5 Key Features That Make Tokenization the Future of Financial Markets

Ted Nguyen

Author

BD & Growth @Fystack

"Tokenization is a freight train and it’ll eat the entire financial system," Vlad Tenev, CEO of Robinhood, recently declared at Token2049.

He’s right. The financial infrastructure we rely on today is struggling to keep up with the speed of the modern world. As Brian Armstrong, CEO of Coinbase, pointed out in his tweet:

It’s nearly 2026, and billions of people still have to wait for the US to wake up before they can trade the best financial markets.

— Brian Armstrong (@brian_armstrong) November 6, 2025

Trading hours and markets that close are outdated.

Tokenized assets will be better for everyone, with instant settlement and 24/7 availability.

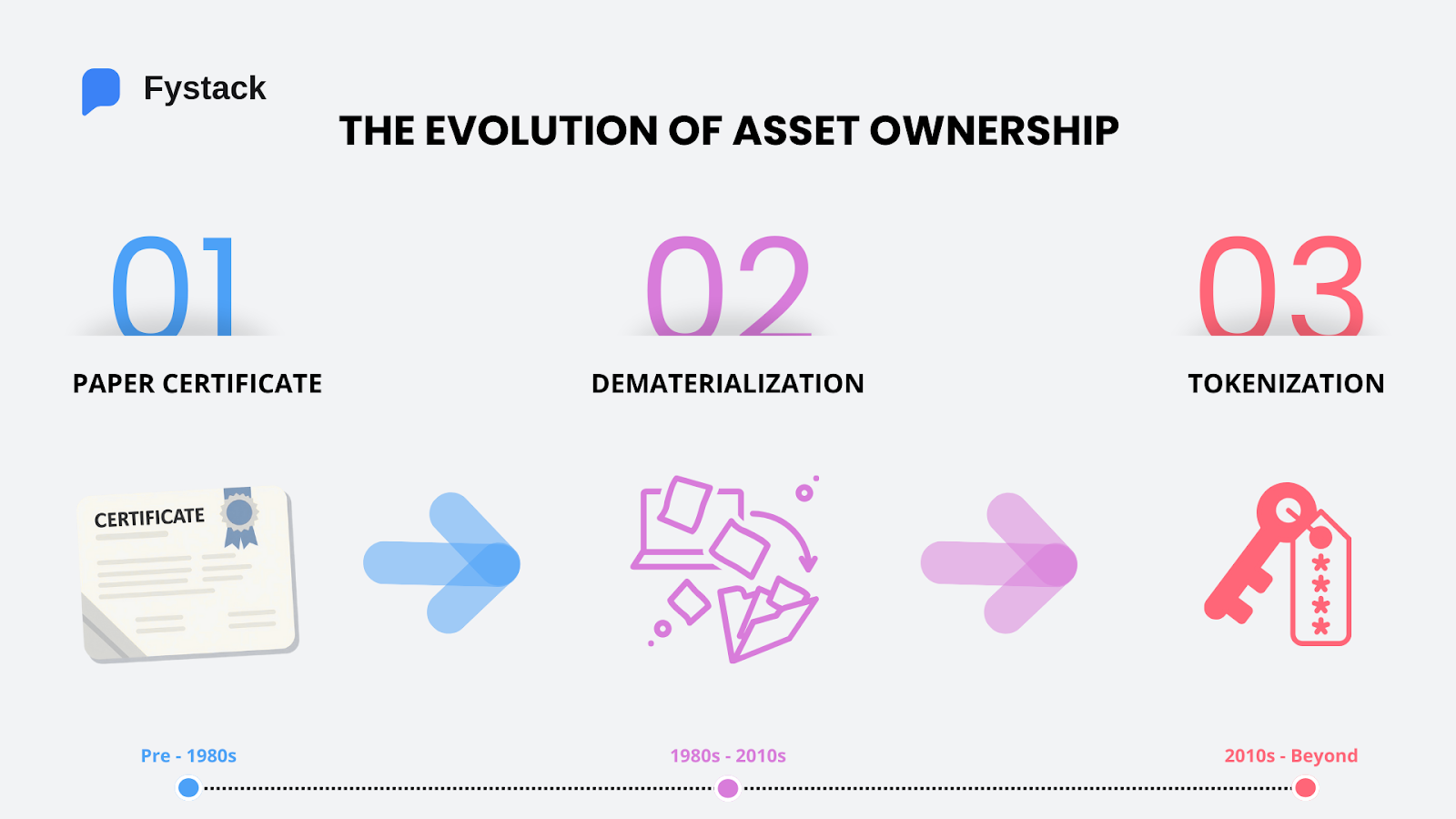

But to understand why tokenization is the inevitable future, we first need to understand where we came from. We are currently undergoing the third major shift in the history of financial markets, a shift from manual fragmentation to distributed, programmable value.

