Why Exchanges and OTC Desks Still Matter in an Onchain World

Ted Nguyen

Author

BD & Growth @Fystack

Despite the rise of onchain trading and DEXs, centralized exchanges and OTC desks continue to process the majority of crypto trading volume.

Heading into 2026, early signals suggest this dominance is accelerating. While retail volume remains steady, OTC markets are seeing a fresh surge, driven by institutions seeking discreet execution for the new year’s allocations.

This article looks at why exchanges and OTC desks still play a critical role, where smaller and regional players continue to find opportunities, and how infrastructure is becoming a key differentiator.

Exchanges and OTC Desks Are Not Being Replaced

The narrative around crypto infrastructure has shifted toward onchain trading, self-custody, and decentralized execution. DEX market share has grown meaningfully over the past five years, reaching over 20% of spot volume at several points in 2025, with perpetuals following a similar trajectory (CoinGecko, 2025)

Yet this growth has not translated into a decline in centralized activity.

Building on a record-breaking 2025, centralized exchanges processed more than $9 trillion in trading volume, the highest figure since the 2021 bull run. This resilience is even more visible in OTC markets, where volumes doubled year-on-year (100%+ growth), far outpacing public exchange growth as trade sizes increased.

However, the market is concentrating. Entering 2026, the top 10 global exchanges controlled over 55% of volume, effectively setting the price of liquidity for the world.

This raises an obvious question.

If volume, liquidity, and brand trust continue to consolidate around a handful of global players, what room is left for smaller exchanges, regional platforms, and independent OTC desks?

Local Regulation and Payment Rails Give Regional Crypto Exchanges a Competitive Edge

Crypto regulation is fragmented. Payments even more so.

This makes it hard for a single global exchange stack to work well everywhere. Local and regional exchanges are built differently. They are designed around:

- One or two licensing regimes

- Local AML/KYC rules

- Domestic payment rails

- Local language, UX, and customer support

In 2025, several regional markets across Asia, the Middle East, Africa, and Latin America recorded double-digit volume growth, even during volatile periods. These platforms competed on access.

In many emerging markets, users cannot rely on international cards or wire transfers. They use

1) mobile money

2) bank payment systems

3) local stablecoin rails.

Exchanges that integrate these rails directly become the default on-ramp. Global platforms often cannot justify the operational and regulatory cost to do the same.

Why Institutional Crypto Trading Relies on OTC Desks Instead of Public Exchanges

OTC desks exist for a simple reason: public order books do not scale cleanly for large trades.

As institutional participation increased, OTC volumes grew faster than centralized exchanges. The drivers are structural:

- Less market impact

- Price certainty

- Flexible settlement

- Discretion

In 2025, institutional trading accounted for a majority of total crypto volume, and a significant share of that flow avoided public venues entirely.

This trend is reinforced by

1) ETF-related flows

2) corporate treasury activity

3) stablecoin & RWA transactions.

Large exchanges remain efficient for retail flow. They are not optimized for negotiated execution or bilateral settlement. OTC desks are.

That gap is not closing.

Specialization Matters More Than Scale

Smaller exchanges that survive are not trying to out-liquify global players.

They specialize in specific regions, asset, user segments, and execution/settlement workflows.

Some focus on fiat on-ramps. Others on stablecoins. Others on OTC or institutional clients. This allows them to operate profitably at a much smaller scale.

As trading fees compress across the industry and DEX activity grows, exchanges increasingly compete on:

1) Execution reliability

2) Regulatory compliance

3) Settlement speed and

4) Operational control.

Brand and volume matter less than they did before.

Constraints Exchanges and OTC Desks Cannot Avoid

Local and regional platforms do have real advantages. But they also face structural constraints that do not disappear just because demand exists.

Liquidity and market depth

Without the scale of top global exchanges, regional platforms often operate with thinner order books. This leads to wider spreads, higher slippage, and limits on executing large trades. For institutional-sized flow, this constraint becomes visible very quickly.

Security and infrastructure risk

Smaller exchanges and OTC desks typically operate with tighter budgets and smaller security teams. That increases exposure to operational risks such as insider threats, phishing, and delayed incident response. Unlike global platforms with continuous audits and dedicated security operations, local players often rely on more manual controls.

Data regulation

In several markets, exchanges and OTC desks are legally required to control where sensitive data and cryptographic material are stored, processed, and accessed. This applies not only to user information, but also to transaction metadata, signing workflows, audit logs, and key management systems.

For exchanges operating in Vietnam (Cybersecurity Law), Indonesia (GR 71), Saudi Arabia, or Russia, the regulatory landscape has shifted.

It is no longer enough to just 'serve' local users. Regulators now demand Physical Data Residency:

1) Data Stay: Customer PII and transaction logs must stay within national borders.

2) Control Stay: The cryptographic keys protecting those assets cannot be under the control of a foreign entity (like a US-based SaaS provider).

This creates a 'Jurisdictional Trap': Using a global SaaS wallet might offer fast integration, but it violates local sovereignty laws, putting your license at risk

Most modern wallet stacks, including many MPC-based solutions, are delivered as SaaS. Keys, signing services, or coordination layers are often hosted on the provider’s cloud infrastructure, sometimes across multiple regions. Even when data is encrypted, control and processing may still occur outside the required jurisdiction.

