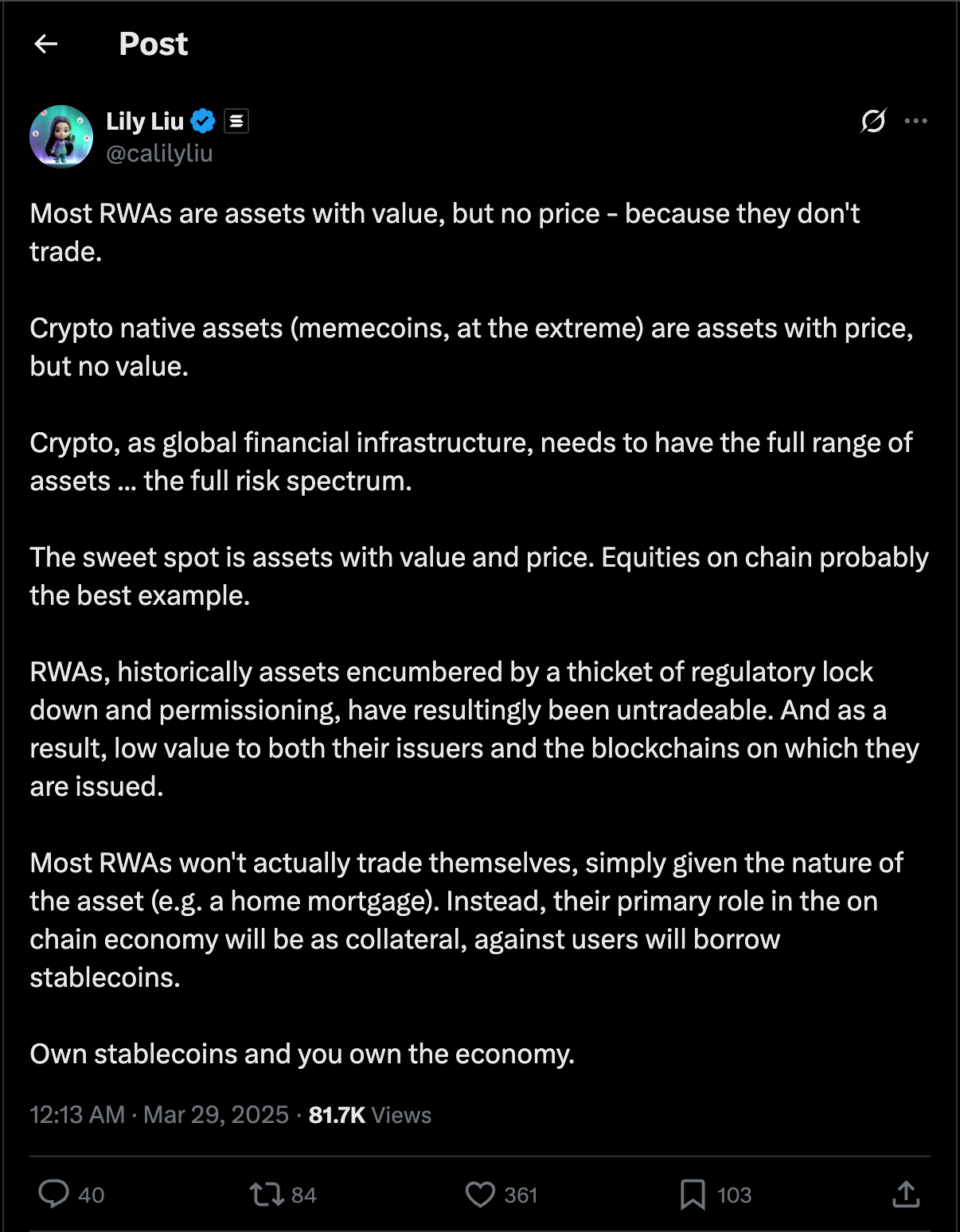

“Most RWAs are assets with value but no price because they don’t trade. The sweet spot is assets with both value and price.” – Lily Liu (@calilyliu), President @solanafndn, 2025

Recently, one study (by Mafrur, 2025) found that the market is dominated by tokenized Treasuries, but almost all of them show very limited on-chain activity.

For example, BlackRock’s BUIDL has just 85 holders and 104 monthly transfers.

By contrast, PAXG (tokenized gold) has over 69,000 holders and 52,000 monthly transfers, making it one of the few liquid asset-backed tokens.