Here is how the operating system of finance has evolved.

The Evolution of Asset Ownership

Phase 1: The Era of Paper Certificates (Pre-1980s)

For the first 400-plus years of investing history, participating in an initial public offering (IPO) or buying stock meant physically holding a piece of paper. This tradition dates back to 1606, when the Dutch East India Company issued the very first stock certificate.

Ownership was tangible and often artistic. For example, Disney designed stock certificates with full-color illustrations of popular characters, which parents often framed to hang in a child's room. The complex designs on old stock certificates were early examples of branding and anti-counterfeiting measures.

However, relying on physical paper created massive operational friction. Certificates had to be manually issued, physically transferred, and securely stored.

Settlement cycles dragged on for T+5 days or longer, and the lack of a centralized coordination system made reconciliation error-prone and capital movement incredibly slow.

Phase 2: Dematerialization (1980s–2010s)

The second evolution moved us from paper to electronic book-entry systems. We digitized securities and centralized them within custodians like the DTCC or Euroclear.

(DTCC or Euroclear is the library of the financial world. It holds the master lists of who owns what stock or bond.)

This solved the physical risks of paper in two significant ways:

1) No one had to worry about losing a certificate in a fire anymore

2) And it improved settlement cycles to T+2.

However, this system introduced a new limitation: silos.

While the records were digital, they were locked within separate, disconnected databases. To move value, my database had to send a message to your database (via SWIFT), and we both had to update our internal ledgers separately.

This reliance on intermediaries and messaging meant that while information moved faster, real-time transparency was restricted to a few select institutions, and geographic barriers continued to constrain global access.

We explored the limitations of this legacy banking model in our article on Why banks should fear stablecoins

Phase 3: Tokenization (Post 2010s – Today)

We are now entering the third phase. Tokenization moves us from siloed databases to shared, programmable ledgers.

This structural transformation, as Larry Fink, CEO of BlackRock, stated, "We believe the next step going forward is the tokenization of financial assets."

Unlike the centralized databases, tokenized assets offer a shared system of record with on-chain auditability. This shift addresses the coordination inefficiencies of the past, enabling multi-asset operations underpinned by financial infrastructure that is composable, accessible, and truly 24/7.

We explored the infrastructure stack for tokenized assets in our deep dive on The Era of Real-World Assets

Jane Fraser, CEO of Citi, summarized this impact perfectly: "Tokenization digitizes entire markets."

The world is moving fast. While everyone is obsessed with AI, we aren't spending enough time talking about how quickly we are going to tokenize every asset on the planet.

This is why the big banks are getting involved. Tokenization is now a fundamental upgrade to the financial market. It changes how value is recorded, managed, and transferred.

So, what makes this different from the databases we use today?