For exchanges and OTC desks operating in the markets above, this can directly violate data residency or data sovereignty rules. If key material or signing workflows touch infrastructure outside the permitted territory, the setup may be non-compliant by design.

Future Crypto Exchange Infrastructure Trends: AI, Stablecoins, and Tokenized Assets

Stablecoins as Settlement Rails

Stablecoins are becoming the default way to settle trades. Exchanges and OTC desks use them for payments, margin, and treasury flows.

This reduces reliance on banks and shortens settlement time. It’s predicted that stablecoin volume could exceed US ACH within the next few years.

AI in Trade Execution

AI is used to price trades and manage execution in real time.

Exchanges apply it to reduce slippage and detect abnormal behavior while OTC desks use AI to generate faster and more accurate quotes.

According to Binance, over 3.2 million users leveraged Binance’s AI summary function to adapt their trading strategies.

Tokenized Assets (RWAs) at Scale

Bonds, funds, and equities are moving on-chain.

Exchanges can list these assets faster than traditional venues and OTC desks handle large trades with lower market impact.

McKinsey projects tokenized real-world assets to reach multi-trillion-dollar scale by 2030.

MPC is Everywhere

MPC is now used almost everywhere in institutional crypto. But not all MPC setups are the same. Each model trades off control, cost, and integration speed.

Teams need to choose based on regulation, operating model, and risk tolerance.

For firms like Fystack, a self-hosted MPC setup supports compliance, keeps costs predictable, and integrates faster with existing systems.

Why MPC Matters for Exchanges and OTC Desks

For exchanges and OTC desks, wallet infrastructure is part of the core trading system.

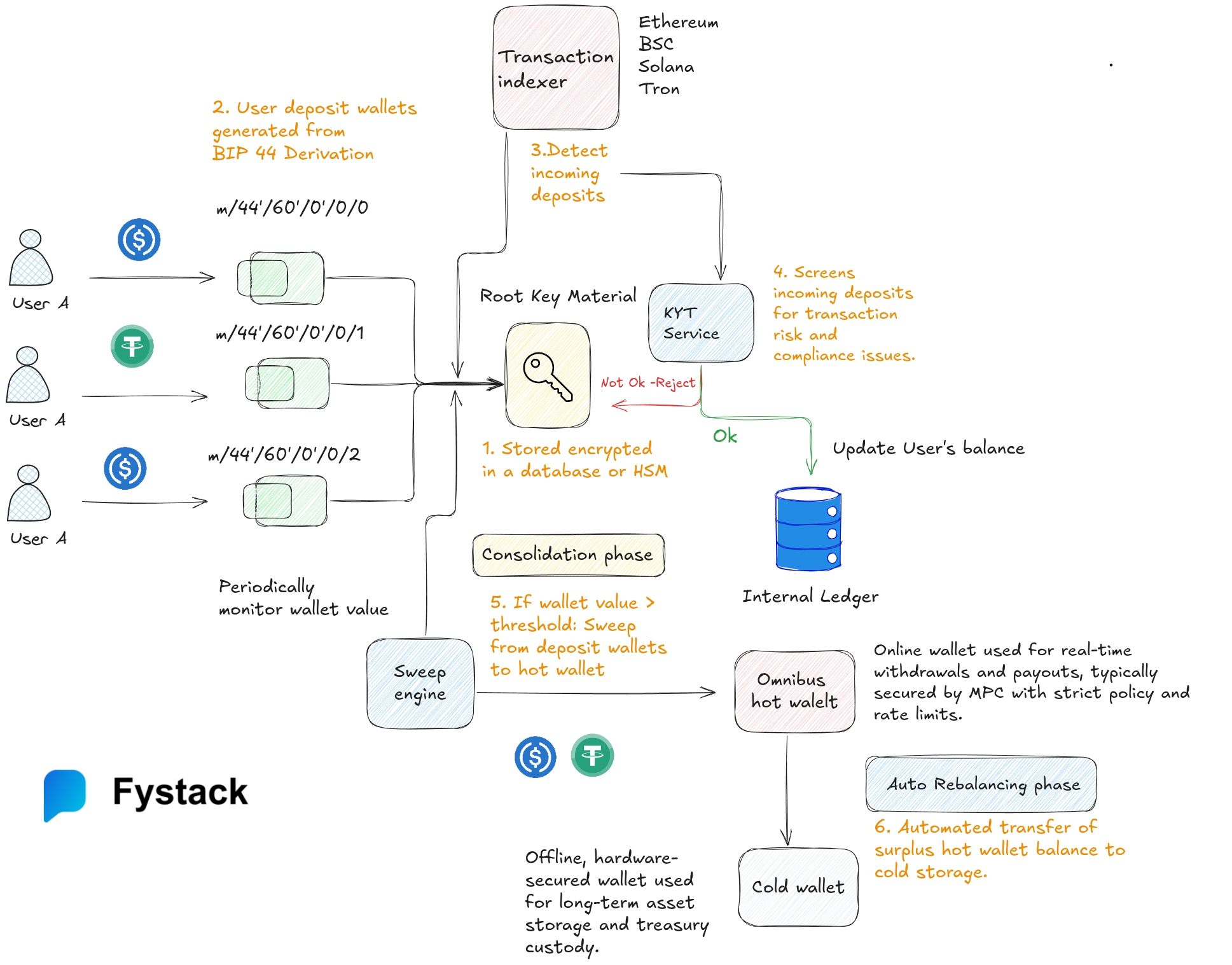

At scale, custody systems must handle:

- Continuous inflows and outflows

- High-value transactions

- Multi-party approvals

- Real-time settlement

- Auditability under regulatory review

This is where Multi-Party Computation (MPC) becomes the default architecture.

MPC allows private keys to be split into multiple cryptographic shares. No single party ever holds the full key, and signatures are generated collaboratively. This reduces single points of failure while maintaining operational speed, which is critical for both exchanges and OTC desks.

For regulated environments, MPC also enables:

- Granular approval policies for large trades

- Separation of duties between operations, risk, and compliance

- Cryptographic audit trails for every signing action

These properties make MPC well-suited for high-volume exchanges and institutional OTC workflows.

Why SaaS MPC Wallets Fail Under Data Residency and Sovereignty Regulations

Most MPC wallet solutions today are delivered as SaaS.

From a product perspective, SaaS MPC is attractive because it’s fast to integrate with lower upfront effort.

However, in SaaS MPC setups, two problems occur:

1) Key shares or signing coordination often run on the vendor’s cloud

2) Data may be replicated across regions for availability

For exchanges and OTC desks operating in jurisdictions with data residency or sovereignty requirements, this creates a hard conflict.

Even if keys are encrypted, processing outside the permitted territory can still violate regulations. Authorities may not accept “logical separation” without physical control.

For teams building or operating exchanges and OTC desks, this is the kind of issue you want to anticipate at the beginning. You don’t want to realize too late that your custody model is structurally incompatible with local requirements.

Self-Hosted MPC Wallet Architecture: A Compliance-First Approach for Exchanges and OTC Desks

Self-hosted custody changes the problem at its root. It allows exchanges to retain full control over private keys, signing processes, and sensitive data, while keeping all critical operations within the required jurisdiction.

For OTC desks specifically, self-hosted MPC supports:

- Quorum-based approvals for large trades

- Secure custody for high-value bilateral settlements

- Automated sweeping from deposit wallets into controlled hot wallets

- Detailed audit logs tied to internal risk and compliance processes

For exchanges, it allows MPC to be combined with:

- HSM-enforced signing policies

- High-throughput transaction pipelines

- Hot, warm, and cold wallet separation without SaaS constraints

This is why self-hosted MPC is becoming the baseline architecture for regulated trading venues and institutional desks.

Platforms like Fystack exist to shorten the gap between fully in-house builds and SaaS custody, without compromising control or compliance.

Conclusion

The market has matured.

Today, the winners are specialized. They are the regional exchanges who master local payments, and the OTC Desks who serve the institutional whale.

And to thrive in this specialized world, your infrastructure must match your strategy. Relying on SaaS custody works for some, but for those facing strict local regulations and high-stakes institutional demands, ownership is the only path forward.

Self-hosted MPC infrastructure is not only keeping keys safe but also keeping your business sovereign, compliant, and ready for the next trillion dollars of volume.

Frequently Asked Questions (FAQs)

How do Data Residency & Sovereignty regulations affect exchange operations?

In markets like Vietnam, Data Localization laws mandate that financial data must stay on domestic servers. This makes foreign SaaS wallets risky. To comply, exchanges must adopt self-hosted infrastructure, ensuring that private keys and transaction logs never physically leave the national border.

Can I use SaaS MPC if my country requires data sovereignty?

Likely not. Most SaaS providers host key shards in cloud regions (e.g., AWS US-East). If local regulations require data to reside on domestic servers, using a foreign SaaS provider violates these sovereignty laws. Self-hosting is the only way to guarantee keys never leave your jurisdiction.

Why do OTC desks prefer MPC over Multi-sig wallets?

Multi-sig wallets reveal signing structures on-chain and lack privacy. MPC is superior for OTC desks because it keeps signing policies off-chain (private) and is chain-agnostic. This allows desks to settle trades using a single, unified workflow.

What is the optimal Crypto Exchange Architecture for regulated markets in 2026?

The optimal Crypto Exchange Architecture must be sovereign. Relying on SaaS wallets creates data risks. Instead, leading exchanges use Self-Hosted MPC. This setup delivers the zero-latency performance needed for high-volume trading while keeping keys and data on local infrastructure to satisfy strict data residency laws.

Is default "White-label Exchange Security" enough for institutional OTC desks?

Rarely. Most default White-label Exchange Security bundles SaaS custody, which often violates data sovereignty rules. To serve institutions, OTC desks must decouple custody from the white-label stack. Integrating an independent, self-hosted MPC wallet ensures you retain full control over assets and audit logs, regardless of the trading engine provider.