Table 1. Monthly On-Chain Activity of RWA Tokens across all available blockchain networks

Asset | Holder | Monthly Active Addresses | Monthly Transfer Count |

BUIDL | 85 | 30 | 104 |

PAXG | 69,164 | 5,678 | 52,140 |

XAUT | 9,407 | 2,735 | 23,897 |

OUSG | 75 | 14 | 25 |

BENJI | 890 | 3 | 0 |

USDY | 15,460 | 979 | 13,189 |

WTGXX | 559 | 4 | 4 |

USTB | 70 | 14 | 704 |

JTRSY | 6 | 2 | 2 |

USYC | 41 | 6 | 125 |

What’s the difference? What’s the reason?

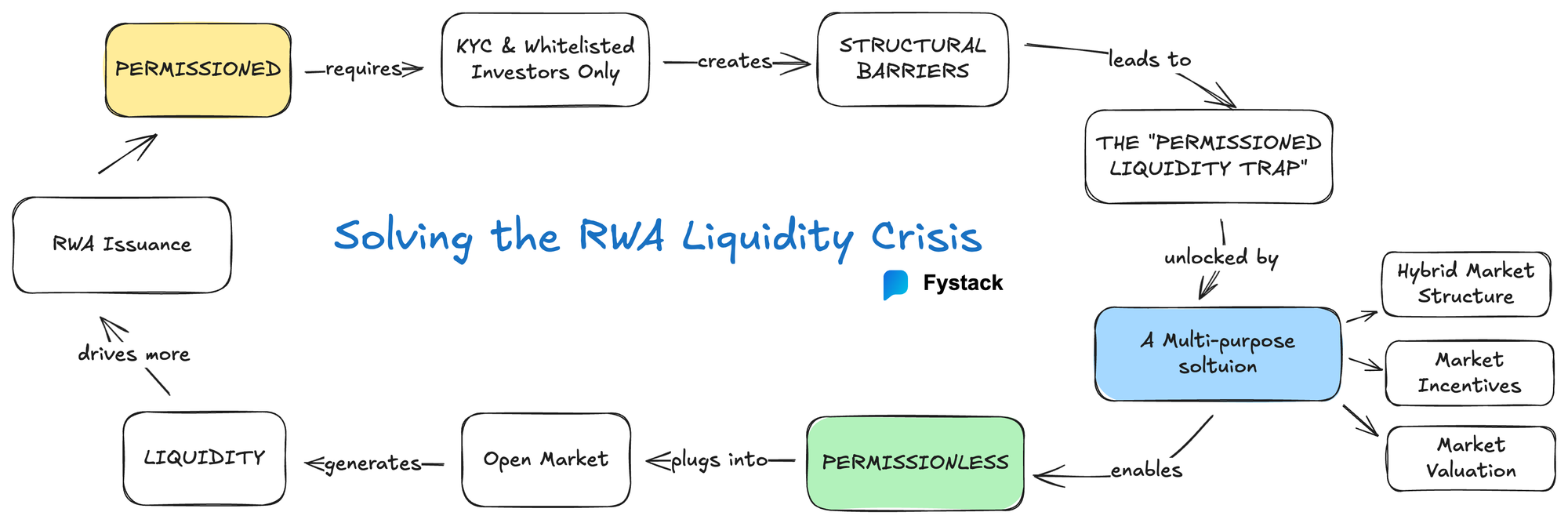

Permissioned vs. Permissionless

Gold-backed tokens like PAXG are liquid for one simple reason: they are permissionless. Anyone, anywhere, can buy them on Binance, trade them on Uniswap, or use them in Decentralized Finance (DeFi). They are open to the entire public crypto market.

In contrast, most other RWA tokens (like BlackRock's BUIDL) are permissioned. They are legal financial assets (securities). You can't just buy one. You must be an "accredited investor," get whitelisted by BlackRock's partners, and pass intense identity verification (KYC).

The digital token itself has rules baked into its code that physically stop you from sending it to a random wallet. You've created a 'token' that can't be used in DeFi, can't be traded by the public, and is locked in a closed, 'permissioned liquidity trap.'