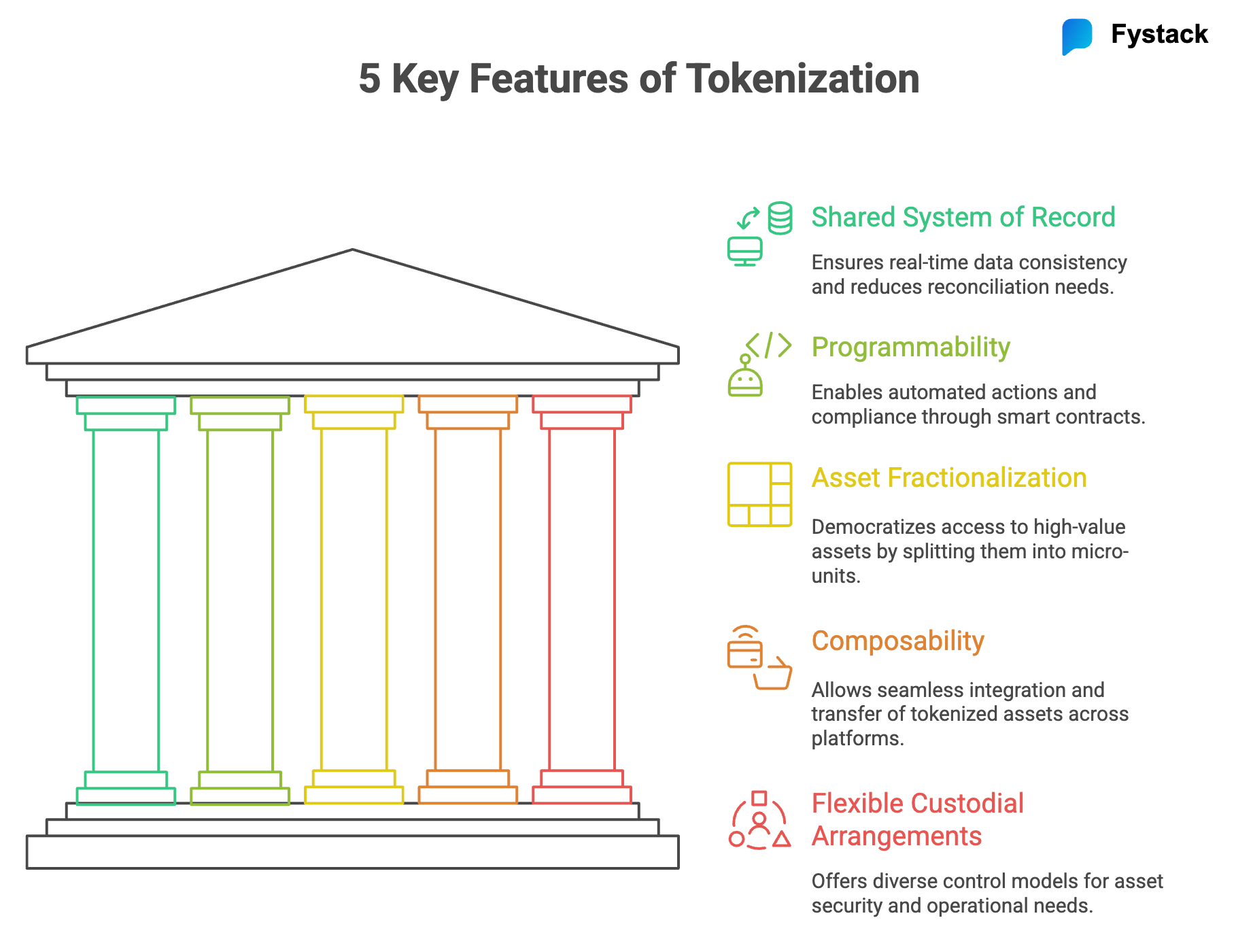

The value proposition of this era is built on five specific breakthroughs.

Let’s break them down.