I want to share a tweet of Yin, Co-founder of Plume Network and former VC at ScaleVP, he tweeted:

“Simply tokenizing does NOT lead to liquidity and efficiency for assets. Adverse selection is real — bad assets don’t magically become good on-chain.” – Chris Yin (@chriseyin), 2025

So, even though total tokenized value has exploded past $35 billion, on-chain liquidity remains shallow and fragmented.

The Real Barriers Holding Back RWA Liquidity

Tokenization has opened up new ways to demonstrate ownership, but there is still inadequate liquidity. Here are five long-lasting structural barriers are what keep tokenization and tradability apart:

Fragmented Marketplaces

If you want to sell stock, you just go to the NYSE or NASDAQ. However, with RWAs, you have to check 10 different, sketchy websites, three private chat groups, and two apps, all with different prices.

That's the RWA market. It's a total mess right now.

There's no single market where everyone can meet. This splits buyers and sellers, making it almost impossible to find a good price, or sometimes, any price.

Regulatory Restrictions

Most RWAs are legally considered securities. What I mean is by law they can only be sold to accredited investors or those who have passed intense KYC checks. These regulatory compliance rules are often hard-coded into the token itself, so you can't even send it to a normal wallet.

Valuation Uncertainty

How do you price a single digital token that represents one slice of a commercial building or private credit loan? When buyers and sellers can't agree on a fair asset valuation, they get nervous. No one wants to get ripped off, so no one trades. The market just freezes.

Lack of Market Makers

Traditional markets rely on dedicated market makers to keep the market alive. The RWA market has almost none. The automated liquidity pools in DeFi weren't built for these unique, low-volume assets.

You show up wanting to sell, but there's literally no one on the other side of the trade.

Technological and Operational Frictions

Even if you find a buyer, agree on a price, and are legally allowed to trade... The tech can still stop you.

You might get hit with high gas fees, slow transaction times. Many RWAs are issued on private, permissioned blockchains that are completely unable to interact with the DeFi markets.

Without cross-chain interoperability, tokenized RWAs remain locked in their own silos.

Key Layers Behind the Tokenization Stack

Is there a magic button to bring off-chain assets on-chain?

I don’t want to simplify it. Tokenization requires a stack of interconnected layers that must work in sync.

It starts with the Issuer (the regulated company that actually holds the asset and creates the token). Then you have Oracles (like Chainlink or Pyth) to feed real-world data (like interest rates) to the blockchain. The Blockchain itself is the layer that records ownership history.

And then there's the most critical part: the Custody Layer. This layer decides who actually controls the asset.

(I've already covered these layers in-depth, with examples, in my last article on the RWA era. You can read that first if you want the full breakdown.)

How To Solve the RWA’s Illiquidity Problem?

Tokenization is easy, but as we've seen, liquidity is hard. We've successfully tokenized $35 billion in assets, but most of it is stuck.

To fix it, We need a multi-purpose solution that addresses the identified barriers:

Fix the Fragmented Market Structure

Right now, assets are scattered across private platforms, OTC desks, and siloed blockchains. A proposed solution is to build hybrid market structures.

This means we might need to build platforms that use regulated, centralized systems for compliance but connect to decentralized protocols (DeFi) for 24/7 secondary trading.

Fix the Empty Market problem

You can't trade if there's no one to trade with. We need incentives for liquidity providers to get market makers involved. Furthermore, we can create indirect liquidity through collateralization.

Fix the Valuation Problem

Illiquidity gets worse when no one knows the fair price. We need standardized valuation. This means better disclosures, on-chain performance metrics, and reliable third-party appraisals, especially for unique assets like real estate or private credit.

Stablecoins: The Final Push for RWAs

Let’s say we fixed the “permissioned liquidity trap”. We’re now free to trade your digital token.

What are we going to trade it for?

We don't trade a tokenized house for a tokenized car. We need cash. And in the on-chain world, fiat-backed stablecoins ($USDC, $USDT, etc.) ARE the cash.

This one fact explains that entire data table from earlier.

Why is PAXG liquid? Because it's permissionless and it trades freely against billions of dollars in stablecoins on Uniswap, Binance, and Kraken.

Why is BUIDL illiquid? Because it's permissioned, and you can't trade it for stablecoins on the open market.

Every liquid RWA ecosystem revolves around stablecoin flows. This is why choosing non-custodial solutions for stablecoin businesses is so critical.

This is exactly why we built Fystack. Relying on a third-party SaaS provider for your asset just creates new problems: vendor lock-in, scaling fees, and a lack of control.