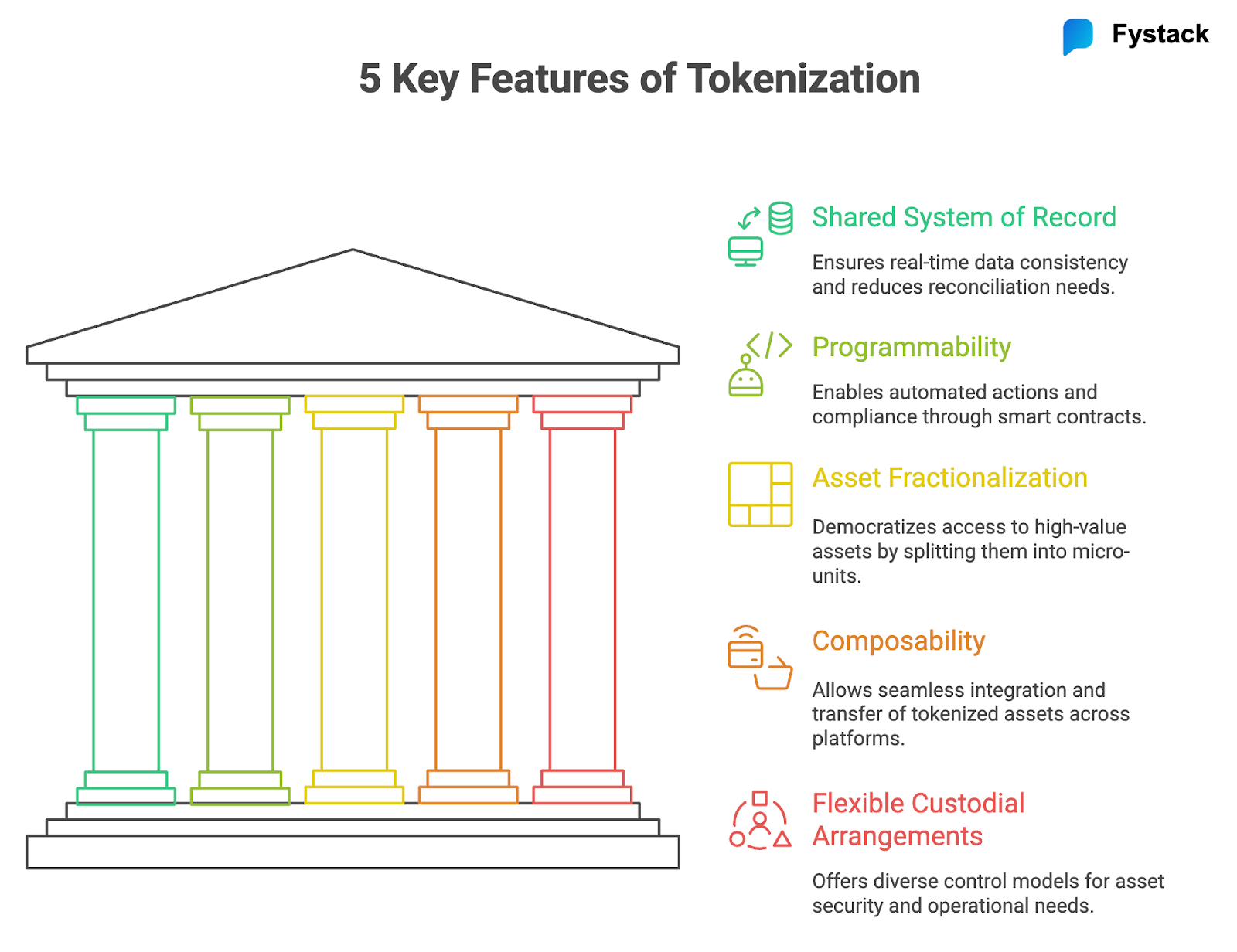

5 Differentiated Features of Tokenization

Shared System of Record

In traditional finance, every institution keeps its own books. If Bank A sends money to Bank B, both banks update their separate ledgers and send electronic messages (like SWIFT) to confirm. This reliance on fragmented databases leads to delays, errors, and the constant need for manual reconciliation.

At the moment, tokenization creates a single, immutable source of truth. Instead of reconciling two separate databases, all parties look at the same shared ledger. This reduces information asymmetry and everyone sees the exact same ownership history in real-time.

However, tokenizing an asset might seem straightforward on paper, but the integration reality is messy. When you bring an asset on-chain, the legacy off-chain systems (SQL databases) don't just disappear.

Institutions often have to run their legacy books alongside the new blockchain ledger. This creates a massive integration challenge: ensuring these two realities stay synchronized.

And if they drift apart, you end up with a Shadow Record, a dangerous state where the off-chain data contradicts the on-chain one, leading to legal disputes and settlement failures.

Programmability

Legacy assets are passive data and stock certificates are just a set of records.

Any actions like paying dividends require external software and manual intervention to trigger.

With smart contracts, it allows us to embed logic directly into the asset. Compliance checks, transfer restrictions, and corporate actions happen automatically based on code.

For a deeper look at the rules, check our 2026 Crypto Compliance Guide where we created a 5-step checklist for fintech founders to navigate the compliant landscape.

Asset Fractionalization

For decades, the best investments have been a rich person's game. If you wanted to buy commercial real estate or get into a private equity fund, you often needed millions of dollars just to get through the door. Legacy systems simply couldn't handle small investors like us.

With tokenization, it breaks these expensive assets into millions of tiny, digital pieces.

This democratizes investment. In a world where currencies are devaluing and inflation is eating away at savings, owning real assets is more important than ever. Tokenization allows anyone with an internet connection to buy a fraction of a building or a bond for just a few dollars.

It also promises to solve a massive market problem: liquidity. There are trillions of dollars worth of assets that have value but no "price". By breaking them down, we create a deeper market where buyers and sellers can trade instantly.

As Akshay BD from the Solana Foundation put it:

I shared some notes with the internal solana foundation team that are relevant more widely. Summary below.

— Akshay BD (@akshaybd) November 26, 2024

----

Solana Fndn 2025 Marketing Memo

Internet Capital Markets and F.A.T. Protocol Engineering.

Solana’s promise is to allow anyone with an internet connection access to…

Composability

Traditional financial products are stuck. If you hold a stock in one brokerage app, you can't easily use it as collateral for a loan in a different banking app instantly. To move them, you usually have to sell them for cash first, which is slow and taxable.

On the other hand, tokenization is portable. You can take a tokenized bond and seamlessly plug it into a completely different application to earn interest or get a loan. This composability allows assets to flow to where they are most useful, rather than sitting idle.

Your money shouldn’t be lazy, they must work for you 24/7/365.

Flexible Custodial Arrangements

In the old world, you didn't have a choice. You had to use a custodian. A bank had to hold assets for you. This concentrated all the power and risk in the hands of a few large intermediaries.

For the first time, with tokenization, businesses and users can decide exactly how they want to hold their assets.