Instead, Fystack offers an on-premise stablecoin wallet infrastructure that gives you 100% control over your own custody.

It's 10x more cost-effective than other models because we offer unlimited wallets, unlimited transaction volume, and unlimited AUM under a simple license.

You own your infrastructure, period.

(Want to build on a foundation you actually control? Contact our team for exclusive sales access.)

The whole picture is clear now:

- Tokenization brings the asset on-chain.

- Custody gives you control of the asset.

- Stablecoins give the asset a price and make it move.

The Future of Tokenization

So, where does this leave us?

We've established a clear problem: we've tokenized $35 billion in assets, but they're stuck in "permissioned liquidity traps" with no buyers.

This constraint splits the industry into two sides.

On one side, optimists look at the idea of tokenization and see a massive opportunity. As David Nett from Token Ventures says, this growth is "sustainable and inevitable" because it solves real-world inefficiencies.

On the other side, we have the pessimists or realists, who look at the reality of today and, as Alex Zhang from Pharos argues, see an industry "under immense pressure to perform" that's stuck in "complexity, lack of standardization, [and] compliance friction."

So, who's right?

My take is that they're both right. They're just looking at different parts of the problem.

If we look at the outcome like the Optimists, of course we’ll see that it will create a better financial system because it makes finance run 24/7, making it cheaper, making it global…

However, the Realist/Pessimist, they’re looking with another perspective, they look at the constraint (today’s infrastructure is broken).

So, I realize that this isn’t even a real debate.

When you read their quotes, you realize the optimist and the realist are actually saying the exact same thing.

They've just perfectly described the next "Problem -> Solution" cycle for this industry.

The Old Problem: "How do we put a real-world asset on a blockchain?" We're great at this. We've successfully parked $35 billion on-chain and it’s on the rise.

The New Problem: "Okay... now how do we do anything with it?" We are terrible at building the infrastructure that makes them usable. We haven't solved "Liquidity."

Ian Balina of Token Metrics nailed it:

“RWAs won’t become real investments until they’re composable and liquid. Once that happens, we move from marketing hype to institutional portfolios.”

And Alex Zhang gave the solution:

“Don’t just tokenize assets — build the institutions to back them.”

"Composable and liquid" and "institutions to back them" are just different ways of saying the same thing: the $35B in stuck assets is waiting for the next layer of infrastructure. It's waiting for the custody solutions to be built. This forces a strategic choice for businesses: self-hosted vs. SaaS platform. What do you think the future of digital asset custody belongs to?

I want to end this article with another quote by Coinbase co-founder Fred Ehrsam:

“Everything will be tokenized and connected by a blockchain one day.”

That day isn't tomorrow. But it’s coming

Frequently Asked Questions

What does RWA stand for?

RWA stands for Real-World Assets.

They’re physical or traditional financial assets such as government bonds, real estate, commodities, or equities that are represented as digital tokens on the blockchain. Tokenization turns these assets into programmable, tradable units, enabling fractional ownership and faster settlement

Is RWA tokenization just hype, or the future of finance?

It’s both hype and a long-term shift.

While early RWA projects struggled with liquidity and regulatory clarity, institutional adoption is accelerating, from BlackRock’s $2.9B BUIDL fund to Singapore’s tokenized bond pilots.

The technology is here. The challenge now lies in standardization, liquidity, and trust.

What are the regulatory developments around RWAs in major regions?

Rules are becoming clearer for tokenized assets.

The Clarity for Payment Stablecoins Act and the GENIUS Act are two early steps in the U.S. toward defining asset-backed tokens and stablecoins. The MiCA framework in Europe is being put into place in 27 member states. It makes clear rules for issuance, custody, and disclosures.

In Asia, Singapore's Project Guardian has let banks like DBS and JPMorgan experiment with tokenized bonds and funds. Japan's FSA also implemented rules just for security tokens and stablecoins. At the same time, Hong Kong is letting regulated tokenization pilots take place in its sandbox, and Vietnam's State Bank and VBA are looking into RWA-linked ETFs through controlled experiments.

Why are RWAs important in assessing bank capital requirements?

RWAs are crucial for figuring out a bank's capital adequacy ratio, which is the amount of capital a bank needs to have in relation to how risky its assets are.

Tokenized RWAs don't replace this framework, but they could make asset reporting more clear and efficient, especially when regulators start to accept on-chain representations of real-world assets.