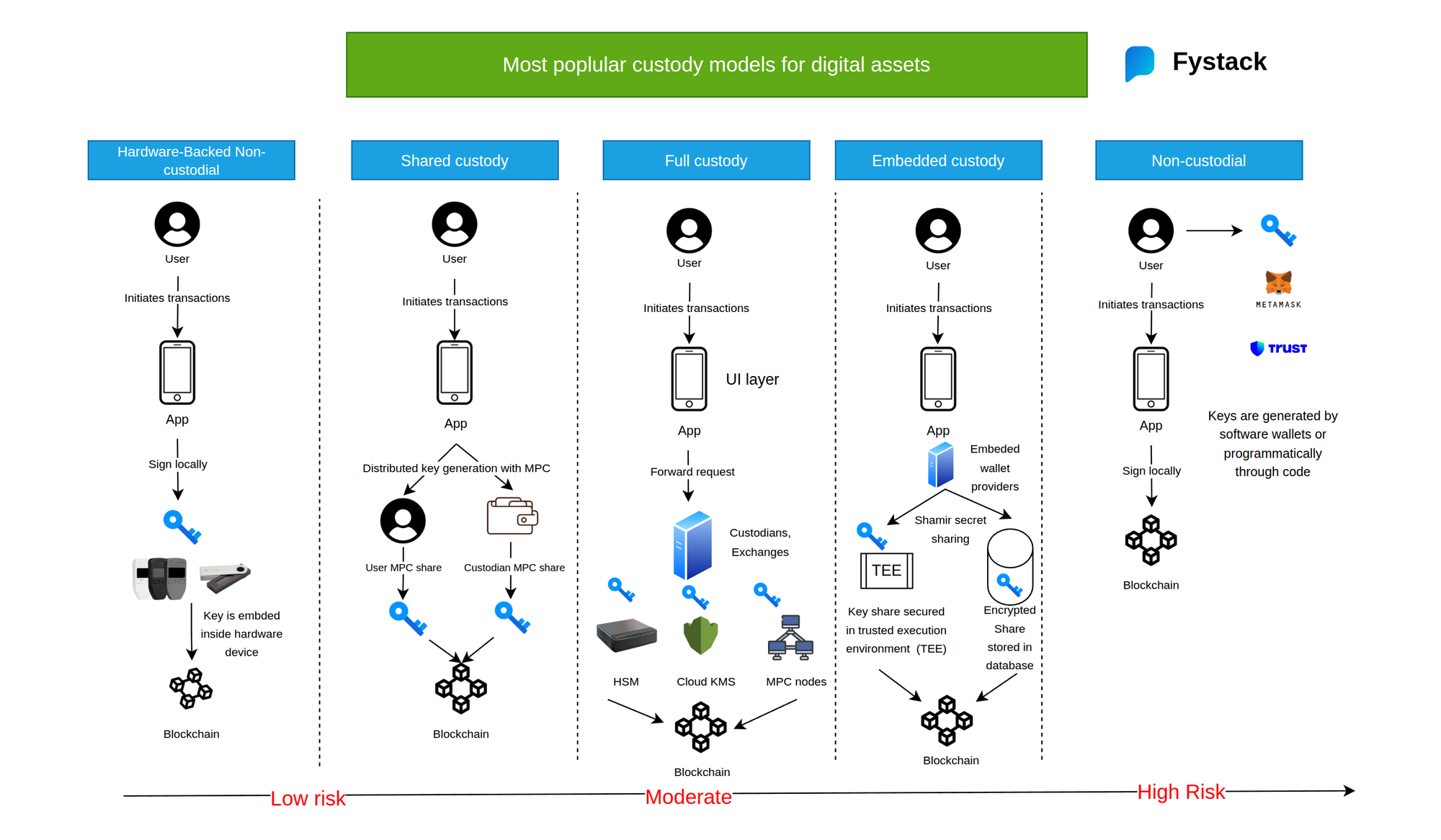

Here are the five key models, ranging from institutional control to full user sovereignty:

Hardware-Backed Non-Custodial

This is one of the lowest risk and most common options for individual security. The private key is embedded inside a physical hardware device (like a Ledger, Trezor). The user initiates a transaction on an app, but the signing happens locally inside the device. This ensures the key never got exposured to the internet.

However, the trade-off of this option is convenience. It requires physical hardware management. If you lose the device and the backup phrase, the assets are unrecoverable.

Collaborative / Shared Custody

Control is distributed. Transactions require approval from multiple parties (e.g., one key share with the user, one with the provider).

It balances security and decentralization. It reduces reliance on a single entity because no one person can move funds alone. However, it also adds operational complexity to coordinate the different signers.

Currently, Fystack is actively developing mobile solutions to support this model, distributing key shares between the server and the client-side app to give users more direct participation in approval flows.

Understanding different custodial models and their trade-offs are important for businesses. We broke down the strategic choice between Self-hosted and SaaS wallet infrastructure in a detailed comparison.

Full Custody

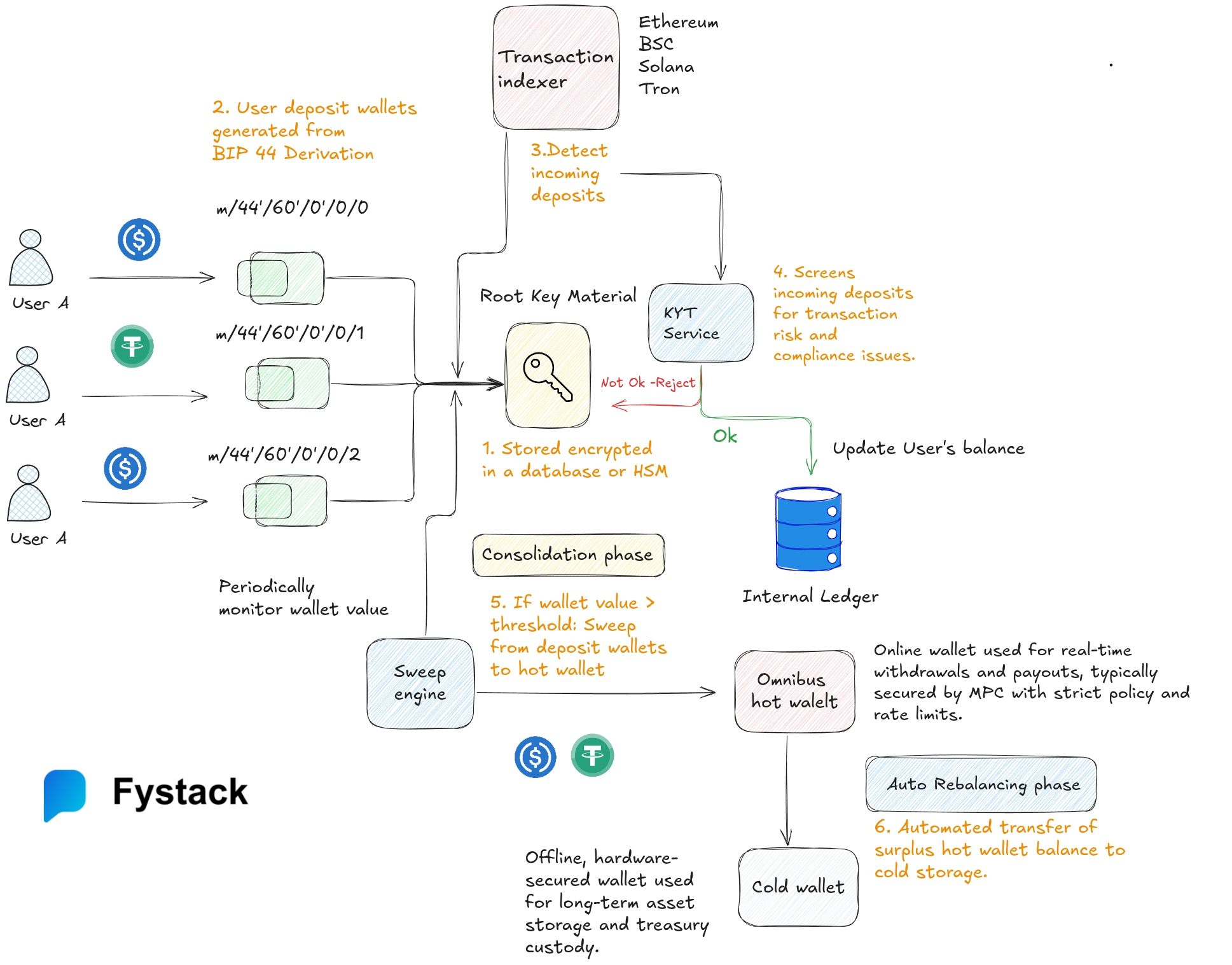

A third-party custodian manages the private keys entirely on behalf of users. The custodian has full control and the user simply interacts with a UI layer, forwarding requests to the custodian. Behind the scenes, the custodian secures assets using HSMs (Hardware Security Modules), Cloud KMS, or institutional MPC nodes.

It is ideal for institutions that require strict regulatory compliance and enterprise-level security. The trade-off is high centralization risk.

Hosted / Embedded Custody

This model works by integrating directly into applications via APIs. The end user feels like they have primary control, while the wallet service provider acts as an invisible backup in the background.

This works perfectly for retail investors and neobanks prioritizing a smooth, easy user experience (UX) while keeping users protected from their own mistakes.

To secure the keys without ruining the UX, providers often use Shamir Secret Sharing (SSS), where key shares are secured in a Trusted Execution Environment (TEE) or encrypted databases.

Self / Non-Custodial

With a self/non-custodial model, users retain full control over their private keys and assets. There are no intermediaries. It offers maximum privacy, autonomy, and control.

The trade-off is there is no recovery. If the private keys are lost, the assets are gone forever.

Fystack currently offers self-hosted stablecoin wallet infrastructure powered by MPC technology that allows businesses to deploy the entire infrastructure on their own servers, Fystack enables a true non-custodial model where the business has 100% control over their data and keys, with zero vendor lock-in.

See how Fystack compares to other non-custodial solutions for stablecoin businesses.

Conclusion

We have successfully moved from physical paper to electronic systems, and now to programmable ledgers. The five features we’ve discussed are the foundation for a completely new financial operating system.

But as I explored in my previous deep-dive, The RWA Liquidity Crisis: Where Tokenized Assets Struggle to Find Buyers, building the asset is only half of the story. The next challenge is making them trade.

The good news? The very features we just analyzed are the keys to solving that crisis.

1) Programmability and Composability will allow assets to connect to global liquidity pools.

2) Fractionalization will bring in the necessary market participants.

3) And Flexible Custody (via MPC infrastructure) will finally give institutions the control they need to enter the market safely.

The assets of the future are being built today, one audited smart contract and one verified custodian at a time.

As Coinbase co-founder Fred Ehrsam said:

“Everything will be tokenized and connected by a blockchain one day.”

That day isn't tomorrow. But it’s coming.